Overview

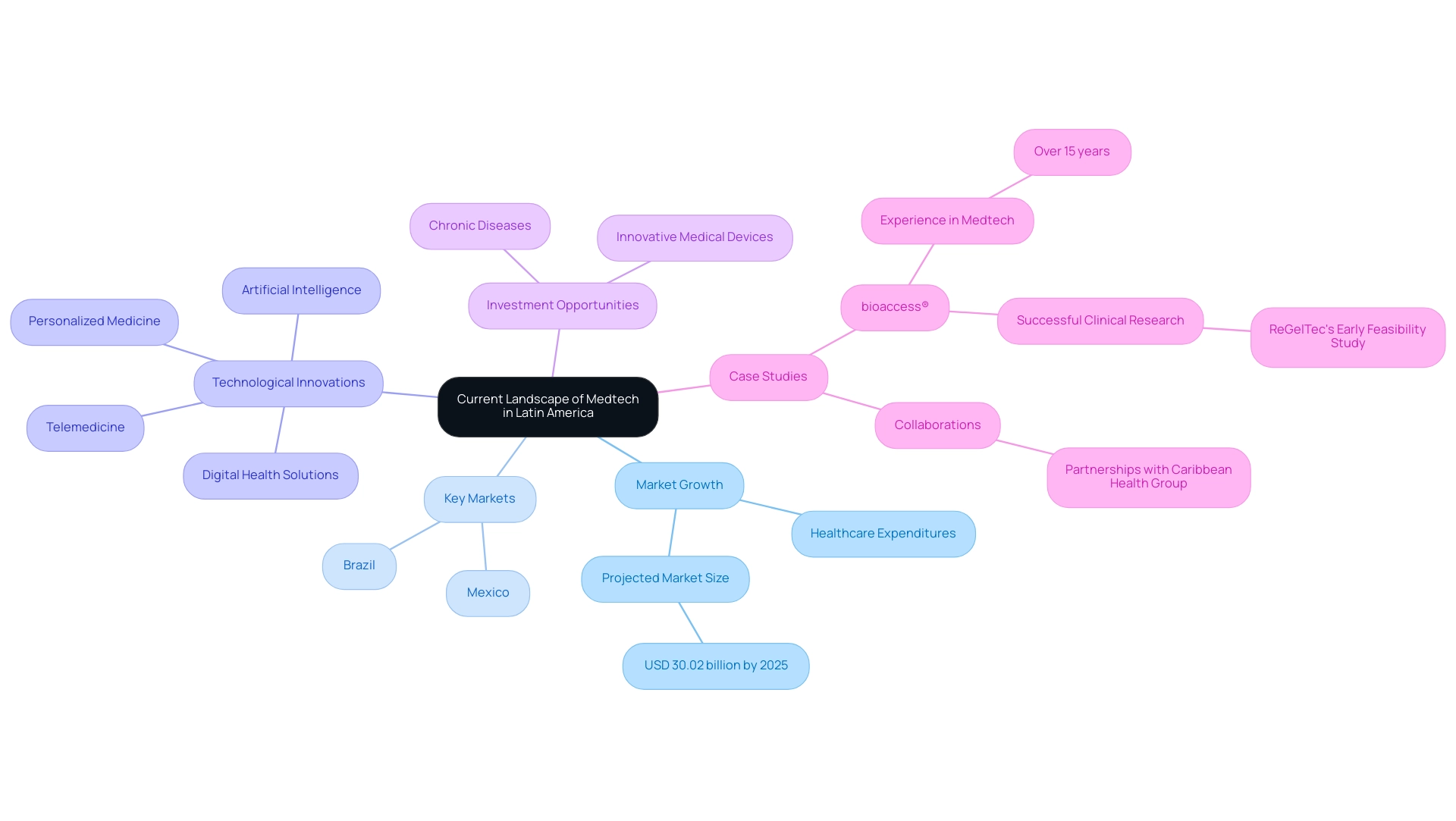

The article investigates the substantial opportunities present in the Medtech sector across Latin America, with a notable market growth projection to approximately USD 30.02 billion by 2025. This growth is propelled by rising healthcare expenditures and an increasing demand for innovative medical technologies. It underscores the critical role of collaborations, particularly those facilitated by bioaccess®, in overcoming regulatory challenges and promoting innovation. Successful case studies are highlighted, illustrating the region's potential for significant advancements in medical technology.

Introduction

The Medtech landscape in Latin America is rapidly evolving, fueled by increasing healthcare investments and a robust demand for innovative medical technologies.

With projected revenues approaching USD 30 billion by 2025, Brazil and Mexico stand out as pivotal players in this expanding market, providing fertile ground for advancements in medical devices.

The integration of cutting-edge technologies, including artificial intelligence and telemedicine, is transforming healthcare delivery, while a shift towards personalized medicine aligns with a broader global trend.

As organizations navigate the complexities of regulatory frameworks and cultural nuances, strategic collaborations become essential for unlocking the region's potential.

This article delves into the current state of Medtech in Latin America, emphasizing emerging trends, regulatory challenges, and the vital role of clinical trials in fostering innovation and growth.

