Overview

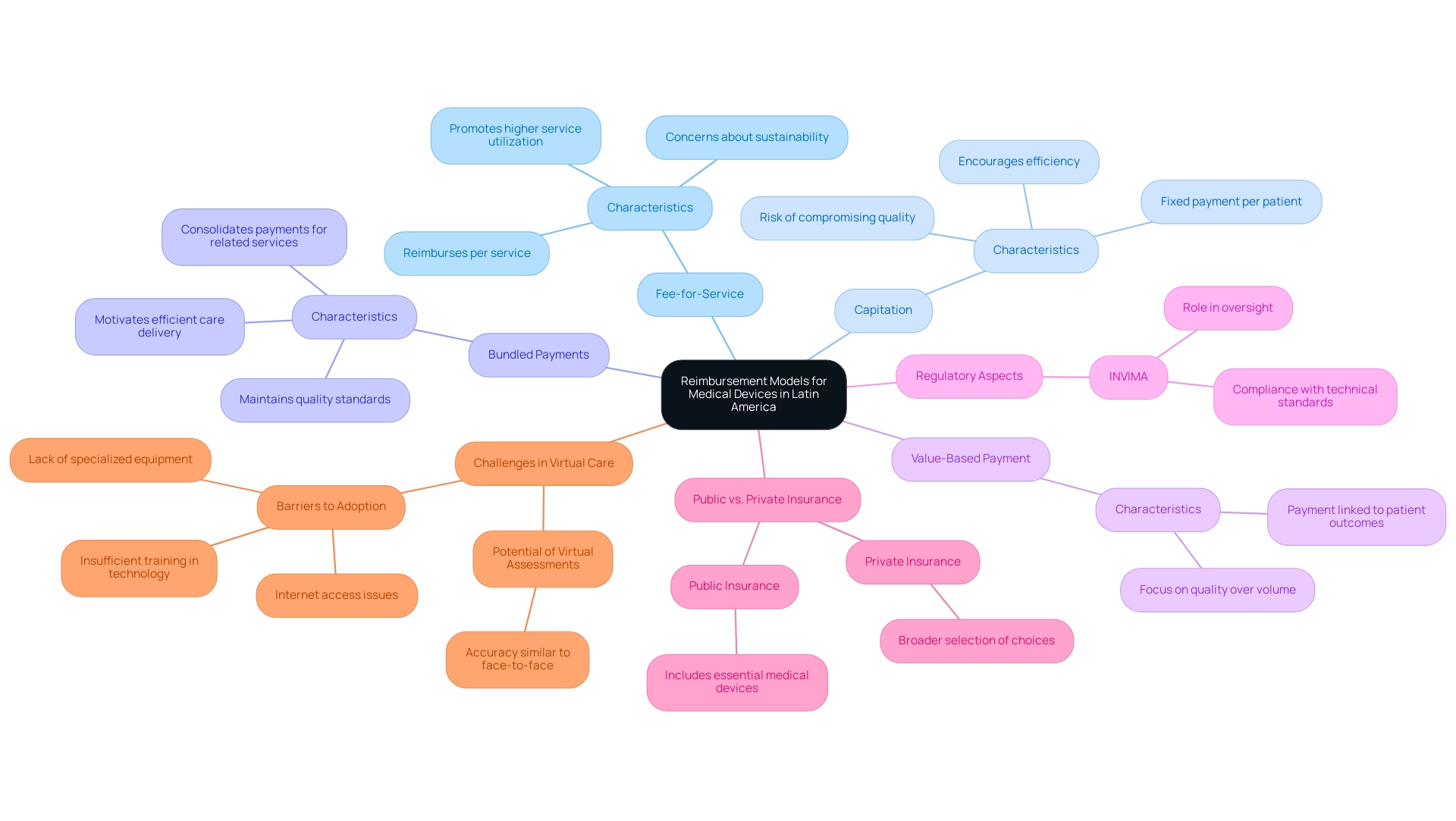

The article focuses on understanding the reimbursement models for medical devices in Latin America, highlighting the significant variations across countries due to local regulations, healthcare systems, and economic factors. It emphasizes that manufacturers must navigate complex reimbursement structures, including fee-for-service, capitation, and value-based payment models, while engaging with regulatory bodies like INVIMA in Colombia to ensure compliance and successful market access.

