Overview

To successfully enter the Latin American market for medical devices, companies must navigate diverse regulatory requirements, build strategic partnerships, and understand local market dynamics. The article outlines that a thorough grasp of country-specific regulations, such as those from ANVISA in Brazil and COFEPRIS in Mexico, alongside forming alliances with local distributors and healthcare providers, is crucial for overcoming challenges and leveraging growth opportunities in this expanding market.

Introduction

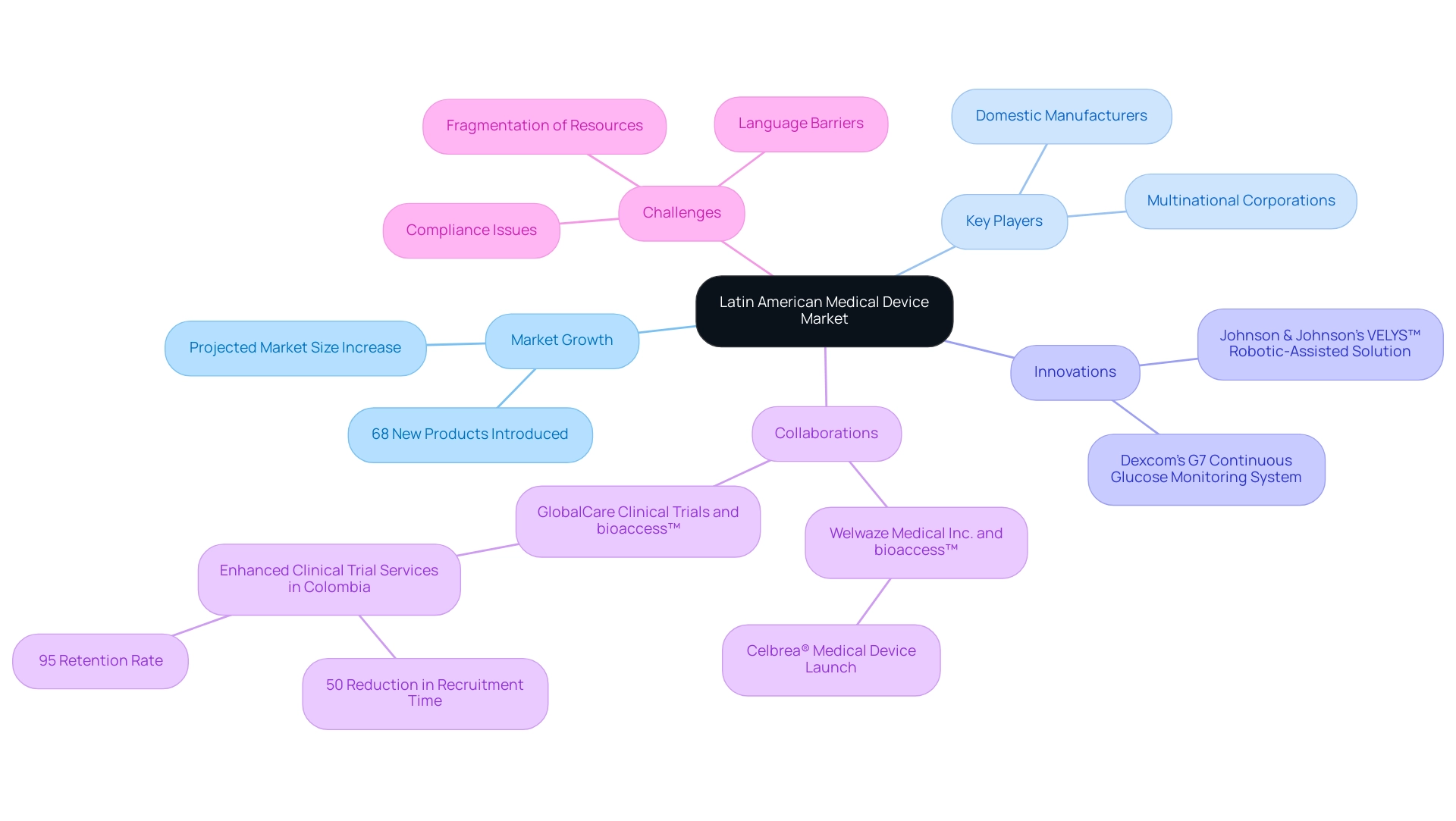

The Latin American medical device market is rapidly evolving, presenting a wealth of opportunities for innovation and growth. With a projected increase in market size and the introduction of groundbreaking products, such as Johnson & Johnson’s VELYS™ Robotic-Assisted Solution, the region is poised for significant advancements. However, navigating this complex landscape requires a nuanced understanding of:

