Overview

Clinical research can be leveraged for successful market entry in Latin America by utilizing the region's diverse patient demographics, cost-effective trial execution, and established regulatory frameworks that facilitate faster approvals. The article highlights how partnerships, local expertise, and the growing healthcare access in countries like Colombia, Brazil, and Mexico contribute to efficient patient recruitment and operational excellence, making the region an attractive destination for clinical trials.

Introduction

The dynamic landscape of clinical trials in Latin America is rapidly evolving, presenting a wealth of opportunities for researchers and organizations alike. With its diverse patient demographics and improving healthcare access, the region is becoming increasingly attractive for clinical research, offering unique advantages such as:

- Lower operational costs

- Expedited regulatory processes

Recent collaborations and strategic initiatives are positioning countries like Colombia, Brazil, and Mexico as key players in this field, fostering an environment ripe for innovation and growth. As the pharmaceutical industry in Latin America gains momentum, understanding the critical role of Contract Research Organizations (CROs) and navigating the complexities of local regulations will be essential for successful trial execution. This article delves into the potential of Latin America for clinical trials, exploring best practices, emerging trends, and the future of research in this vibrant region.

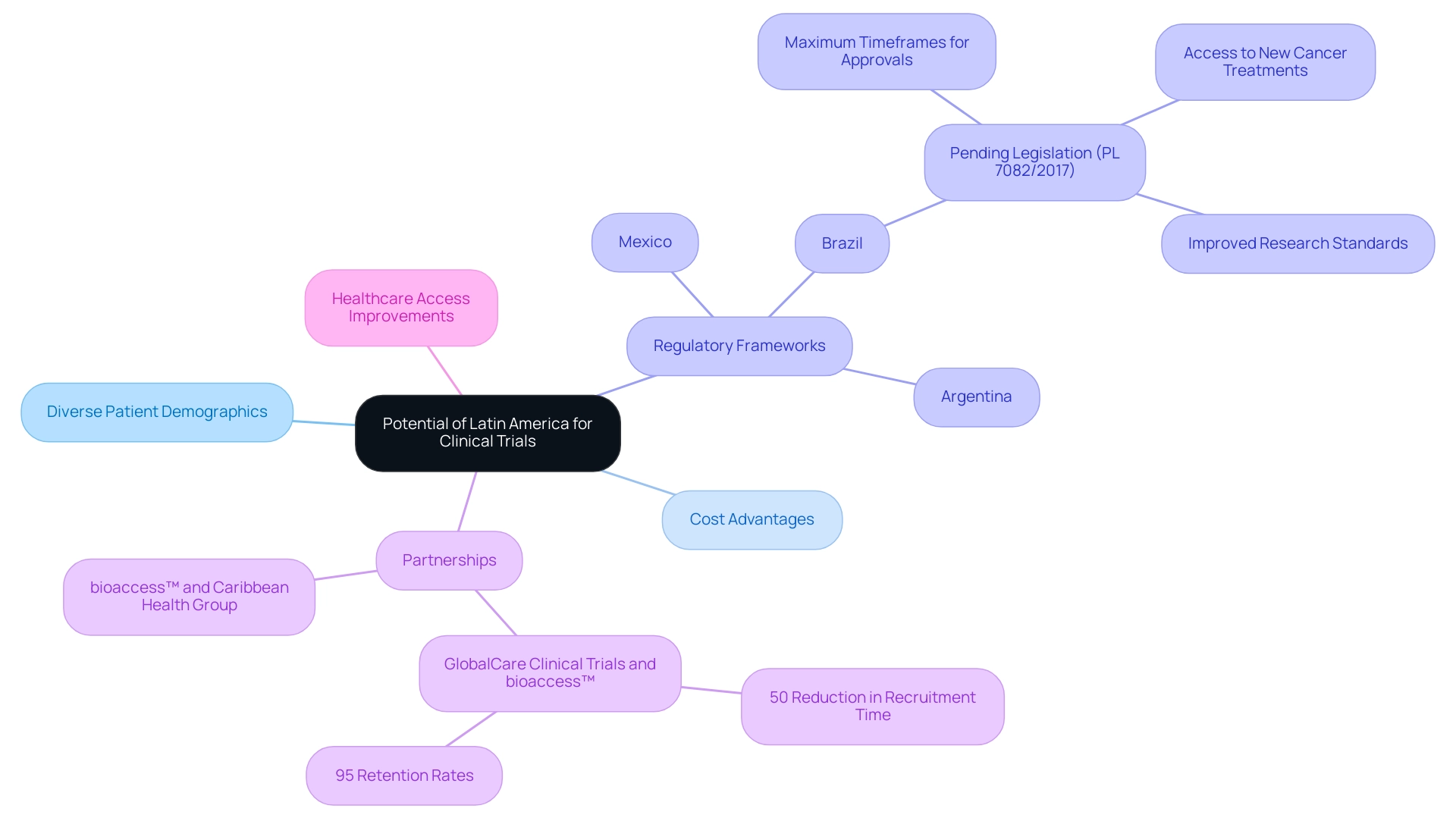

Unlocking the Potential of Latin America for Clinical Trials

The distinctive environment for medical studies in the area demonstrates how clinical research supports market entry in Latin America, fueled by its varied patient demographics that greatly improve the applicability of research results. Recent partnerships, like the one declared on March 29, 2019, between bioaccess™ and Caribbean Health Group at PROCOLOMBIA's office in Miami, are positioning Barranquilla as a prominent destination for health studies in the region, backed by the Colombian Minister of Health's initiative to draw more research projects. As the region's population continues to grow and gain better access to healthcare services, it becomes an increasingly attractive site for participant recruitment.

