Overview

Latin America is emerging as a medtech hub, driven by a favorable economic environment for research, diverse patient populations, and increasing healthcare investments. These factors collectively foster innovation and growth in the medical technology sector. The article underscores this trend by highlighting successful partnerships, regulatory improvements, and the region's cost-effectiveness in conducting clinical trials. Such elements create an attractive landscape for medtech companies aiming to expand their operations. As the region continues to evolve, collaboration among stakeholders will be crucial in addressing challenges and leveraging opportunities for advancement.

Introduction

Latin America is rapidly transforming into a formidable force in the global Medtech sector, driven by a unique blend of innovation, investment, and strategic partnerships. Countries like Brazil, Mexico, and Argentina are at the forefront of this movement, positioning the region as an attractive destination for clinical trials and medical technology development.

With a diverse patient population and cost-effective operational frameworks, Latin America provides Medtech companies with the opportunity to conduct research and launch products more efficiently than in traditional markets.

This article delves into the key factors behind this emergence, exploring the role of clinical trials, the evolving regulatory landscape, and the innovations reshaping healthcare delivery.

As the demand for advanced medical solutions grows, understanding the dynamics of this burgeoning market will be essential for stakeholders aiming to capitalize on its potential.

Latin America's Emergence as a Medtech Powerhouse

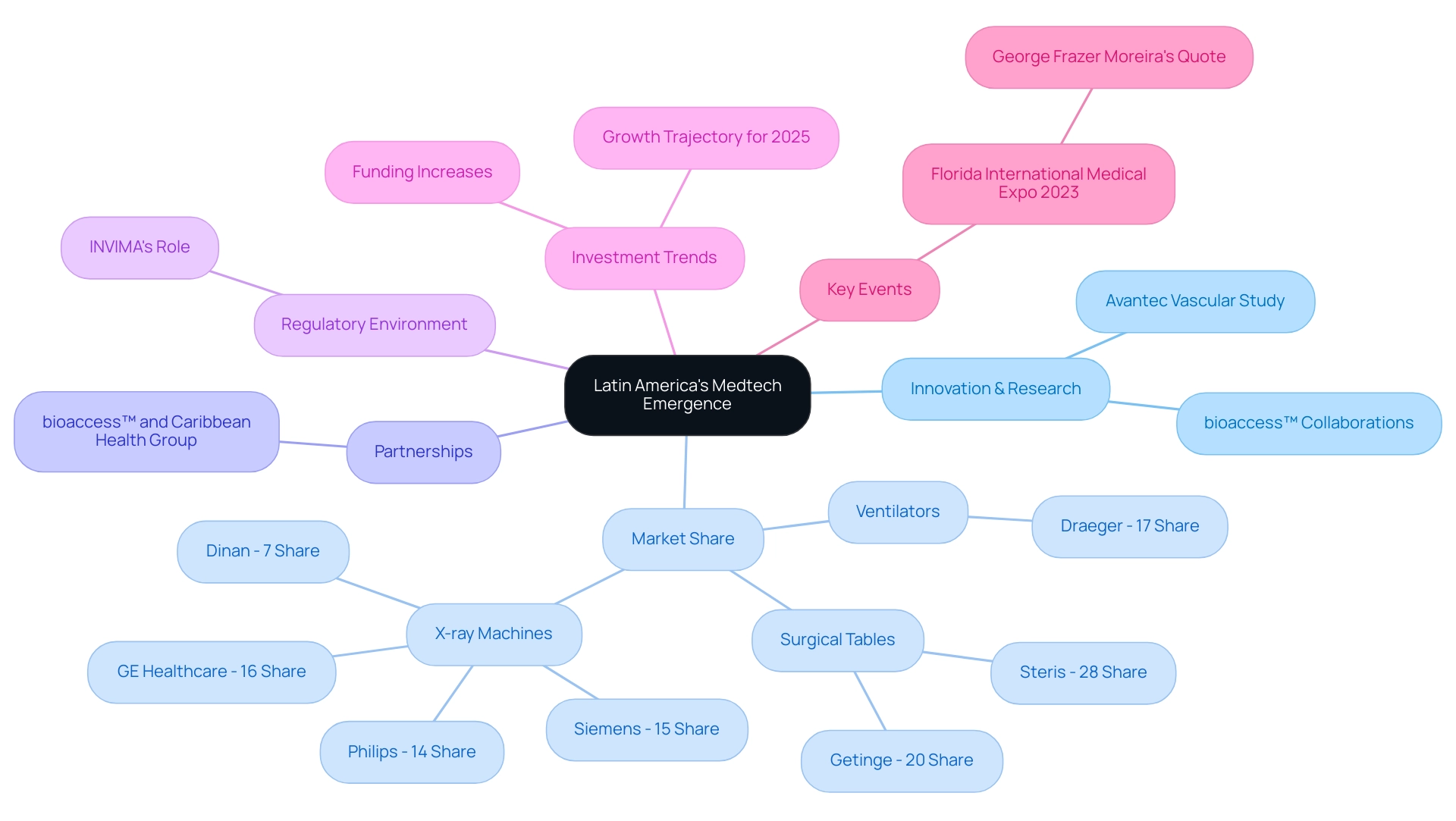

The swift emergence of Latin America as a pivotal player in the global Medtech arena illustrates why the region is a medtech hub, driven by a confluence of factors that position it as a hotspot for innovation and investment. Partnerships such as bioaccess™ collaborating with Caribbean Health Group to establish Barranquilla as a premier location for research, alongside GlobalCare Clinical Trials enhancing ambulatory services in Colombia—achieving over a 50% decrease in recruitment time and 95% retention rates—underscore this transformation. The healthcare market is expanding rapidly, with significant increases in funding directed towards medical technologies.

