Overview

The emerging clinical trial markets to monitor in 2025 prominently feature regions such as:

- Latin America

- Asia-Pacific

These markets are propelled by:

- Favorable regulatory environments

- Diverse patient populations

- Significant advancements in technology

Such dynamics are poised to enhance the efficiency and effectiveness of clinical research. The integration of AI and strategic collaborations will play a pivotal role in this transformation, ultimately leading to improved patient outcomes and fostering medical innovation.

Introduction

In the rapidly evolving landscape of clinical research, emerging markets present a compelling opportunity for pharmaceutical companies in search of innovative solutions and diverse patient populations. Latin America, in particular, emerges as a vibrant hub for clinical trials, distinguished by its favorable regulatory environments and cost efficiencies.

As organizations prepare for 2025, advancements in technology—such as artificial intelligence and telemedicine—are poised to revolutionize trial designs, enhancing efficiency and prioritizing patient-centric approaches.

This article explores the dynamics of emerging clinical trial markets, examining the factors driving growth, the challenges encountered, and the promising future that awaits stakeholders ready to navigate this complex yet rewarding terrain.

Understanding Emerging Clinical Trial Markets

Emerging clinical trial markets are gaining traction for conducting studies due to factors such as an expanding patient population, reduced operational costs, and evolving regulatory frameworks. Latin America stands out as a prime example, providing a unique environment for pharmaceutical companies to conduct studies with greater efficiency and cost-effectiveness.

In 2025, the research landscape is expected to develop considerably, marked by quicker timelines and enhanced precision. This change is mainly due to the incorporation of AI-driven analytics, which improves patient recruitment, retention, and endpoint tracking, making research more adaptive and efficient. As a result, stakeholders can navigate uncertainties more effectively, establishing a solid foundation for future advancements in the field.

Significantly, around 54,000 inquiries annually can be prevented by enhancing system functionality, such as not necessitating users to input future visit dates, further highlighting the potential for increased efficiency in medical studies.

The expansion of medical studies in Latin America is especially remarkable. With its diverse patient demographics and a regulatory environment that is becoming increasingly favorable, the region is set to attract more research activities. For example, bioaccess®, with more than 20 years of experience in Medtech, has shown its dedication to this growth through its extensive research management services, including Early-Feasibility Studies (EFS), First-In-Human Studies (FIH), and Post-Market Follow-Up Studies (PMCF).

A recent case study highlighted how innovative decentralized research models are enhancing accessibility and inclusivity, allowing for a broader participant base and more robust data collection. The partnership between bioaccess® and Caribbean Health Group aims to position Barranquilla as a leading destination for research trials in Latin America, supported by Colombia's Minister of Health, which further underscores the region's potential.

Grasping these developing markets is essential for stakeholders looking to broaden their studies worldwide. The advantages of performing medical studies in these areas are numerous, including reduced expenses and the capacity to access previously underused patient groups. Additionally, Medtech research studies have a significant impact on local economies, contributing to job creation and economic growth.

As the FDA's Single IRB Requirement is expected to be put into effect in 2025, it is anticipated to simplify processes and improve collaboration internationally, which could greatly influence studies in Latin America.

In summary, the emerging clinical trial markets in 2025, particularly in Latin America, offer a wealth of opportunities for pharmaceutical companies. By leveraging the unique advantages these regions offer, stakeholders can not only accelerate their clinical research efforts but also contribute to the advancement of medical technologies that improve patient outcomes. As noted by the Head of Clinical Data Engineering, "Traditionally, data management was outsourced to our CRO vendor partners. Part of the initiative is to bring all our research in-house so that our internal teams can start working on it. They can be more hands-on, and we operationalize studies in-house and we are able to take control of our data, and we deliver for our patients with high quality.

