Overview

The article focuses on the regulatory advantages available to businesses in Latin America, particularly through mechanisms like open banking, nearshoring, and evolving cryptocurrency regulations. It emphasizes that understanding and adapting to these regulations can enhance competitiveness and innovation, as evidenced by the economic potential of open banking projected to significantly contribute to global GDP and the strategic benefits of nearshoring in reducing operational costs.

Introduction

As Latin America stands on the brink of a transformative regulatory landscape, the implications for businesses are profound and multifaceted. The rise of open banking, nearshoring, and cryptocurrency regulations presents both opportunities and challenges that organizations must navigate with strategic foresight.

With projections indicating substantial economic contributions from these sectors, understanding the intricate legal frameworks and fostering a culture of compliance becomes imperative. As companies adapt to these evolving policies, the ability to leverage innovative solutions and establish robust partnerships will be critical in enhancing competitiveness and driving sustainable growth.

This article delves into the key regulatory dynamics shaping the business environment in Latin America, offering insights into how organizations can position themselves for success in this rapidly changing landscape.

Exploring Open Banking: A Key Regulatory Advantage in Latin America

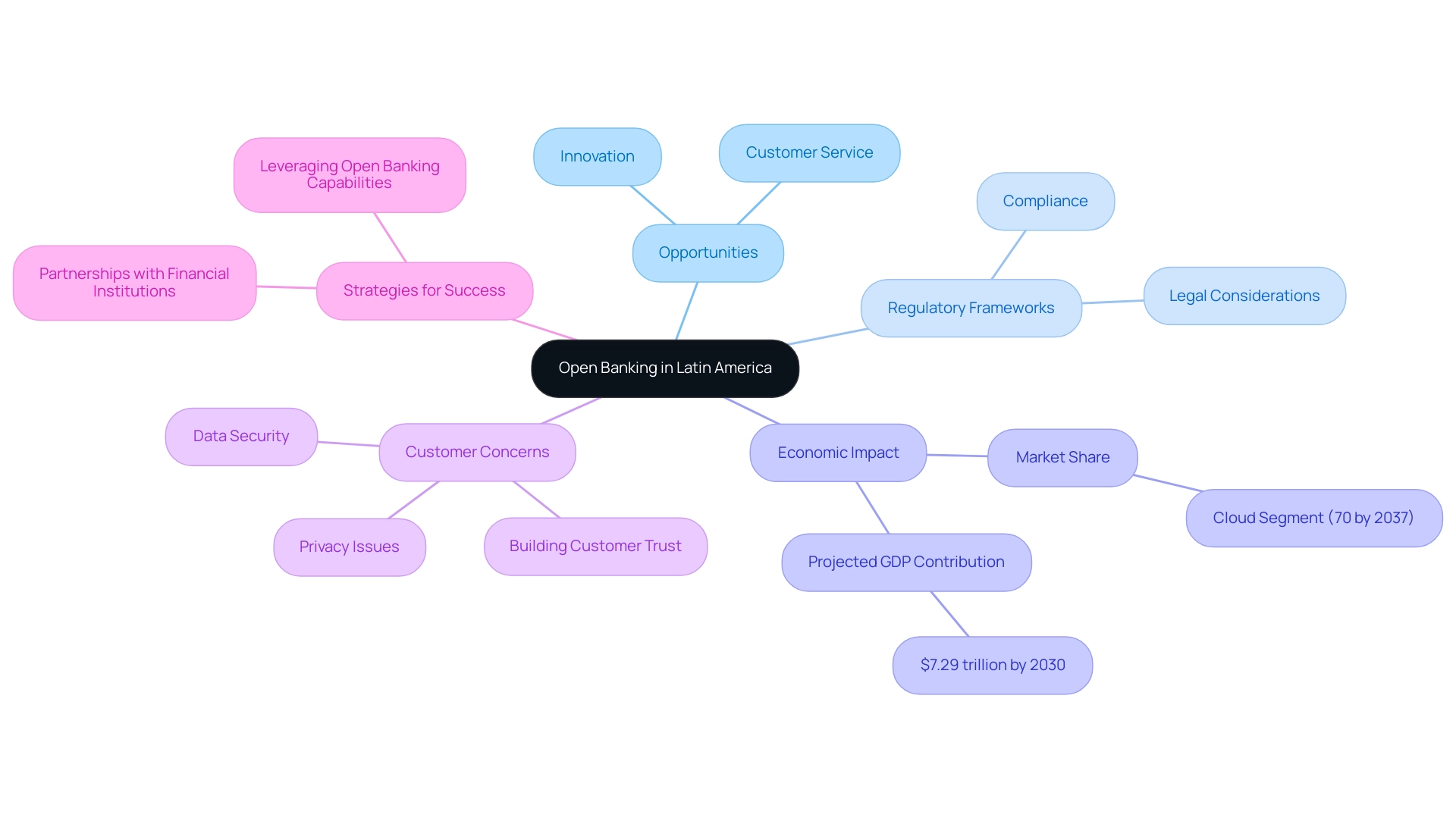

Open banking is quickly gaining traction in the region, unlocking significant opportunities for companies to innovate and improve their customer service offerings. By enabling third-party providers to access financial data, organizations can tailor products to meet the unique needs of their clientele. As Andres Aguirre from MasterCard aptly states,

If financial institutions are to succeed with open banking in Latin America, they will first need to change the curriculum <—a reminder that adapting to these changes is paramount.

Understanding the legal frameworks governing open banking is essential for organizations to ensure compliance and fully capitalize on the regulatory advantages in Latin America offered by these regulations. The economic significance of open banking is underscored by projections that it will contribute $7.29 trillion to the global GDP by 2030. Additionally, Brazil's open banking initiative aims to foster competition and improve customer choice, making it a benchmark for other countries in the region.