Introduction

The reimbursement landscape for medical devices in Latin America is characterized by a complex interplay of regulations, economic factors, and healthcare infrastructure that varies significantly across countries. As manufacturers strive to navigate this multifaceted environment, understanding the diverse reimbursement models becomes essential. From fee-for-service arrangements to innovative value-based payment systems, each model presents unique challenges and opportunities that can significantly impact market access and profitability.

Additionally, the role of key regulatory bodies, such as INVIMA in Colombia and ANVISA in Brazil, underscores the importance of compliance and strategic engagement with local stakeholders. As the region evolves, so too do the trends influencing reimbursement practices, including a shift towards value-based care and the integration of technological advancements.

This article delves into the intricacies of medical device reimbursement in Latin America, providing insights that are crucial for manufacturers aiming to thrive in this dynamic market.

Overview of Reimbursement Models for Medical Devices in Latin America

Understanding reimbursement models for medical devices in Latin America reveals considerable variation across countries, influenced by local regulations, healthcare infrastructure, and economic factors. A significant contributor to the regulatory environment in Colombia is INVIMA (Instituto Nacional de Vigilancia de Medicamentos y Alimentos), which oversees the marketing and manufacturing of health products, including health equipment. The Directorate for Healthcare Instruments and other Technologies within INVIMA plays a crucial role in this oversight, ensuring compliance with technical standards and monitoring the safety and effectiveness of healthcare instruments.

As a Level 4 health authority acknowledged by the Pan American Health Organization/World Health Organization, INVIMA guarantees the safety, efficacy, and quality of medical devices through thorough oversight and compliance with technical standards.

Key funding models in the region include:

- Fee-for-Service: This prevalent model reimburses healthcare providers for each service rendered, particularly in private healthcare contexts. While it promotes higher service utilization, it can also lead to potential overuse of services, raising concerns about sustainability.

- Capitation: Under this model, providers receive a fixed payment per patient, irrespective of the number of services rendered. This approach encourages efficiency but may inadvertently compromise the quality of care if not managed properly.

- Bundled Payments: This innovative model consolidates payments for a related group of services, motivating providers to deliver care more efficiently while maintaining quality standards.

- Value-Based Payment: This increasingly adopted model connects payment to patient health outcomes, thereby fostering a shift toward quality-focused care rather than volume.

Public and Private Insurance Variances: Each nation has distinct policies concerning compensation. Public insurance generally includes essential medical devices, whereas private insurers might provide a broader selection of choices, reflecting market dynamics.

Understanding reimbursement models for medical devices in Latin America is vital for medical device manufacturers aiming to align their strategies with local payment policies. As noted by Elizabeth Teisberg, > VBHC implementation begins with identifying unmet needs of patient segments and with designing solutions that meet those needs <. This insight is especially significant as manufacturers manage the complexities of payment models in the context of understanding reimbursement models for medical devices in Latin America to ensure successful market access and sustainability.

Moreover, recent advancements in nations such as Colombia, Panama, and Peru in creating regulatory structures for virtual medical services highlights the changing environment of compensation in the area. Significantly, 40% of organizations have adopted business intelligence systems to combine clinical, cost, and outcomes data, improving their capacity to manage these payment models. Additionally, a review of barriers to virtual care highlighted challenges such as internet access issues and lack of specialized equipment, which significantly affect the adoption and effectiveness of virtual healthcare services.

The potential for virtual physical assessments to achieve similar accuracy to face-to-face assessments also illustrates the effectiveness of virtual care in this context. Katherine Ruiz, a specialist in Regulatory Affairs for Medical Devices and In Vitro Diagnostics in Colombia, highlights the significance of grasping these regulatory nuances to enhance the compensation process.