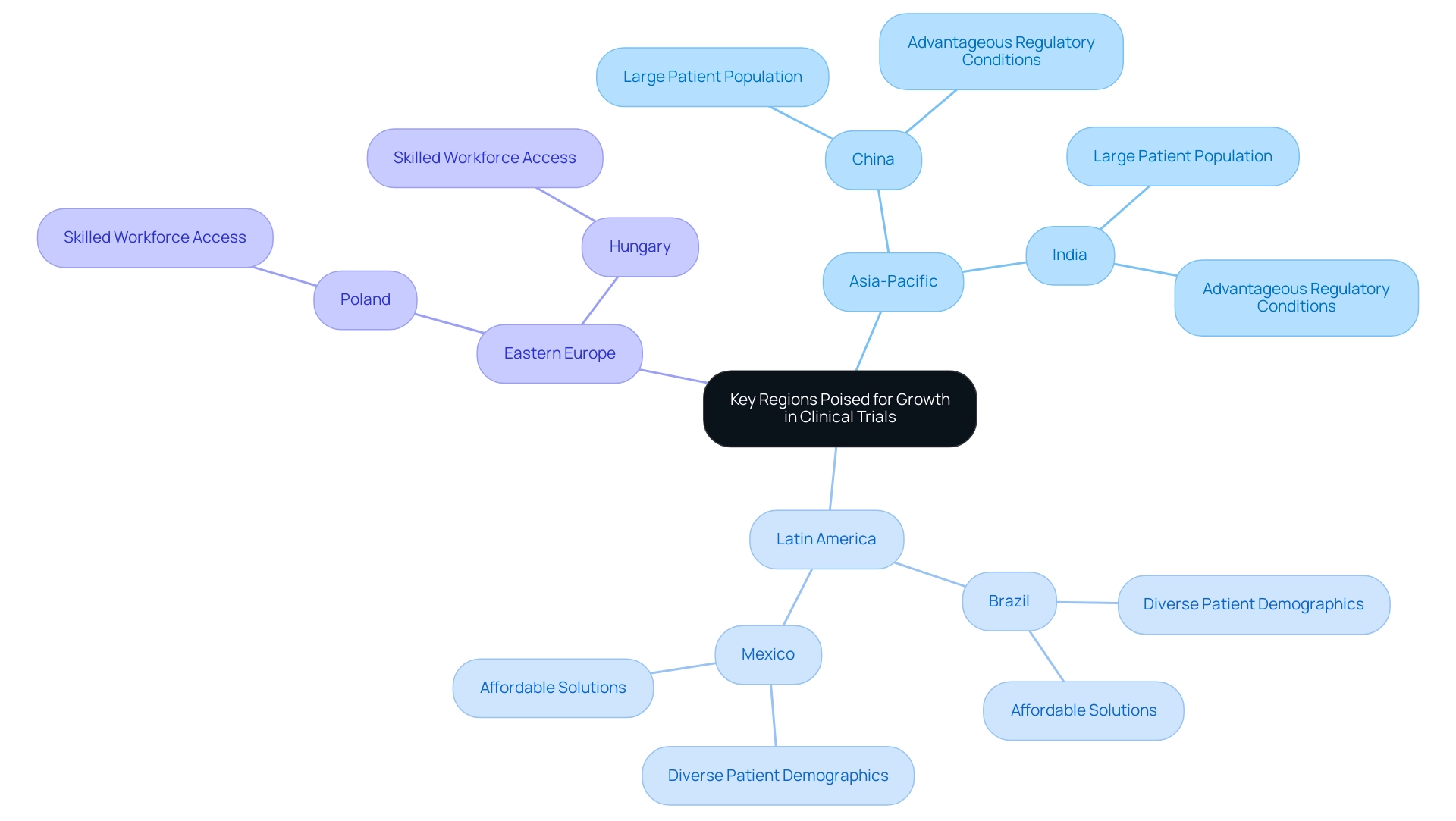

Key Regions Poised for Growth in Clinical Trials

In 2025, the clinical trial markets are poised for significant expansion across multiple areas. The Asia-Pacific region, particularly China and India, leads the charge in emerging clinical trial markets, as these nations rapidly enhance their medical study capabilities. This growth is driven by large patient populations and progressively advantageous regulatory conditions, collectively accounting for approximately 40% of the total experiments documented among major nations.

Latin America is emerging as a crucial player in the clinical trial arena, with Brazil and Mexico at the forefront. These countries boast diverse patient demographics and affordable solutions, making them attractive locations for clinical trials. The research markets in Brazil and Mexico are expected to expand significantly, propelled by the demand for innovative medical solutions and the potential of these markets to conduct studies effectively.

With over 20 years of experience in Medtech, bioaccess® provides comprehensive management services for various studies, including:

- Pilot studies

- First-in-human studies

- Early-feasibility studies

- Pivotal studies

- Post-market follow-up studies

This expertise bridges the gap between innovative Medtech companies and opportunities in Latin America through a customized approach.

A notable example is ReGelTec's Early Feasibility Study on HYDRAFIL™ for treating chronic low back pain in Colombia, where eleven patients were successfully treated, showcasing the effectiveness of bioaccess's management. Furthermore, Eastern European nations such as Poland and Hungary are gaining traction in the clinical trial markets by providing effective execution and access to a skilled workforce. As the worldwide contract development organization (CRO) market is projected to approach nearly $63 billion by 2030, with an annual growth rate of 7.39% from 2025 to 2030, the Asia-Pacific area is expected to demonstrate the quickest expansion in clinical trial markets, particularly in oncology.

Steven Roan observes the acceleration of research studies in Australia and Asia, emphasizing the significance of emerging clinical trial markets in the global medical research environment. The expansion of medical studies in these regions not only promotes innovation but also aids in job creation and economic development, further enhancing the local healthcare landscape.

