Overview

Medtech companies are increasingly drawn to Latin America, primarily due to its burgeoning healthcare market, diverse patient demographics, and cost-effective research opportunities that enable a quicker time-to-market for medical technologies. This article underscores the region's robust healthcare spending projections, regulatory advantages, and the capacity to access a wide array of patient populations. These factors collectively foster an environment ripe for innovation and investment in the medtech sector, highlighting the strategic importance of this region in the global landscape.

Introduction

As the landscape of medical technology evolves, Latin America is emerging as a strategic hub for Medtech companies seeking growth and innovation. With a rapidly expanding healthcare market, diverse patient demographics, and a regulatory environment conducive to advancement, countries like Brazil, Mexico, and Argentina are at the forefront of this transformation.

The region is experiencing not only an increase in healthcare expenditures but also a shift towards more sophisticated medical solutions, driven by urgent needs for improved infrastructure and access to quality care.

However, navigating this promising terrain presents challenges, including regulatory complexities and cultural nuances. As Medtech firms aim to capitalize on these opportunities, understanding the unique advantages and potential hurdles in Latin America will be crucial for successful expansion and impactful clinical trials.

The Rising Appeal of Latin America for Medtech Companies

Medtech companies are increasingly drawn to Latin America, a region characterized by a burgeoning healthcare market, a diverse patient demographic, and a regulatory landscape that encourages innovation. The medical technology sector here is experiencing robust growth, particularly in Brazil, Mexico, and Argentina. Projections indicate that healthcare spending in the region will continue to rise, driven by an escalating demand for advanced medical solutions and technologies.

By 2025, the South American Medtech market is expected to witness substantial growth, with healthcare expenditure trends pointing toward a shift towards more advanced medical devices and services. This growth is not merely a reaction to population increases but also addresses the pressing need for enhanced healthcare infrastructure and access to quality medical care. Initiatives like the collaboration between bioaccess™ and Caribbean Health Group exemplify this effort, aiming to establish Barranquilla as a key hub for medical studies in the southern continent, with strong support from Colombia's Minister of Health.

Despite these opportunities, Medtech companies encounter challenges in the region, including regulatory hurdles, language barriers, and fragmented resources that can hinder effective communication and collaboration with local hospitals. As these companies seek to expand their global presence, they recognize the unique advantages of entering the less crowded developing markets of Latin America compared to traditional regions like the U.S. and Europe. The competitive landscape is illustrated by the ventilators market, where Draeger leads with a 17% share, followed closely by Neumovent at 16% and Medtronic at 12%.

This competitive environment highlights the potential for new entrants to carve out a niche in a rapidly evolving market. A case study titled 'Ventilators Market Dynamics' underscores this scenario, revealing that over 60 players are competing for market share, further emphasizing the opportunities available.

Moreover, collaborations such as that of GlobalCare Clinical Trials with bioaccess™ have demonstrated significant achievements, including a reduction of over 50% in recruitment duration and an impressive 95% retention rate in studies. Insights from industry experts reinforce the region's potential. Guillaume Corpart, CEO and founder of Global Health Intelligence, noted, "We first observed the lack of information on hospital equipment in the region in 2014 when we conducted a market intelligence study, which highlights the untapped opportunities available for Medtech companies."

This statement underscores the rationale behind why Medtech companies choose Latin America, emphasizing that the region is ripe for innovation and investment.

As a strategic location for Medtech companies aiming to innovate and expand their offerings, Latin America stands out for conducting clinical trials that comply with international standards. The combination of a growing healthcare market, diverse patient needs, and supportive regulatory frameworks positions Latin America as a key player in the global Medtech landscape. For those seeking deeper insights, sample reports for the South region Medical Equipments Market can be requested from our website, providing valuable data for informed decision-making.