Nations like Brazil, Mexico, and Argentina are at the forefront of this evolution, showcasing remarkable advancements in research and technological innovation. The area's diverse patient population provides a unique environment for testing and developing new medical devices, establishing it as an ideal setting for trials and product introductions. For instance, Avantec Vascular’s first-in-human clinical study, facilitated by bioaccess™, exemplifies the region's potential for innovative vascular devices. bioaccess™ played a crucial role in this study by assisting with the selection of a principal investigator, regulatory dossier submissions, and other essential activities to ensure the study's success.

The surgical tables market in Latin America is moderately concentrated, with Steris commanding a 28% share and Getinge closely following at 20%. This competitive atmosphere nurtures innovation and motivates new participants to explore the market, emphasizing the significance of the surgical tables industry to the overall medical technology growth narrative. Investment trends suggest a robust growth trajectory for the medical technology sector in 2025, focusing on enhancing healthcare delivery and accessibility. The medical devices and equipment market is also gaining traction, bolstered by bioaccess®'s expertise in managing comprehensive clinical trial services, including feasibility studies, site selection, compliance reviews, and project management. Leading companies such as Draeger and GE Healthcare are making significant strides—Draeger holds a 17% share of the ventilators market, while GE Healthcare leads the X-ray machines market with a 16% share.

Expert opinions further underscore the region's importance in the global medical technology landscape. George Frazer Moreira noted that the 'Latin region is Open for Business' workshop at the Florida International Medical Expo 2023 is more than just a session—it's an opportunity to gain hands-on knowledge from industry veterans, engage in fruitful dialogues, and network with professionals sharing the same vision. As the demand for innovative healthcare solutions escalates, it is essential to explore why Latin America is a medtech hub, as the region is well-positioned to become a central area for medical technology development, driven by its unique growth factors and a commitment to advancing healthcare technology.

Moreover, the function of INVIMA, Colombia's National Food and Drug Surveillance Institute, is vital in supervising medical device regulations, ensuring adherence, and promoting a supportive atmosphere for research in the region.