Drivers of Growth in Emerging Clinical Trial Markets

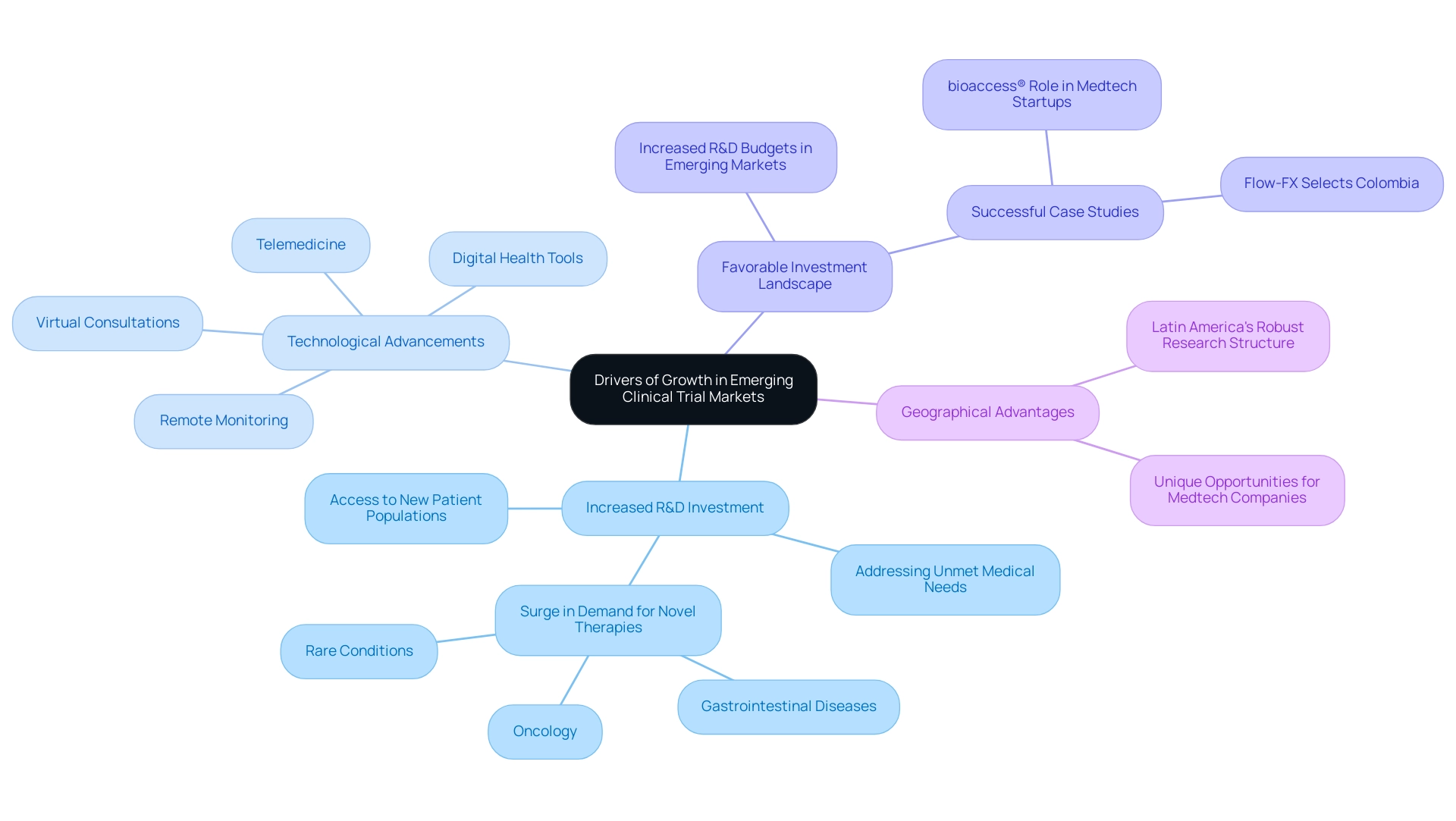

The expansion of emerging clinical trial markets is being driven by several pivotal factors. At the forefront is a significant increase in research and development investment from pharmaceutical companies, as they aim to access new patient populations and address unmet medical needs. By 2025, the demand for novel therapies—particularly in oncology, gastrointestinal diseases, and rare conditions—is expected to surge, prompting companies to explore these promising markets more aggressively.

Notably, bioaccess® specializes in 14 therapeutic centers of excellence, positioning it well to meet this demand. Furthermore, technological advancements are playing a crucial role in this evolution. The integration of digital health tools and telemedicine is transforming study designs, enhancing efficiency and patient recruitment processes. For instance, the use of remote monitoring and virtual consultations has streamlined participant engagement, allowing for broader geographic reach and improved data collection.

Moreover, the investment landscape in emerging markets is becoming increasingly favorable. Statistics indicate that pharmaceutical companies are allocating a larger portion of their R&D budgets to these regions, recognizing the potential for high returns on investment. This trend is additionally backed by case analyses demonstrating successful medical experiments conducted in Latin America, where bioaccess® has played a key role in promoting the progress of medical devices and therapies. For instance, the case examination titled 'Flow-FX Selects Colombia For A First-In-Human Medical Device Initiative On Its Flow-Screw Device For Delivery Of Intraosseous Antibiotics' illustrates how bioaccess® has assisted Medtech startups in maneuvering through the intricacies of medical investigations, ultimately resulting in successful product launches.

As the demand for innovative pharmaceuticals continues to rise, the strategic emphasis on emerging markets is expected to intensify, making them critical participants in the global medical examination landscape. With a robust structure for conducting medical research, Latin America stands out as a region ripe for exploration, offering unique opportunities for Medtech companies to accelerate their studies and bring novel therapies to market. Furthermore, suggested drug price changes are expected to slightly decrease profit margins but are not likely to greatly impede R&D investment, further reinforcing the region's appeal for research studies.