Current Landscape of Medtech in Latin America

The robust growth trajectory of the Medtech sector underscores the significant opportunities within Latin America, driven by escalating healthcare expenditures and an increasing demand for innovative medical technologies. By 2025, the medical technology sector in Latin America is projected to reach approximately USD 30.02 billion, underscoring the region's expanding potential. Brazil emerges as the largest market, closely followed by Mexico, both pivotal players in this dynamic landscape.

Diverse patient demographics and the rising incidence of chronic diseases in these countries create substantial opportunities for innovation and investment in medical devices. Notably, the integration of advanced technologies such as artificial intelligence and telemedicine is revolutionizing healthcare delivery, resulting in numerous opportunities for medical technology firms aiming to establish a foothold in the region.

Current growth trends indicate a significant shift toward personalized medicine and digital health solutions, reflecting a broader global movement within the industry. Experts anticipate that healthcare spending in the southern continent will continue to rise, further enhancing opportunities for medical technology innovations. Successful case studies from Brazil and Mexico exemplify the region's capacity to foster groundbreaking medical technologies, showcasing the potential for accelerated development and market entry of new devices.

Organizations like bioaccess®, with over 20 years of experience in the medical technology industry, play a crucial role in bridging the gap between innovative companies and the available opportunities in Latin America. Their expertise in managing various types of studies—including Early-Feasibility Studies, First-In-Human Studies, Pilot Studies, Pivotal Studies, and Post-Market Clinical Follow-Up Studies—is instrumental in ensuring successful outcomes for clinical trials. A notable example is ReGelTec's Early Feasibility Study on HYDRAFIL™ for treating chronic low back pain in Colombia, which highlights the potential for impactful clinical research in the region.

Moreover, partnerships between bioaccess® and entities such as the Caribbean Health Group are establishing Barranquilla as a premier destination for clinical trials, showcasing the opportunities available in Latin America, and are supported by Colombia's Minister of Health. This collaborative environment not only stimulates local economies through job creation and healthcare advancements but also fosters international collaborations, further solidifying the region's role in the global medical technology landscape.