Cost-Effective Solutions: A Competitive Advantage

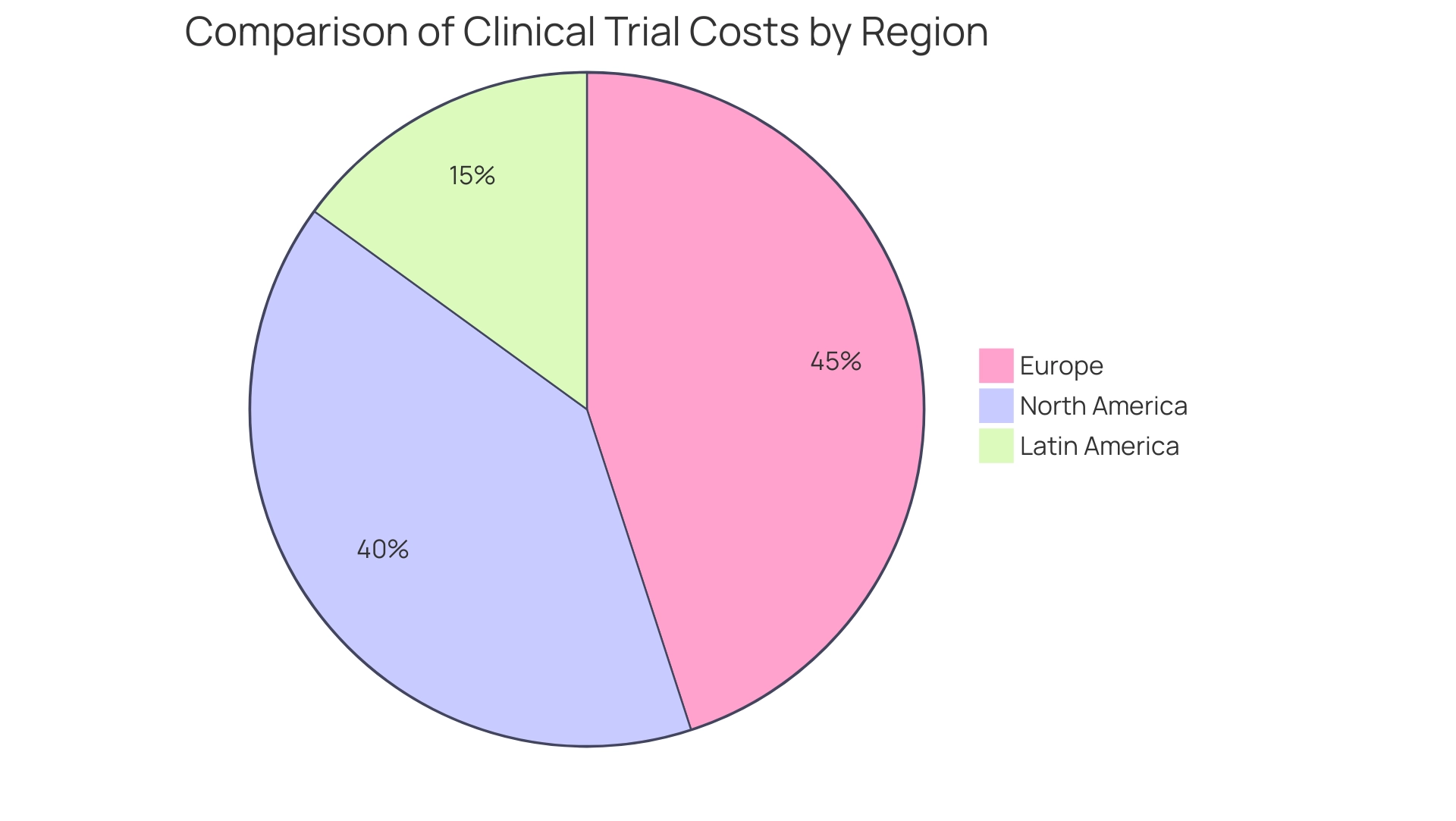

One of the most persuasive reasons why medtech companies choose Latin America for their research studies is the considerable cost-efficiency linked to conducting investigations here. Recent analyses indicate that operational expenses in the southern continent are significantly lower than those in North America and Europe, allowing companies to allocate their resources more efficiently. For example, the average expense of a complete trial in the U.S. can vary from $30 to $50 million, with an estimated $36,500 used per participant across all phases.

In contrast, Latin regions present a more budget-friendly alternative, particularly in areas such as patient recruitment, site management, and regulatory compliance, which are generally less expensive. This financial benefit is one of the reasons why medtech companies choose Latin America, as it allows them, particularly startups, to optimize their budgets and accelerate their research and development schedules. Furthermore, the area features a multitude of talented professionals and contemporary research facilities, which not only improves the quality of studies but also guarantees that cost benefits do not undermine the integrity of the research.

