Overview

Building successful medtech partnerships in Peru necessitates a comprehensive understanding of the local healthcare landscape, active engagement with regional stakeholders, and effective navigation of regulatory requirements. These partnerships are crucial, as they can significantly enhance patient access to innovative medical devices and improve research efficiency. This is particularly important in light of the country's growing demand for quality healthcare. Furthermore, aligning with local regulations is essential to ensure sustainable success in this dynamic environment.

Introduction

In the dynamic and rapidly evolving Medtech landscape of Peru, opportunities abound for those prepared to navigate its complexities. With the market projected to reach approximately $1.79 billion by 2025, understanding the local dynamics is crucial for forging successful partnerships. This sector is shaped not only by technological advancements but also by a growing demand for quality healthcare, driven by a rising middle class.

As the regulatory framework undergoes transformation, foreign medical device manufacturers are uniquely positioned to capitalize on this momentum, particularly in high-demand areas such as oncology and telehealth. Engaging with local stakeholders and developing collaborative strategies can further enhance the potential for success, making it imperative to grasp the intricacies of this promising market.

Understand the Medtech Landscape in Peru

To effectively create collaborations, building medtech partnerships in Peru's medical technology sector requires cultivating a comprehensive awareness of the regional environment. The medical technology market in Peru is anticipated to reach approximately $1.79 billion by 2025, indicating a vibrant landscape shaped by evolving consumer demands and technological advancements. Key players in this sector comprise local manufacturers and international companies, particularly those specializing in high-demand medical devices such as diagnostic tools and surgical instruments. Notably, the largest markets for medical instruments exported from Peru include Bolivia, Argentina, and Chile, which collectively account for a significant 69% share of total exports.

The regulatory framework, overseen by the Peruvian Ministry of Health, plays a pivotal role in the approval and marketing of medical devices. Familiarizing oneself with these regulations is vital for navigating the market effectively. Furthermore, the healthcare system in Peru is undergoing substantial transformation, propelled by a growing middle class that seeks quality care and increased private sector investment. This shift has created considerable opportunities for foreign medical device manufacturers, particularly in oncology and telehealth, with a focus on building medtech partnerships in Peru as underscored by recent developments in response to the COVID-19 pandemic. The urgent requirement for modern healthcare facilities and tools underscores the necessity for investment in the Medtech industry, especially in building medtech partnerships in Peru, where leveraging extensive research management services, such as those offered by bioaccess®, can significantly enhance the effectiveness of collaborations. Their expertise encompasses feasibility studies, site selection, compliance reviews, experiment setup, import permits, project management, and reporting. This ensures that clinical trials are conducted efficiently and in accordance with regional regulations. Such comprehensive management not only facilitates smoother market entry for foreign manufacturers but also contributes to job creation, economic development, and healthcare enhancement in the region.

Utilizing resources like industry reports and market analysis platforms can provide valuable insights into current trends and forecasts. This foundational knowledge will empower you to make informed strategic decisions as you focus on building medtech partnerships in Peru.