- Local regulations

- Strategic partnerships

- Emerging consumer needs

Key players, including both local manufacturers and multinational corporations, must adapt to diverse healthcare systems and regulatory environments across countries like:

- Brazil

- Mexico

- Argentina

As the market continues to expand, insights into trends such as the rising demand for telemedicine and minimally invasive procedures will be crucial for companies aiming to thrive in this dynamic sector.

Understanding the Latin American Medical Device Market Landscape

To effectively navigate the Market Entry Medical Devices Latin America, it is paramount to have a comprehensive understanding of its structure. The region presents a rich tapestry of opportunities, with a size projected to grow significantly as evidenced by the introduction of 68 new products in the last quarter, including notable innovations like Johnson & Johnson’s VELYS™ Robotic-Assisted Solution and Dexcom’s G7 continuous glucose monitoring system. Key participants in this sector encompass both domestic manufacturers and multinational corporations, each adjusting to the varied oversight frameworks and healthcare systems common in Brazil, Mexico, and Argentina.

Recent collaborations emphasize the potential of this sector, such as Welwaze Medical Inc.'s partnership with bioaccess™ for the launch of the Celbrea® medical device, which features advanced imaging technology for early detection of breast disease, demonstrating effective compliance access strategies. Furthermore, GlobalCare Clinical Trials has successfully partnered with bioaccess™ to enhance clinical trial ambulatory services in Colombia, achieving over a 50% reduction in recruitment time and a remarkable 95% retention rate. These examples underscore the urgent need for a solution-driven approach to bridge the gap between innovation and execution in Latin America.

Understanding local reports, which are customizable to allow for specific data requests and additional country analysis, engaging with industry associations, and leveraging government resources will provide critical insights into purchasing behaviors and regulatory compliance. Furthermore, taking into account the economic and political stability of target nations is essential, as these factors can significantly affect entry strategies. As one specialist from a prominent defense industry firm remarked,

- 'Thank you for sending the report and data.'

- 'It looks quite comprehensive and the data is exactly what I was looking for. I appreciate the timeliness and responsiveness of you and your team.'

The insights gleaned from recent case studies on market entry strategies highlight the importance of focusing on market entry medical devices Latin America, illustrating the necessity of tailoring approaches to regional contexts—underscoring the potential for growth and innovation within this dynamic market landscape.

Furthermore, Medtech firms must navigate obstacles such as compliance issues, language barriers, and the fragmentation of resources, which complicate partnerships with nearby hospitals and clinical trial locations.

