Introduction

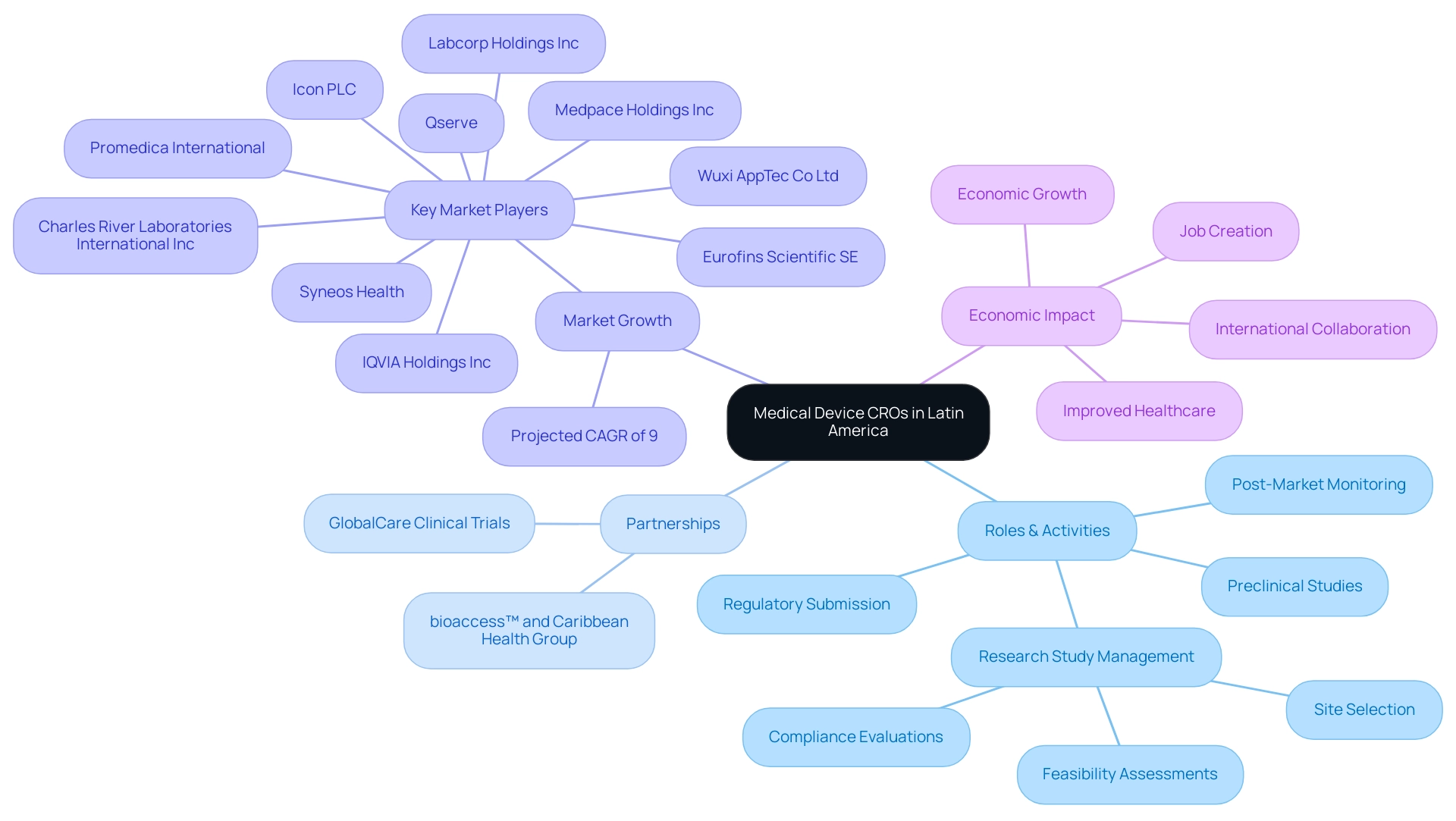

The medtech sector in Latin America is undergoing a transformative evolution, fueled by advancements in technology and a rising demand for innovative healthcare solutions. As the industry adapts to these changes, Contract Research Organizations (CROs) have emerged as vital partners, facilitating the clinical development process for medical devices. From navigating complex regulatory landscapes to expediting clinical trials, CROs like bioaccess™ are positioning themselves at the forefront of this burgeoning market.