The Importance of US-Latin American Medtech Collaboration

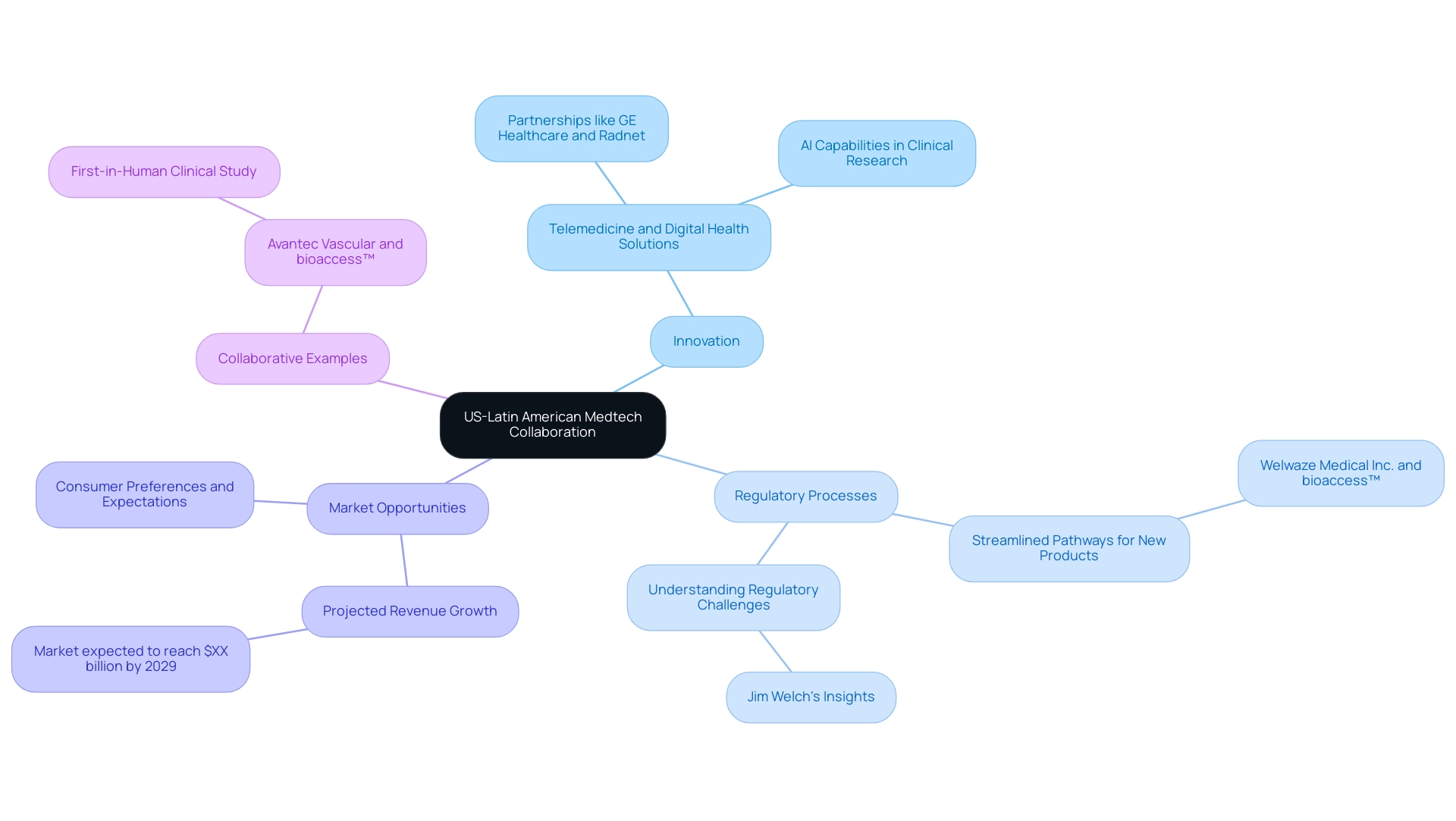

Collaboration between US and South American Medtech companies is pivotal for fostering innovation and expediting the development of medical technologies, highlighting the importance of Latin America medtech opportunities. The US, recognized for its advanced research capabilities and robust funding resources, can effectively leverage the diverse patient populations and favorable regulatory environments of the region to conduct clinical trials with enhanced efficiency. For instance, collaborations such as that of Avantec Vascular, which selected bioaccess™ for its first-in-human clinical study of an innovative vascular device in the southern continent, exemplify how the combination of shared resources and expertise can drive significant progress in medical devices.

Moreover, these collaborations are instrumental in streamlining regulatory processes, as evidenced by the partnership between Welwaze Medical Inc. and bioaccess™ for the Celbrea® medical device launch in Colombia. This collaboration not only facilitates a smoother pathway for new products to enter the industry but also enhances patient outcomes across both regions. The healthcare technology sector in the region, identified as one of the Latin America medtech opportunities, is projected to generate substantial revenue, reaching approximately $XX billion by 2029, underscoring the significance of these collaborations.

Health system leaders express optimism about overcoming challenges such as clinical staff shortages and budget constraints, aiming to reduce costs while enhancing patient experiences by 2025.

The increasing investment in telemedicine and digital health solutions further underscores the potential of US-Latin American collaborations in relation to Latin America medtech opportunities. Successful partnerships, such as those integrating AI capabilities into clinical research, exemplified by IDx Technologies' collaboration with bioaccess™ to identify South American ophthalmology centers for AI-based disease detection, illustrate how innovation can be propelled through cooperative efforts. As Jim Welch, EY Global Healthcare Leader, stated, "Understanding the state of the industry and its regulatory challenges is essential for leveraging opportunities in this evolving landscape."

As the landscape evolves, comprehending the regulatory challenges and capitalizing on Latin America medtech opportunities will be crucial for stakeholders seeking to exploit the growing medical technology market in the southern continent.

