Overview

Medtech innovation in Latin America is rapidly advancing, driven by local and international investments, with the industry projected to reach $40 billion by 2025, focusing on telemedicine, wearable devices, and affordable medical solutions. The article highlights the importance of regulatory compliance, strategic partnerships, and emerging technologies like AI and IoT, which are essential for navigating challenges and fostering growth in the region's healthcare landscape.

Introduction

As the medtech sector in Latin America continues to flourish, it stands at the intersection of innovation and opportunity, driven by a unique blend of local ingenuity and international investment. With a projected market size of $40 billion by 2025, the region is rapidly transforming into a global player in medical technology, particularly in areas such as:

- Telemedicine

- Wearables

- Diagnostic tools

This article delves into the current landscape of medtech innovation, exploring the challenges and opportunities faced by companies navigating this complex environment. It examines the critical role of:

- Regulatory frameworks

- The emergence of innovation hubs

- Future trends shaping the industry

Providing insights into how stakeholders can effectively position themselves for success in this dynamic market.

Current Landscape of Medtech Innovation in Latin America

Over the past ten years, the emergence of medtech innovation in Latin America has positioned South America as a dynamic center, showcasing an environment characterized by both local and international investments. With a projected industry size set to reach $40 billion by 2025, driven by heightened healthcare demands and a pivot towards digital health solutions, medtech innovation in Latin America is positioning the region as a leader in the global medtech landscape. Countries such as Brazil, Mexico, and Argentina are spearheading advancements in telemedicine, wearable devices, and diagnostic technologies.

Notably, innovative startups are increasingly focusing on developing low-cost medical devices tailored to the unique needs of underserved populations. In the X-ray equipment sector, for example, Dinan possesses a 7% share of the installed base in hospitals across South America, contributing to the medium concentration of leading players like GE Healthcare and Siemens. Additionally, the ventilators sector is led by Draeger with a 17% share, followed closely by Neumovent at 16% and Medtronic at 12%.

As this landscape evolves, there is a pronounced emphasis on regulatory compliance, particularly with INVIMA, Colombia's National Food and Drug Surveillance Institute. INVIMA is responsible for overseeing the marketing and manufacturing of health products, ensuring compliance with health standards, and providing medical approval for imports and exports. Its classification as a Level 4 health authority by PAHO/WHO signifies its competence in regulating health products to guarantee their safety, efficacy, and quality.

Guillaume Corpart, CEO and founder of Global Health Intelligence, emphasizes the significance of this data-driven approach, stating,

We cover roughly 90% of all the hospitals in South America within our database, with more than 140 data points for each.

This commitment to data integrity supports a more informed and strategic development of Medtech innovation in Latin America across the region. Furthermore, the surgical tables sector demonstrates medium concentration, with Steris leading at 28% and Getinge at 20%, illustrating the competitive dynamics at play.

However, US medtech companies also face challenges in this landscape, including language barriers, resource fragmentation, and the need for seamless communication with American hospitals, which underscores the importance of collaboration and innovative solutions to bridge these gaps.