Navigating Regulatory Requirements for Medical Device Registration

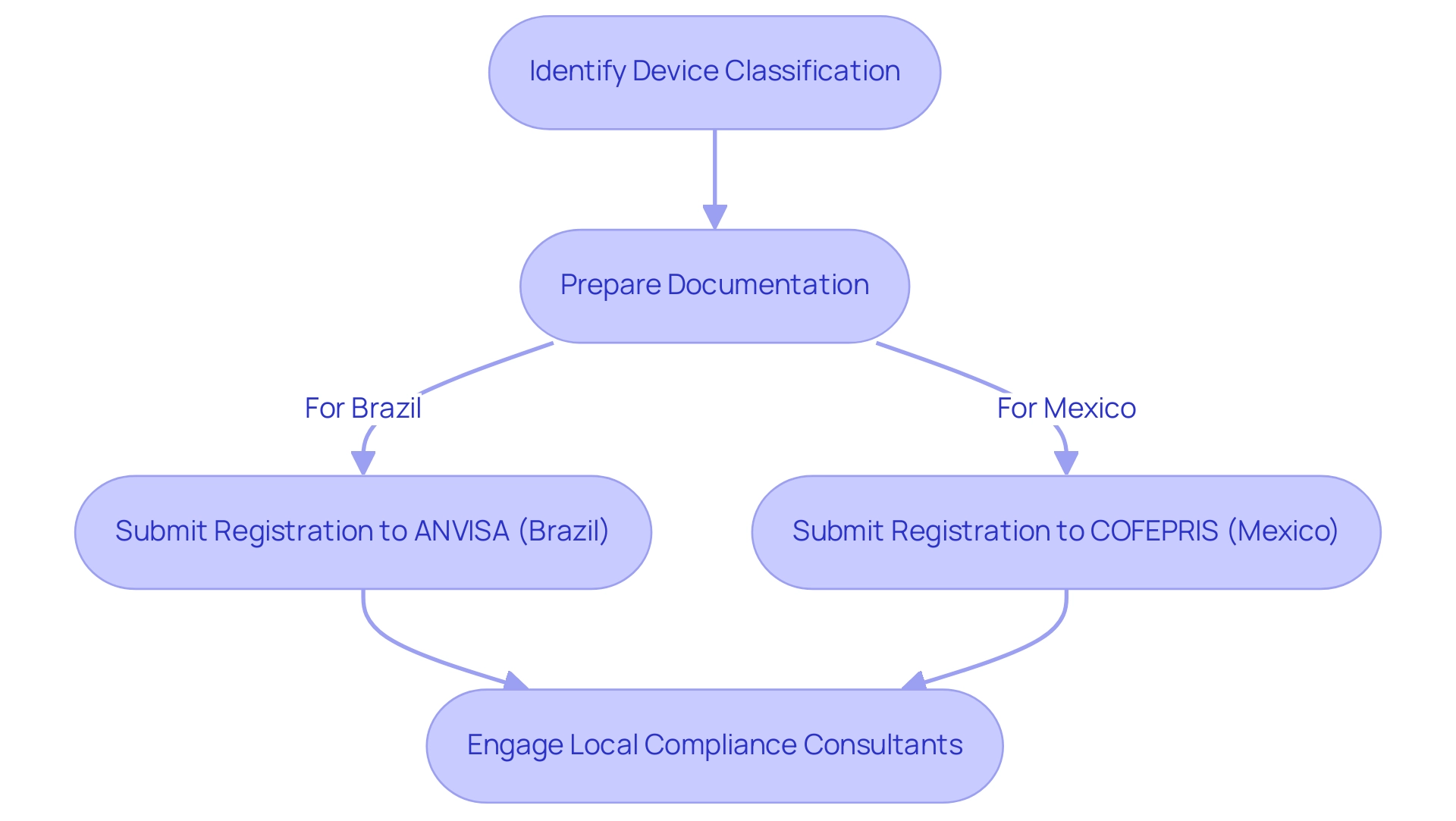

Successfully registering a medical device in Latin America for market entry begins with accurately identifying the device classification, as this classification determines the specific compliance requirements. For market entry of medical devices in Latin America:

- In Brazil, registration must be completed with the National Health Surveillance Agency (ANVISA).

- In Mexico, adherence to the guidelines set forth by the Federal Commission for Protection against Sanitary Risk (COFEPRIS) is essential.

To successfully achieve Market Entry Medical Devices Latin America, companies should prepare all requisite documentation, including:

- Detailed technical files

- Clinical data

- Labeling information

Ensuring that each element aligns with the regulations of the respective countries is crucial.

The sponsor or the CRO must ensure that all investigators conduct the trial in strict compliance with the protocol as well as with ANVISA’s and the ethics committee (EC)’s requirements. Engaging local compliance consultants, such as Katherine Ruiz, an expert in Affairs for Medical Devices and In Vitro Diagnostics in Colombia, can significantly streamline the registration process and ensure adherence to local laws. It is essential to carry out comprehensive compliance evaluations and feedback on study documents to ensure they meet required standards.

For instance, Brazilian regulations mandate that informed consent for research involving children must be obtained from a parent or legal guardian, while also ensuring that children understand the study in accessible language. This highlights the significance of following compliance guidelines in practice. Furthermore, it is vital to stay updated on compliance changes, as these shifts can significantly affect registration strategies and operational plans.

For further inquiries, the Coordination of Clinical Research in Medicines and Biological Products (COPEC) can be contacted at phone number (61) 3462-5599/5526.