With a projected compound annual growth rate of 9% from 2024 to 2030, the significance of these organizations is undeniable, providing essential support to both emerging startups and established companies alike. This article delves into the multifaceted roles of CROs in Latin America, exploring the challenges and opportunities within the medtech landscape, the regulatory intricacies that define it, and the future trends that promise to reshape the industry.

Understanding Medical Device CROs in Latin America

Latin America Medical Device CROs are essential to the medtech environment in the region, specializing in outsourced development services customized for the medical device sector. These organizations enable an extensive array of activities, from preclinical studies to post-market monitoring, thus playing a vital role in the regulatory submission process and the management of research studies. Significantly, the partnership between bioaccess™ and Caribbean Health Group seeks to establish Barranquilla as a premier location for medical research in Latin America, backed by Colombia's Minister of Health, Juan Pablo Uribe.

Furthermore, GlobalCare Clinical Trials has partnered with bioaccess™ to enhance its clinical trial ambulatory services in Colombia, achieving a remarkable reduction in clinical trial subject recruitment time by over 50% and an impressive subject retention rate exceeding 95%. With a projected compound annual growth rate (CAGR) of 9% anticipated for the Latin America Medical Device CRO from 2024 to 2030, the significance of these entities is set to grow. Key market players such as IQVIA Holdings Inc, Charles River Laboratories International Inc, and Icon PLC, recognized as a Latin America Medical Device CRO, are at the forefront of this expansion, leveraging their expertise to navigate the diverse regulatory frameworks across Latin American nations.

CROss provide customized solutions that help ensure compliance while accelerating product development timelines. Their deep local market knowledge proves invaluable for international companies looking to establish a foothold in the region. bioaccess™ provides extensive research study management services, including feasibility assessments, site selection, compliance evaluations, study setup, import permits, project management, and reporting.

Moreover, bioaccess™ operates as a Latin America Medical Device CRO and consulting partner for U.S. medical device companies in Colombia, facilitating successful trials under the guidance of INVIMA, the Colombian National Food and Drug Surveillance Institute, which is recognized as a Level 4 health authority by PAHO/WHO. Lastly, the impact of Medtech clinical studies on local economies is significant, contributing to job creation, promoting economic growth, improving healthcare, and fostering international collaboration. Insights from the case study titled 'Market Insights for Latin America' highlight trends and revenue projections that underscore the evolving landscape, making CROss essential partners for both emerging startups and established firms aiming to enhance their competitiveness in the global medtech arena.