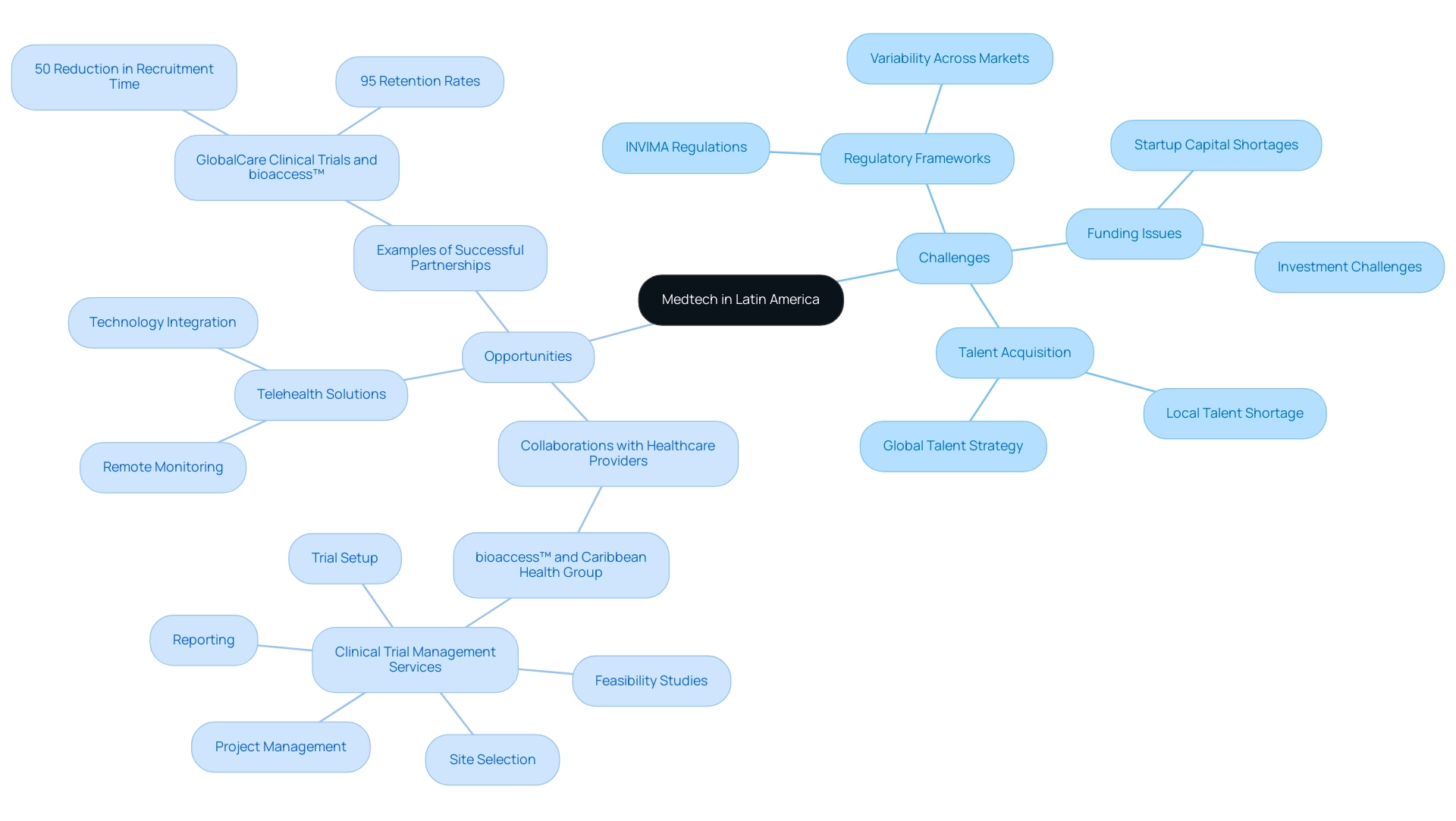

Challenges and Opportunities for Medtech Companies in Latin America

Medtech firms functioning in South America face a unique set of challenges, mainly defined by strict regulatory frameworks and variable access policies. A comprehensive understanding of regional regulations, such as those enforced by INVIMA, is essential, as these can vary drastically from those in other global markets. Funding remains a significant hurdle, with many startups struggling to secure the necessary capital to fuel their innovation and growth.

However, there is a promising talent pool emerging that can support Medtech innovation in Latin America, as recent insights indicate that Latin American students are 2.4 times more likely to invest in data science skills than the global average, which can help address regional talent needs. As Iffi Wahla, CEO and Co-founder of Edge, aptly states, 'My message for Healthtech companies is pretty straightforward – rather than seeing time and resources ebb away in the hunt for much-needed talent – think globally.' This perspective emphasizes the importance of adopting a global approach in talent acquisition.

Amidst these challenges lies a wealth of opportunity for Medtech innovation in Latin America, particularly through collaborative efforts with local healthcare providers and academic institutions. For instance, the collaboration between bioaccess™ and Caribbean Health Group aims to position Barranquilla as a leading destination for clinical trials, showcasing the potential for medtech innovation in Latin America, supported by the endorsement of Colombia's Minister of Health. This partnership encompasses comprehensive clinical trial management services, including:

- Feasibility studies

- Site selection

- Trial setup

- Project management

- Reporting

These services are vital for successful study execution.

Forming strategic partnerships can streamline market entry and enhance product development initiatives, leading to improved customer engagement and better health outcomes. A notable example is GlobalCare Clinical Trials' partnership with bioaccess™, which achieved over 50% reduction in recruitment time and 95% retention rates, showcasing the measurable impacts of such collaborations. Moreover, clinical studies play a crucial role in regional economies through job creation and economic development, emphasizing the importance of Medtech innovation in Latin America for promoting advancements in medical services.