However, customer concerns about data security and privacy remain significant barriers to adoption. A MasterCard survey highlighted that many customers are hesitant to share financial information due to fears of fraud and complexity, indicating that building customer trust is crucial for successful implementation. Furthermore, the cloud segment is anticipated to hold the largest market share of 70% by 2037, providing a technological backbone for open banking initiatives.

To thrive in this evolving landscape, companies should actively seek partnerships with financial institutions, leveraging open banking capabilities to drive growth and enhance customer satisfaction.

Harnessing Nearshoring Opportunities: Economic Benefits for Businesses in Latin America

Nearshoring represents a strategic opportunity for companies aiming to enhance supply chain efficiency and minimize operational expenses. By relocating manufacturing and services closer to their primary markets, companies can achieve significant reductions in shipping times and costs. Countries like Mexico and Colombia are emerging as prime nearshoring destinations, bolstered by a skilled labor force and competitive cost structures.

For instance, Mexico's automotive and electronics sectors are particularly important in global value chains (GVCs), attracting investments and contributing significantly to supply chains in North America. Narciso Campos Cuevas points out that Mexico, for example, has 14 free trade agreements with 52 countries and 30 bilateral investment treaties, positioning it favorably within global value chains. Furthermore, business leaders emphasize that nearshoring not only reduces costs but also enhances responsiveness to market demands.

Mexico has initiated tax incentive programs, including substantial corporate income tax exemptions, to attract further investment. As companies consider these opportunities, it is crucial to evaluate the regulatory advantages in Latin America and in both countries to ensure compliance and maximize benefits. Particular challenges associated with globalization in the region must be considered, as they can affect operational strategies.

Forming strategic alliances with regional suppliers can further enhance operational efficiency, giving companies a competitive edge as they navigate the current trends in nearshoring across the region in 2024.

Navigating Cryptocurrency Regulations: Challenges and Opportunities for Latin American Businesses

