Introduction

Cardiac device development is an evolving field that is driven by the increasing demand for improved healthcare outcomes and advancements in technology. With innovative tools like machine learning, augmented reality, and 5G, this sector is experiencing a significant rise in novel solutions. The landscape of cardiac device development is marked by phases of inception, accelerated adoption, and eventual market saturation, all aimed at addressing specific needs within cardiovascular care.

Recent advancements in interventional heart failure and mechanical circulatory support systems are pushing the boundaries of what is possible. However, these advancements come with challenges, including the need to balance the needs of various stakeholders and the integration of new technologies into the healthcare ecosystem. Despite the challenges, the development of cardiac devices is flourishing, driven by the necessity for improved care delivery and technological advancements.

As these devices become increasingly integrated into the digital and connected homecare ecosystem, stakeholders are focused on optimizing their viability for patients worldwide.

I. Background on Cardiac Device Development

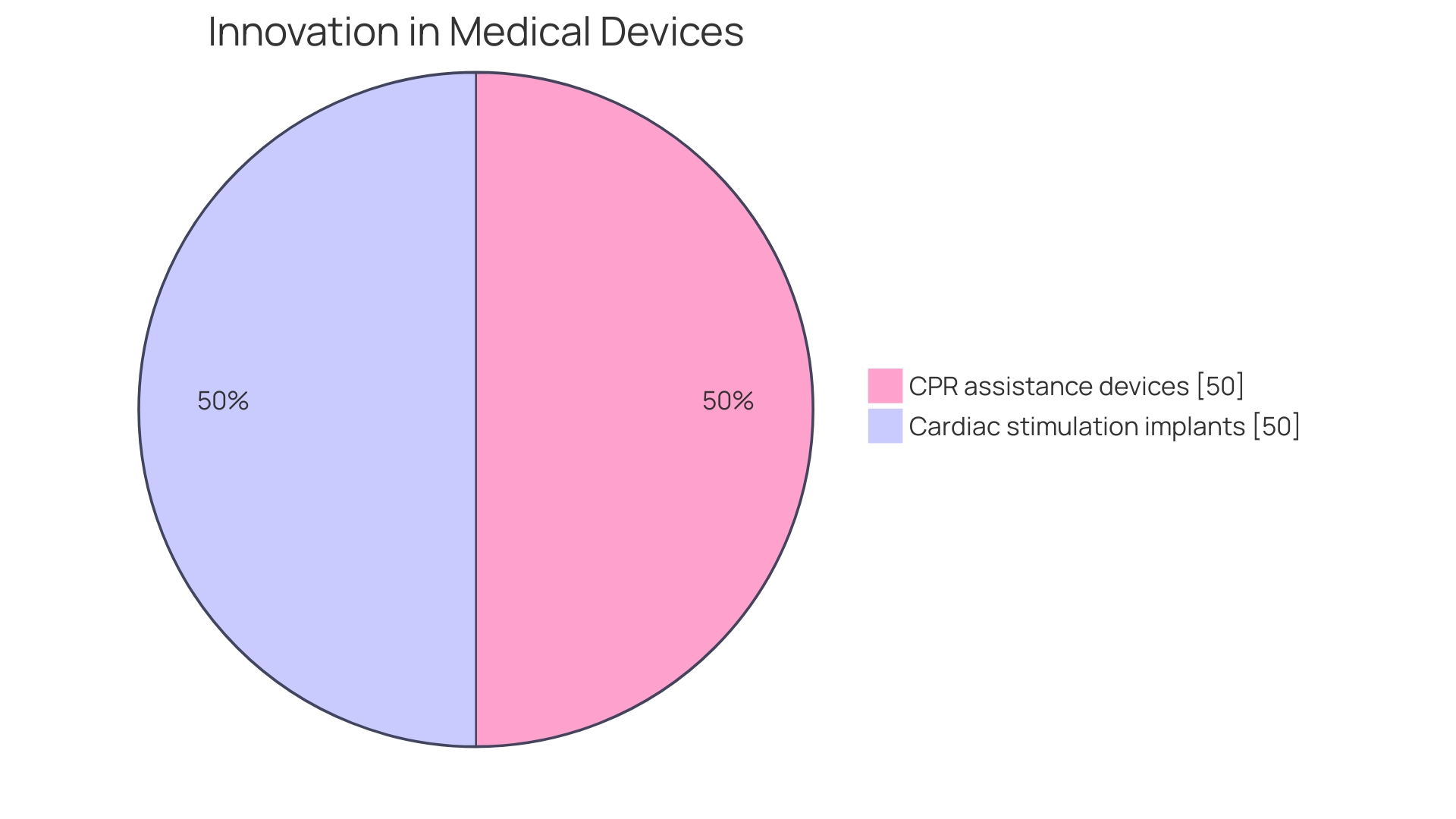

The domain of cardiac device development is at the forefront of healthcare innovation, responding to an increased demand for home care, preventative care, early diagnosis, and better patient outcomes. Equipped with the progressive tools of technologies such as machine learning, augmented reality, and 5G, this field is experiencing a prolific rise in novel solutions—garnering over 710,000 patents for medical devices, as reported by GlobalData on cardiac stimulation implants. Notably, the trajectory of these innovations mirrors an S-shaped curve, marking the significant phases from inception through accelerated adoption to eventual market saturation.

Driving this innovation are specific needs within cardiovascular care. For instance, Israel, an emerging leader in cardiovascular medtech, is making strides particularly in addressing structural heart conditions. Innovators are increasingly focusing on valvular diseases, with recent years seeing a transition from the aortic to the mitral and, more recently, the tricuspid valve, which holds significant implications for heart failure.

This pivot towards mechanical solutions for rhythm disturbances and anatomical challenges has set a fast pace for advancements in interventional heart failure and mechanical circulatory support systems.