The rising emphasis on telehealth and remote monitoring solutions offers exciting avenues for innovation, allowing companies to harness technology in response to the evolving demands of the healthcare sector. By navigating the complexities of the regional landscape and proactively addressing these challenges, medtech companies can strategically position themselves for success in this dynamic environment, driven by medtech innovation in Latin America and supported by the transformative efforts of entrepreneurs in the area.

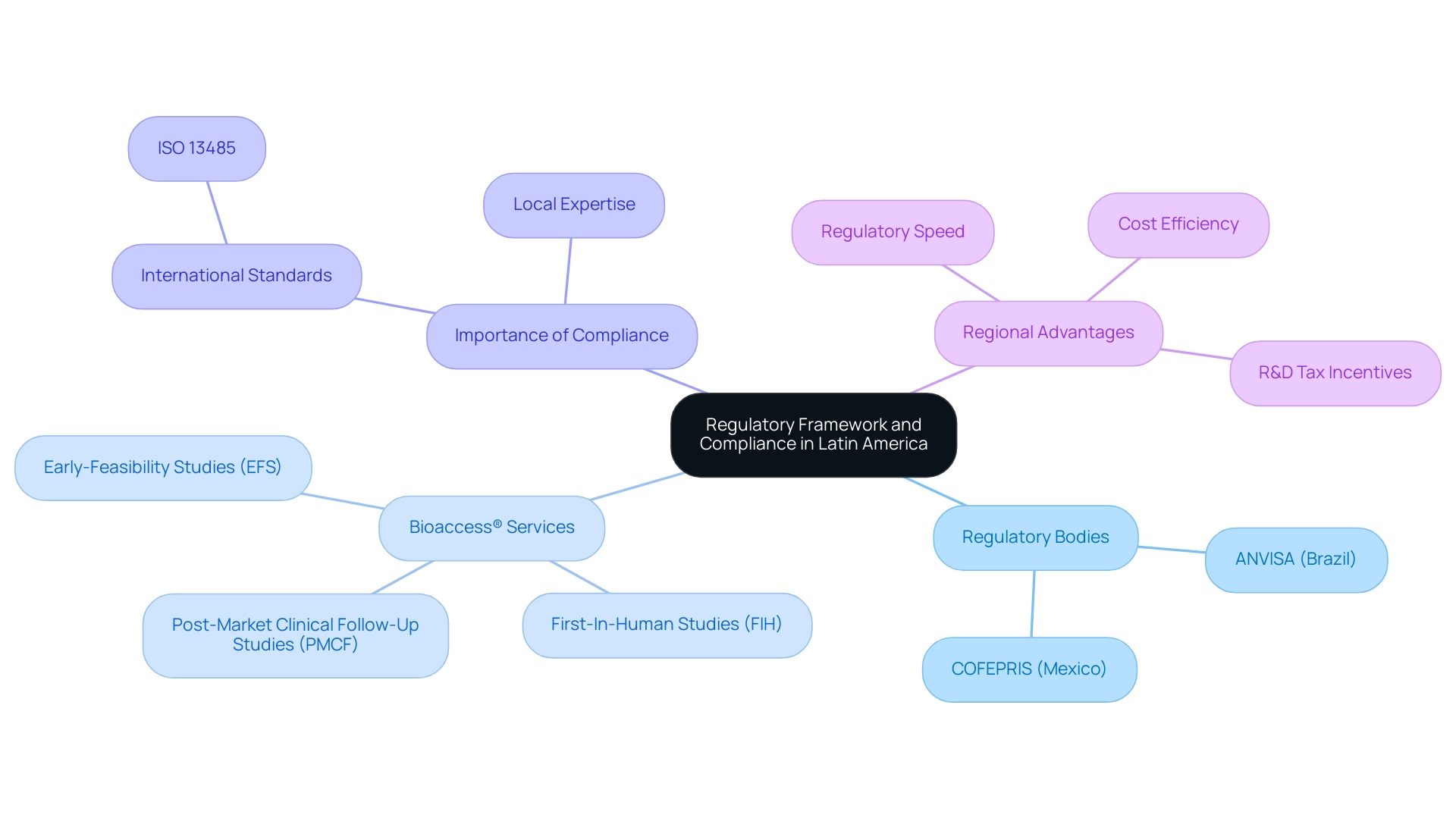

Regulatory Framework and Compliance in Latin America

Navigating the regulatory landscape for Medtech innovation in Latin America presents a multifaceted challenge, as it varies significantly across countries. Regulatory bodies such as ANVISA in Brazil and COFEPRIS in Mexico play crucial roles in overseeing the approval and ongoing monitoring of medical devices. Regional expertise is vital; as Katherine Ruiz, a specialist in Regulatory Affairs for Medical Devices and In Vitro Diagnostics in Colombia, observes, comprehending these regional regulations is crucial for successful entry.