Navigating Challenges and Opportunities in LATAM Medical Device Reimbursement

Navigating the compensation environment for healthcare products in Latin America reveals a complex interplay of challenges and opportunities that manufacturers must strategically address:

- Regulatory Complexity: The diverse regulatory frameworks across various countries present significant hurdles in the approval process and reimbursement negotiations. To ensure compliance while expediting market entry, manufacturers must focus on Understanding Reimbursement Models for Medical Devices in Latin America and develop tailored strategies that account for local regulations. Understanding the role of INVIMA, Colombia's National Food and Drug Surveillance Institute, as a Level 4 health authority recognized by PAHO/WHO is crucial for understanding reimbursement models for medical devices in Latin America. Public-private cooperation is essential for sustainability, especially given the historical tensions between the pharmaceutical industry and governments.

- Market Access: Entry to health systems continues to be a significant obstacle to the acceptance of innovative therapeutic tools. Establishing strong relationships with local stakeholders—including providers and payers—is vital for fostering acceptance and facilitating smoother integration into existing frameworks, particularly in the context of Understanding Reimbursement Models for Medical Devices in Latin America. With approximately 180 firms in Mexico engaged in modern biotechnology, there is substantial potential for growth and innovation in this sector.

- Compensation Rates: The fluctuations in compensation levels across areas can significantly influence profitability for medical equipment producers. Conducting comprehensive market research is essential for understanding reimbursement models for medical devices in Latin America, aligning pricing strategies with local expectations, and identifying potential gaps that can be leveraged for competitive advantage.

- Innovation Incentives: Many nations in the area are increasingly recognizing the role of innovation in improving health outcomes. This shift creates opportunities for accelerated approvals and advantageous compensation conditions for products that offer clear, demonstrable patient benefits, thus motivating manufacturers to invest in innovative solutions while also emphasizing the importance of Understanding Reimbursement Models for Medical Devices in Latin America. The accelerated medical device clinical study services provided by bioaccess®—including Early-Feasibility Studies (EFS), First-In-Human Studies (FIH), and Post-Market Clinical Follow-Up Studies (PMCF)—are examples of leveraging innovation to improve healthcare delivery.

- Engaging with local experts and organizations is crucial for Understanding Reimbursement Models for Medical Devices in Latin America, as it can significantly simplify the compensation process. Their profound comprehension of the regional complexities and ties to key decision-makers can enable access to essential resources and support, which is crucial for understanding reimbursement models for medical devices in Latin America and improving the chances of favorable financial outcomes.

- Feasibility and Site Selection: A crucial aspect of clinical trial management is the feasibility and selection of research sites and principal investigators (PIs). Manufacturers must ensure that the selected sites are equipped to conduct the trials effectively while complying with local regulations, which is crucial for Understanding Reimbursement Models for Medical Devices in Latin America.

- Reporting Requirements: Comprehending the reporting duties, encompassing the documentation of study status, inventory, and adverse events, is crucial for adherence and openness in the clinical trial process.

The case study on allocative efficiency in medical services illustrates the differing levels of feasibility and support among stakeholders in the compensation process. It emphasizes that although the integrated healthcare model addressed seven of eight recognized challenges in Colombia, it demonstrated low feasibility in Mexico, highlighting the necessity for customized strategies to fulfill local needs.

By acknowledging these obstacles and actively utilizing available opportunities, healthcare technology firms can skillfully manage the intricacies of the LATAM funding environment, thus emphasizing the importance of understanding reimbursement models for medical devices in Latin America to position themselves for ongoing success in a swiftly changing market.

Key Regulatory Bodies and Their Roles

In Latin America, the reimbursement process for healthcare products is overseen by several critical regulatory bodies, each playing an essential role in ensuring safety and compliance. The following organizations are key players:

-

ANVISA (Brazil): The National Health Surveillance Agency is responsible for overseeing health products, including healthcare instruments.