Challenges in Emerging Clinical Trial Markets

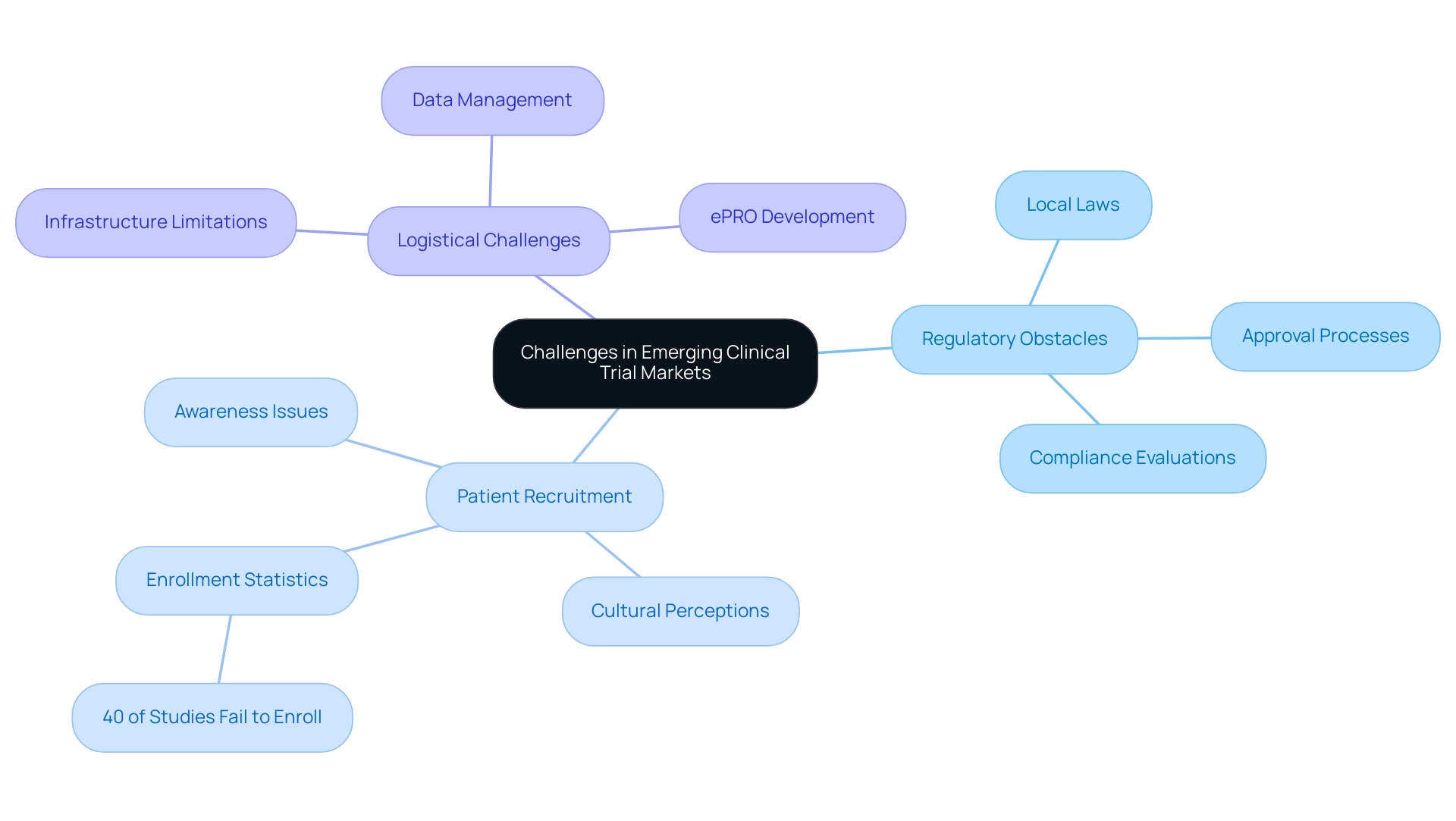

Emerging clinical trial markets present a wealth of opportunities, yet they are accompanied by distinct challenges. Regulatory obstacles can differ markedly from one country to another, complicating the approval process for research studies. Navigating the regulatory landscape in Latin America necessitates a nuanced understanding of local laws and practices, which can vary significantly across nations.

With over 20 years of experience in Medtech, bioaccess® is exceptionally positioned to assist organizations in surmounting these regulatory challenges, ensuring a more streamlined study initiation process. Our comprehensive research management services include:

- Feasibility assessments

- Site selection

- Compliance evaluations

- Setup

- Import permits

- Project management

- Reporting

All tailored to meet the specific needs of each market.

In addition to regulatory hurdles, patient recruitment poses a significant challenge. Many potential participants may be unaware of medical studies, a situation exacerbated by cultural differences that shape perceptions of healthcare research. Statistics indicate that by 2025, recruitment difficulties are expected to persist, with research showing that up to 40% of clinical studies fail to achieve their enrollment targets.

This shortfall impacts not only timelines but also the diversity of participant populations, which is crucial for the generalizability of results. As Victor Dillard, VP of Strategy & Operations at Resolution Therapeutics, emphasizes, "Cell therapy is showing promise in very large patient populations with inflammatory and fibrotic diseases," underscoring the critical role of innovative technologies in bolstering patient recruitment efforts.

Logistical challenges further complicate the clinical trial landscape. Infrastructure limitations in certain regions can hinder the efficient execution of studies, while data management issues may lead to inconsistencies in results. The development of electronic patient-reported outcomes (ePRO) is vital for addressing the evolving expectations of study participants and the complexities of modern protocols.

As ePRO continues to enhance the participant experience, it will foster improved adherence and engagement, alleviating some of the logistical challenges faced in research studies. With the biopharma sector showing signs of recovery and growth post-2024, particularly with the increasing significance of biosimilars, addressing these challenges will be essential for unlocking the full potential of emerging clinical trial markets. By comprehending and navigating these complexities, organizations can better position themselves for success in this dynamic environment.

Moreover, bioaccess®'s partnership with Caribbean Health Group aims to establish Barranquilla as a premier hub for medical studies in Latin America, supported by Colombia's Minister of Health. This collaboration illustrates our commitment to enhancing research opportunities in the region.