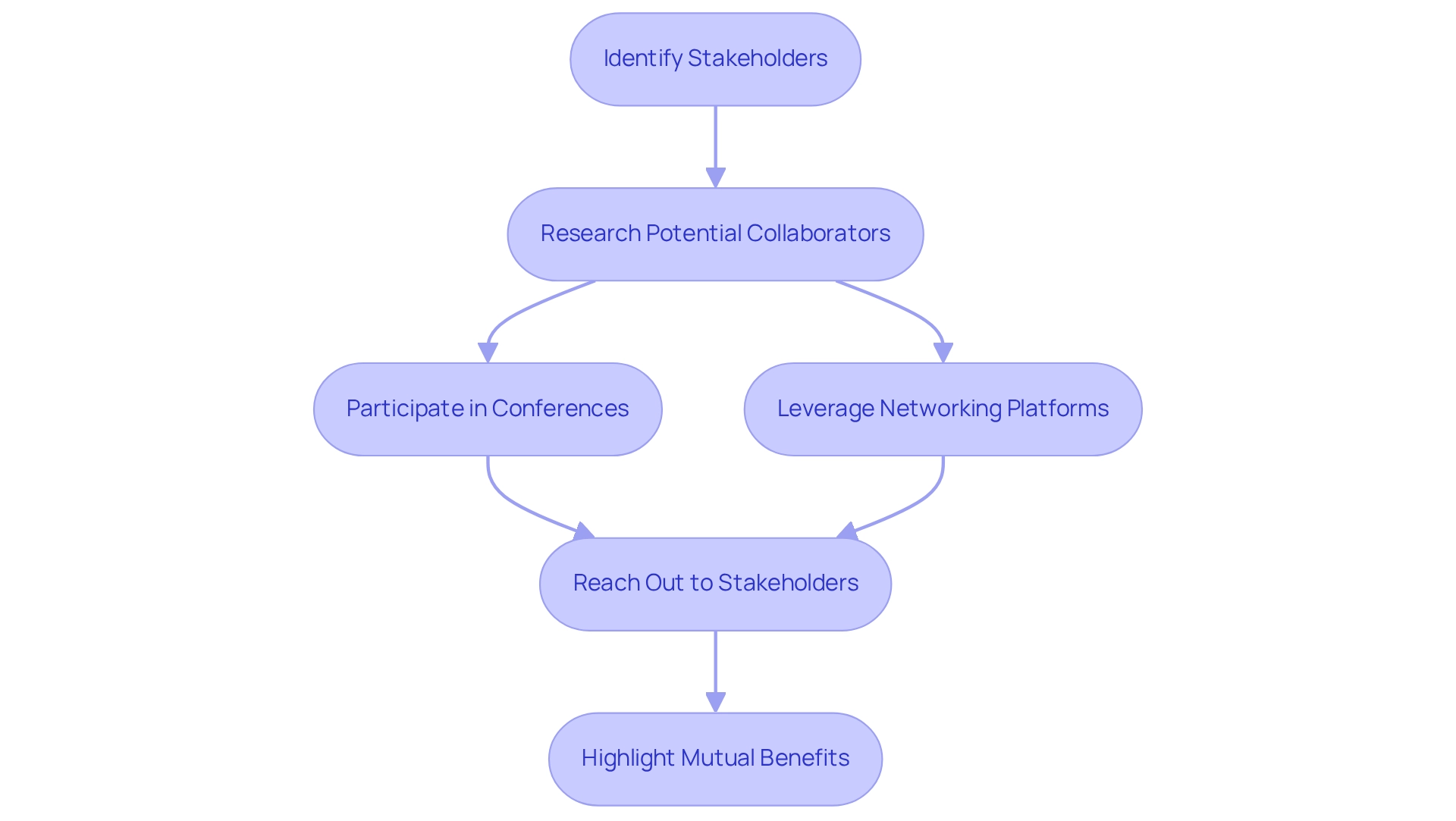

Identify and Engage Local Stakeholders

Comprehending the medical technology landscape is merely the starting point; the subsequent essential step is to identify and involve regional stakeholders, including healthcare providers, regulatory bodies, and community organizations. Begin by identifying potential collaborators such as hospitals, clinics, and nearby medical technology companies. Participation in industry conferences and networking events is crucial for establishing face-to-face connections with these stakeholders. Furthermore, leveraging platforms like LinkedIn can facilitate professional interactions and broaden your network.

When reaching out, it is vital to highlight the mutual benefits of collaboration, such as resource sharing and knowledge exchange. Recent regulatory changes in Peru are fostering an environment that encourages innovation in healthcare delivery, as underscored in the case study on regulatory frameworks supporting healthcare innovation. This evolving landscape presents an opportune moment for Medtech companies to engage with local stakeholders. Establishing strong connections with these organizations not only enhances your credibility but also significantly improves patient recruitment and retention in research studies. Comprehensive clinical trial management services—including feasibility studies, site selection, compliance reviews, trial setup, import permits, project management, and reporting—are essential for navigating the complexities of clinical trials. Building medtech partnerships in Peru between medical technology firms and nearby healthcare providers can yield innovative solutions that address the diverse needs of the population, ultimately promoting the medical technology sector. As St. Francis de Sales wisely articulated, 'Have patience with all things, but chiefly have patience with yourself.' This sentiment is particularly pertinent when navigating the complexities of building medtech partnerships in Peru.