Navigating the Regulatory Framework for Medtech in Latin America

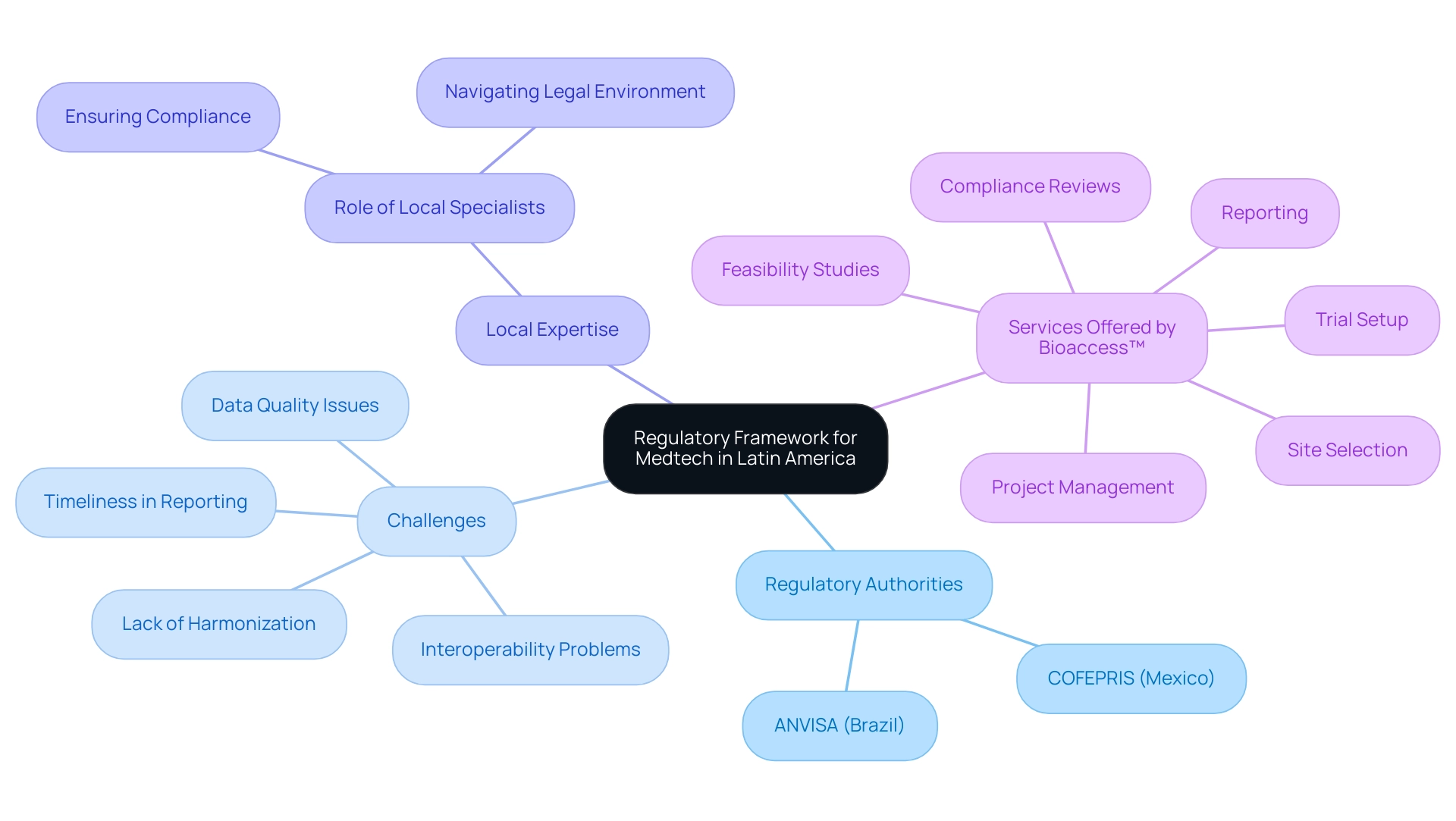

Navigating the regulatory framework for medical technology in South America presents a multifaceted challenge, primarily due to the lack of harmonization among nations. Each country operates under its own regulatory authority, with ANVISA in Brazil and COFEPRIS in Mexico playing pivotal roles in the approval and registration of medical devices. Companies must familiarize themselves with diverse requirements, which encompass clinical trial protocols, product classification, and post-market surveillance obligations.

As April Chan-Tsui, Director of Product Operations at Clarivate, emphasizes, "Involving local specialists is essential for guaranteeing adherence in a complex legal environment," underscoring the critical role of local expertise in navigating these regulations.

In recent years, several Latin American countries have made significant strides in streamlining their regulatory processes, resulting in faster approvals and enhanced transparency. For instance, the FDA Adverse Event Reporting System (FAERS) is now supported by over 150 countries, underscoring the global commitment to improving safety monitoring for medical devices. However, challenges remain, particularly in areas such as data quality and interoperability, which can impede effective signal detection in adverse event reporting systems.

The case study titled "Challenges in Adverse Event Reporting Systems" illustrates these issues, emphasizing that addressing these challenges is crucial for enhancing pharmacovigilance efficacy and ensuring patient safety through timely regulatory actions.

As the demand for medical devices continues to rise in Latin America, driven by the increasing prevalence of chronic diseases in the region, companies that proactively address regulatory hurdles and engage in strategic collaborations—such as those facilitated by bioaccess™—will be better positioned to thrive in these medtech opportunities. Bioaccess™ offers comprehensive service capabilities, including:

- Feasibility studies

- Site selection

- Compliance reviews

- Trial setup

- Project management

- Reporting

These services are essential for navigating the complexities of regulatory compliance. For example, bioaccess™ has effectively partnered with Welwaze Medical Inc. to introduce the Celbrea® medical device in Colombia, demonstrating its proficiency in regulatory access and entry strategies.

Staying informed about the latest developments in ANVISA and COFEPRIS regulations is essential for successful entry and compliance in 2025 and beyond. The capacity to adapt to ongoing regulatory changes will be a key factor in the success of medical technology firms operating in South America.