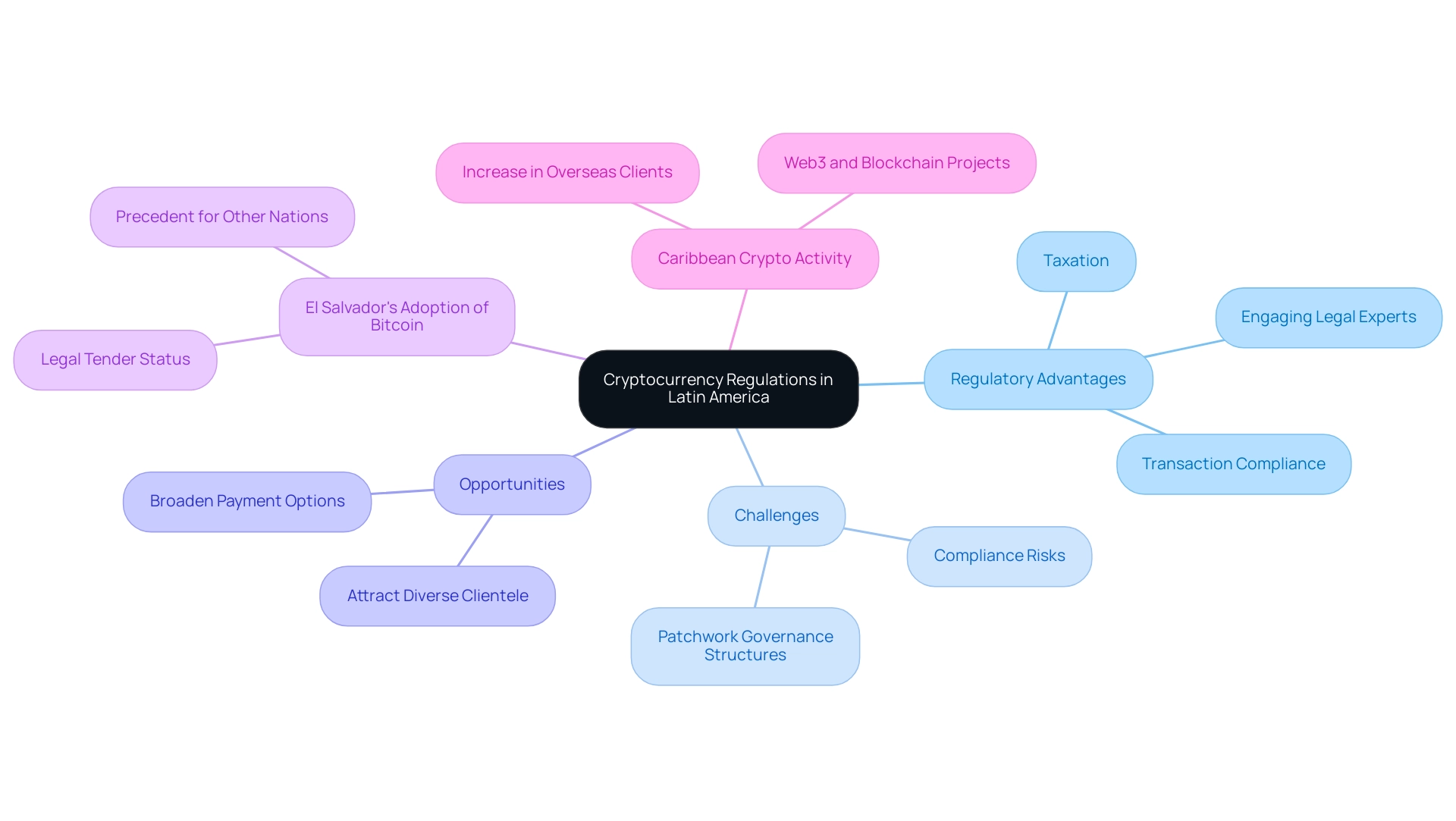

The governance environment for cryptocurrency in Latin America is swiftly evolving, leading to regulatory advantages in Latin America while also generating challenges and opportunities for companies operating in this space. Notably, El Salvador has taken a pioneering step by adopting Bitcoin as legal tender, setting a precedent that other nations may follow. As Aaron Stanley, Founder of Brazil Crypto Report, notes, "They view it as a tool to be leveraged rather than a threat to be crushed."

A governance framework that is well-received by the market should provide a stable foundation for the crypto economy here for years to come, particularly due to the regulatory advantages in Latin America, which is crucial as numerous nations in the area are still developing their governance structures, leading to a patchwork of methods that can greatly influence commercial activities. Furthermore, the Caribbean is experiencing a resurgence in crypto activity, with a significant increase in overseas clients seeking to establish Web3 and blockchain projects, highlighting the growing interest in this sector. Companies must remain vigilant and informed about these diverse regulations, as the regulatory advantages in Latin America can influence various aspects from taxation to transaction compliance.