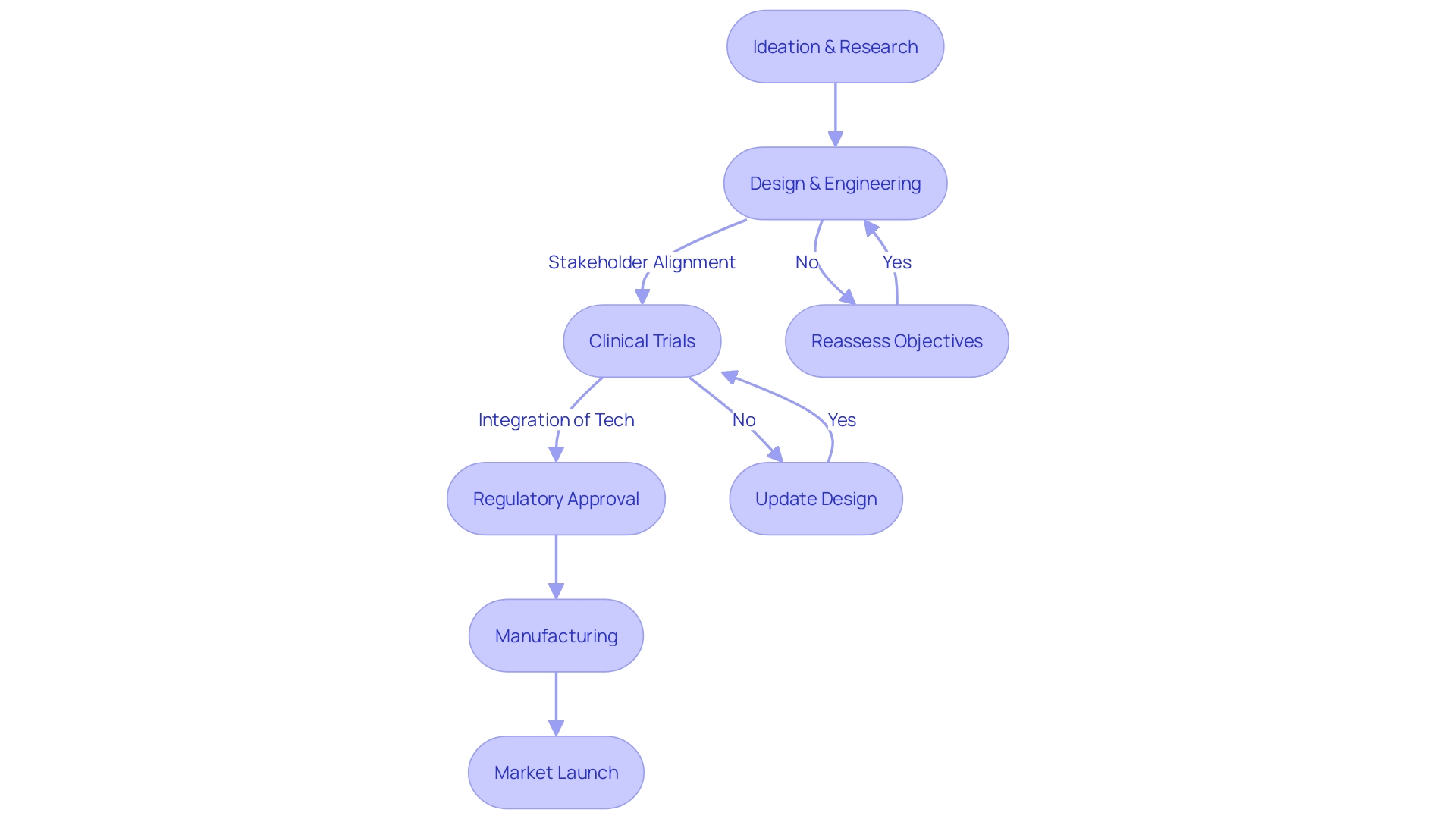

These advancements are not without their challenges or complexities. As Dr. Thomas Fogarty emphasized, the significance lies not in the idea itself but in its implementation and widespread acceptance within the holistic healthcare ecosystem. This balance includes satisfying the intricate and sometimes competing needs of key stakeholders such as patients, families, medical professionals, regulators, and investors.

Innovators must align clinical, engineering, market, and economic considerations to be successful. One stark example of this harmonization is the development of leadless pacemakers—devices that exemplify ingenuity in design yet also present logistical hurdles in battery replacement and removal given their intracardiac placement.

Furthermore, the emergent Medtronic EV ICD system demonstrates the potential of targeted approaches to cardiac devices, featuring prominently in the EV ICD Pivotal study across 17 countries and showcasing sustained safety and effectiveness outcomes over 18 months. These studies are crucial in providing evidence for the adoption of new technologies in clinical settings.

In conclusion, the landscape of cardiac device development continues to flourish, powered by the necessity for improved care delivery coupled with technological advancements. As these devices increasingly become part of the digital and connected homecare ecosystem, stakeholders maintain a vigilant eye on their lifecycle, eager to optimize the clinical and practical viability for patients worldwide.

II. Recent Innovations in Cardiac Device Technology

As the medtech industry progresses, the evolution of cardiac devices has been substantial, particularly in the refinement of pacemakers, defibrillators, and cardiac resynchronization therapy (CRT) devices. The push for innovation within this space is driven not only by the traditional needs of cardiac care but also by the increasing integration of technologies such as digitalization, machine learning, and 5G. Over the last three years, there's been a surge in intellectual property activity, with over 710,000 patents filed and granted in the medical devices arena.

Consolidating this momentum, leadless pacemakers have emerged as a significant technological leap forward. Unlike traditional pacemakers that rely on wires (leads) which can break or cause complications, leadless variants offer a promising solution. Dr. Ip highlights the vulnerability of wired pacemakers stating, "The wire is the Achilles heel of the pacemaker."