Emerging Trends and Future Opportunities in Latin American Medtech

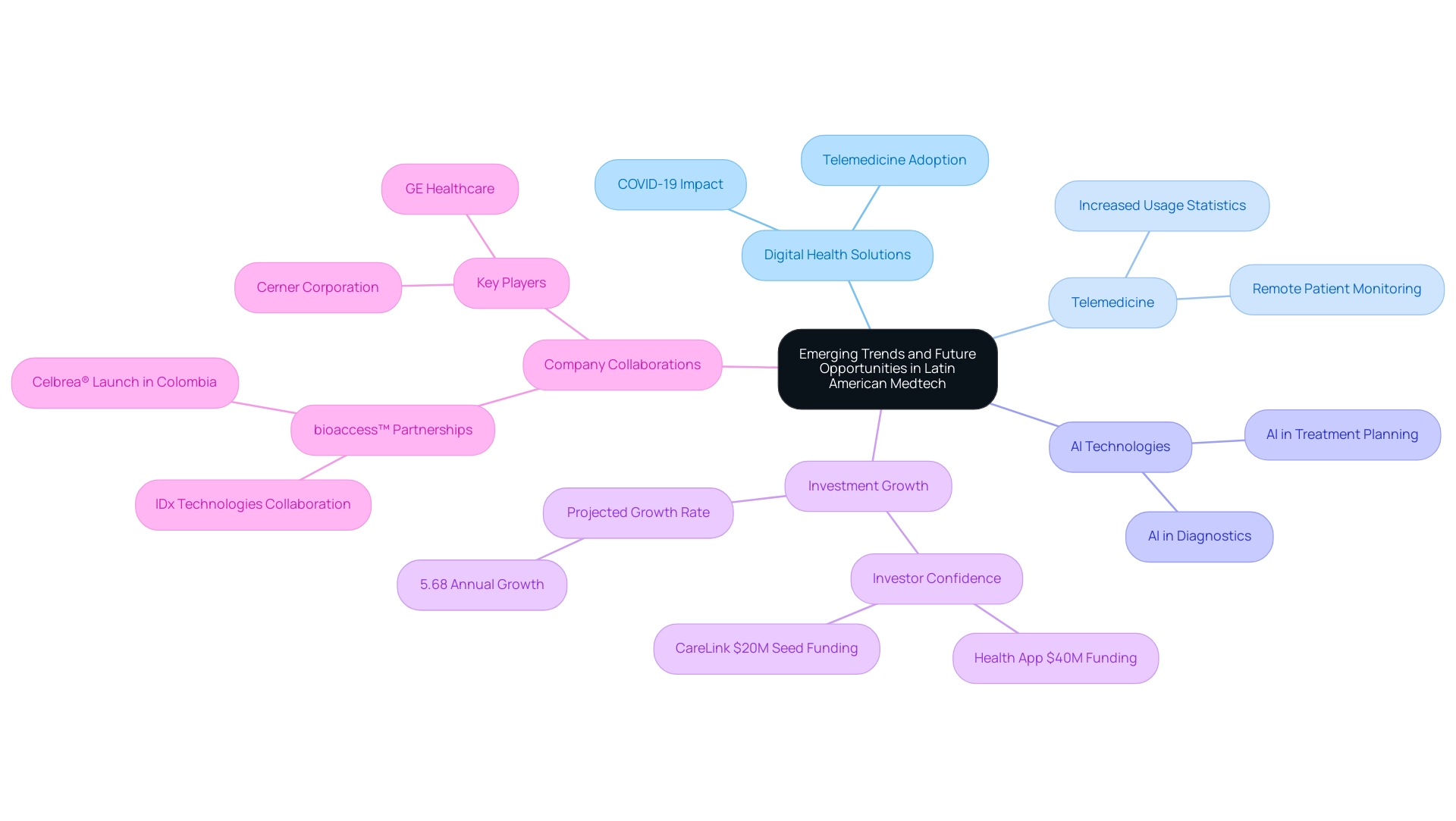

The transformative shift in the Latin American healthcare technology sector presents significant opportunities in Latin America medtech, characterized by the rapid adoption of digital health solutions, telemedicine, and AI-driven technologies. As healthcare systems adapt to new challenges, there is an increasing demand for innovative solutions that not only enhance patient care but also streamline operational efficiencies. The integration of artificial intelligence in diagnostics and treatment planning is particularly noteworthy, offering substantial improvements in both accuracy and efficiency.

The COVID-19 pandemic has acted as a catalyst for this evolution, significantly accelerating the transition towards remote patient monitoring and telehealth services. This shift has opened up new avenues for Medtech companies to innovate and effectively promote their products, especially regarding Latin America medtech opportunities. For instance, the health sector has seen substantial investment, with companies like Health App securing $40 million in Series B funding to enhance their platforms, reflecting strong investor confidence in the potential for growth and innovation in health technology. This trend illustrates a competitive environment, where key players like Cerner Corporation and GE Healthcare are establishing standards for success.

Furthermore, the digital health sector is divided by technology, application, and end-user, with the North region being the largest area. This context is essential for understanding the region's placement within the global market. Looking ahead, the medical device sector in South America is projected to grow at an annual rate of 5.68%, indicating strong Latin America medtech opportunities for investment and innovation. This growth is further supported by increasing digital health adoption statistics, which indicate a rising trend in telemedicine usage across the region. As these technologies continue to advance, they promise to transform the healthcare landscape in Latin America, providing substantial medtech opportunities for medical technology startups and established companies alike.

In this dynamic environment, bioaccess™ is leading the charge in medical technology clinical research, facilitating collaborations such as the partnership with IDx Technologies to identify South American ophthalmology centers for AI-based disease detection. Additionally, bioaccess™ has played a pivotal role in the successful launch of the Celbrea® medical device in Colombia, in collaboration with Welwaze Medical Inc., showcasing its commitment to regulatory excellence and international collaboration. The launch of Celbrea® not only enhances early detection of breast disease but also contributes to local job creation and economic growth, further solidifying bioaccess's impact in the region.

As Alicia, Vice Chair and US Health Care Sector Leader, points out, the potential for growth in Latin America medtech opportunities is substantial, highlighting the importance of strategic investments and partnerships in navigating this dynamic industry.