The Impact of Technology on Clinical Trials

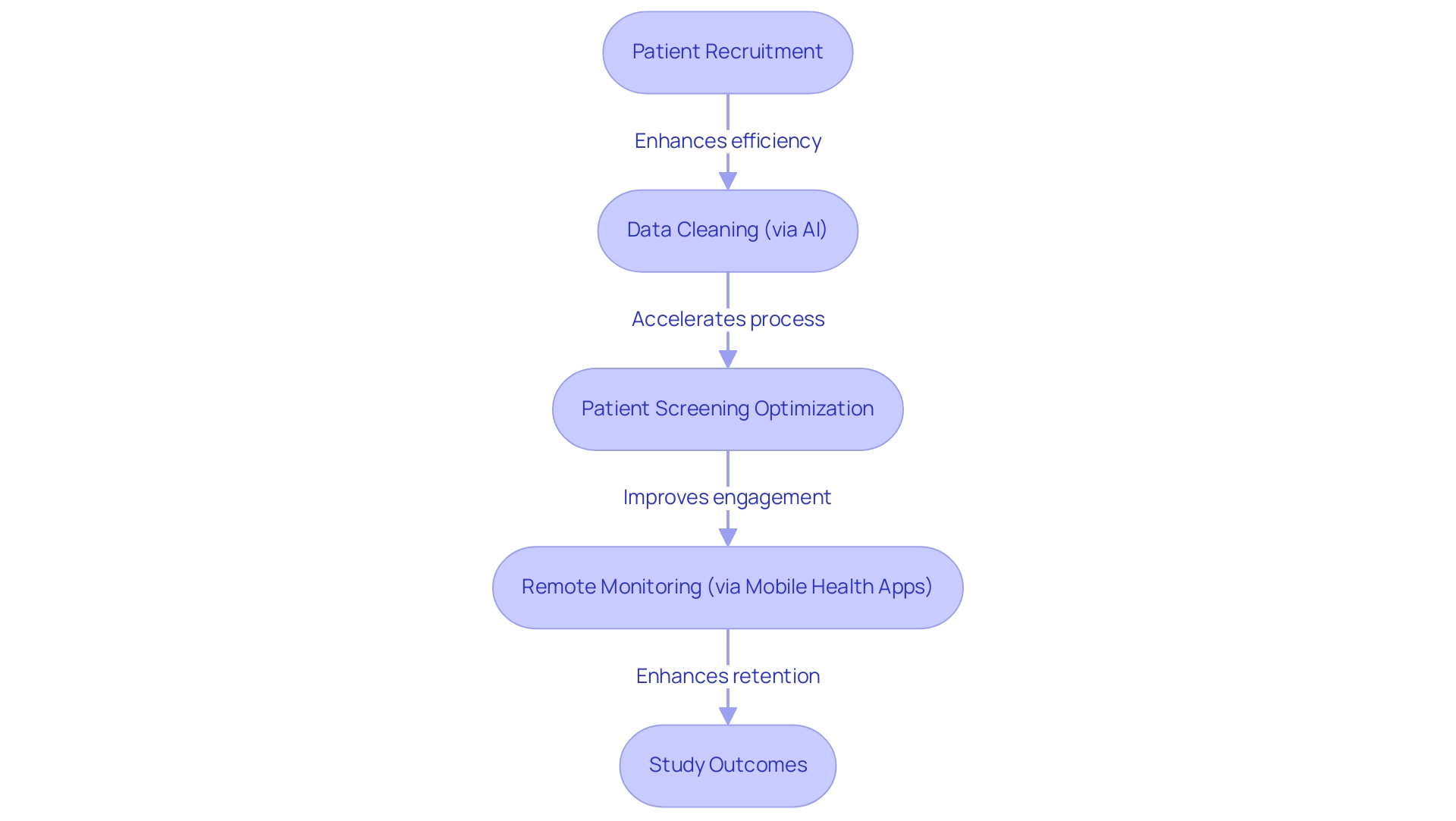

Technology is fundamentally transforming medical studies, particularly in emerging clinical trial markets such as those in Latin America. Innovations including artificial intelligence (AI), machine learning, and digital health tools streamline processes from patient recruitment to data analysis. By 2025, the integration of AI in clinical experimentation design is expected to significantly enhance efficiency, with research indicating that organizations employing AI can reduce the time to database lock by as much as 30%.

For example, GSK is leveraging rule-based automation for data cleaning, thereby accelerating this crucial process. AI not only improves experimental designs but also optimizes patient screening, ensuring that appropriate participants are selected for research. Mobile health applications represent another vital advancement, enabling remote monitoring and data collection. These tools enhance patient engagement and retention, both essential for successful study outcomes. A recent case analysis titled "Replacing Anecdotal Evidence with Empirical Evidence in DCTs" underscores the shift towards prioritizing empirical evidence, demonstrating a measurable impact on patient recruitment and retention rates.

In this context, bioaccess® stands out as a leader in providing comprehensive research management services, including feasibility assessments, site selection, compliance evaluations, and project oversight. With over 20 years of experience in Medtech, bioaccess® specializes in various studies such as:

- Early-Feasibility Studies (EFS)

- First-In-Human Studies (FIH)

- Pilot Studies

- Pivotal Studies

- Post-Market Clinical Follow-Up Studies (PMCF)

The partnership between bioaccess® and Caribbean Health Group is set to establish Barranquilla as a premier hub for emerging clinical trial markets in Latin America, supported by Colombia's Minister of Health.

This collaboration is expected to enhance the effectiveness of research studies in the region, aligning with the global trend of leveraging technology to improve study outcomes. Expert opinions highlight the significance of these technological advancements. As Max Baumann, Head of Execution at Treehill Partners, notes, "We expect continued focus on optimizing the development journeys of assets to achieve not only an approval-enabling endpoint but to qualify for commercial success." In this rapidly evolving landscape, the ability to adapt and integrate these technologies will be crucial for organizations like bioaccess®, which aims to expedite the advancement of medical devices while delivering high-quality outcomes.