Legal experts in the region provide invaluable insights into the regulatory advantages in Latin America, enabling enterprises to navigate these complexities effectively. By engaging in proactive compliance strategies, companies can not only mitigate compliance risks but also harness the momentum of cryptocurrency adoption to broaden their payment options. This flexibility can draw a more varied clientele that increasingly prefers digital currencies, positioning enterprises to succeed amid the rising acceptance of cryptocurrencies throughout the region.

Additionally, Ethereum's role in NFTs serves as a case study illustrating the practical implications of cryptocurrency for operational activities, emphasizing the importance of adapting to regulatory changes.

The Impact of Regulatory Reforms on Business Competitiveness in Latin America

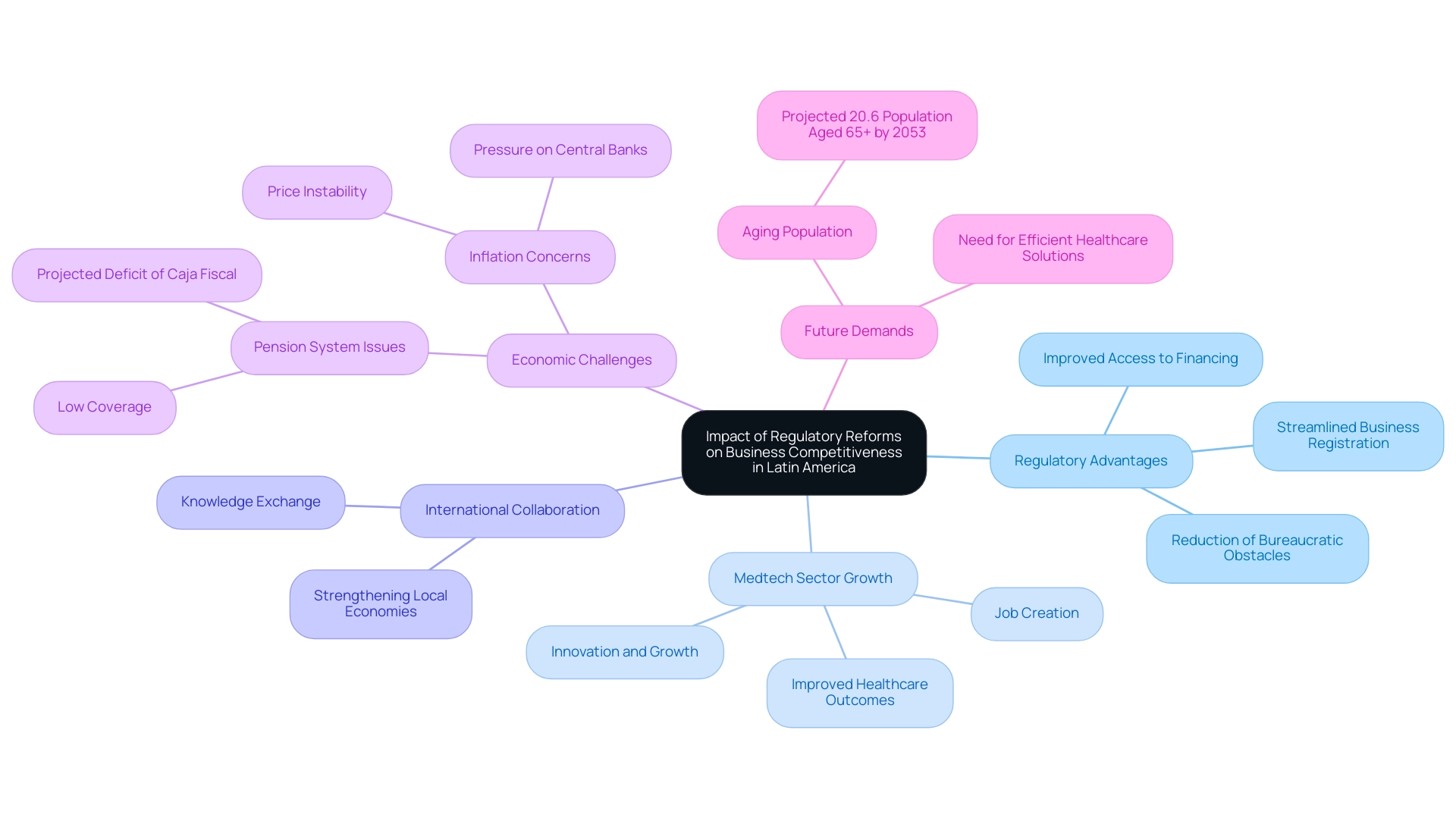

The regulatory advantages in Latin America are crucial in improving competitiveness by promoting a more open and transparent market environment. These reforms, which aim to reduce bureaucratic obstacles and improve access to financing, are essential for innovation and growth in the Medtech sector. For instance, recent initiatives aimed at streamlining the business registration process have shown promising results, significantly decreasing both the time and costs associated with launching new ventures.

The impact of Medtech clinical studies in these countries creates ripples with far-reaching benefits, including job creation and improved healthcare outcomes, highlighting the importance of international collaboration in advancing medical technology. Such collaboration not only facilitates knowledge exchange but also strengthens the capacity of local economies to integrate innovative solutions. However, the economic landscape is also influenced by challenges such as Paraguay's pension system, which suffers from low coverage and institutional problems, projected to lead to a growing deficit of the Caja Fiscal reaching 1.16% of GDP by 2030.