Key Factors Driving Medtech Investment in Latin America

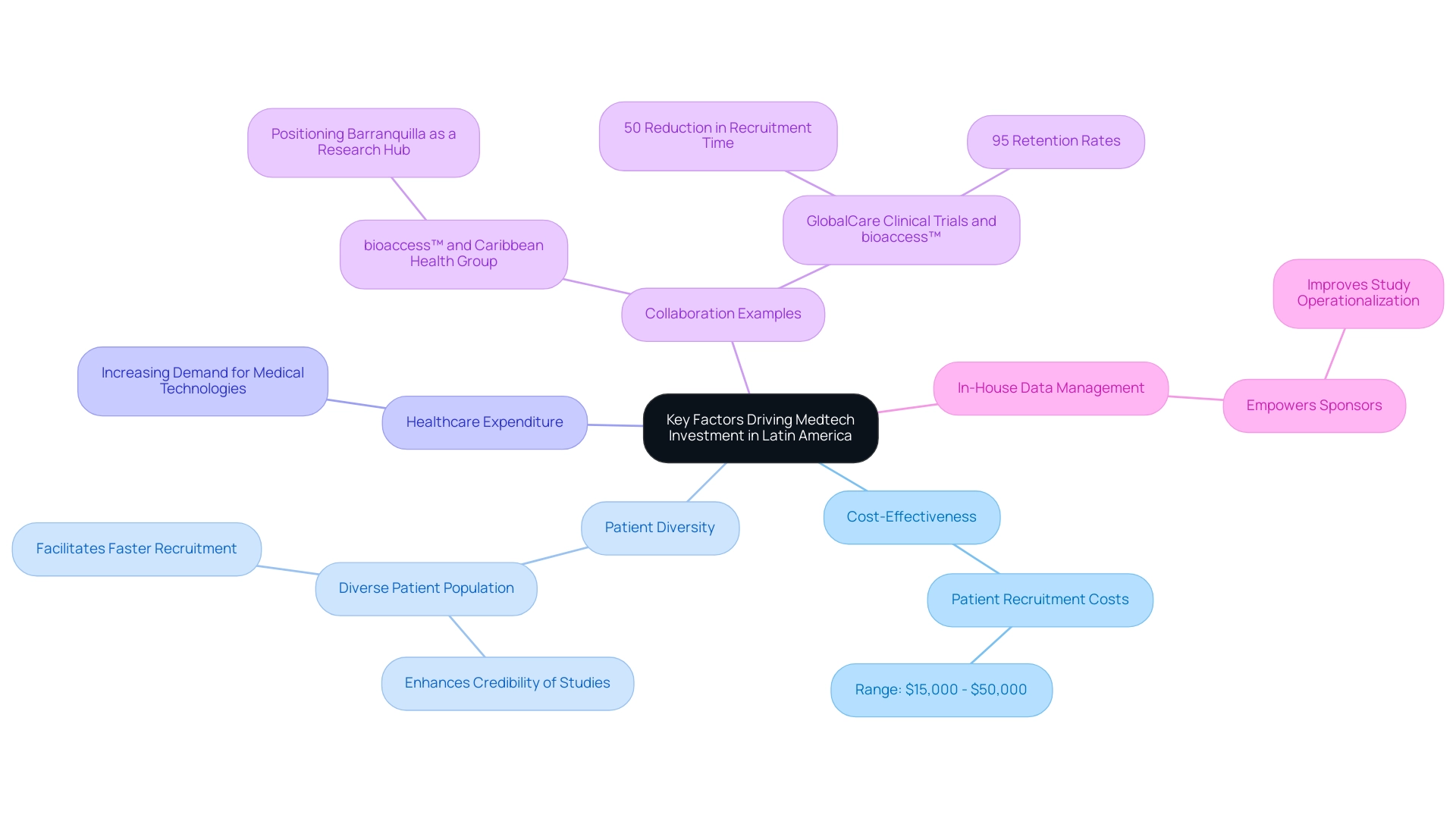

Several pivotal factors are propelling Medtech investment in Latin regions. This area is recognized for its economical setting for research studies, with operational expenses significantly lower than those in North and South Europe. Such financial advantages enable companies to conduct extensive research without the prohibitive costs typically associated with studies in more developed markets.

For instance, patient recruitment expenses can range from $15,000 to $50,000, making Latin regions an appealing choice for budget-conscious Medtech companies. This sentiment is echoed by Dushyanth Surakanti, Founder & CEO of Sparta Biomedical, who shares his favorable experience with bioaccess® during its initial human study in Colombia, highlighting the region's potential for successful medical research. Additionally, Latin regions boast a diverse patient population, which is crucial for gathering comprehensive data on medical devices across various demographics.

This diversity not only enhances the credibility of research studies but also facilitates faster patient recruitment, allowing companies to adhere to their study schedules more effectively. The collaboration between bioaccess™ and Caribbean Health Group exemplifies this, as they unite to position Barranquilla as a significant research study hub, supported by Colombia's Minister of Health, Juan Pablo Uribe, who has actively championed this initiative.

Moreover, the increasing healthcare expenditure in Latin regions signals a growing demand for innovative medical technologies. As healthcare investments rise, medical technology companies are further motivated to explore opportunities within the region. Patricio Ledesma, Head of Clinical Operations and Founder at Sofpromed CRO, underscores this potential, asserting his personal and enthusiastic commitment to assisting biotech Chief Executive, Operations, Scientific, Medical, and Regulatory Officers in the planning and execution of phase I-IV clinical trials throughout Latin regions.

Furthermore, the shift towards in-house data management empowers sponsors to take control of their data and enhance study operationalization, adding another layer of operational advantage for medical technology firms in the region. The combination of cost-effectiveness, patient diversity, and expanding healthcare budgets illustrates why Latin America stands as a Medtech hub for research and development, cultivating an environment ripe for innovation and growth. The collaboration between GlobalCare Clinical Trials and bioaccess™ has also demonstrated tangible benefits, achieving over a 50% reduction in recruitment time and 95% retention rates, further enhancing the region's attractiveness for research studies.

Navigating the Regulatory Landscape for Medtech in Latin America

Navigating the regulatory landscape in Latin America presents unique challenges due to the diverse requirements set by individual countries, each operating under its own regulatory authority. This complexity complicates the approval process for medical devices. However, significant strides are being made towards regulatory harmonization, particularly in key markets like Brazil and Mexico. In 2025, Brazil's ANVISA and Mexico's COFEPRIS have implemented measures to streamline their approval processes, aiming to enhance efficiency and reduce regulatory timelines.