The removal of these wires not only reduces the potential for mechanical failures but also lowers the risk of infections—a notable concern with their wired counterparts.

These advances are integral in addressing the global burden of cardiovascular diseases (CVD), identified by the World Health Organization as the foremost cause of mortality worldwide, claiming approximately 17.9 million lives annually. The shift towards more compact, durable, and wireless cardiac devices resonates with the need to augment patient outcomes and manage heart rhythm complexities more effectively.

The growing prevalence and sophistication of pacemakers are also underscored by the statistics from GlobalData that nearly 1.5 million individuals received a pacemaker in 2022 alone, with projections anticipating that sales could reach 2.5 million by 2033. Yet, challenges remain, such as the complexity of replacing batteries in leadless pacemakers and the difficulty in extracting these devices, which underscores the continuous need for innovation.

Each evolution in technology is mapped on an S-shaped curve—a pattern reflecting innovation lifecycles from nascent stages to accelerated adoption and eventual maturation. Market dynamics during the Covid-19 pandemic accentuated the volatility of medical services demand, both surging and waning, thereby affecting the supply chain and medical procedures globally. Despite these fluctuations, advances in the medtech sector persevere, promising transformative changes in the way we approach cardiovascular health, particularly in the context of collaborative efforts in regions like the United States and Latin America, where organizations like AmCham and CEA are pivotal.

III. Case Study: Successful Implementation of New Cardiac Devices

Highlighting a pivotal success in medical technology, a recent initiative involved a synergistic partnership between a frontline American medical device producer and a distinguished cardiac institution in Latin America. The outcome was a state-of-the-art cardiac implant elegantly crafted to address precise diagnostic needs and tailored treatment options for various heart conditions. This cardiac device stands out not only for its technological sophistication but also for its patient-centric approach.

With cardiovascular diseases topping the list as the number one cause of death globally, claiming an estimated 17.9 million lives annually according to WHO, advancements like these are crucial. Particularly in regions with rising healthcare demands due to aging populations and lifestyle factors, such breakthroughs herald a significant leap forward in cardiovascular healthcare.

The seamless integration of expertise spanning countries and disciplines has been instrumental. For example, the state of Guanajuato in Mexico has become a focal point for medical device manufacturing due to its youthful workforce and strategic geographic proximity to the U.S., which has been a catalyst for medical device production. Innovations in cardiovascular health, which now range from cutting-edge diagnostics and therapeutics to surgical advancements and preventive strategies, echo the sentiment that progress is contingent on collaborative efforts.

This is underlined by the shared knowledge and facilitated connections across national and international platforms, as witnessed in programs such as the one launched at the Global Health Exhibition 2023 in partnership with healthcare and commercial experts.

Furthermore, the rationale for selecting locations like Guanajuato roots in three key advantages: a proven track record in manufacturing, desirable workforce demographics, and a strategic location favorable to global medical device manufacturers. These attributes—combined with a professional perception of manufacturing roles, contrasting with aging workforce dynamics in the U.S. or Europe—make it an idyllic region for medtech collaborations. As medical devices become increasingly vital in the landscape of healthcare solutions, this case study exemplifies the impactful benefits that can ensue when medtech sectors across nations unite to confront the prevalent challenge of cardiovascular diseases.

IV. Challenges and Opportunities in Cardiac Device Development

The landscape of cardiac device development is remarkable for both its transformative impacts on patient care and the stringent regulatory landscape that ensures product safety and efficacy. As innovations advance, regulatory bodies such as the FDA evolve their guidelines to mitigate risks associated with new cardiac technologies. These regulatory updates necessitate vigilant adherence from medical device developers to avoid delays in market introduction.

With cardiovascular diseases remaining the number one cause of death globally, the impetus for advancement in this field is stronger than ever. Substantial progress in diagnostics and treatments has raised the bar for CVD management, responding to the rising incidence of heart conditions worldwide.