Such economic pressures underscore the need for regulatory advantages in Latin America, along with regulatory stability and effective tax reform. Investments in administrative capacity and proper valuation are necessary to ensure that these reforms are impactful. As the population aged 65 and older in the region is projected to reach 20.6% by 2053, the demand for efficient healthcare solutions amplifies the need for these reforms.

Senior Manager at Deloitte Spanish Latin America, Daniel Gonzalez, notes that 'inflation, while still stubbornly resistant to significant reduction, has been on the rise in some Latin American countries, increasing concerns about potential price instability.' This emphasizes the significance of consistent governance for enterprises functioning in the region. Interacting with policymakers to promote changes that foster a supportive economic climate is essential for firms, particularly in the Medtech field, where specialists such as Katherine Ruiz are vital in managing compliance matters for medical devices and in vitro diagnostics.

By remaining aware of compliance changes, companies can recognize new market opportunities and adjust their strategies efficiently. For example, Uruguay's fiscal rule implementation in 2020 aimed at controlling public spending growth and ensuring fiscal sustainability, although its effectiveness is challenged by the political context. Leveraging these reforms not only enhances operational efficiency but also strengthens competitive positioning in the evolving Medtech landscape by taking advantage of the regulatory advantages in Latin America.

The interconnectedness of these reforms and the benefits of international collaboration are akin to a global network, represented by the globe icon, emphasizing the shared goals of improving healthcare and economic stability across borders.

Preparing for the Future: Adapting to Evolving Regulatory Policies in Latin America