Significantly, the expense of carrying out medical trials in South regions is generally less than in North America and Europe, allowing for more effective distribution of resources. Nations like Brazil, Mexico, and Argentina stand out due to their well-established regulatory frameworks, demonstrating how clinical research supports market entry in Latin America while enabling easier navigation of the approval processes. For instance, GlobalCare Clinical Trials' partnership with bioaccess™ has led to over a 50% reduction in recruitment time and impressive 95% retention rates, showcasing the potential for operational excellence in this region.

As Gotuzzo observes in 'Clinical Research in the region: Constraints and Opportunities,' the area's potential is significant, particularly in demonstrating how clinical research supports market entry in Latin America, especially considering ongoing enhancements in healthcare access and research standards. Pending legislation in Brazil (PL 7082/2017) aims to further improve research practices, illustrating how clinical research supports market entry in Latin America by establishing maximum timeframes for regulatory approvals, enhancing access to new cancer treatments, and elevating research standards. This reflects a commitment to better healthcare access.

Furthermore, the Asia Pacific software market for matching research studies is anticipated to hit USD 100.0 million by 2030, suggesting a competitive environment that the region can strategically utilize as it aims to enhance its research processes. Together, these elements establish this region as a promising area for efficient and effective medical studies.

The Critical Role of CROs in Latin American Clinical Research

Contract Research Organizations (CROs) play a crucial role in how clinical research supports market entry in Latin America, where 52 percent of global clinical studies are now carried out outside the U.S. This shift is largely influenced by Colombia's competitive advantages, including how clinical research supports market entry in Latin America with a cost savings of over 30 percent compared to trials in North or Western Europe, and a regulatory speed that sees total IRB/EC and INVIMA review completed in just 90-120 days. Recent reports indicate that the pharmaceutical sector in the southern continent is experiencing rapid growth, with increased investments and a focus on innovative therapies.