Building Strategic Partnerships for Successful Market Entry

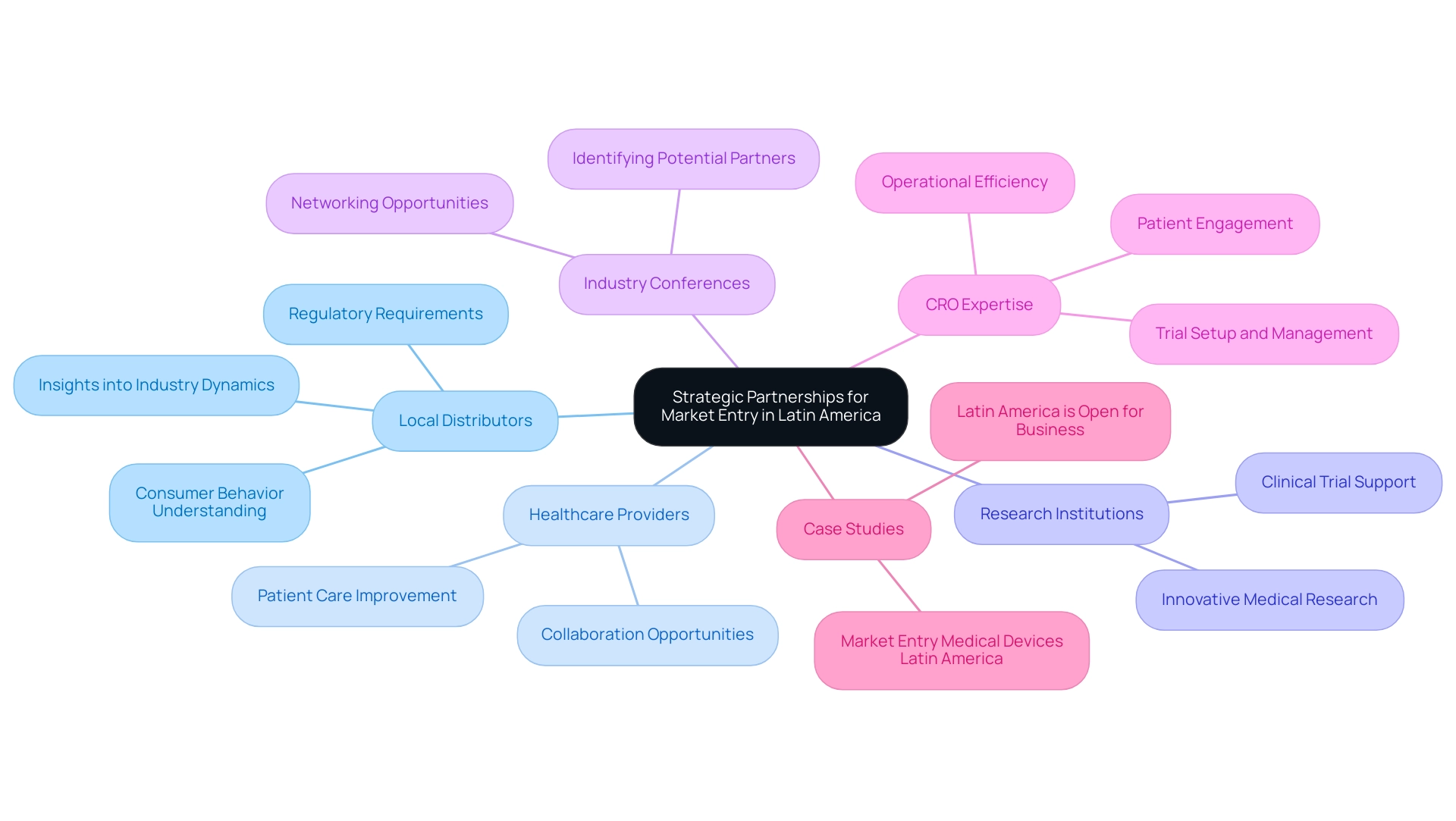

Establishing a presence in the Latin American medical equipment sector is essential for successful market entry of medical devices in Latin America, which necessitates forming strategic alliances with local distributors, healthcare providers, or research institutions. Such collaborations yield critical insights into industry dynamics, consumer behavior, and regulatory requirements. The medical devices sector in Latin America, which generated revenues of $27.33 billion in 2017, is ripe with opportunity for market entry medical devices Latin America, and these partnerships can significantly enhance entry strategies.