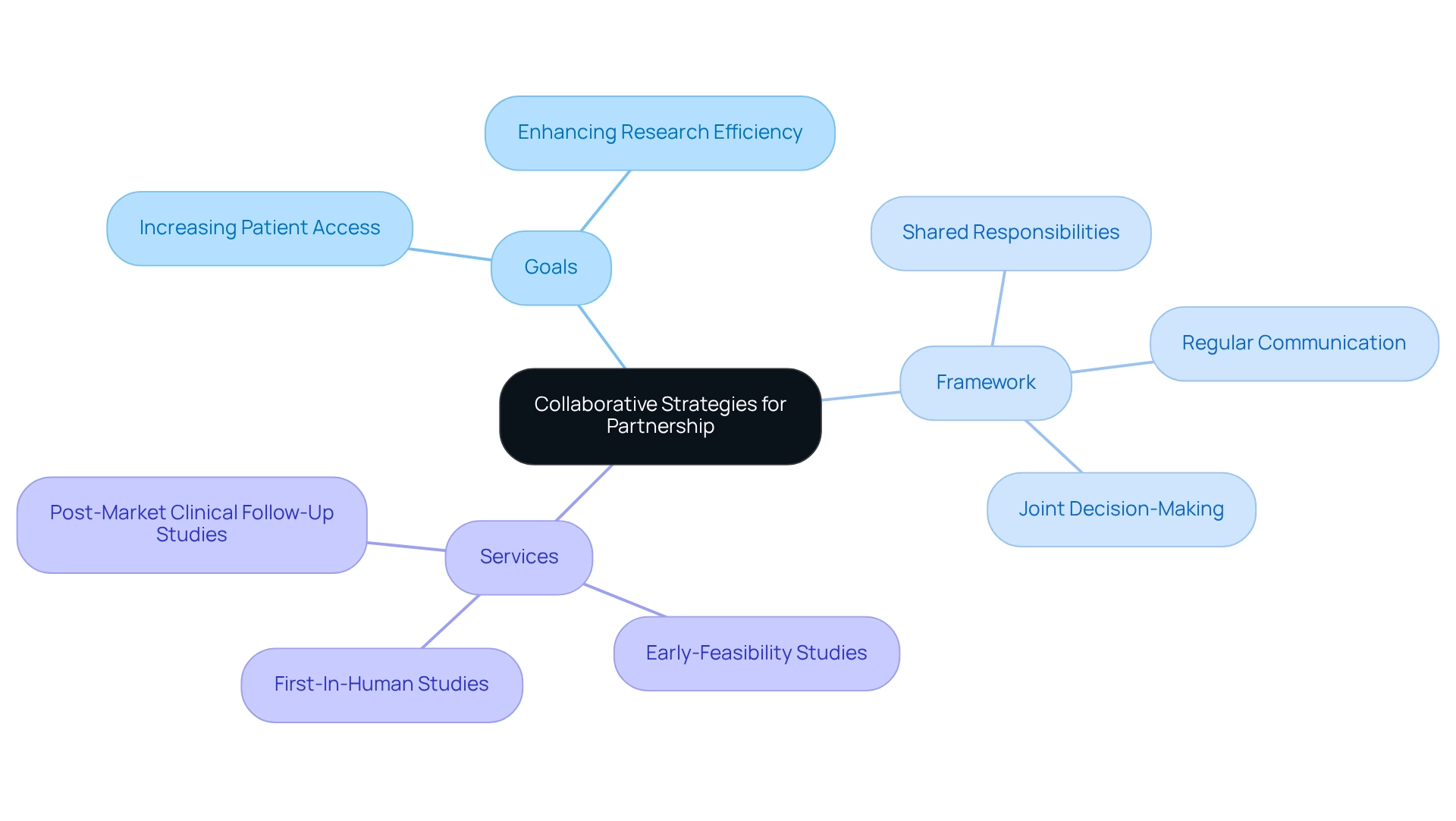

Develop Collaborative Strategies for Partnership

Once regional stakeholders are identified, it is essential to create collaborative strategies that align with your organizational objectives. Begin by setting clear goals for the collaboration, such as:

- Increasing patient access to innovative medical devices

- Enhancing the efficiency of research studies

A well-defined framework for collaboration should include:

- Regular communication

- Shared responsibilities

- Joint decision-making processes

Forming advisory boards with representatives from both your organization and local stakeholders can facilitate ongoing dialogue and ensure that all voices are heard.

Incorporating technology is crucial for streamlining collaboration; utilizing project management tools can help track progress and share updates effectively. By fostering a culture of collaboration, you not only enhance the effectiveness of your partnerships but also drive successful outcomes.