Colombia's hospitals rank among the best in Latin America, supported by a healthcare system recognized by the World Health Organization as one of the top five globally. Significantly, hospitals in Colombia must undergo a rigorous ICH/GCP certification process before conducting research with pharmaceutical drugs, ensuring high-quality standards. The expertise of CROs in navigating the diverse regulatory landscapes is crucial for understanding how clinical research supports market entry in Latin America and overcoming the complexities of the approval processes.

Moreover, these organizations leverage established networks that facilitate efficient patient recruitment, essential for achieving faster enrollment and ensuring access to over 50 million Colombians, which illustrates how clinical research supports market entry in Latin America, as 95 percent of these individuals are covered by universal healthcare. This universal coverage not only improves patient recruitment but also offers a varied participant pool for research studies. As highlighted by Julio G. Martinez-Clark, CEO of bioaccess, 'Colombia has acknowledged these advantages and has an ambitious science, technology, and innovation strategy for 2022–2031 to evolve into a knowledge economy,' which exemplifies how clinical research supports market entry in Latin America by demonstrating a wider commitment to improving research capabilities.

Collaborating with a reputable CRO not only assists sponsors in managing timelines effectively but also guarantees adherence to ethical standards, which is essential for understanding how clinical research supports market entry in Latin America, ultimately contributing to successful study outcomes. Furthermore, the R&D tax incentives offered for investments in science, technology, and innovation projects, including a 100% tax deduction and substantial government grants, demonstrate how clinical research supports market entry in Latin America, thereby boosting Colombia's appeal for research studies. This strategic alliance is crucial, especially as the pharmaceutical environment in Latin America keeps changing, highlighting how clinical research supports market entry in Latin America, with CROs being increasingly acknowledged for their influence on research efficiency and success.

Customized patient recruitment strategies are crucial for tackling the distinct challenges of the area, ensuring that studies can achieve their enrollment goals while upholding high ethical standards. The experiences of leaders like Dushyanth Surakanti, Founder & CEO of Sparta Biomedical, during their first human examination with bioaccess® in Colombia, and insights from Dr. John B. Simpson on Avinger's OCT-guided atherectomy research further underscore the collaborative potential and benefits present in this flourishing research environment.

Navigating Challenges in Latin American Clinical Trials

Carrying out medical studies in Latin America illustrates how clinical research supports market entry in Latin America, presenting a landscape with varied regulatory demands that can greatly hinder study commencement. Each country has its own set of regulations, highlighting how clinical research supports market entry in Latin America, making it crucial for researchers to remain informed and adaptable. Regulatory bodies like INVIMA, recognized as a Level 4 health authority by PAHO/WHO, oversee medical device classification and compliance, emphasizing the need for robust compliance reviews.