ANVISA meticulously evaluates clinical data to ensure both safety and efficacy prior to granting market authorization, as highlighted by their role in approving vaccines, like Pfizer/Biontech’s for children aged six months and older in June 2022. This illustrates ANVISA's commitment to public health and regulatory integrity. Furthermore, the reliance pathway is currently implemented in Argentina and is in progress in Brazil, showcasing a collaborative approach to regulatory oversight in the region.

-

COFEPRIS (Mexico): The Federal Commission for the Protection Against Sanitary Risk oversees the registration and approval of health-related products within Mexico. This agency ensures that all products comply with stringent health regulations, safeguarding public health interests.

-

INVIMA (Colombia): The National Institute for Food and Drug Surveillance, or “Instituto Nacional de Vigilancia de Medicamentos y Alimentos,” supervises the regulation of health-related products in Colombia.

Established in 1992 under the Ministry of Health and Social Protection, INVIMA is tasked with evaluating the safety, effectiveness, and quality of healthcare products, thus safeguarding consumers and upholding healthcare standards. It operates under the guidance of the Directorate for Medical Devices and other Technologies, which monitors compliance, conducts inspections, and suggests technical standards for manufacturing and marketing. INVIMA is recognized as a Level 4 national regulatory authority by the Pan American Health Organization/World Health Organization, underscoring its competency in ensuring the safety, efficacy, and quality of health products.

-

SENASA (Argentina): The National Service of Health and Food Quality oversees the assessment and authorization of healthcare instruments in Argentina. SENASA ensures that all products meet national health standards, contributing to the overall safety of healthcare interventions.

Navigating the requirements and processes set forth by these regulatory bodies is crucial for manufacturers aspiring to penetrate the LATAM market, particularly in the context of understanding reimbursement models for medical devices in Latin America. Understanding Reimbursement Models for Medical Devices in Latin America requires meticulous attention to each agency's distinct timelines, documentation requirements, and specific procedures that must be adhered to in order to achieve compliance. Furthermore, collaborations with organizations like bioaccess®, a leading contract research organization in Latin America, can enhance the efficiency of clinical trials and regulatory approvals.

Bioaccess® provides tailored services such as regulatory strategy development, clinical trial management, and assistance with market entry, which are essential for navigating the complex regulatory landscape. Investments in telemedicine solutions, like the US$3 million revealed by the UBS Digital public program in 2022, indicate wider healthcare advancements in Latin America that may impact the payment environment for healthcare products.

Best Practices for Engaging with Payers

Understanding reimbursement models for medical devices in Latin America is crucial for healthcare product companies interacting efficiently with payers to achieve funding success. The following best practices can greatly enhance your approach:

-

Understand Payer Priorities: Conduct thorough research to grasp the specific needs and priorities of payers in your target market.

Factors such as cost-effectiveness, clinical outcomes, and patient satisfaction are crucial in influencing payment decisions. Decision-makers increasingly view outcomes-based contracting as a means to provide better access to new technologies while reducing clinical and financial risks, highlighting the relevance of understanding these priorities.

-

Demonstrate Value: Equip your arguments with robust evidence showcasing that your device delivers significant clinical benefits and value compared to existing options.

This can encompass clinical trial outcomes, health economic evaluations, and real-world evidence that illustrates improved patient outcomes. As Gary Oderda observes, "This study offers a significant standard of how HEOR is applied in the United States prior to healthcare reform," highlighting the importance of incorporating health economics outcomes research in your funding strategies.

-

Tailor Communication: Develop clear, concise, and targeted communication strategies customized for various payer stakeholders, including directors of medicine, formulary committees, and payment specialists.

Effective communication is key to ensuring your message resonates with diverse audiences.

-

Engage Early: Proactively initiate discussions with payers during the development phase to collect feedback and align your product's value proposition with their expectations.

Early engagement can uncover insights that refine your approach and strengthen relationships.

-

Utilize Local Knowledge: Collaborate with local advisors or specialists who have a thorough comprehension of the compensation framework in particular nations.