Engaging in industry conferences and networking events is vital for identifying potential partners and fostering relationships that can lead to successful joint ventures. Notably, Contract Research Organizations (CROs) in the region are expanding due to their expertise in specialized therapeutic areas, which enhances patient recruitment and retention rates, thereby strengthening the foundation for strategic alliances. As emphasized by Dushyanth Surakanti, Founder and CEO of Sparta Biomedical, his experience with bioaccess® during its first human trial in Colombia highlights the significance of utilizing regional expertise for successful clinical trials.

Furthermore, Dr. John B. Simpson's work on Avinger's OCT-guided atherectomy research in Cali, Colombia, illustrates how collaboration with LATAM CRO experts can facilitate innovative medical research. The growth of these organizations is pivotal as it allows healthcare companies to leverage their capabilities for better patient engagement and operational efficiency. Additionally, the detailed service capabilities of CROss, including trial setup, project management, and compliance reviews, are crucial for ensuring the success of clinical trials.

The case study titled 'Market Entry Medical Devices Latin America' illustrates the resilience and growth of the healthcare sector, highlighting how the revitalized economy and low investor competition present opportunities for healthcare businesses to expand, with increased mergers and acquisitions activity expected in key sectors. It is also essential that any partnership agreement delineates roles, responsibilities, and compliance obligations clearly to mitigate the risk of conflicts. As articulated by Anil Kumar P., a Research Manager in Healthcare, he is committed to staying at the forefront of industry innovations, ensuring that partnerships consistently exceed client expectations.

Additionally, staying informed about the industry's dynamics, which is updated twice a year to reflect changes and the impact of COVID-19, is crucial for forming effective partnerships. The anticipated increase in mergers and acquisitions resulting from the revitalized economy in Latin America presents an opportune moment for healthcare businesses to leverage these collaborations effectively. Moreover, the impact of Medtech clinical studies on local economies, including job creation and healthcare improvement, further underscores the importance of these collaborations.