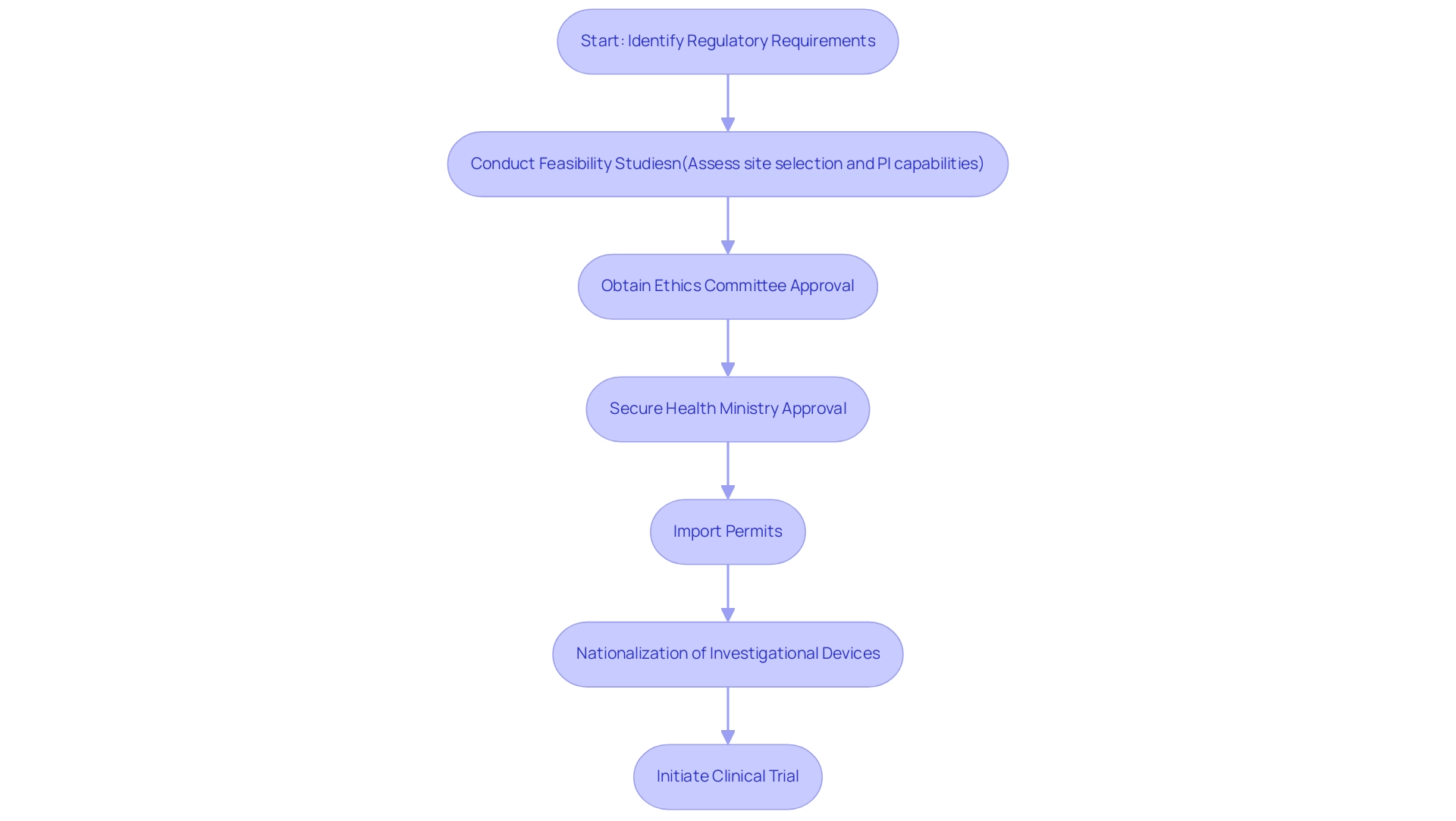

Our extensive research management services encompass:

- Feasibility studies to evaluate site selection and principal investigator (PI) capabilities, ensuring that studies comply with local regulations.

- Understanding how clinical research supports market entry in Latin America involves navigating trial setup and approval processes, including:

- Ethics committee reviews

- Health ministry approvals

These are critical for successful initiation. Import permits and nationalization of investigational devices are also essential components of our service.

Cultural nuances, influenced by education, socioeconomic status, and ethnic backgrounds, can affect patient recruitment and retention; thus, tailored communication strategies are essential to overcoming these barriers and fostering trust among participants. Ethical considerations, particularly regarding informed consent and data privacy, must be prioritized to ensure compliance and enhance participant confidence. The region's commitment to healthcare improvement is notable; as highlighted by Julio G. Martinez-Clark, CEO of bioaccess, Colombia has recognized these benefits and has an ambitious science, technology, and innovation plan for 2022–2031 to transition into a knowledge economy.

Colombia ranks 22 out of 191 nations in the World Health Organization's healthcare system ranking, highlighting the importance of its progress in medical studies. Moreover, the strong bond between patients and physicians contributes to lower dropout rates, a positive aspect in this region. Addressing these challenges is crucial for understanding how clinical research supports market entry in Latin America, which requires a thorough understanding of the local context and proactive engagement with key stakeholders, including regulatory bodies and patient advocacy groups.