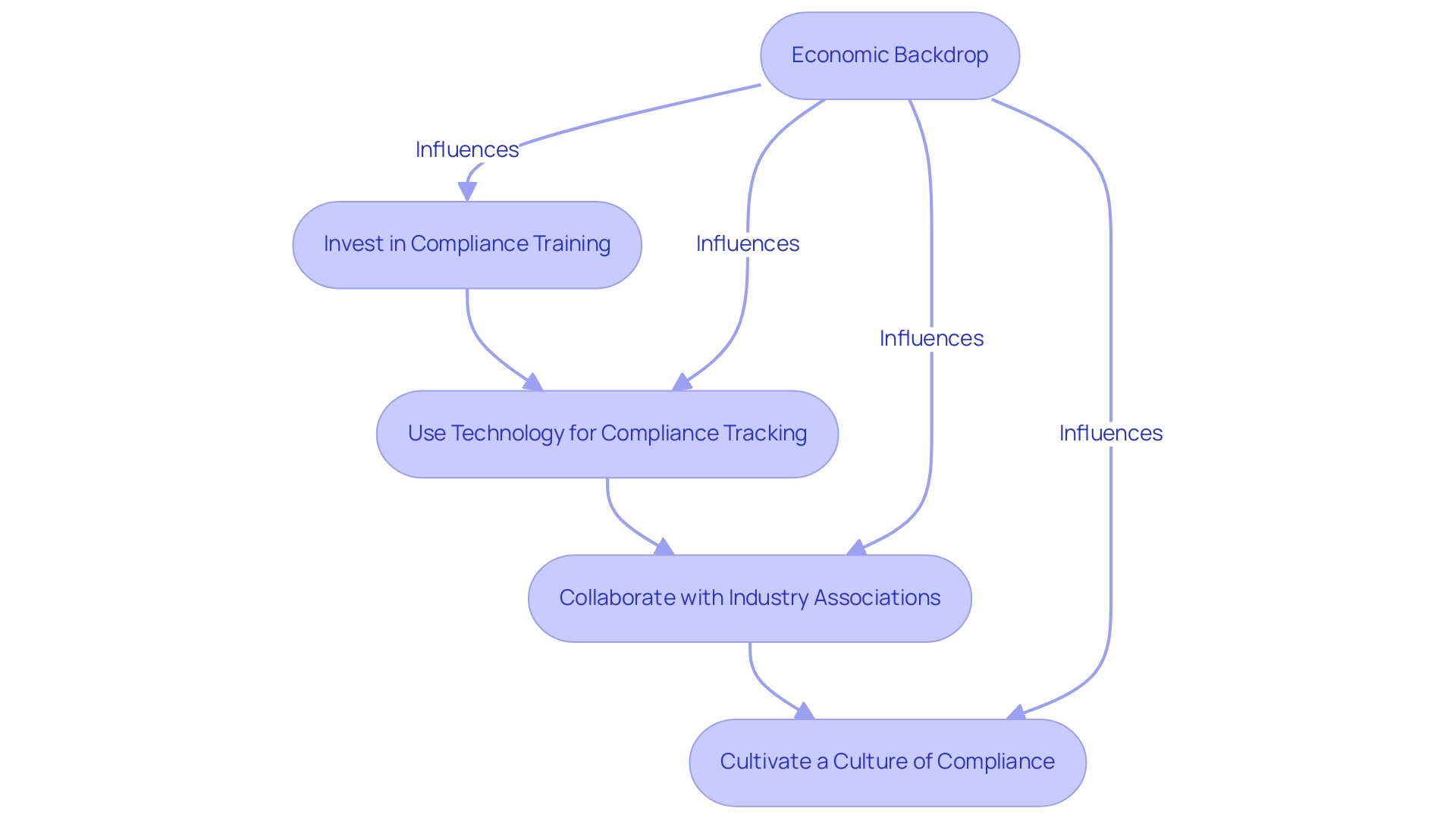

To successfully maneuver the changing compliance environment, enterprises in Latin America must adopt a proactive approach that takes advantage of the regulatory advantages in Latin America. This approach encompasses not only keeping abreast of existing regulations but also anticipating future shifts that could significantly influence operations. Investing in compliance training is crucial, as it equips teams with the necessary skills to manage these changes effectively.

Moreover, using technology to track compliance updates enables firms to obtain prompt insights, facilitating quick modifications to operational practices. Collaboration with industry associations can also serve as a valuable resource, providing advocacy and shared expertise. By cultivating a culture of compliance and adaptability, businesses are better positioned to leverage regulatory advantages in Latin America, allowing them to navigate the complexities of the regulatory environment and ensure long-term success in the region.

The current economic backdrop, characterized by inflationary pressures in some South American countries, underscores the importance of such adaptability as firms seek stability amidst potential price fluctuations and shifting monetary policies. As Daniel Gonzalez, Senior Manager at Deloitte Spanish Latin America, notes, "inflation, while still stubbornly resistant to significant reduction, has been on the rise in some Latin American countries in recent months, increasing concerns about potential price instability and adding pressure on these countries’ central banks to reconsider their monetary policy stances." Furthermore, the statistics indicate that 34% of Development Finance Institutions have a specific mandate to support the financial inclusion of micro-, small and medium-sized enterprises, emphasizing the significance of financial inclusion in the context of policy changes.