Bioaccess® specializes in comprehensive clinical trial management services, focusing on:

- Early-Feasibility Studies (EFS)

- First-In-Human Studies (FIH)

- Post-Market Clinical Follow-Up Studies (PMCF)

Their services encompass:

- Detailed feasibility studies

- Careful site selection

- Compliance reviews

- Efficient trial setup

- Obtaining import permits

- Effective project management

- Thorough reporting

This ensures adherence to regional and international standards. The case study titled 'Need for Regulatory Updates in LATAM' highlights the critical requirement for LATAM countries to regularly update their drug registration and clinical research requirements to align with international standards.

Frequent updates and the adoption of alternative registration pathways are essential to facilitate quicker access to new drugs for patients in the region. Adherence to international standards, especially ISO 13485, is essential for entry and maintaining operational credibility. Moreover, an acute understanding of regional regulations concerning product registration, labeling, and post-market surveillance is vital for ensuring ongoing compliance and safeguarding product safety.

Engaging with local experts or regulatory consultants can significantly enhance a company’s ability to adhere to evolving compliance requirements, facilitating smoother market access for medtech innovation in Latin America. Additionally, Colombia provides competitive advantages for first-in-human clinical trials, including cost efficiency, regulatory speed, high-quality medical services, and R&D tax incentives, making it an appealing location for conducting trials. With the United States projected to generate the highest revenue in the medtech sector, amounting to US$190.70bn in 2025, the importance of compliance in this region cannot be overstated.

The Role of Innovation Hubs and Startups

Innovation hubs and startups are becoming increasingly crucial for driving Medtech innovation in Latin America, acting as incubators for innovative ideas and technologies that not only foster collaboration among entrepreneurs, researchers, and medical providers but also create significant economic ripples. These entities enhance the sector's dynamism by generating jobs, promoting economic growth, and gaining international recognition. A prime example is Brazil's Healthtech Hub, which provides startups access to crucial resources such as mentorship, funding, and networking opportunities essential for bringing new solutions to market.

Many of these startups concentrate on tackling local medical challenges, creating affordable diagnostic tools and mobile health applications designed for community needs. This aligns with the broader impact of Medtech clinical studies, which are known to enhance medical outcomes and drive international recognition. As David J. Dykeman noted, 'M&A transactions likely to deliver immediate returns to investors through mechanisms such as premium valuations and stock swaps,' highlighting the financial dynamics that impact these startups and their collaborations with established companies.

Furthermore, the synergy between established companies and startups can lead to successful partnerships, allowing larger firms to leverage cutting-edge technologies while equipping smaller enterprises with the necessary resources to scale their innovations. Initiatives like Colombia's Platzi, which offers online training to over a million students across South America, underscore the educational aspect vital for the growth of Medtech innovation in Latin America, contributing to economic growth and research development. As the Medtech landscape continues to evolve, Medtech innovation in Latin America will remain essential in shaping the future, fostering an environment where collaboration and creativity flourish, ultimately improving medical outcomes throughout America.