With over 80% of its population residing in city regions, the urbanization of this region improves access to potential study participants, aiding strong enrollment and retention rates. This advantage is further supported by case studies such as 'Impact of Urbanization on Research Studies,' which illustrates the significant benefits urbanization provides for participant involvement compared to the U.S. and EU.

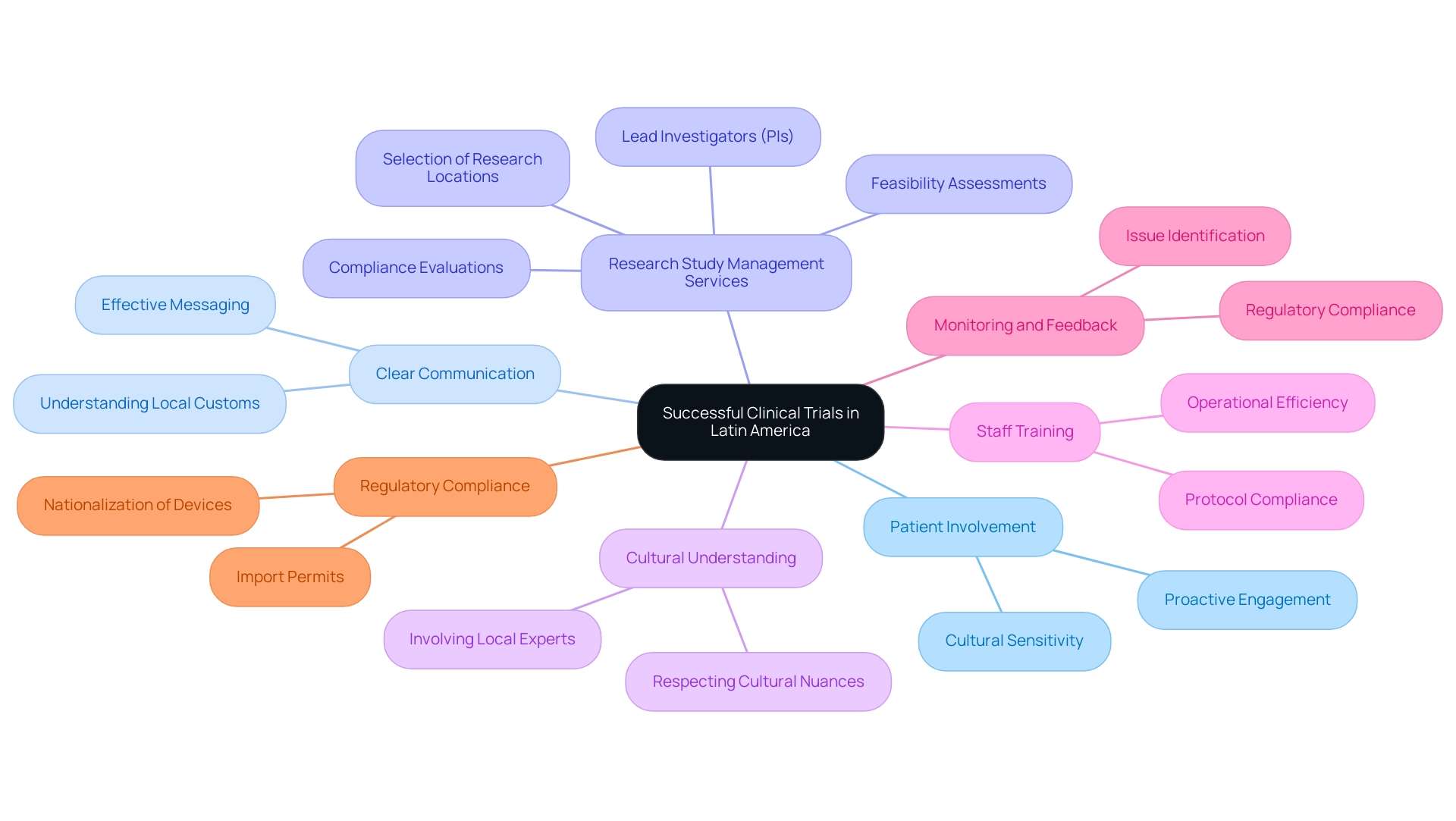

Best Practices for Successful Clinical Trials in Latin America

Successful implementation of medical studies in the southern continent depends on proactive patient involvement from the beginning and the upkeep of clear communication throughout the research. According to Ofelia Rodriguez Nieves, Managing Director for the region, ‘So why has this area become such a hotspot of research activity?' Numerous countries in South America have each of these success elements, which we will explore.

One of these essential success components is the extensive research study management services we offer, including:

- Feasibility assessments

- Compliance evaluations

- The choice of research locations and lead investigators (PIs)

The utilization of local staff, whose understanding of cultural nuances can significantly enhance recruitment and retention rates among diverse patient populations, is paramount. Moreover, implementing comprehensive training programs for site staff is essential. These programs not only improve operational efficiency but also promote compliance with established protocols, ensuring that evaluations are conducted rigorously and ethically.

Establishing robust monitoring and feedback loops is equally important; this facilitates the prompt identification and resolution of any issues, thereby keeping studies on schedule and compliant with regulatory requirements.

Additionally, while the Asia Pacific market is projected to reach USD 25,992.8 million by 2030, this statistic underscores the growing global clinical research landscape, highlighting the potential for Latin America to become a key player in this expansion. The use of customizable reports allows companies to focus on specific markets, demographics, or product segments, significantly improving market entry efforts and optimizing resource allocation.

Import permits and the nationalization of investigational devices are also critical components of our service capabilities, ensuring that assessments comply with local regulations and can proceed without delays. Finally, the case study titled 'Cultural Sensitivity in Clinical Trials' illustrates the importance of understanding local customs and values. By respecting cultural nuances and involving local experts, organizations can enhance patient understanding and willingness to participate, ultimately leading to more successful trial outcomes.

By implementing these strategies, organizations can enhance their market entry and pace in medical research throughout the region, illustrating how clinical research supports market entry in Latin America while fostering job creation, economic growth, and international cooperation in the Medtech sector.