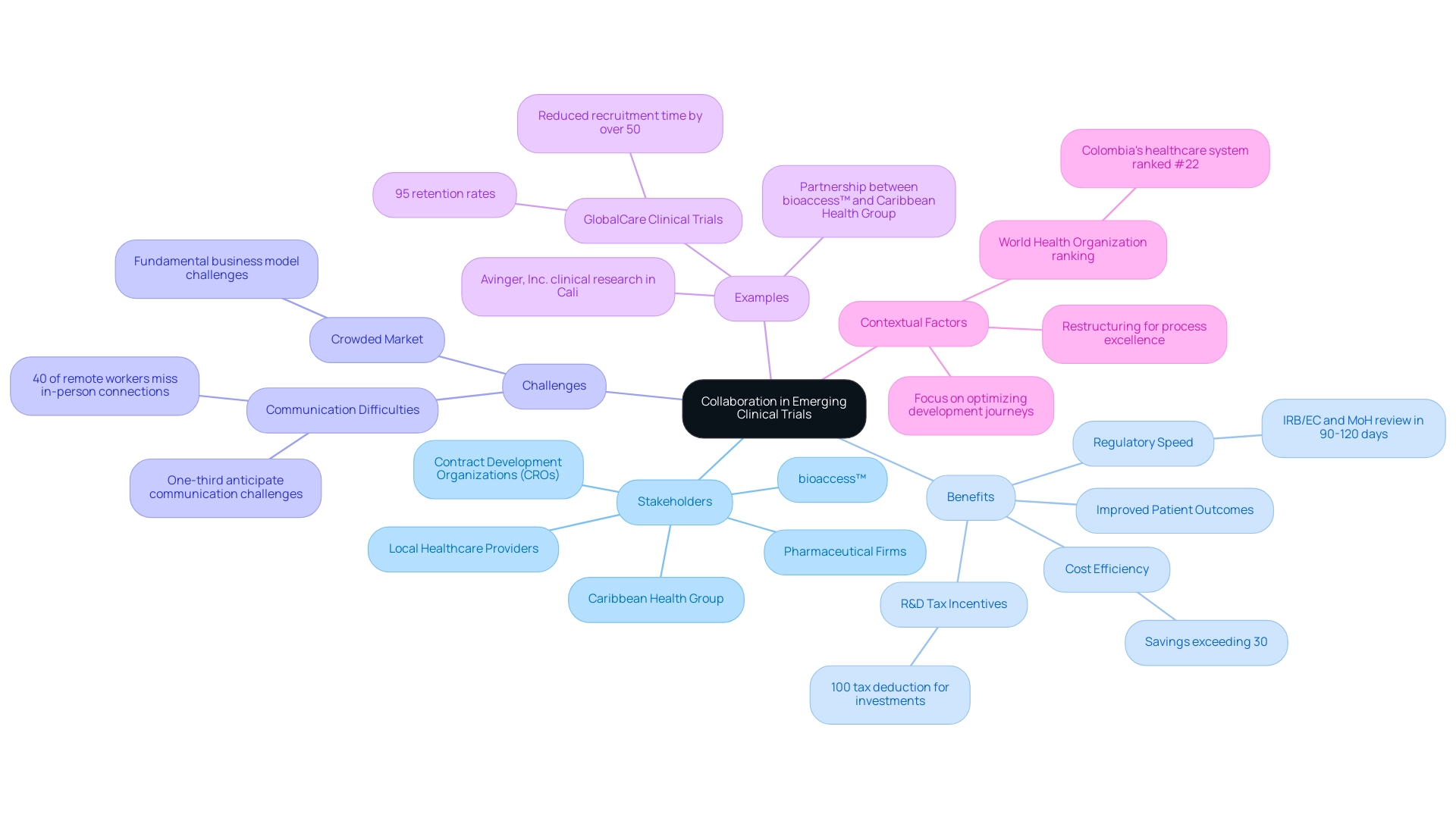

Collaboration: A Key to Success in Emerging Markets

Cooperation serves as a pivotal foundation for success in emerging clinical trial markets, particularly in Latin America. Strategic collaborations among contract development organizations (CROs), pharmaceutical firms, and local healthcare providers are essential for enhancing study execution and optimizing patient recruitment in these markets. A notable example is the partnership between bioaccess™ and Caribbean Health Group, which aims to position Barranquilla as the premier location for medical studies in Latin America, with support from Colombia's Minister of Health.

By leveraging each other's strengths, these stakeholders can adeptly navigate the complex regulatory landscapes and cultural nuances that often characterize emerging clinical trial markets. Furthermore, collaborative initiatives promote the sharing of resources and expertise, driving innovation and significantly improving patient outcomes in research.

Colombia presents various competitive advantages for first-in-human studies in emerging clinical trial markets, including cost efficiency, offering savings exceeding 30% compared to studies in North America or Western Europe. The regulatory speed is also favorable, with the total IRB/EC and MoH (INVIMA) review taking only 90-120 days. The quality of healthcare in Colombia is recognized globally, contributing to the World Health Organization ranking its healthcare system as #22 among 191 countries.

Additionally, the nation provides R&D tax incentives, including a 100% tax deduction for investments in science and technology, making it an attractive option for emerging clinical trial markets.