Collaboration between the US and Latin American medtech sectors opens a gateway to innovation while streamlining the path to market. Evidence of this potential is seen in Mexico’s rise as a major exporter of medical instruments to the US, powered by its burgeoning workforce and strategic geographical advantage. Initiatives like Guanajuato’s focus on medical devices illustrate the region’s commitment to growth in this sector.

Recent clinical trials, such as Edwards Lifesciences' initiative engaging 100 patients across 30 sites, hint at the promise of such collaboration. These joint efforts not only tackle heart-related ailments but also expedite the development process of life-saving devices. Embracing digital health strategies, such as Ventric Health's Vivio, offers clinicians rapid, reliable heart failure diagnostics, reflecting a shift towards integrated care systems.

Understanding the 'golden triangle'—patients, providers, and payors—is crucial for success in this intricate market. The U.S. healthcare delivery system’s past reliance on its 'four Ps' has been reshaped by the digital health wave, underscoring the importance of adaptive strategies for stakeholders involved in cardiac device development. Such strategies could potentially be enhanced through U.S.-Latin American partnerships, leveraging diverse expertise and shared objectives.

V. Future Directions and Potential Breakthroughs

Well into the future, cardiac device development is poised to harness the evolving technologies of miniaturization, extended battery lifespan, and enhanced remote monitoring capabilities. The integration of artificial intelligence and machine learning heralds a new era of precision medicine in cardiology, leveraging these tools for data analysis and improved patient care. A surge in the patent landscape indicates traction for these advanced technologies, with over 710,000 patents in the medical devices sector recognized in the past three years alone, as reported by GlobalData.

Notably, a focus on homecare, preventive treatments, and early diagnosis is propelling the need for innovation in cardiac devices, including those designed to address valvular heart diseases. Recent innovations have pivoted from a historical focus on the aortic valve to emerging solutions targeting the mitral and tricuspid valves, which underscore the potential for significant cardiovascular advancements.

The push for technological breakthroughs aligns with the growth of the pacemaker market, a stalwart in cardiac therapeutics. With a history spanning over six decades, it remains robust, propelled by demographic shifts and technological advancements. Almost 1.5 million patients worldwide benefited from pacemaker implantation in 2022, and forecasts suggest annual sales could reach 2.5 million units by 2033.

This wave of innovation is not limited to well-established markets. There are burgeoning opportunities in under-explored territories like pulmonary hypertension, a niche in medtech with 500-1000 new US cases annually, presently managed by a wide array of pharmaceutical treatments. Clinical studies backed by substantial funding, such as the $31 million raised in a 2020 Series B round, signal the industry's readiness to dive into these uncharted realms with novel device-based therapies.

Progress is further supported by a commitment among thought leaders, as expressed by Ian Bolland of Med-Tech Innovation, to engage the medtech sector in addressing challenges and advancing responsible innovation in an ever-changing regulatory environment. The intersection of expertise, international cooperation, and patient-centric design is key to sustaining this momentum and transforming the landscape of cardiac device development.

Conclusion

In conclusion, cardiac device development is thriving due to increasing demand for improved healthcare outcomes and technological advancements. Innovations like machine learning, augmented reality, and 5G are driving the rise of novel solutions. Advancements in interventional heart failure and mechanical circulatory support systems are pushing the boundaries of cardiovascular care.

Balancing the needs of stakeholders is crucial for successful implementation. Collaborative efforts and the integration of expertise across countries are key to addressing the global burden of cardiovascular diseases. Regulatory guidelines ensure safety and efficacy, while collaboration between the US and Latin American medtech sectors streamlines innovation.

Future developments include miniaturization, extended battery lifespan, and enhanced remote monitoring capabilities. Artificial intelligence and machine learning will revolutionize precision medicine in cardiology. In conclusion, cardiac device development holds great promise for improving cardiovascular care.

Collaboration, technology integration, and patient-centric design are vital for advancing responsible innovation in this field.