Future Trends and Opportunities in Latin American Clinical Research

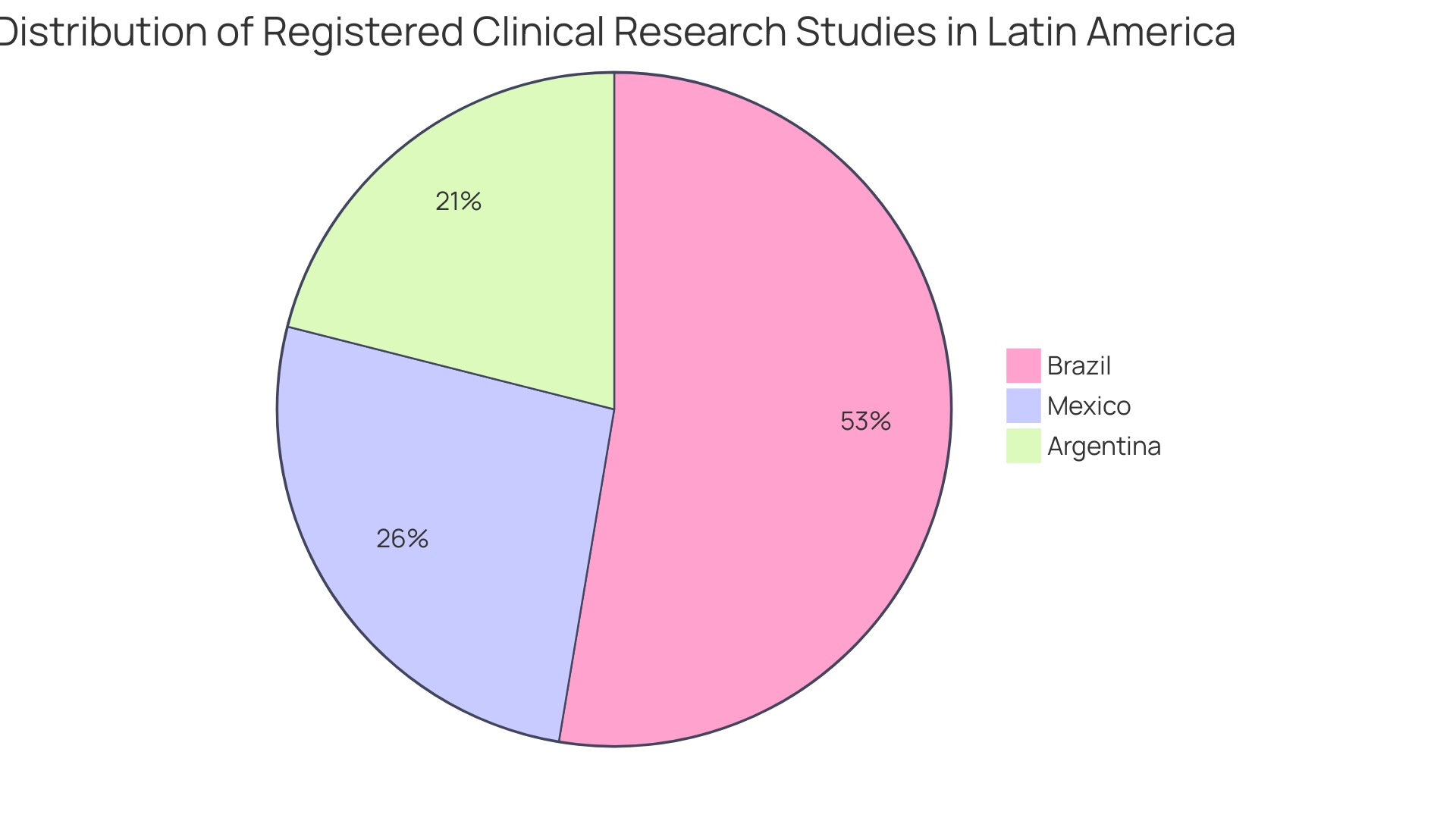

The landscape of medical research in Latin America is on the brink of significant expansion, highlighting how clinical research supports market entry in Latin America through innovations in digital health technologies and a growing focus on personalized medicine. As of April 2024, Brazil leads with approximately 10,000 registered research studies, followed by Mexico with 5,000 and Argentina with 4,000, highlighting how clinical research supports market entry in Latin America through a robust framework for research initiatives across the region. Our comprehensive clinical study management services encompass essential capabilities such as:

- Feasibility studies

- Site selection

- Compliance reviews

- Setup

- Import permits

- Project management

- Meticulous reporting of study status and adverse events

- Ensuring regulatory excellence

The growing use of telemedicine and mobile health applications is streamlining patient recruitment and enhancing data collection, illustrating how clinical research supports market entry in Latin America. Mariana Bei, Sr. Director of Clinical Operations and Brazil GMBA at Parexel, emphasizes that having a local presence and leadership based in the LATAM region is essential, as it illustrates how clinical research supports market entry in Latin America by strengthening the relationships that Parexel builds with local talent, regulatory authorities, local associations, and our global network of sites. This local engagement is crucial as the demand for personalized treatments escalates, creating opportunities for trials that target specific patient populations, particularly in areas with high incidences of diseases like cancer and diabetes. The case study titled 'Disease Trends in Latin America' highlights the increasing incidences of these diseases, especially in countries like Chile and Peru, demonstrating how clinical research supports market entry in Latin America by emphasizing the need for specialized medical studies.