Identifying Market Trends and Consumer Needs in Latin America

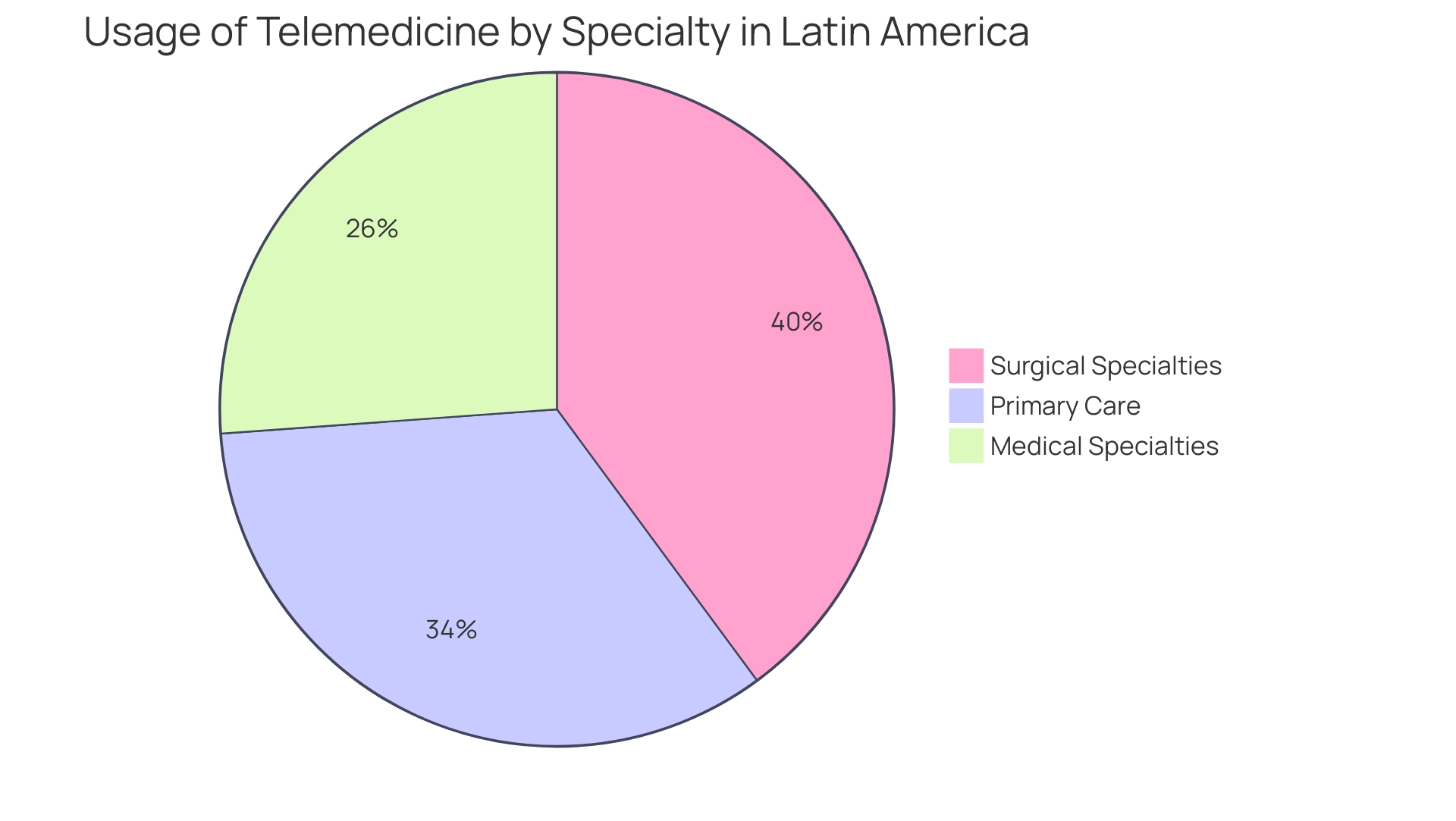

Carrying out thorough industry research is crucial for recognizing key trends affecting market entry medical devices in Latin America, especially the rising demand for telemedicine and minimally invasive procedures. Recent statistics reveal that video consultations account for 45% of the total telehealth sector, highlighting a significant shift in healthcare delivery. Furthermore, telehealth statistics show that:

- 53.9% of respondents use telemedicine for primary care

- 63.3% for surgical specialties

- 41.5% for medical specialties

This underscores the growing reliance on these services.

In this context, bioaccess® provides accelerated medical clinical study services, leveraging over 20 years of expertise in managing studies like Early-Feasibility, First-In-Human, and Post-Market Clinical Follow-Up Studies, which are crucial for adapting to these emerging demands. Our comprehensive clinical trial management services include:

- Feasibility and selection of research sites

- Compliance reviews

- Trial setup

- Import permits

- Ongoing project management and reporting

To effectively gather insights into consumer preferences and pain points, it is advisable to utilize surveys, focus groups, and interviews.

Analyzing competitor offerings is also crucial, as it allows for the identification of market gaps that your product could address. Tailoring marketing strategies to emphasize how your product meets local needs is paramount, particularly by showcasing unique features or benefits that set it apart from competitors. Engaging with healthcare professionals and end-users to validate findings will refine your approach and enhance the relevance of your offerings.

As telemedicine continues to play a vital role in improving healthcare access, especially in unstable regions affected by conflict and disasters, it complements humanitarian efforts and highlights the importance of understanding consumer needs in this context. Additionally, the regulatory functions of INVIMA, as a Level 4 health authority by PAHO/WHO, are crucial for Market Entry Medical Devices Latin America, as they play a significant role in overseeing medical equipment compliance, further supporting the services provided by bioaccess®. Insights from the regional analysis of the telehealth sector can provide further guidance on trends and future growth prospects in Latin America.

Overcoming Challenges and Risks in the Latin American Medical Device Market

Navigating the challenges of market entry for medical devices in Latin America can include bureaucratic hurdles, cultural variances, and economic fluctuations. A major participant in this arena is INVIMA, the Colombia National Food and Drug Surveillance Institute, which plays an essential role in regulating health products and supervising medical equipment. As a Level 4 health authority classified by PAHO/WHO, INVIMA ensures the safety, efficacy, and quality of medical devices, making it essential for companies to understand its regulatory framework.