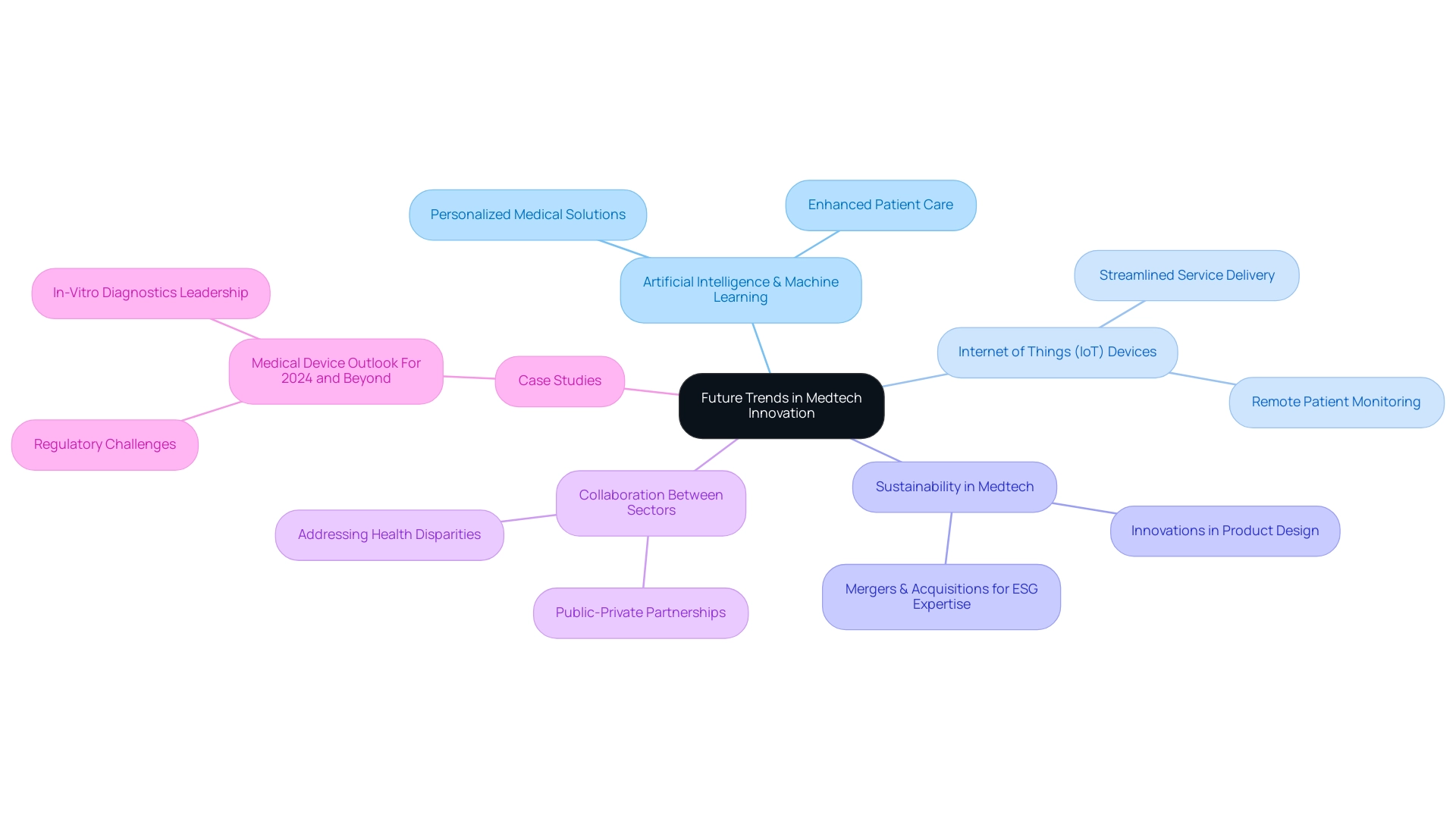

Future Trends in Medtech Innovation

Looking ahead, several pivotal trends are poised to significantly influence medtech innovation in Latin America. A significant rise in the adoption of artificial intelligence (AI) and machine learning within diagnostics and treatment plans is expected, promoting the development of more personalized medical solutions. This sentiment is echoed by Arda Ural, PhD, a prominent figure in the life sciences sector, who underscores the transformative potential of these technologies in enhancing patient care.

Simultaneously, the integration of Internet of Things (IoT) devices is poised to transform remote patient monitoring and management, thereby streamlining service delivery and enhancing overall patient outcomes.

In addition to technological advancements, there is a growing emphasis on sustainability within the medtech sector. With 55% of medical device companies recognizing mergers and acquisitions as a strategic avenue to enhance their environmental, social, and governance (ESG) expertise, the focus on reducing carbon footprints is becoming increasingly vital. This drive for sustainability is expected to inspire innovations in product design and manufacturing processes.

The case study titled "Medical Device Outlook For 2024 and Beyond" highlights how companies are navigating regulatory challenges while focusing on sustainability, particularly in the context of in-vitro diagnostics leading the market.

Moreover, fostering increased collaboration between public and private sectors will be essential to tackle disparities in health services and enhance access to medical technologies throughout the region. As Jennifer Hemmerdinger points out, entrepreneurs predict a stronger economy in 2025, further incentivizing investments in innovative healthcare solutions. Furthermore, methods to speed up time to launch, such as reusing technology, outsourcing, and managing strategic partnerships, will be vital for companies aiming to capitalize on these trends.