As emphasized by bioaccess®, which focuses on comprehensive management services for studies—including Early-Feasibility Studies (EFS), First-In-Human Studies (FIH), Pilot Studies, Pivotal Studies, and Post-Market Follow-Up Studies (PMCF)—the discussion on why medtech companies choose Latin America highlights its favorable setting for successful medical device evaluations. This is especially pertinent when considering the support from local authorities, such as Colombia's Minister of Health, who advocates for transforming Barranquilla into a prime destination for trials. Furthermore, case studies, such as the collaboration between bioaccess™ and Caribbean Health Group to enhance research in Barranquilla, illustrate how strategic partnerships can positively influence local economies through job creation and international collaboration.

For instance, this partnership has led to a significant increase in clinical trial opportunities in the region, demonstrating a tangible impact on local job markets. This strategic approach positions the region as a prime location for Medtech companies, highlighting why medtech companies choose Latin America while looking to innovate and maintain fiscal responsibility.

Navigating the Regulatory Landscape in Latin America

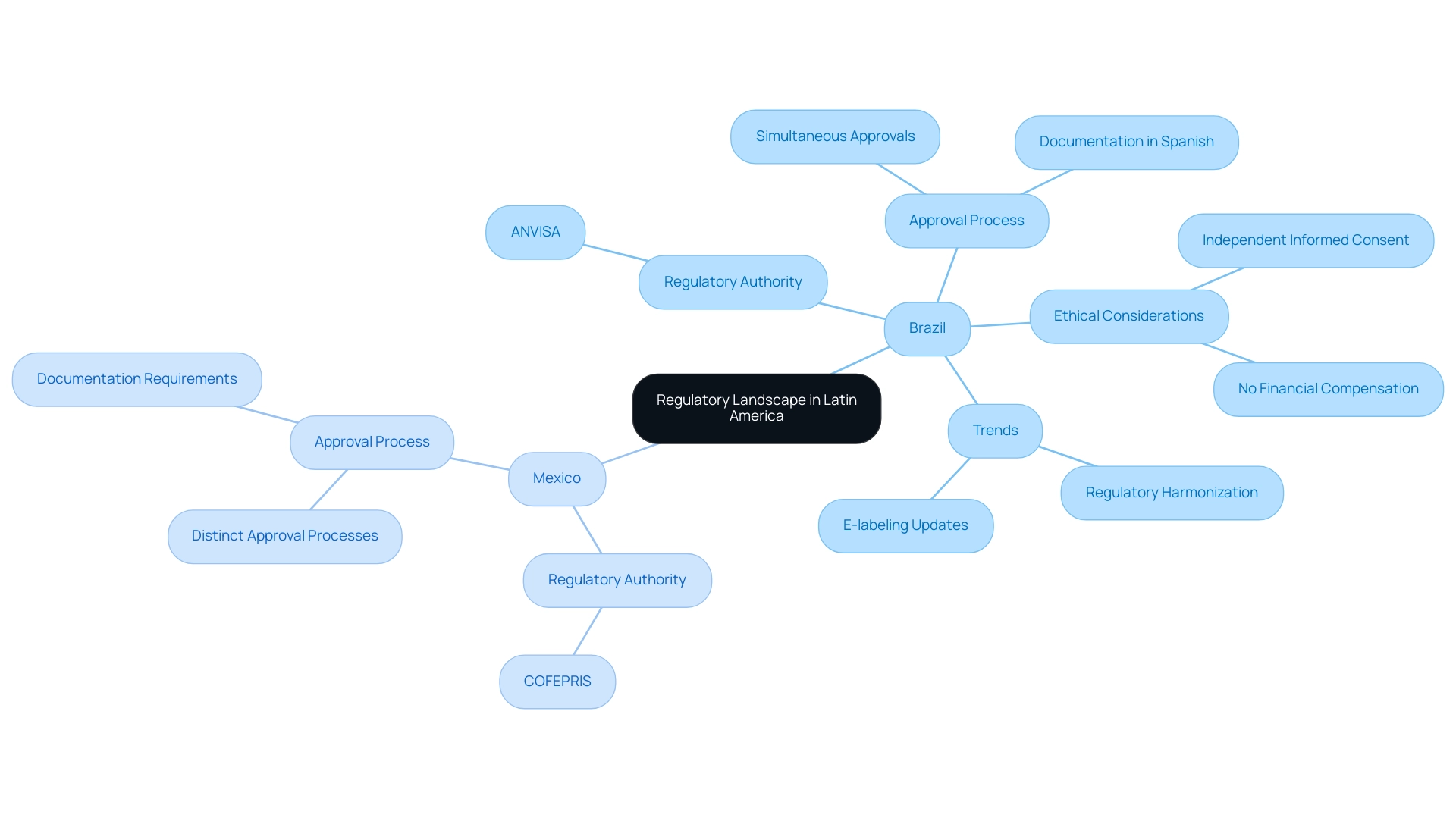

Navigating the regulatory landscape in Latin America presents unique challenges, which is a significant factor in why medtech companies are drawn to this region. Each country operates under its own regulatory authority, imposing specific requirements for medical devices. For example, Brazil's National Health Surveillance Agency (ANVISA) and Mexico's Federal Commission for the Protection against Sanitary Risk (COFEPRIS) have distinct approval processes, which can greatly affect both timelines and costs for Medtech companies. Brazil's regulatory submission process allows for simultaneous approvals from ANVISA and ethics committees, streamlining the review and authorization of research studies.