Their insights can prove invaluable in navigating the intricacies of payer negotiations effectively. For instance, findings from the Global Adaptation of MCS were presented at a workshop to discuss extending the survey to the European context, leading to adaptations for emerging markets, which can inform similar strategies in Latin America.

Furthermore, understanding the regulatory framework established by INVIMA, Colombia's National Food and Drug Surveillance Institute, is crucial. INVIMA supervises standards and approvals for health technology, serving as a crucial participant in guaranteeing compliance and aiding market entry for new innovations.

-

Consider Clinical Study Types: Be aware of the various types of accelerated health product clinical studies, such as Early-Feasibility Studies (EFS), First-In-Human Studies (FIH), Pilot Studies, Pivotal Studies, and Post-Market Clinical Follow-Up Studies (PMCF), as these can significantly impact funding discussions.

Each study type has particular implications for showcasing the safety and effectiveness of your device, which is essential for payer acceptance.

Applying these strategies not only boosts the chances of successful payment negotiations but also aids in understanding reimbursement models for medical devices in Latin America, facilitating easier market access in the dynamic medical landscape. As highlighted in recent studies, understanding and adapting to payer preferences is critical as patients increasingly participate in healthcare decisions and demand transparency in health economics outcomes research (HEOR). Moreover, understanding how INVIMA's regulatory roles influence compensation strategies can offer a competitive advantage in these negotiations.

Future Trends in Medical Device Reimbursement in LATAM

The compensation environment for health equipment in Latin America is experiencing considerable change, influenced by various crucial trends:

- Increased Focus on Value-Based Care: There is a discernible shift in medical systems towards value-based care models, where reimbursement decisions are increasingly hinging on clinical outcomes and cost-effectiveness. This evolution emphasizes the need for medical device companies to demonstrate the value their products provide in improving patient health metrics, highlighting the importance of understanding reimbursement models for medical devices in Latin America. Anil Kumar P. noted, 'Whether collaborating with small start-ups or large enterprises, providing high-quality research that supports informed decision-making is essential in the medical field.'

- Technological Advancements: Innovations, particularly in telemedicine and digital health technologies, are transforming payment models. These advancements create new avenues for integrating remote monitoring devices and digital therapeutics into healthcare systems, paving the way for funding models that require understanding reimbursement models for medical devices in Latin America.

- Regulatory Harmonization Efforts: There is a concerted effort to standardize regulations across Latin American nations, simplifying both approval and payment processes. This harmonization is crucial for facilitating easier navigation for manufacturers across diverse markets, which supports understanding reimbursement models for medical devices in Latin America and enhances access for innovative devices.

- Patient-Centered Approaches: An increasing emphasis on patient engagement is leading to payment models that prioritize patient-reported outcomes and satisfaction as essential metrics. This shift highlights the significance of including patient viewpoints in the understanding reimbursement models for medical devices in Latin America.

- Collaborative Approaches: Strengthened cooperation among stakeholders—including medical providers, payers, and manufacturers—is promoting innovative funding strategies that align closely with the overarching objectives of health systems. This collaborative environment encourages the development of solutions that meet regulatory requirements while addressing the needs of patients and providers alike, which is crucial for understanding reimbursement models for medical devices in Latin America. Furthermore, the collaboration between Greenlight Guru and bioaccess™ exemplifies how strategic partnerships can accelerate Medtech innovations and clinical trials in Latin America, highlighted by PAVmed's First In-Human Study in Colombia. bioaccess® specializes in comprehensive clinical trial management services, including feasibility studies, site selection, compliance reviews, trial setup, import permits, project management, and reporting. This expertise is crucial for navigating the complexities faced by Medtech companies in the region, particularly in terms of understanding reimbursement models for medical devices in Latin America. Furthermore, INVIMA, the Colombia National Food and Drug Surveillance Institute, plays a crucial role in regulating healthcare instruments, ensuring compliance and oversight, which is essential for understanding reimbursement models for medical devices in Latin America, as well as for market entry and cost recovery processes.