A key player in this evolving landscape is bioaccess®, which specializes in accelerated medical device clinical study services across various study types, including:

- Early-Feasibility

- First-In-Human

- Pilot

- Pivotal

- Post-Market Follow-Up Studies

With over 20 years of experience in Medtech, bioaccess® is led by Clinical Trial Manager Dr. Sergio Alvarado, who is dedicated to innovative medical research and the application of artificial intelligence in diagnostics. Bioaccess® not only enhances the quality of clinical studies in South America but also navigates regulatory challenges effectively, ensuring compliance and facilitating smoother study processes.

By remaining attuned to these emerging trends, stakeholders in the Latin American medtech market can strategically position themselves for success in an evolving landscape characterized by rapid medtech innovation in Latin America and growth. The impact of bioaccess®'s studies on local economies is evident, as they contribute to job creation and improved healthcare access, further solidifying their importance in the region.

Conclusion

The medtech sector in Latin America is on the brink of unprecedented growth, with a projected market size of $40 billion by 2025. This transformation is fueled by the region's unique blend of local innovation and international investment, particularly in key areas such as:

- Telemedicine

- Wearable technology

- Diagnostic tools

Companies must navigate a complex landscape characterized by stringent regulatory frameworks and varying market access policies, as highlighted by the critical role of local regulatory bodies like INVIMA, ANVISA, and COFEPRIS.

Despite facing challenges such as funding constraints and regulatory hurdles, opportunities abound for medtech companies willing to collaborate with local healthcare providers and academic institutions. Strategic partnerships have proven essential, enabling firms to enhance product development and streamline market entry. The emergence of innovation hubs and startups is driving this collaboration, fostering an environment ripe for economic growth and technological advancement. These entities are not only addressing local healthcare needs but also gaining international recognition, further solidifying the region's place in the global medtech arena.

Looking ahead, trends such as the integration of artificial intelligence and sustainable practices are set to reshape the medtech landscape in Latin America. By embracing these innovations and fostering collaboration between public and private sectors, stakeholders can significantly enhance healthcare access and outcomes across the region. As the medtech sector evolves, it is imperative for companies to remain agile and informed, positioning themselves to capitalize on the dynamic opportunities that lie ahead. The collective efforts of industry players, supported by data-driven approaches and innovative solutions, will undoubtedly pave the way for a brighter future in Latin American healthcare.

Frequently Asked Questions

What is the current state of medtech innovation in Latin America?

Over the past ten years, Latin America has emerged as a dynamic center for medtech innovation, with a projected industry size of $40 billion by 2025. This growth is driven by increased healthcare demands and a shift towards digital health solutions, particularly in countries like Brazil, Mexico, and Argentina.

What types of advancements are being made in the medtech sector?

Advancements in telemedicine, wearable devices, and diagnostic technologies are being spearheaded by innovative startups, which are also focusing on developing low-cost medical devices for underserved populations.

Who are the leading companies in specific medtech sectors in South America?

In the X-ray equipment sector, Dinan holds a 7% market share, while Draeger leads the ventilators sector with a 17% share, followed by Neumovent at 16% and Medtronic at 12%. Steris leads the surgical tables sector with a 28% share, followed by Getinge at 20%.

What role does INVIMA play in the medtech landscape of Latin America?

INVIMA, Colombia's National Food and Drug Surveillance Institute, oversees the marketing and manufacturing of health products, ensuring compliance with health standards. It is classified as a Level 4 health authority by PAHO/WHO, indicating its competence in regulating health products for safety, efficacy, and quality.

What challenges do US medtech companies face in Latin America?

US medtech companies encounter challenges such as language barriers, resource fragmentation, and the need for effective communication with American hospitals, highlighting the necessity for collaboration and innovative solutions.

How is talent acquisition affecting medtech innovation in Latin America?

Securing funding remains a significant challenge for startups, but there is a promising talent pool emerging, with Latin American students being 2.4 times more likely to invest in data science skills than the global average. This can help address regional talent needs.

What opportunities exist for collaboration in medtech innovation?

Collaborative efforts with local healthcare providers and academic institutions present significant opportunities. For example, partnerships like that of bioaccess™ and Caribbean Health Group aim to establish Barranquilla as a hub for clinical trials, enhancing medtech innovation.

How do clinical studies impact the medtech industry in Latin America?

Clinical studies are crucial for job creation and economic development within regional economies, emphasizing the importance of medtech innovation in improving medical services.

What is the significance of telehealth and remote monitoring in medtech?

The rising emphasis on telehealth and remote monitoring solutions offers exciting avenues for innovation, allowing companies to leverage technology to meet the evolving demands of the healthcare sector.