As we approach 2025, it is crucial to acknowledge that nearly one-third of employees foresee communication challenges with team members and customers, emphasizing the necessity of collaboration to overcome these obstacles. Max Baumann, Head of Execution at Treehill Partners, states, "As we approach 2025, we still observe biotech encountering essential business model difficulties as end-markets become increasingly crowded." This insight underscores the competitive landscape that demands robust alliances.

Moreover, the partnership with GlobalCare Clinical Trials has enhanced trial ambulatory services in Colombia, showcasing the benefits of strategic alliances in emerging clinical trial markets, evidenced by a reduction of over 50% in recruitment time and 95% retention rates. Dr. John B. Simpson, CEO of Avinger, Inc., reflects on Avinger's positive experience conducting OCT-guided atherectomy clinical research at a research site in Cali, Colombia, highlighting the favorable outcomes of such collaborations. The case study titled "Commercial Outcomes in Drug Development" illustrates how optimizing development journeys in emerging clinical trial markets can facilitate both regulatory approval and commercial success, reinforcing the value of collaboration in achieving these goals.

In light of these challenges, companies are restructuring to establish dedicated process excellence teams aimed at enhancing R&D efficiency, further aligning with the theme of improving execution through collaboration. As the industry evolves, the importance of such alliances will only intensify, particularly given the increasing competition and complexity within the biopharmaceutical sector and the emergence of emerging clinical trial markets.

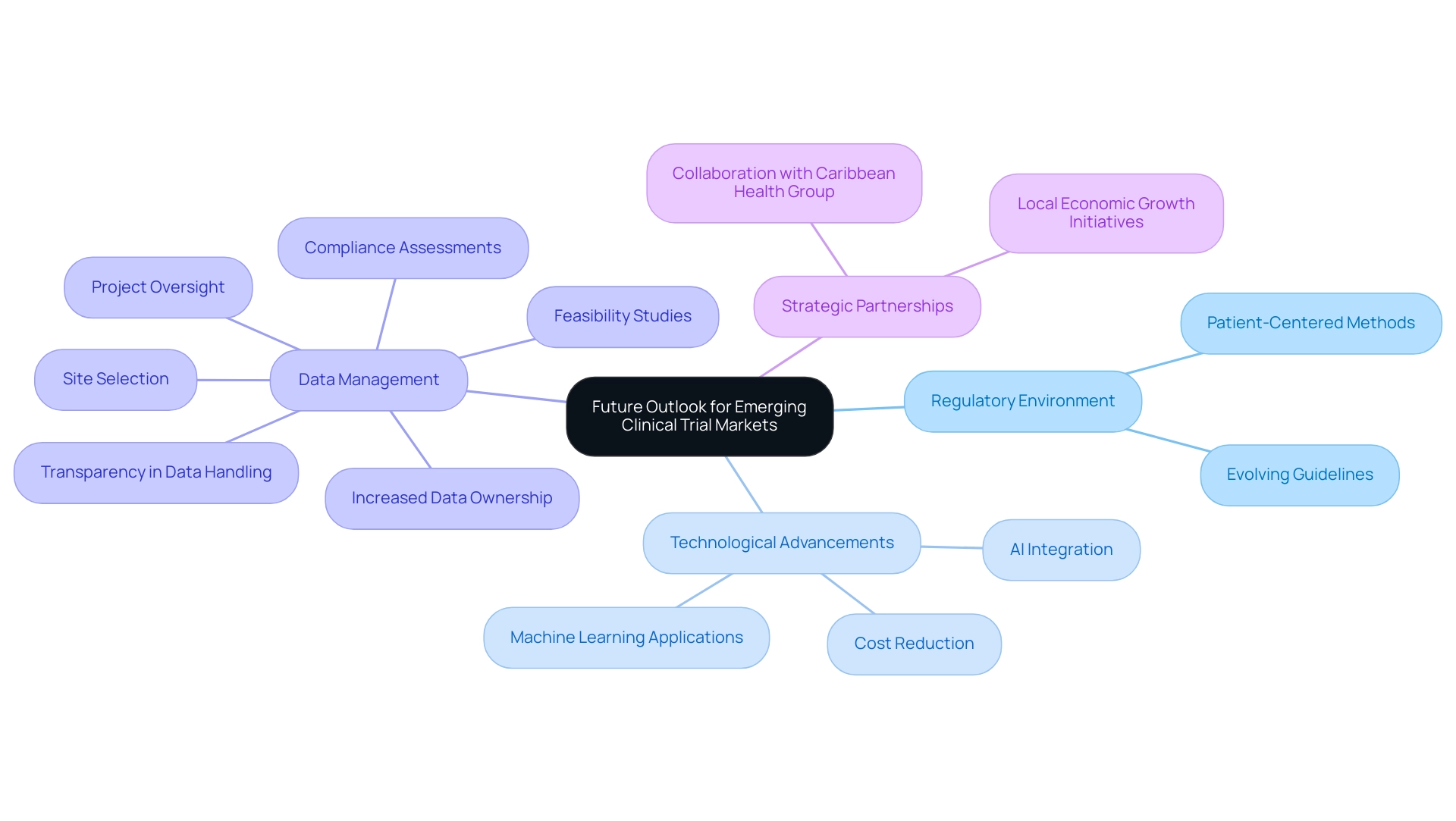

Future Outlook: What Lies Ahead for Emerging Clinical Trial Markets

The outlook for emerging research markets in 2025 is exceptionally optimistic, driven by a confluence of favorable regulatory environments and rapid technological advancements. As these areas become increasingly appealing for research activities, the focus on patient-centered methods and the incorporation of real-world evidence are poised to transform study designs. Significantly, the integration of artificial intelligence and machine learning is expected to shorten research timelines by up to 30% and decrease expenses by as much as 20%, thereby improving the effectiveness of medical experiments.