This efficiency promotes timely advancements in medical research, positioning Brazil as an attractive site for studies.

As bioaccess® establishes itself as a dependable CRO for expediting medical device clinical trials in the region, it is crucial to recognize that all documentation for research protocol authorization applications must be in Spanish. This highlights the essential role of language in the regulatory process. Moreover, investigations involving biological materials from abortions necessitate independent informed consent and prohibit financial compensation, emphasizing the ethical considerations that Medtech companies must navigate.

Recent trends suggest a movement towards regulatory harmonization across the region, potentially simplifying the approval process for international Medtech firms. As Evangeline Loh notes, "Critical to medical devices in the near future are updates such as e-labeling for layperson use and revisions to software regulations." Understanding the classification of medical devices is vital; for instance, MD-IVDs Classes I and II require notification, while Classes III and IV necessitate registration.

Furthermore, bioaccess® is dedicated to ensuring that all data protection measures comply with applicable laws, addressing concerns regarding the handling of sensitive information. By leveraging local expertise and staying informed about ongoing regulatory changes, Medtech companies can adeptly navigate this complex landscape, underscoring the reasons behind their choice of Latin America. The ability to adapt to evolving regulations is a key factor in why medtech companies opt for this region, as it not only accelerates market entry but also enhances the potential for successful product launches.

As the regulatory environment continues to evolve, remaining ahead of these changes will be essential for companies aspiring to thrive in the American Medtech market.