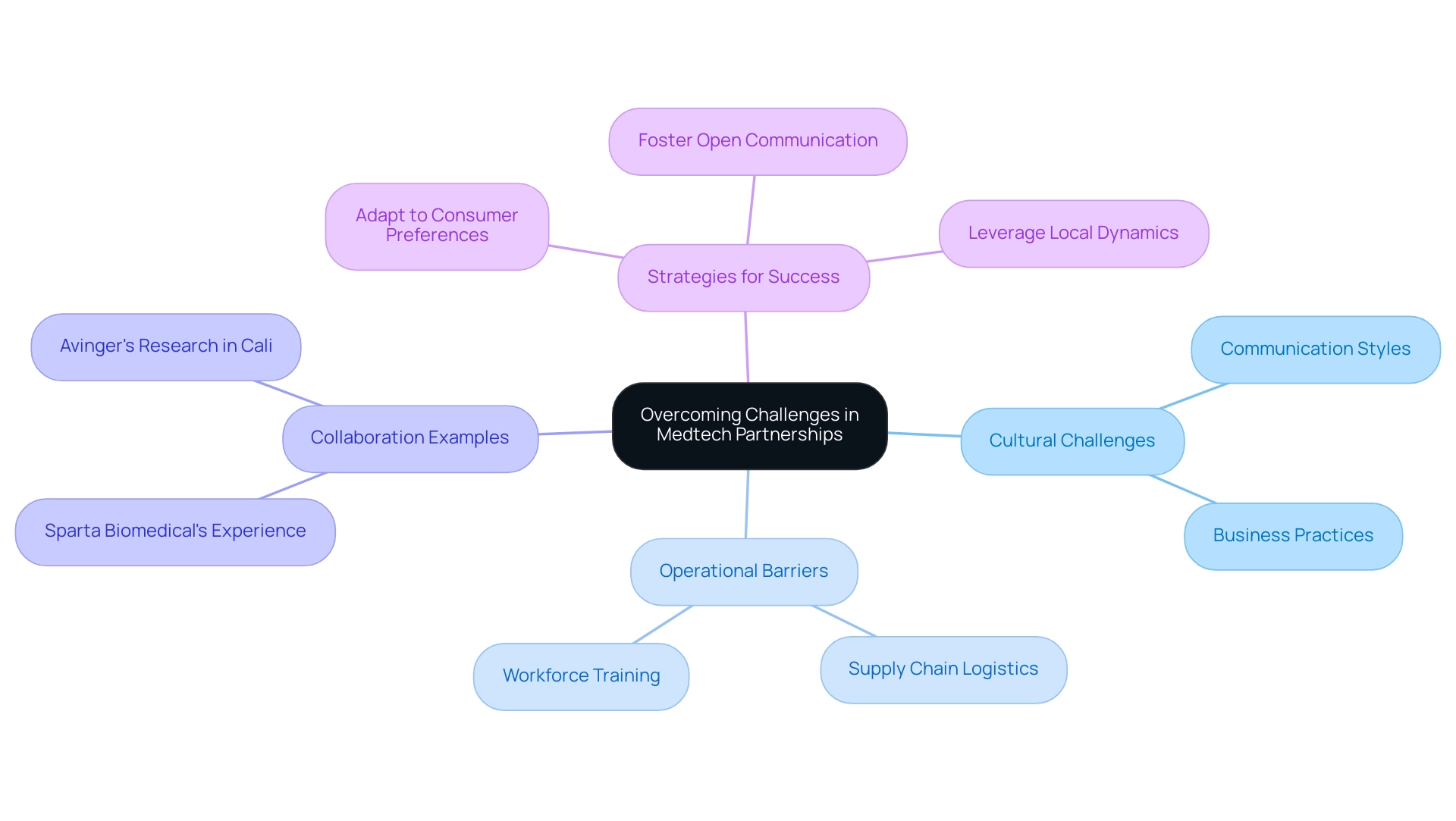

Overcoming Cultural and Operational Challenges in Medtech Partnerships

Entering the Latin America medtech opportunities sector presents a unique set of cultural and operational challenges that can significantly influence success. Variations in communication styles, business practices, and regulatory expectations often lead to misunderstandings and inefficiencies. To navigate these complexities, Medtech companies must prioritize relationship-building with local stakeholders, taking the time to understand cultural nuances and adapting their strategies accordingly.

Dushyanth Surakanti, Founder & CEO of Sparta Biomedical, emphasizes the significance of these relationships, drawing from his experience with bioaccess®, a prominent contract research organization, during its first human trial in Colombia, where local collaboration was crucial to success.

Operational barriers, such as supply chain logistics and workforce training, further complicate entry. Companies may face difficulties in sourcing materials or ensuring that local teams are adequately trained to meet the demands of advanced medical technologies. The challenges highlighted in the case study on clinical research in the region, including regulatory hurdles and recruitment issues, underscore the importance of addressing these operational challenges to leverage Latin America medtech opportunities for establishing effective partnerships and achieving long-term success in this area.

Dr. John B. Simpson's work on Avinger's OCT-guided atherectomy research in Cali, Colombia, illustrates how collaboration with LATAM CRO experts, including bioaccess®, can facilitate smoother navigation through these hurdles.

Moreover, medical technology firms must adapt to changing consumer preferences and expectations to develop successful market entry strategies. A recent survey highlighted that 85% of international sponsors rated data quality from Chilean trials as 'excellent' or 'very good,' reinforcing the Latin America medtech opportunities for high-quality research. As leaders in the medical technology sector, it is crucial to listen to quiet signals, make bold moves, and prepare for lasting change.