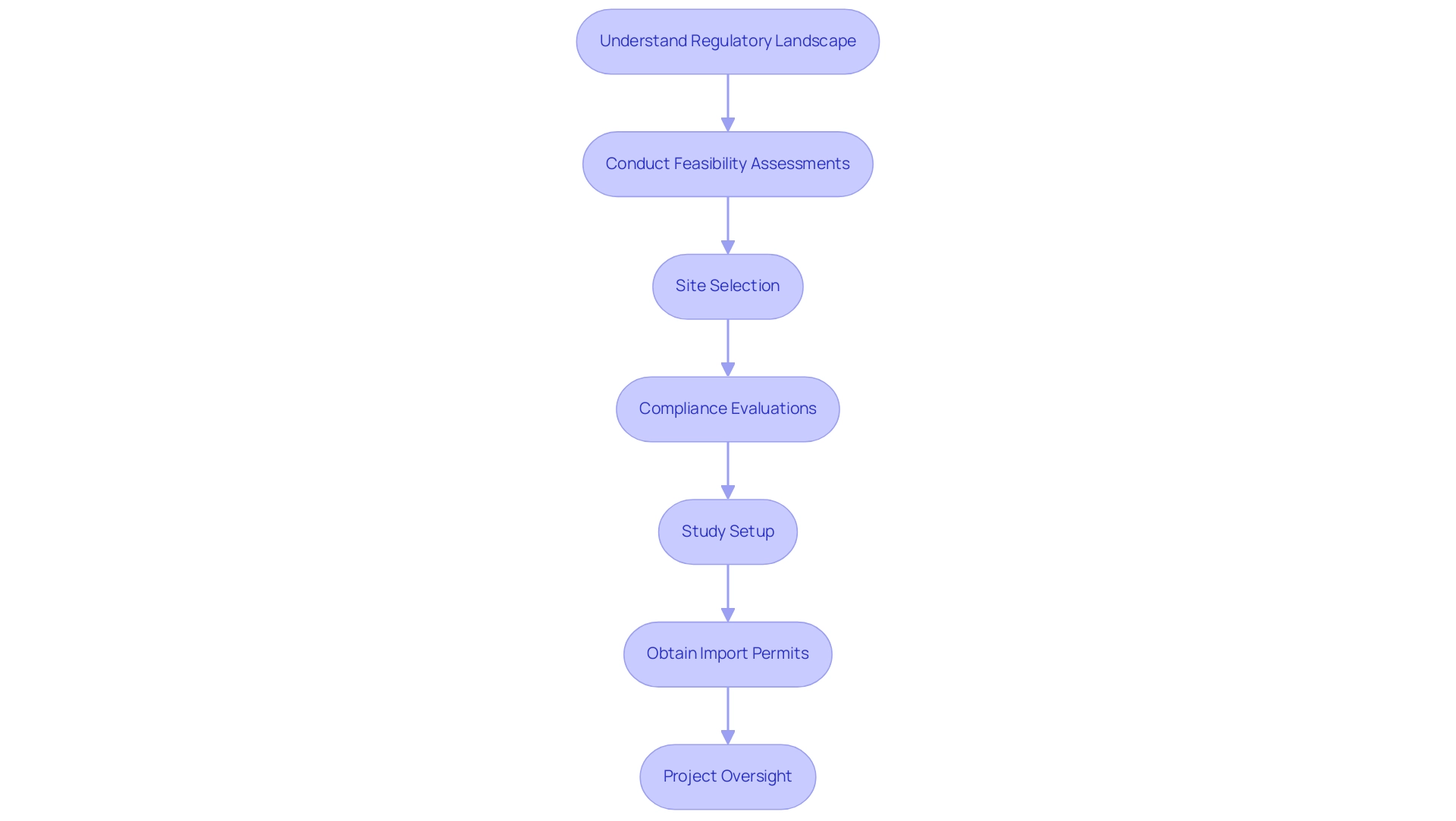

This progress is essential, as the average authorization duration for medical devices in these nations can differ greatly, impacting market entry strategies for medical technology companies. As a prominent contract research organization, bioaccess provides extensive management services for research studies that tackle these issues. These services include:

- Feasibility assessments

- Site selection

- Compliance evaluations

- Study setup

- Import permits

- Project oversight

Compliance with evolving regulations is crucial for the successful launch of medical devices and for maintaining the integrity of clinical trials. As Dr. Oliver Eikenberg, an expert in global medical device regulations, emphasizes, 'Understanding the regulatory environment is vital for ensuring that products meet safety and efficacy standards, ultimately improving patient outcomes.'

Moreover, recent case studies highlight how companies are effectively navigating these regulatory challenges. For instance, a medical technology company that collaborated with local regulatory experts successfully reduced its product approval time by 30%, demonstrating the value of leveraging local knowledge. Companies that have invested in local regulatory expertise have shown higher adaptability to the evolving environment, underscoring why Latin America is a medtech hub, enabling them to capitalize on the growing medical technology market in the region.

The ongoing updates to regulatory frameworks in the region, particularly concerning digital health and telemedicine, illustrate why Latin America is a medtech hub for healthcare innovation. Notably, countries in APAC, LATAM, and MENA regions are updating their regulatory frameworks to support innovation in digital health, addressing challenges related to AI, data protection, and cybersecurity.

As medical technology companies look to launch products in Brazil and Mexico, staying informed about ANVISA and COFEPRIS regulatory changes in 2025 will be critical. By leveraging local knowledge and aligning with regulatory requirements, companies can expedite their market entry and enhance their competitive edge in this dynamic sector. Understanding these dynamics will be essential for navigating the complex landscape of medical device regulation.

Additionally, best practices from industry leaders emphasize the importance of building strong relationships with local stakeholders and continuously adapting strategies to meet the unique needs of each market.