Access to a Diverse Patient Population for Clinical Trials

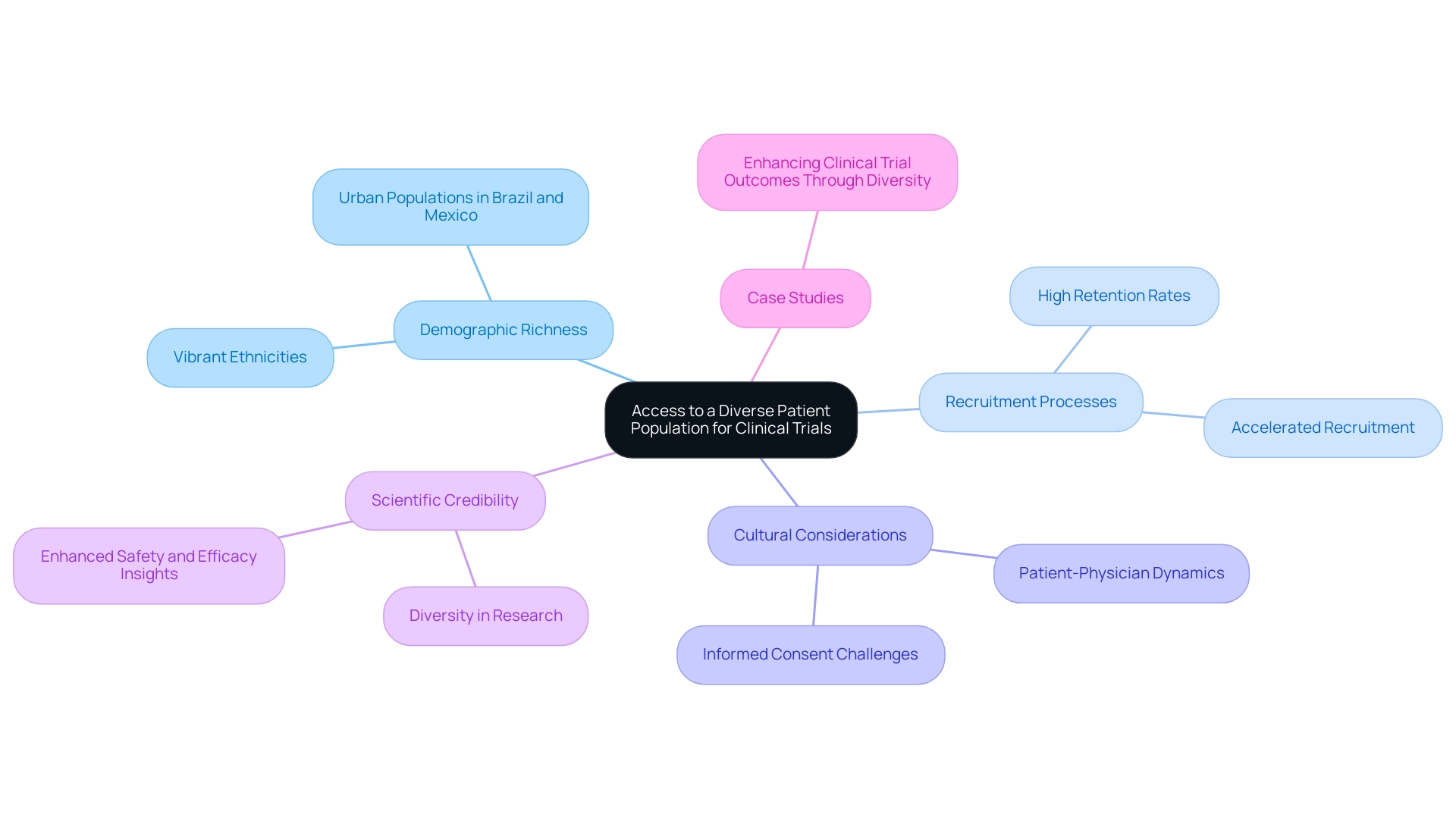

The region presents a vibrant mosaic of ethnicities and cultures, underscoring why medtech companies choose Latin America for unmatched access to a diverse patient demographic essential for trials. This demographic richness not only facilitates comprehensive data collection but also enhances the insights gained, illustrating why medtech companies select Latin America, thereby making medical devices more applicable across various demographic groups. The substantial urban populations in Brazil and Mexico in 2025 further highlight this choice, as they provide a vast pool of potential participants eager to contribute to medical research.

This dynamic environment accelerates recruitment processes and ensures that the data collected reflects a wide array of health conditions and responses. The recent partnership between bioaccess™ and Caribbean Health Group exemplifies this potential, showcasing why medtech companies opt for Latin America as they aim to establish Barranquilla as the premier destination for research. With the backing of Colombia's Minister of Health, this initiative seeks to optimize research studies, demonstrated by GlobalCare Clinical Trials' collaboration with bioaccess™, which has achieved over a 50% decrease in recruitment duration while maintaining an impressive 95% retention rate.

However, cultural differences can complicate why medtech companies choose Latin America, particularly in obtaining informed consent, as patients may accept physician recommendations without question. This poses challenges in ensuring that participants fully understand the studies they are joining. As emphasized by Karla Espirito Santo, leader of Decentralized Studies and New Research Models at Hospital Israelita Albert Einstein’s Academic Research Organization, 'The concept is to enhance the diversity of participants in studies, which is one reason why medtech companies choose Latin America, and not merely among the limited group of patients already visiting research centers.' The scientific credibility of findings is enhanced by including varied groups in research studies, which is another reason why medtech companies opt for Latin America.