The dedication to quality and efficiency shown by bioaccess, with over 20 years of experience in overseeing research studies, makes it an appealing choice for sponsors. Utilizing the comprehensive clinical study management services provided by bioaccess®, including:

- Early-Feasibility Studies

- First-In-Human Studies

- Post-Market Clinical Follow-Up Studies

can greatly improve the success of these collaborations. Ultimately, building medtech partnerships in Peru can lead to successful cooperation that enhances success rates in studies, job creation, economic growth, and healthcare enhancement, further advancing the objectives of medical technology partnerships.

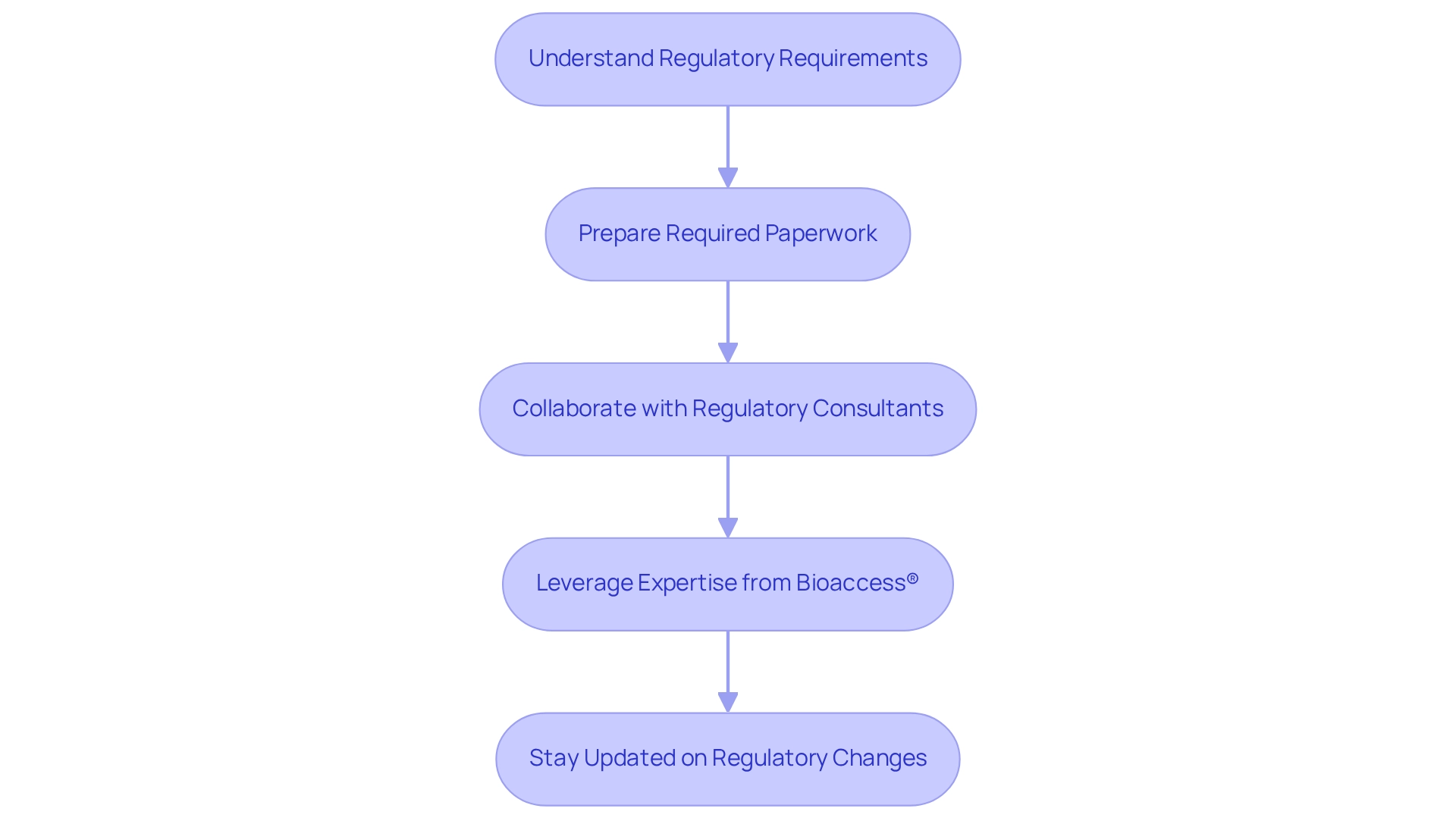

Navigate Regulatory Requirements for Medtech Partnerships

Building medtech partnerships in Peru requires navigating the regulatory landscape, which is essential for success. It begins with a thorough understanding of the requirements set by the Dirección General de Medicamentos, Insumos y Drogas (DIGEMID), the authority responsible for the registration and approval of medical devices. Preparing and submitting all required paperwork, including research protocols and safety reports, must be done in strict compliance with regional regulations. Collaborating with regional regulatory consultants, such as Emergo, which oversees Peru medical device registration from U.S. or European offices, offers invaluable guidance on compliance and simplifies the approval process.