Additionally, the Horizon Databook provides access to over 1 million market statistics and 20,000+ reports, offering valuable data for informed decision-making in this evolving landscape. Stakeholders must remain agile and willing to embrace innovative methodologies to fully leverage these emerging trends, which illustrates how clinical research supports market entry in Latin America, driving job creation, economic growth, and healthcare improvement while ensuring successful clinical outcomes.

Conclusion

The potential of Latin America for clinical trials is increasingly recognized, driven by a combination of diverse patient demographics and improving healthcare access. The region's strategic advantages, such as lower operational costs and expedited regulatory processes, position it as an attractive destination for clinical research. Collaborative efforts, particularly in countries like Colombia, Brazil, and Mexico, are enhancing the landscape, making it vital for organizations to engage with Contract Research Organizations (CROs) to navigate local complexities effectively.

The role of CROs cannot be overstated, as they bring essential expertise in managing regulatory requirements and optimizing patient recruitment. Their ability to facilitate faster enrollment while ensuring adherence to ethical standards is crucial for the success of clinical trials. Moreover, understanding the unique cultural and regulatory challenges across different countries in Latin America is essential for researchers aiming to execute successful trials.

Looking ahead, the integration of digital health technologies and personalized medicine is set to further transform clinical research in the region. With a robust framework for clinical studies and a growing emphasis on specialized treatments for prevalent diseases, stakeholders must remain adaptive and innovative. By leveraging these trends, Latin America can solidify its position as a key player in the global clinical trial landscape, ultimately contributing to enhanced healthcare outcomes and economic growth.

Frequently Asked Questions

How does clinical research support market entry in Latin America?

Clinical research supports market entry in Latin America by leveraging the region's diverse patient demographics, which enhance the applicability of research results. It also benefits from lower costs compared to North America and Europe, established regulatory frameworks, and partnerships that facilitate efficient participant recruitment.

What recent developments have positioned Barranquilla as a health study destination?

A partnership announced on March 29, 2019, between bioaccess™ and Caribbean Health Group, supported by the Colombian Minister of Health, has positioned Barranquilla as a prominent destination for health studies in the region.

What advantages do countries like Brazil, Mexico, and Argentina offer for clinical research?

These countries have well-established regulatory frameworks that simplify the approval processes for clinical trials, making them attractive for conducting research.

What are the financial benefits of conducting medical trials in South America?

The cost of conducting medical trials in South America is generally over 30% less than in North America and Western Europe, allowing for more effective resource distribution.

How has GlobalCare Clinical Trials improved recruitment and retention in studies?

Their partnership with bioaccess™ has led to over a 50% reduction in recruitment time and achieved impressive 95% retention rates, demonstrating operational excellence in the region.

What legislative changes are being proposed in Brazil regarding clinical research?

Pending legislation (PL 7082/2017) in Brazil aims to improve research practices by establishing maximum timeframes for regulatory approvals and enhancing access to new cancer treatments.

What role do Contract Research Organizations (CROs) play in clinical research in Latin America?

CROs are essential for navigating the regulatory landscape, managing timelines, ensuring ethical standards, and facilitating patient recruitment, thereby supporting market entry in Latin America.

How does Colombia's healthcare system contribute to clinical research?

Colombia's hospitals rank among the best in Latin America and must undergo rigorous ICH/GCP certification, ensuring high-quality standards for research conducted with pharmaceutical drugs.

What is the significance of universal healthcare coverage in Colombia for clinical trials?

Universal healthcare coverage improves patient recruitment and provides a diverse participant pool, as 95% of the population is covered, which is beneficial for research studies.

What incentives are available for research and development in Colombia?

Colombia offers R&D tax incentives, including a 100% tax deduction and substantial government grants for investments in science, technology, and innovation projects, enhancing its appeal for research studies.