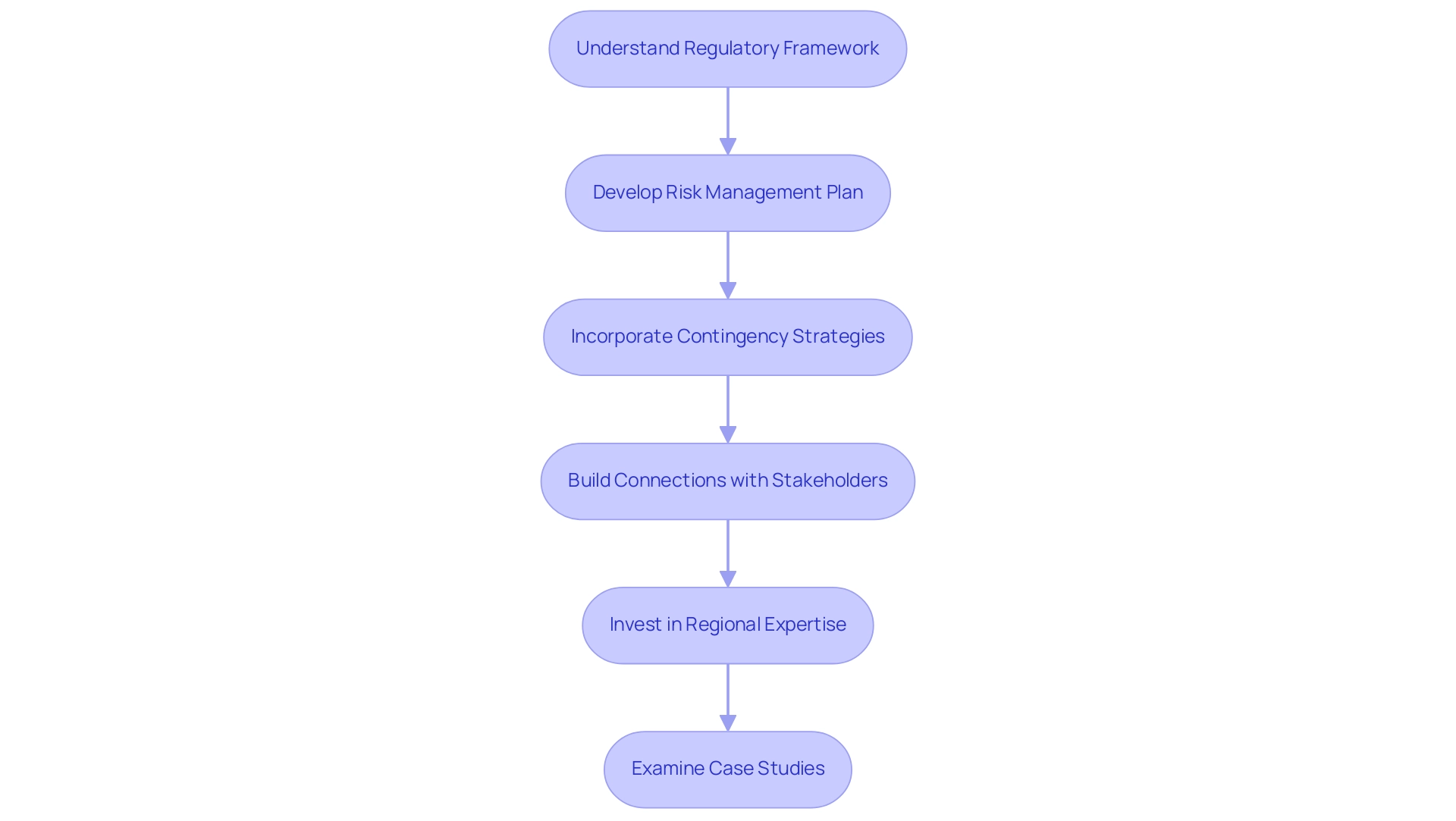

To effectively mitigate risks associated with market entry, it is essential to develop a comprehensive risk management plan that incorporates contingency strategies for potential setbacks. Staying informed about regional economic conditions and political developments is crucial, as these factors can significantly impact operations. Building strong connections with community stakeholders not only offers valuable insights but also secures support during turbulent periods.