The Role of Clinical Trials in Accelerating Medtech Growth

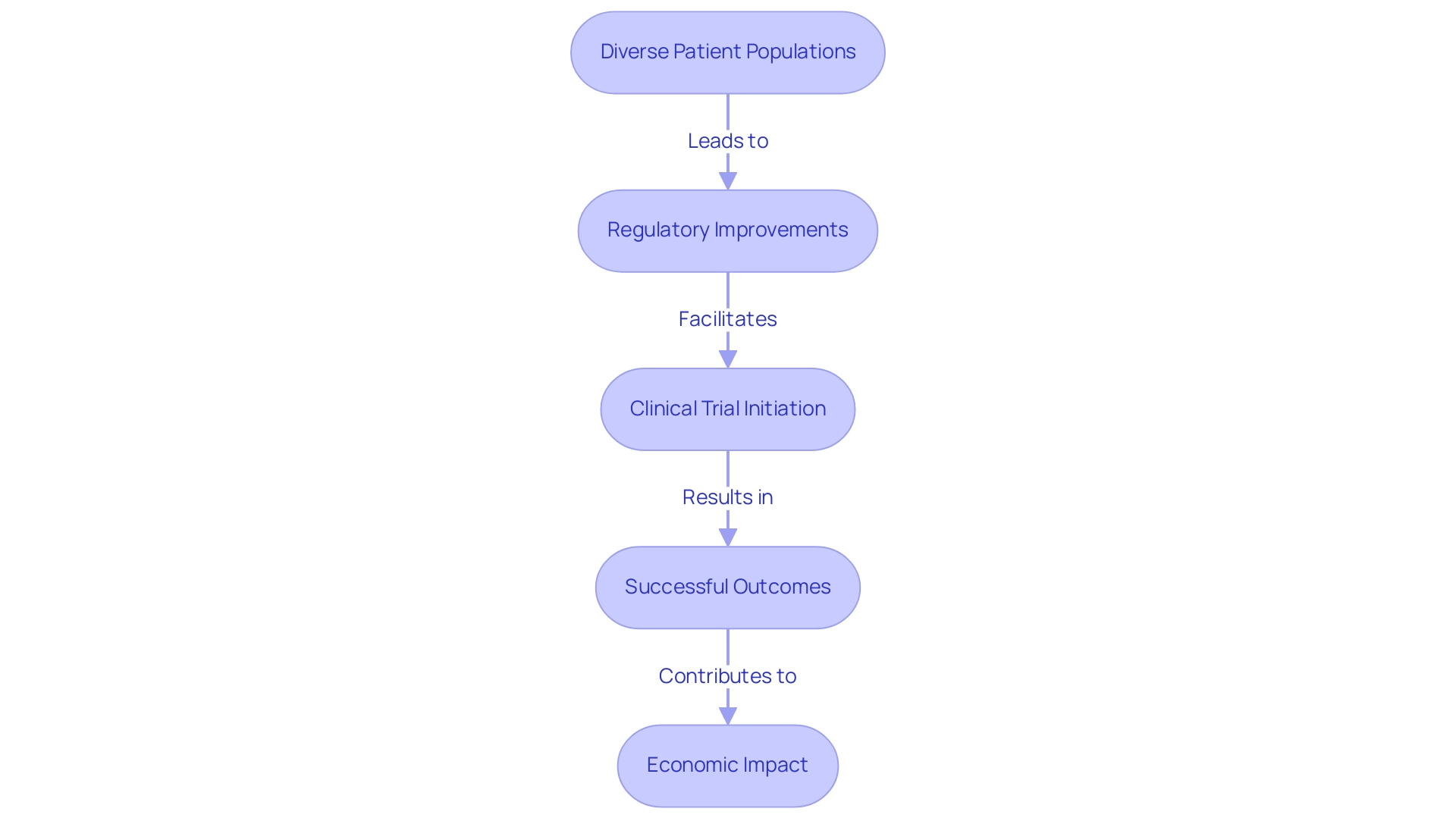

Clinical studies play a pivotal role in advancing Medtech expansion across Latin regions, characterized by diverse patient populations and varying operational structures. Countries like Chile and Argentina are emerging as leaders in this field, equipped with advanced research facilities and a strong commitment to high-quality data collection. The efficiency of conducting experiments in these nations not only accelerates the development of innovative medical devices but also enhances the credibility of research outcomes.

In 2025, research success rates in Latin America are on a notable rise, driven by a transforming regulatory landscape that enhances the feasibility of studies. Recent improvements in regulatory processes in Argentina, Brazil, and Mexico have streamlined approval timelines, facilitating Medtech companies in initiating and concluding studies. A prime example is ReGelTec's Early Feasibility Study on HYDRAFIL™ for treating chronic low back pain, where eleven patients in Barranquilla, Colombia, were successfully treated, underscoring the region's capacity for effective research.

Moreover, successful research studies in Latin regions can significantly reduce the time to market for new products. This is particularly critical as the demand for healthcare solutions continues to escalate in the area. A case study highlighting the potential for conducting vaccine research in Latin America illustrates this point, emphasizing cost advantages and the availability of bilingual, board-certified physicians, which enhance the feasibility and success of studies.

The study also highlights Citius Pharmaceuticals' pivotal Phase III Study 302, which achieved an objective response rate of 36.2% in treating relapsed/refractory cutaneous T-cell lymphoma, underscoring the potential for successful outcomes in the region.

The economic impact of these research studies is substantial, contributing to job creation, economic development, and improved healthcare access, all of which are vital for local communities. Expert insights reveal a growing trend among sponsors to insource data management, which allows for better control and quality of research studies. As the Head of Clinical Data Engineering remarked, "Traditionally, data management was outsourced to our CRO vendor partners. Part of the initiative is to bring all our studies in-house so that our internal teams can start working on it. They can be more hands-on, operationalize studies in-house, take control of our data, and deliver high-quality outcomes for our patients." This shift reflects a broader movement towards operationalizing studies internally, enabling teams to ensure high-quality results for patients.

Additionally, the collaboration between bioaccess™ and GlobalCare Clinical Trials has significantly improved ambulatory services in Colombia, achieving over a 50% reduction in recruitment time and 95% retention rates.