Moreover, sponsors are prioritizing data ownership and transparency, evidenced by a notable shift towards insourcing data management. This trend, emphasized in a recent case analysis titled 'Increased Data Ownership and Transparency,' underscores the implications of ICH E6 R2, where sponsors gain direct access to live data, enhancing data quality and patient outcomes. Furthermore, a statistic from Alcon indicates that 45% of data is entered on the same day as the visit date, highlighting the effectiveness of data management practices in research studies.

As stakeholders strategically position themselves within the emerging clinical trial markets, they will be well-positioned to leverage the opportunities that arise, ultimately fostering advancements in medical knowledge and enhancing patient care. Additionally, bioaccess®, with over 20 years of experience in Medtech, is leading this evolution by providing extensive research management services that encompass:

- Feasibility studies

- Site selection

- Compliance assessments

- Setup

- Import permits

- Project oversight

- Reporting

Their proficiency in overseeing Early-Feasibility Studies, First-In-Human Studies, Pilot Studies, Pivotal Studies, and Post-Market Follow-Up Studies is essential for navigating the complexities of trials in Latin America.

Furthermore, the partnership between bioaccess™ and Caribbean Health Group aims to establish Barranquilla as a premier location for trials in Latin America, backed by Colombia's Minister of Health. This initiative not only enhances the region's appeal for medical research but also contributes to local economic growth and healthcare improvement. As Peng Lu, chief medical officer of Dutch biotech Pharvaris, notes, "Standardizing the use of specific outcomes and outcome measures for studies will support guidelines development and future indirect comparisons among interventions."

With the regulatory landscape evolving to support innovative trial designs, the future of clinical trials in these regions is not only promising but also pivotal for the advancement of medical technology and improved health outcomes.

Conclusion

Emerging clinical trial markets, particularly in Latin America, are poised for remarkable growth, offering distinct advantages for pharmaceutical companies. The combination of diverse patient populations, cost efficiencies, and increasingly favorable regulatory environments positions these regions as attractive destinations for clinical research. As organizations prepare for 2025, the integration of advanced technologies, such as artificial intelligence and telemedicine, will further enhance trial efficiency and patient engagement, paving the way for more innovative and patient-centric approaches.

However, while opportunities abound, stakeholders must navigate a complex landscape filled with regulatory challenges and recruitment hurdles. Successful strategies will rely heavily on collaboration among contract research organizations, pharmaceutical companies, and local healthcare providers to optimize trial execution and enhance patient outcomes. The partnerships formed, exemplified by the collaboration between bioaccess® and Caribbean Health Group, illustrate how shared resources and expertise can drive innovation and efficiency in clinical research.

Looking ahead, the future of clinical trials in these emerging markets appears promising. By leveraging the unique benefits these regions offer and addressing the inherent challenges, stakeholders can contribute to the advancement of medical technologies that significantly improve patient care. As the clinical trial landscape evolves, embracing a collaborative and technology-driven approach will be essential for harnessing the full potential of emerging markets, ultimately leading to better health outcomes and economic growth in the regions involved.

Frequently Asked Questions

What are the main factors driving the growth of emerging clinical trial markets?

The growth of emerging clinical trial markets is primarily driven by an expanding patient population, reduced operational costs, and evolving regulatory frameworks.

Why is Latin America considered a prime location for conducting clinical trials?

Latin America is considered a prime location for clinical trials due to its diverse patient demographics and a regulatory environment that is becoming increasingly favorable, allowing for greater efficiency and cost-effectiveness in research.

How is AI expected to impact clinical trials by 2025?

By 2025, AI-driven analytics are expected to enhance patient recruitment, retention, and endpoint tracking, leading to quicker timelines and improved precision in clinical trials.

What potential efficiencies can be gained in medical studies?

Enhancements in system functionality could prevent around 54,000 inquiries annually, such as not requiring users to input future visit dates, indicating a significant potential for increased efficiency in medical studies.

What role does bioaccess® play in the Latin American clinical trial market?

bioaccess® provides extensive research management services, including Early-Feasibility Studies (EFS), First-In-Human Studies (FIH), and Post-Market Follow-Up Studies (PMCF), demonstrating its commitment to the growth of clinical research in Latin America.

How are decentralized research models benefiting clinical trials?

Innovative decentralized research models enhance accessibility and inclusivity, allowing for a broader participant base and more robust data collection in clinical trials.

What is the significance of the partnership between bioaccess® and Caribbean Health Group?

This partnership aims to position Barranquilla as a leading destination for research trials in Latin America, supported by Colombia's Minister of Health, highlighting the region's potential for clinical research.

What economic benefits do medical studies bring to local economies?

Medical studies contribute to job creation and economic growth in local economies, making them beneficial beyond just the research outcomes.

How will the FDA's Single IRB Requirement affect clinical trials in 2025?

The FDA's Single IRB Requirement is anticipated to simplify processes and improve international collaboration, which could significantly influence clinical studies in Latin America.

What opportunities do emerging clinical trial markets present for pharmaceutical companies?

Emerging clinical trial markets, particularly in Latin America, offer numerous opportunities for pharmaceutical companies to accelerate their research efforts and improve patient outcomes by leveraging the unique advantages of these regions.