Additionally, leveraging the expertise of bioaccess®, a prominent contract research organization, can enhance your management efforts in studies. Bioaccess® specializes in comprehensive services, including:

- Early-Feasibility Studies (EFS)

- First-In-Human Studies (FIH)

- Pilot Studies

- Pivotal Studies

- Post-Market Clinical Follow-Up Studies (PMCF)

This guarantees that your clinical trials are executed efficiently and in accordance with regional regulations. Staying updated on regulatory changes is vital, as these can significantly impact your partnership. Building medtech partnerships in Peru involves proactively addressing these requirements, which not only mitigates risks but also enhances the potential for successful collaboration. With Peru's evolving healthcare infrastructure and increasing demand for quality care, particularly in telemedicine and oncology, aligning with local regulations and adapting to the needs of Peruvian customers can position your Medtech innovations for success in this promising market. The combination of government interest in improving health systems and private investment creates significant opportunities for foreign medical device manufacturers.

Conclusion

The Medtech landscape in Peru presents a wealth of opportunities for foreign manufacturers willing to engage deeply with local dynamics. With the market poised to reach approximately $1.79 billion by 2025, understanding the intricacies of the sector—from regulatory requirements to stakeholder engagement—becomes essential. The transformative healthcare environment, driven by a rising middle class and increased private sector investment, is particularly favorable for innovations in areas like oncology and telehealth.

Identifying and collaborating with local stakeholders is a critical step in this journey. Building relationships with healthcare providers and regulatory bodies not only enhances credibility but also fosters innovation through resource sharing and knowledge exchange. As regulatory frameworks evolve to support healthcare advancements, now is the opportune moment for Medtech companies to forge robust partnerships that can lead to significant improvements in patient care and clinical trial success rates.

Moreover, developing collaborative strategies and maintaining clear communication with local partners will ensure that objectives are met efficiently. By leveraging the expertise of established clinical trial management services, like those offered by bioaccess®, companies can navigate the complexities of the regulatory landscape and enhance their chances of successful market entry.

In conclusion, the synergy between government initiatives and private investment in Peru's healthcare sector is paving the way for transformative change. By aligning with local regulations and engaging with the community, foreign medical device manufacturers can not only enhance their market presence but also contribute to the overall improvement of healthcare in the region. The potential for growth in this promising market is significant, making it imperative for stakeholders to act decisively and collaboratively.

Frequently Asked Questions

What is the projected size of the medical technology market in Peru by 2025?

The medical technology market in Peru is anticipated to reach approximately $1.79 billion by 2025.

Who are the key players in Peru's medical technology sector?

Key players in this sector include local manufacturers and international companies, particularly those specializing in high-demand medical devices such as diagnostic tools and surgical instruments.

Which countries are the largest markets for medical instruments exported from Peru?

The largest markets for medical instruments exported from Peru include Bolivia, Argentina, and Chile, which together account for a significant 69% share of total exports.

What role does the Peruvian Ministry of Health play in the medical technology sector?

The Peruvian Ministry of Health oversees the regulatory framework that is crucial for the approval and marketing of medical devices in the country.

How is the healthcare system in Peru changing?

The healthcare system in Peru is undergoing substantial transformation, driven by a growing middle class seeking quality care and increased private sector investment.

What opportunities exist for foreign medical device manufacturers in Peru?

There are considerable opportunities for foreign medical device manufacturers in sectors such as oncology and telehealth, particularly in response to the growing demand for modern healthcare facilities and tools.

How can bioaccess® assist in building medtech partnerships in Peru?

Bioaccess® offers extensive research management services that enhance collaboration effectiveness, including feasibility studies, site selection, compliance reviews, experiment setup, import permits, project management, and reporting.

Why is it important to understand the regulatory environment in Peru's medical technology sector?

Familiarizing oneself with the regulatory environment is vital for navigating the market effectively and ensuring compliance with local laws.

What resources can provide insights into current trends in Peru's medical technology market?

Utilizing industry reports and market analysis platforms can provide valuable insights into current trends and forecasts in the medical technology sector in Peru.