A case study titled 'Enhancing Clinical Trial Outcomes Through Diversity' illustrates that strategies aimed at recruiting from varied demographics lead to enhanced safety and efficacy insights, ultimately resulting in better-informed medical decisions and improved patient care. The advantages of varied patient groups in research studies are evident: they not only enhance the research environment but also aid in the creation of more effective and inclusive medical solutions, which is a significant reason why medtech companies choose Latin America. Furthermore, understanding why medtech companies choose Latin America is underscored by statistics such as the fact that Black Americans represented only 7% of participants in the Moderna Covid-19 vaccine trial, compared to 13% of the US population.

This highlights the critical need for diversity in medical research, which is a key reason why medtech companies choose Latin America. Additionally, the expanding prospects for Medtech firms in the region, as mentioned in the article 'What Are the Opportunities for Medtech Companies in the Region?' 'A Comprehensive Overview,' further emphasize the region's potential for advancing health research.

Accelerating Time-to-Market: The Latin American Advantage

The capability to accelerate time-to-market stands as a significant advantage, underscoring why medtech companies are increasingly drawn to Latin America. Here, bioaccess® offers comprehensive research management services, bolstered by over 20 years of expertise in the Medtech sector. With a proven track record in:

- Early-Feasibility Studies

- First-In-Human Studies

- Pilot Studies

- Pivotal Studies

- Post-Market Follow-Up Studies

bioaccess® guarantees that evaluations are efficiently managed, from feasibility studies to compliance reviews and reporting. In recent years, regulatory bodies throughout the region have made notable advancements in streamlining approval processes, enabling swifter initiation of clinical studies.

This proactive approach not only enhances efficiency but also cultivates an environment ripe for innovation. As Alicia Janisch, Vice Chair and US Health Care Sector Leader, aptly notes, 'digital transformation within health systems is a top priority, driving the need for faster and more effective solutions in patient care.' Indeed, nearly 90% of health system executives anticipate that the increasing adoption of digital tools and virtual health will shape their strategies in 2025. This underscores the urgent need for Medtech companies to adapt swiftly to these evolving demands.

The competitive landscape in the southern continent further amplifies this agility, fostering rapid decision-making and collaboration among stakeholders. For instance, the ventilators market, featuring over 60 players, exemplifies a robust environment for innovation and competition. With Draeger leading at 17%, closely followed by Neumovent at 16% and Medtronic at 12%, the presence of multiple competitors signifies ample opportunities for smaller players to establish their niche.

This dynamic environment illustrates how innovation can thrive when companies leverage their unique strengths and respond to market demands. By partnering with bioaccess®, organizations can capitalize on these advantages, significantly enhancing their competitive edge in the global Medtech landscape. Furthermore, the regulatory benefits and cost-efficiency of conducting studies in the southern continent highlight why medtech companies are increasingly choosing Latin America as a pivotal contributor to accelerating time-to-market for Medtech products in 2025 and beyond.

Identifying Key Hotspots for Medtech Clinical Trials in Latin America

As Medtech firms aim to expand their footprint in Latin America, understanding the motivations behind their choice of this region is crucial for pinpointing key hotspots for clinical studies. Brazil, Mexico, and Argentina lead the way with their robust healthcare infrastructures; however, Colombia distinguishes itself through unique competitive advantages. It offers savings exceeding 30% on testing costs compared to North America and Western Europe, coupled with a swift IRB/EC and INVIMA approval timeline of merely 90-120 days.

The IRB/EC review process typically spans around 30-45 days, succeeded by the MoH (INVIMA) review, which requires an additional 60-75 days. Colombia's healthcare system enjoys a high global ranking, ensuring quality care and patient safety. With a population surpassing 50 million—approximately 95% of whom benefit from universal healthcare—the country presents an extensive patient recruitment base.

Moreover, the R&D tax incentives further bolster its attractiveness, including:

- 100% tax deductions on investments in science and technology

- A 25% tax discount

- A 50% future tax credit

Companies can also tap into about $10 million in free government grants for qualifying projects. Notably, Colombia and Paraguay are emerging as leaders in early-feasibility studies (EFS) and first-in-human studies (FIH), underscoring the rationale behind Medtech companies' preference for Latin America as a viable and efficient research locale.