As Latin regions solidify their status as a hub for medical technology, it becomes evident why Latin America is recognized as a medtech center, where the role of research studies continues to be fundamental for expansion, fostering innovation, and enhancing healthcare access throughout the region. The support from Colombia's Minister of Health further positions Barranquilla as a premier destination for clinical trials, reinforcing the region's dedication to cultivating a robust clinical research environment.

Innovations Shaping the Future of Medtech in Latin America

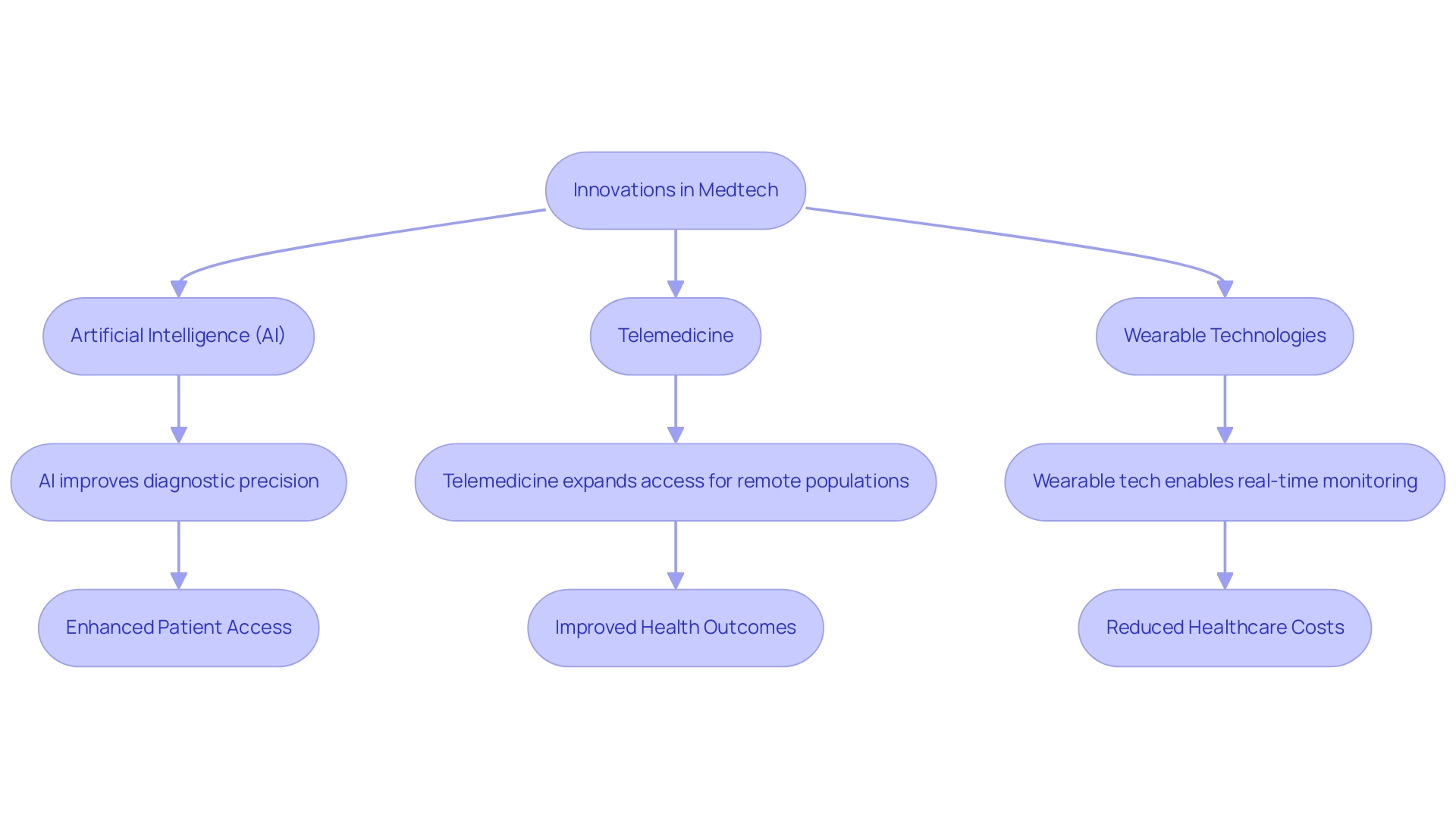

The integration of artificial intelligence (AI), telemedicine, and wearable technologies in Latin regions exemplifies why Latin America has emerged as a medtech hub. These innovations are fundamentally driving the evolution of the medical technology sector and transforming healthcare delivery and monitoring. A prime example is the partnership between IDx Technologies and bioaccess™, which aims to identify high-volume ophthalmology centers for AI-based disease detection collaboration. This initiative will significantly enhance patient access to high-quality, affordable disease detection, showcasing how AI-driven diagnostics can achieve sensitivity rates of 87% and accuracy levels of 92%, as highlighted in a recent meta-analysis.

Such advancements not only improve the precision of medical assessments but also create a profound emotional impact by enhancing patient outcomes. Meanwhile, telemedicine is dismantling geographical barriers, thereby expanding access to healthcare services for populations in remote areas and addressing critical healthcare disparities. The emergence of digital health solutions is further revolutionizing patient care by enabling real-time monitoring, which leads to improved health outcomes and reduced overall healthcare costs. This shift towards innovative healthcare delivery models underscores why Latin America stands as a medtech hub, attracting substantial investment from global medical technology firms eager to leverage the region's burgeoning capabilities.