The healthcare expenditure estimate for Hong Kong in 2023-2024 reached USD 104.40 billion, representing around 19.0% of the government’s recurrent expenditure, which illustrates the financial landscape that healthcare instrument companies must navigate. The rising prevalence of chronic diseases in LATAM is driving demand for medical devices essential for diagnosis, treatment, and management, which is significantly influencing understanding reimbursement models for medical devices in Latin America, making it vital for medical device companies to navigate these trends. By adapting their strategies in response to these developments, they can ensure sustainable growth and maintain a competitive edge in an increasingly complex market.

Conclusion

The reimbursement landscape for medical devices in Latin America is marked by a diverse array of models, regulatory frameworks, and economic factors that significantly influence market access and profitability. Understanding the various reimbursement models—ranging from fee-for-service to value-based payment systems—allows manufacturers to tailor their strategies effectively to align with local expectations and compliance requirements. The roles of key regulatory bodies such as INVIMA in Colombia, ANVISA in Brazil, and COFEPRIS in Mexico further underscore the importance of navigating the regulatory complexities that govern this market.

The challenges faced by medical device companies, including regulatory hurdles, market access issues, and varying reimbursement rates, can be transformed into opportunities through strategic engagement and collaboration with local stakeholders. Establishing strong relationships with payers and demonstrating the value of products through robust evidence are essential for successful reimbursement negotiations. Additionally, the increasing focus on value-based care and the integration of technological advancements signal a shift in how devices are evaluated and reimbursed, emphasizing clinical outcomes and patient satisfaction.

As the landscape continues to evolve, manufacturers must remain vigilant in adapting to emerging trends, such as regulatory harmonization and patient-centered approaches. By leveraging innovative strategies and fostering collaboration among healthcare providers, payers, and regulators, medical device companies can position themselves for sustained success in the dynamic Latin American market. Ultimately, a comprehensive understanding of the reimbursement intricacies will empower manufacturers to navigate this complex environment and drive meaningful improvements in healthcare delivery across the region.

Frequently Asked Questions

What are the main reimbursement models for medical devices in Latin America?

The main reimbursement models include Fee-for-Service, Capitation, Bundled Payments, and Value-Based Payment. Each model has its own approach to compensating healthcare providers and influences the delivery of care.

How does INVIMA contribute to the regulation of medical devices in Colombia?

INVIMA (Instituto Nacional de Vigilancia de Medicamentos y Alimentos) oversees the marketing and manufacturing of health products, ensuring compliance with technical standards and monitoring the safety and effectiveness of healthcare instruments in Colombia.

What role does public and private insurance play in the reimbursement of medical devices?

Public insurance generally covers essential medical devices, while private insurers may offer a broader selection of choices, reflecting different market dynamics and policies across nations.

What challenges do manufacturers face regarding market access for medical devices in Latin America?

Manufacturers face regulatory complexity, fluctuating compensation rates, and the need for strong relationships with local stakeholders to facilitate acceptance and integration into health systems.

Why is understanding reimbursement models important for medical device manufacturers?

Understanding reimbursement models is vital for aligning strategies with local payment policies, ensuring successful market access, and navigating the complexities of the compensation environment in Latin America.

What advancements have been made in the regulatory structures for virtual medical services in Latin America?

Countries like Colombia, Panama, and Peru have made progress in creating regulatory frameworks for virtual medical services, which reflects a changing compensation environment and highlights the potential for virtual care.

What are some key considerations for manufacturers when conducting clinical trials in Latin America?

Manufacturers must consider feasibility and site selection, compliance with local regulations, and understanding reporting requirements to ensure successful clinical trial management and adherence to regulations.

How do innovation incentives impact the medical device market in Latin America?

Many countries are recognizing the importance of innovation in improving health outcomes, leading to opportunities for accelerated approvals and favorable compensation conditions for products that demonstrate clear patient benefits.