By fostering open communication and collaboration, healthcare technology firms can not only overcome these challenges but also leverage the region's significant growth potential and innovation opportunities. Effective operational strategies will depend on a deep understanding of local dynamics and a commitment to adapting to the evolving landscape of consumer preferences and expectations.

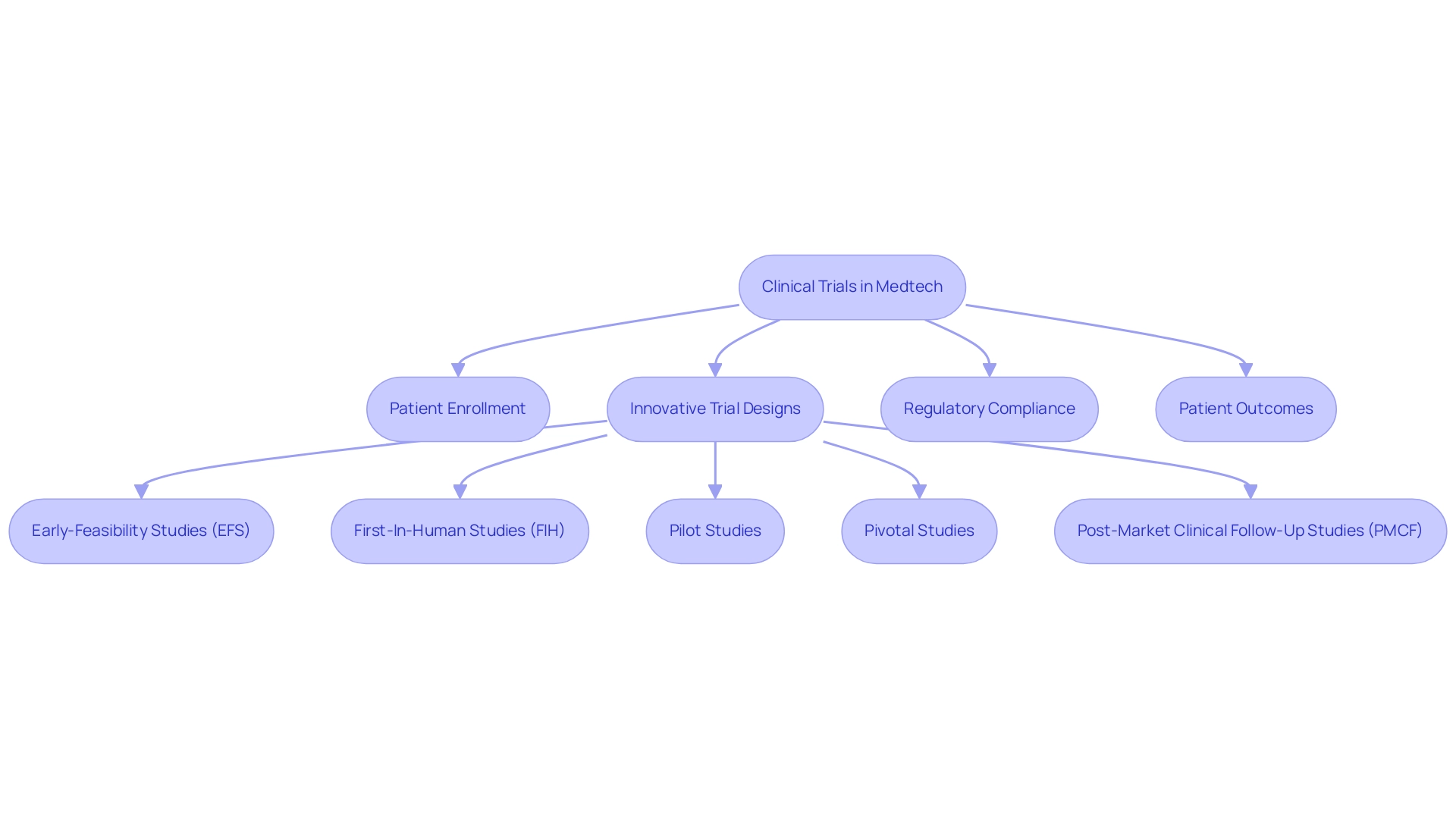

The Role of Clinical Trials in Advancing Medtech Innovations

Clinical trials are essential for advancing Medtech innovations, especially in regions where diverse patient populations and supportive regulatory environments create unique opportunities. This area is recognized for its capacity to accelerate patient enrollment, significantly reducing operational costs compared to other sectors. As we approach 2025, the focus on patient-centered research and the collection of real-world evidence (RWE) increasingly shapes the landscape, prompting a shift toward innovative trial designs, including decentralized trials.

These advancements not only streamline the clinical trial process but also enhance the relevance and applicability of findings in real-world settings.