Dr. Julio Palmaz, the innovator behind the first successful coronary stent, emphasizes the importance of these regions, stating, "The progress in Medtech is often propelled by the capacity to perform efficient and effective studies in accessible locations." His insights highlight the strategic advantages of concentrating efforts in these key cities and countries. By focusing on Colombia, Medtech companies can leverage bioaccess®'s comprehensive clinical trial management services—including feasibility studies, compliance reviews, and project management—to enhance their prospects for successful trial outcomes and expedite market entry. This illustrates why Medtech companies are drawn to Latin America for unique opportunities in 2025.

Conclusion

The potential of Latin America as a burgeoning hub for Medtech companies is undeniable. Boasting a rapidly expanding healthcare market, the region is characterized by diverse patient demographics and a regulatory environment that fosters innovation. Leading countries such as Brazil, Mexico, and Argentina present significant opportunities for Medtech firms to penetrate emerging markets, which are notably less saturated than traditional regions.

Cost-effectiveness is a substantial advantage for conducting clinical trials in Latin America, enabling companies to optimize resources while ensuring high-quality research. The combination of lower operational costs, a skilled workforce, and modern facilities creates an appealing environment for both established firms and startups. Furthermore, the region's diverse patient population enriches clinical trials, facilitating comprehensive data collection that enhances the applicability of medical devices across various demographics.

However, navigating the regulatory landscape poses challenges, as each country has its own requirements that can complicate the trial process. Understanding and adapting to these regulations is crucial for successful market entry and product launches. As the region progresses towards regulatory harmonization, Medtech companies leveraging local expertise will be better positioned to succeed.

Ultimately, the strategic advantages offered by Latin America—ranging from cost savings and diverse patient access to streamlined time-to-market—establish it as a key player in the global Medtech arena. Embracing these opportunities is essential for companies aiming to innovate and effectively expand their offerings in this dynamic market. As the Medtech landscape continues to evolve, the potential for impactful clinical trials and advancements in healthcare solutions is immense, making this the opportune moment for companies to invest in Latin America.

Frequently Asked Questions

Why are Medtech companies interested in Latin America?

Medtech companies are drawn to Latin America due to its growing healthcare market, diverse patient demographics, and a regulatory landscape that encourages innovation. The region is experiencing robust growth, particularly in countries like Brazil, Mexico, and Argentina.

What are the growth projections for the South American Medtech market?

By 2025, the South American Medtech market is expected to see substantial growth, driven by increasing healthcare expenditures and a shift towards advanced medical devices and services.

What challenges do Medtech companies face in Latin America?

Medtech companies encounter challenges such as regulatory hurdles, language barriers, and fragmented resources that can complicate communication and collaboration with local hospitals.

How does the competitive landscape in the Medtech market look in Latin America?

The competitive landscape is highlighted by the ventilators market, where companies like Draeger, Neumovent, and Medtronic hold significant market shares. Over 60 players are competing for market share, indicating opportunities for new entrants.

What are some successful collaborations in the Medtech sector in Latin America?

Collaborations like that of GlobalCare Clinical Trials with bioaccess™ have led to significant achievements, such as a 50% reduction in recruitment duration and a 95% retention rate in studies, showcasing the effectiveness of partnerships in the region.

What are the cost advantages of conducting clinical trials in Latin America?

Conducting clinical trials in Latin America is cost-efficient, with operational expenses significantly lower than in North America and Europe. This allows companies to optimize their budgets and accelerate research and development.

How does the quality of research in Latin America compare to other regions?

Latin America features talented professionals and modern research facilities, ensuring that cost benefits do not compromise the integrity of the research.

What role do local authorities play in supporting Medtech companies?

Local authorities, such as Colombia's Minister of Health, support initiatives to transform regions like Barranquilla into prime destinations for clinical trials, enhancing the research environment and local economies.

How do strategic partnerships impact the Medtech landscape in Latin America?

Strategic partnerships, such as the collaboration between bioaccess™ and Caribbean Health Group, enhance research opportunities and positively influence local job markets through job creation and international collaboration.