As these technological advancements continue to gain traction, they reinforce Latin America's position as a key player in the global medical technology landscape. According to Guillaume Corpart, CEO and founder of Global Health Intelligence, "The future of collaboration in the MedTech sector between the US and Latin countries is promising, driven by advancements in telemedicine and personalized medicine." This sentiment is echoed in the case study titled "Future of US-Latin American MedTech Collaboration," which emphasizes that sustained collaboration is vital for unlocking new markets and improving healthcare for diverse populations.

Stakeholders must remain agile and proactive in exploring these emerging trends to capitalize on the opportunities presented by this dynamic region. Importantly, bioaccess is committed to benefiting humanity through international collaboration and knowledge transfer, ensuring that innovations in medical technology lead to improved global health outcomes.

Building Strategic Partnerships for Medtech Success

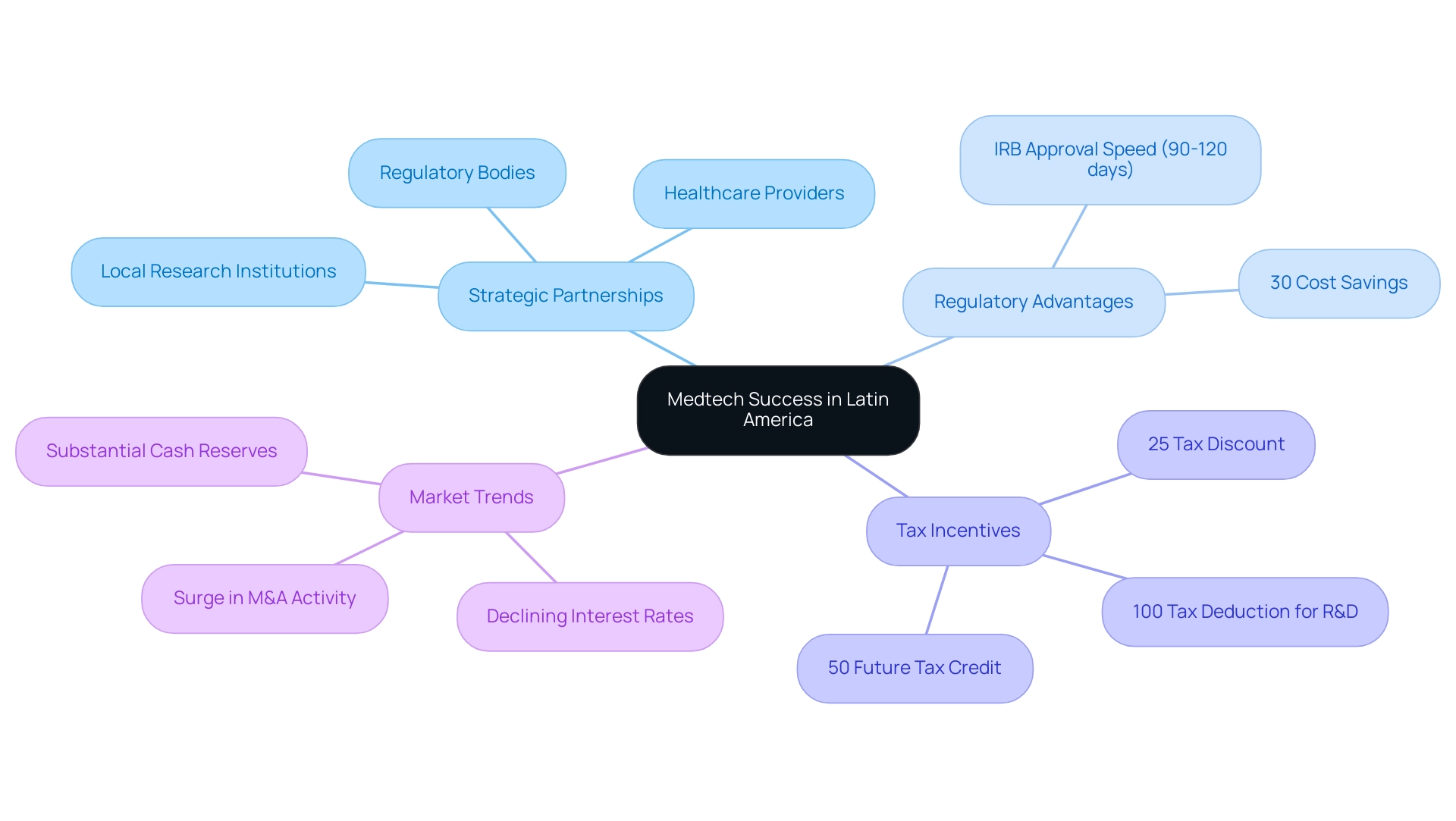

Strategic alliances are crucial for medical technology firms aiming for success, underscoring Latin America's status as a medtech hub. Collaborating with local research institutions, healthcare providers, and regulatory bodies significantly enhances research capabilities while streamlining the product development process. These alliances provide access to invaluable resources and expertise, facilitating compliance with local regulations—an essential factor for smoother market entry.