Furthermore, the ongoing pension system reforms in countries like Colombia, Peru, and Uruguay illustrate how regulatory advantages in Latin America are being effectively managed in the region, reinforcing the argument for adaptability and compliance training.

Conclusion

The regulatory landscape in Latin America is undergoing significant transformation, driven by the rise of open banking, nearshoring, and cryptocurrency regulations. These developments present a unique set of opportunities and challenges for businesses that must be navigated with strategic acumen.

- Open banking is set to enhance customer service and innovation, enabling organizations to create tailored financial products while addressing crucial customer concerns over data security.

- Nearshoring emerges as a powerful strategy for reducing operational costs and improving supply chain efficiency, particularly in countries like Mexico and Colombia, which boast favorable regulatory environments and skilled labor forces.

In the realm of cryptocurrency, the diverse regulatory approaches across the region create both hurdles and avenues for growth. Engaging with the evolving frameworks is essential for companies aiming to capitalize on the burgeoning digital currency market. The ongoing regulatory reforms further underscore the importance of fostering a competitive business environment that prioritizes transparency and reduces bureaucratic barriers, particularly in sectors like Medtech.

To thrive amid these changes, businesses must cultivate a proactive approach to compliance and adaptability. Investing in training, leveraging technology for regulatory monitoring, and collaborating with industry associations will empower organizations to stay ahead of regulatory shifts. As the economic landscape continues to evolve, the ability to navigate these complexities will be pivotal for long-term success in Latin America. By embracing innovation and fostering strategic partnerships, companies can position themselves favorably in this rapidly changing environment, ultimately driving sustainable growth and enhancing their competitive edge.

Frequently Asked Questions

What is open banking and why is it gaining traction in Latin America?

Open banking is a system that allows third-party providers to access financial data, enabling companies to innovate and improve their customer service offerings. It is gaining traction in Latin America as it opens significant opportunities for organizations to tailor products to meet unique customer needs.

What is the economic impact of open banking?

Open banking is projected to contribute $7.29 trillion to the global GDP by 2030, highlighting its economic significance.

What role does Brazil play in the open banking initiative?

Brazil's open banking initiative aims to foster competition and improve customer choice, making it a benchmark for other countries in the region.

What are the main barriers to the adoption of open banking?

Customer concerns about data security and privacy are significant barriers to adoption, with many hesitant to share financial information due to fears of fraud and complexity.

How important is customer trust in the implementation of open banking?

Building customer trust is crucial for the successful implementation of open banking, as many customers are concerned about sharing their financial data.

What is the anticipated market share of the cloud segment in open banking by 2037?

The cloud segment is anticipated to hold the largest market share of 70% by 2037, providing the technological backbone for open banking initiatives.

How can companies thrive in the open banking landscape?

Companies should actively seek partnerships with financial institutions to leverage open banking capabilities, driving growth and enhancing customer satisfaction.

What is nearshoring and how does it benefit companies?

Nearshoring is the practice of relocating manufacturing and services closer to primary markets, which enhances supply chain efficiency and minimizes operational expenses by reducing shipping times and costs.

Which countries are emerging as prime nearshoring destinations?

Mexico and Colombia are emerging as prime nearshoring destinations due to their skilled labor force and competitive cost structures.

What advantages does Mexico offer in global value chains?

Mexico has 14 free trade agreements with 52 countries and 30 bilateral investment treaties, positioning it favorably within global value chains, particularly in the automotive and electronics sectors.

What incentives has Mexico introduced to attract investment?

Mexico has initiated tax incentive programs, including substantial corporate income tax exemptions, to attract further investment.

What should companies consider when evaluating nearshoring opportunities?

Companies should evaluate the regulatory advantages in Latin America and consider challenges associated with globalization that may affect operational strategies.

How can forming strategic alliances benefit companies in nearshoring?

Forming strategic alliances with regional suppliers can enhance operational efficiency and provide a competitive edge as companies navigate current trends in nearshoring.