The successful execution of clinical trials in the southern region not only validates products but also enriches the broader medical knowledge base, ultimately leading to improved patient outcomes. For instance, bioaccess® offers comprehensive clinical trial management services, including:

- Early-Feasibility Studies (EFS)

- First-In-Human Studies (FIH)

- Pilot Studies

- Pivotal Studies

- Post-Market Clinical Follow-Up Studies (PMCF)

Their service capabilities encompass feasibility studies, site selection, compliance reviews, trial setup, import permits, project management, and reporting.

This expertise is crucial in navigating the complexities of clinical research in the region. The consistent regulatory compliance observed in Peru, where all inspected clinical trial sites have passed regulations since 2000, underscores the region's commitment to maintaining high standards in clinical research. As Dipanwita Das, CEO & co-founder, notes, "Regulations are getting more complex and more prescriptive and more demanding... staying current with international regulations, so that you have a very smooth commercialization process, as well as data privacy."

This highlights the importance of navigating the regulatory landscape effectively.

Furthermore, the increasing focus on RWE, as outlined in the case study titled 'Focus on Real-World Evidence,' emphasizes its importance in aiding regulatory submissions and access. This trend enriches the discussion on innovative trial designs, making them more relevant to real-world applications. The partnership between bioaccess™ and Caribbean Health Group to establish Barranquilla as a premier location for clinical trials in the region, backed by Colombia's Minister of Health, illustrates the possibilities for global collaboration and economic development through medical technology clinical studies.

As the clinical trial technology and services sector continues to evolve, encompassing areas such as trial launch, patient and site recruitment, trial management, and data analytics, Medtech companies are well-positioned to leverage these advantages. By tapping into the unique characteristics of Latin America's Medtech opportunities, they can accelerate product development and ensure alignment with both local and global market needs.

Conclusion

The Medtech landscape in Latin America is undergoing rapid evolution, with projected revenues approaching USD 30 billion by 2025. Brazil and Mexico spearhead this growth, exemplifying the region's innovative capabilities through advanced technologies such as artificial intelligence and telemedicine.

Successfully navigating the regulatory complexities and cultural nuances is paramount for organizations aiming to excel in this dynamic market. Strategic partnerships, particularly those facilitated by bioaccess®, play a critical role in overcoming regulatory hurdles and ensuring the efficacy of clinical trials. These collaborations not only stimulate local economies but also strengthen international connections within the Medtech ecosystem.

With the rise of digital health and AI-driven solutions, the potential for innovation in Latin America remains substantial. Companies that prioritize local relationships and expertise will find themselves better positioned for success. Furthermore, a commitment to clinical research and real-world evidence will accelerate the development of medical technologies, ultimately enhancing patient outcomes.

In conclusion, the Medtech sector in Latin America stands at a transformative crossroads, brimming with opportunities for those prepared to navigate its complexities and cultivate collaboration. Stakeholders must remain agile, leveraging the region's unique strengths to propel innovation and improve healthcare delivery for the future.

Frequently Asked Questions

What is the projected growth of the medical technology sector in Latin America by 2025?

The medical technology sector in Latin America is projected to reach approximately USD 30.02 billion by 2025.

Which countries are the largest markets for medical technology in Latin America?

Brazil is the largest market, followed closely by Mexico.

What factors are driving opportunities for innovation in the Medtech sector in Latin America?

Diverse patient demographics, the rising incidence of chronic diseases, and the integration of advanced technologies like artificial intelligence and telemedicine are driving opportunities for innovation and investment in medical devices.

How are personalized medicine and digital health solutions trending in the region?

There is a significant shift toward personalized medicine and digital health solutions in Latin America, reflecting a broader global movement within the industry.

What role do organizations like bioaccess® play in the Medtech sector?

Organizations like bioaccess® bridge the gap between innovative companies and opportunities in Latin America, managing various types of studies to ensure successful outcomes for clinical trials.

Can you provide an example of a successful clinical study in the region?

ReGelTec's Early Feasibility Study on HYDRAFIL™ for treating chronic low back pain in Colombia is an example of impactful clinical research in the region.

How are partnerships contributing to the growth of clinical trials in Latin America?

Partnerships, such as between bioaccess® and the Caribbean Health Group, are establishing locations like Barranquilla as premier destinations for clinical trials, stimulating local economies and fostering international collaborations.

What is the significance of collaboration between US and South American Medtech companies?

Collaboration is pivotal for fostering innovation and expediting the development of medical technologies, leveraging the US's advanced research capabilities and the favorable regulatory environments of Latin America.

How do collaborations streamline regulatory processes in the Medtech sector?

Collaborations, such as between Welwaze Medical Inc. and bioaccess™, facilitate smoother pathways for new products to enter the market, enhancing patient outcomes.

What are the challenges faced by health system leaders in the region?

Health system leaders face challenges such as clinical staff shortages and budget constraints, which they aim to overcome while reducing costs and enhancing patient experiences by 2025.

How is investment in telemedicine and digital health solutions affecting the Medtech landscape?

Increasing investment in telemedicine and digital health solutions underscores the potential for US-Latin American collaborations, driving innovation and improving healthcare delivery.

What is essential for stakeholders seeking to exploit the growing medical technology market in Latin America?

Understanding regulatory challenges and capitalizing on opportunities in the Medtech sector will be crucial for stakeholders looking to succeed in this evolving landscape.