Colombia offers notable cost efficiency, with savings exceeding 30% compared to North America and Western Europe, alongside regulatory speed where IRB and MoH approvals occur within just 90-120 days. Engaging with local stakeholders fosters trust and credibility—elements vital for sustained success in the region. Organizations that prioritize these strategic partnerships are better equipped to navigate the complexities of the Latin American medical technology landscape, illustrating why Latin America is a medtech hub. Moreover, the R&D tax incentives in Colombia, including a 100% tax deduction for investments in science, technology, and innovation, a 25% tax discount, and a 50% future tax credit, enhance the financial viability of conducting clinical trials in this region.

As we approach early 2025, a surge in mergers and acquisitions (M&A) activity among major medical technology firms is anticipated, driven by declining interest rates and substantial cash reserves, indicating a robust market environment. Companies such as Stryker and Boston Scientific are already formulating significant acquisition plans, reflecting a strong inclination towards collaboration and partnership. This trend emphasizes the necessity for medical technology companies to leverage local knowledge and resources, as highlighted by Christof Baron, CEO, who stated, 'Statista is a great source of knowledge, and pretty helpful to manage the daily work.'

Statistics indicate that companies with established local partnerships are more likely to achieve faster regulatory approvals and market entry, thereby accelerating the advancement of innovative medical devices. By fostering successful collaborations with local institutions, Medtech companies can enhance their operational efficiency and strategically position themselves to capitalize on burgeoning opportunities, further illustrating why Latin America is a medtech hub. Additionally, understanding local dynamics will be essential for navigating the evolving landscape and ensuring long-term success, especially as Colombia's healthcare system ranks highly on a global scale and offers robust patient recruitment through its universal coverage.

Conclusion

Latin America is undeniably carving out its place as a significant player in the global Medtech landscape. The region's unique combination of cost-effective clinical trial environments, diverse patient demographics, and a commitment to innovation has established it as an attractive destination for medical technology development. Key players like Brazil, Mexico, and Argentina are not only leading this transformation but also demonstrating the potential for rapid advancements in clinical research and product launches.

The ongoing evolution of regulatory frameworks across the region is pivotal. As countries such as Brazil and Mexico streamline their approval processes, Medtech firms are finding it easier to navigate the complexities of market entry. These developments, coupled with strategic partnerships between local and international stakeholders, are enhancing the operational efficiency and credibility of clinical trials, ultimately paving the way for innovative healthcare solutions.

Moreover, the integration of cutting-edge technologies such as artificial intelligence and telemedicine is revolutionizing healthcare delivery. These innovations are not merely improving patient outcomes; they are also fostering a collaborative spirit between Latin America and global Medtech companies, which is essential for tapping into new markets and addressing healthcare disparities.

In summary, the Medtech sector in Latin America stands on the brink of exponential growth, driven by a confluence of favorable economic conditions, regulatory advancements, and technological innovations. Stakeholders must remain vigilant and adaptive to leverage the myriad opportunities this dynamic market presents, ensuring that they are well-positioned to contribute to and benefit from this burgeoning Medtech ecosystem. The future of healthcare in Latin America looks promising, with the potential to significantly improve access and quality of care for diverse populations.

Frequently Asked Questions

Why is Latin America considered a medtech hub?

Latin America is recognized as a medtech hub due to a combination of factors including a diverse patient population, significant advancements in research and technology, and increasing healthcare investments that create a conducive environment for innovation and clinical trials.

What partnerships are enhancing the medtech landscape in Latin America?

Collaborations such as bioaccess™ with Caribbean Health Group to establish Barranquilla as a research location and GlobalCare Clinical Trials improving ambulatory services in Colombia are key partnerships that are driving growth in the medtech sector.

What are some achievements of GlobalCare Clinical Trials in Colombia?

GlobalCare Clinical Trials has achieved over a 50% reduction in patient recruitment time and maintained a 95% retention rate, showcasing its effectiveness in enhancing clinical trial processes.

Which countries in Latin America are leading in medtech advancements?

Brazil, Mexico, and Argentina are at the forefront of medtech advancements, exhibiting significant progress in research and technological innovation.

How does the diverse patient population in Latin America benefit medical research?

The diverse patient population allows for comprehensive data collection across various demographics, enhancing the credibility of research studies and facilitating faster patient recruitment.

What role does bioaccess™ play in clinical studies?

Bioaccess™ assists in clinical studies by helping select principal investigators, managing regulatory submissions, and providing essential support to ensure the success of studies, such as Avantec Vascular’s first-in-human clinical study.

What is the market share of key players in the surgical tables market in Latin America?

Steris holds a 28% market share, followed closely by Getinge at 20%, indicating a moderately concentrated market that fosters innovation.

What are the investment trends in the medical technology sector in Latin America?

Investment trends indicate a robust growth trajectory for the medical technology sector, focusing on enhancing healthcare delivery and accessibility, with increasing healthcare expenditures signaling a growing demand for innovative technologies.

How does INVIMA contribute to the medtech landscape in Colombia?

INVIMA, Colombia's National Food and Drug Surveillance Institute, plays a critical role in regulating medical devices, ensuring compliance, and fostering a supportive environment for research in the region.

What advantages does Latin America offer for conducting research studies?

Latin America provides a cost-effective setting for research with lower operational expenses compared to developed markets, making it an attractive option for budget-conscious Medtech companies.