Moreover, investing in regional expertise or consulting services can prove advantageous in navigating the complex legal framework and understanding the cultural nuances specific to each nation. As emphasized by Monica Mabel Guaita, CEO and Founding Partner of MMGC SRL, 'Understanding local regulatory frameworks is vital for success in the region.' Her insights will be shared during the upcoming session, 'Main Regulatory Issues for LATAM — How to Surf LATAM's Regulatory Issues,' scheduled for June 20.

Additionally, examining case studies on market entry strategies can provide valuable lessons on overcoming challenges in the Market Entry Medical Devices Latin America. The comprehensive process for advancing medical device trials in Colombia includes critical services such as:

- Feasibility studies

- Investigator selection

- Trial set-up

- Project management

This emphasizes the necessity for a strategic approach to risk management in this dynamic healthcare sector. Colombia offers competitive advantages for first-in-human clinical trials, including:

- Cost efficiency

- Regulatory speed

- High-quality healthcare

- Patient recruitment

- R&D tax incentives

These factors can further enhance operational effectiveness.

Conclusion

The Latin American medical device market presents a landscape rich with opportunities for innovation and growth, as evidenced by the introduction of numerous groundbreaking products and advancements in technology. Understanding the complexities of local regulations, forming strategic partnerships, and recognizing emerging consumer needs are critical for success in this evolving sector. Companies must navigate diverse healthcare systems and regulatory environments while leveraging insights from market research to identify trends such as the increasing demand for telemedicine and minimally invasive procedures.

Establishing strong partnerships with local distributors and healthcare providers is essential, as these collaborations can facilitate market entry and enhance operational efficiency. Engaging with local expertise not only streamlines the regulatory process but also fosters a deeper understanding of consumer preferences and behaviors. As the region continues to experience economic revitalization, the anticipated increase in mergers and acquisitions presents further opportunities for growth.

However, companies must remain vigilant in overcoming challenges, including regulatory hurdles and cultural differences. Developing comprehensive risk management strategies and staying informed about local political and economic conditions will be crucial. By adopting a solution-driven approach and prioritizing adaptability, stakeholders in the medical device market can effectively navigate this dynamic environment and harness the potential for substantial advancements in healthcare delivery across Latin America.

Frequently Asked Questions

What is the current state of the medical devices market in Latin America?

The medical devices market in Latin America is experiencing significant growth, with a projected increase in size and the introduction of 68 new products in the last quarter, including innovations like Johnson & Johnson’s VELYS™ Robotic-Assisted Solution and Dexcom’s G7 continuous glucose monitoring system.

Who are the key participants in the Latin American medical devices sector?

Key participants include both domestic manufacturers and multinational corporations, all of which must adapt to the diverse regulatory frameworks and healthcare systems in countries such as Brazil, Mexico, and Argentina.

What recent collaborations have occurred in the medical devices sector?

Recent collaborations include Welwaze Medical Inc.'s partnership with bioaccess™ to launch the Celbrea® medical device for early breast disease detection, and GlobalCare Clinical Trials' partnership with bioaccess™ to improve clinical trial services in Colombia, achieving over a 50% reduction in recruitment time and a 95% retention rate.

What factors should companies consider when entering the Latin American market?

Companies should consider local reports, industry associations, government resources, and the economic and political stability of target nations, as these elements significantly influence purchasing behaviors and regulatory compliance.

What are the key steps for successfully registering a medical device in Latin America?

To register a medical device in Latin America, companies must accurately identify the device classification and adhere to specific regulations: in Brazil, registration must be done with ANVISA, and in Mexico, with COFEPRIS. Required documentation includes detailed technical files, clinical data, and labeling information.

How can companies ensure compliance during clinical trials?

Companies should engage local compliance consultants to streamline the registration process, ensure adherence to local laws, and conduct comprehensive compliance evaluations. It is also crucial to stay updated on compliance changes that may affect registration strategies.

What are some specific compliance requirements for conducting research involving children in Brazil?

Brazilian regulations require that informed consent for research involving children be obtained from a parent or legal guardian, and that children understand the study in accessible language.

Where can companies seek further information about clinical research compliance?

Companies can contact the Coordination of Clinical Research in Medicines and Biological Products (COPEC) at phone number (61) 3462-5599/5526 for further inquiries.