Challenges and Opportunities for Medtech Startups in Latin America

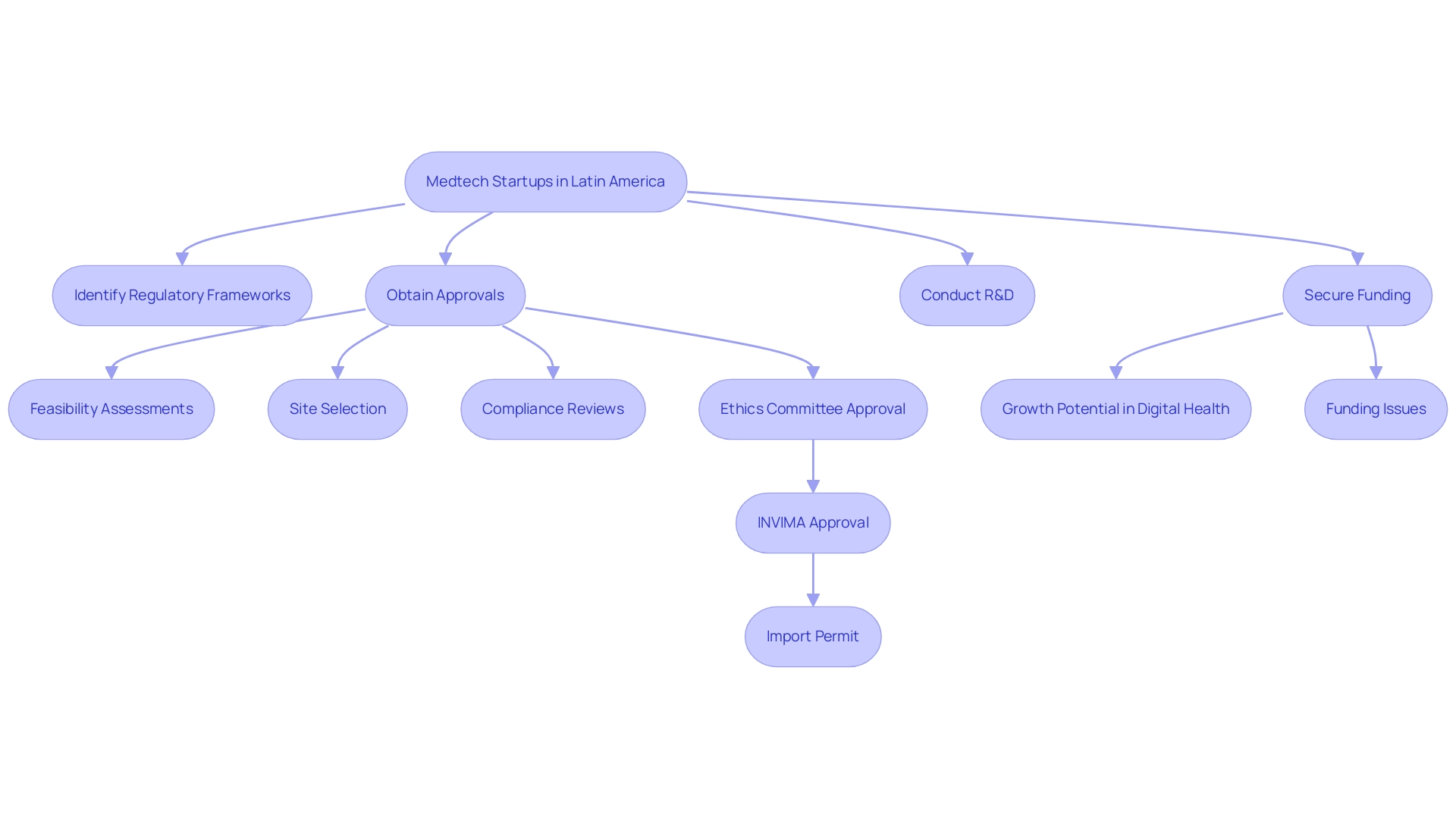

Medtech startups face numerous challenges in Latin America Medical Device CRO, particularly in navigating the complex and diverse frameworks across the region. These differences can result in significant delays in product approvals and hinder market entry, complicating the path to commercialization. Along with compliance obstacles, startups frequently face challenges in obtaining adequate funding, as venture capital access continues to be restricted.

This funding is essential for conducting research and development, crucial for innovation in the medical device field. Notably, the digital health market in Latin America is projected to reach $20 billion, reflecting an increasing demand for innovative healthcare solutions and underscoring the growth potential in the region. However, despite this promising landscape, startups struggle to secure the necessary funding, as highlighted in the case study titled 'Funding and Future Prospects for Healthtech.'

This study illustrates how the digital health market, while burgeoning, poses funding challenges that must be addressed to unlock its full potential. Recently, the pause of Embecta's insulin patch pump program on November 26, 2024, serves as a timely reminder of the challenges within the medtech industry, reinforcing the urgent need for action from investors and policymakers. A supportive entrepreneurial ecosystem is emerging, fostering collaboration and regional support for Healthtech entrepreneurs.

Contract Research Organizations (CROs), like bioaccess®, can play a crucial role in the Latin America Medical Device CRO environment by providing extensive study management services, including:

- Feasibility assessments

- Site selection

- Compliance reviews

- Setup

- Import permits

- Project management

- Reporting

This partnership enables startups to focus on their core strengths while maneuvering through the intricate compliance landscape, especially with the assistance of professionals knowledgeable about INVIMA's procedures. Moreover, acquiring research study approval in Colombia requires securing study authorization from the site's institutional review board (IRB)/ethics committee (EC), followed by endorsement from Colombia's oversight agency (INVIMA)/Ministry of Health (MoH), and obtaining an import permit at Colombia's Ministry of Industry and Commerce (MinCIT) to ship investigational devices.

Colombia's competitive advantages for first-in-human clinical trials, such as cost efficiency, swift approval processes, and a high-quality healthcare system, alongside generous R&D tax incentives, significantly enhance the chances of successful medtech innovations in the region. As Amanda Pedersen aptly noted, 'If we don’t, we may look back on this moment as the one when the future of medtech was forever altered — and not for the better.' This highlights the urgent need for concerted efforts to bolster the medtech ecosystem in Latin America.

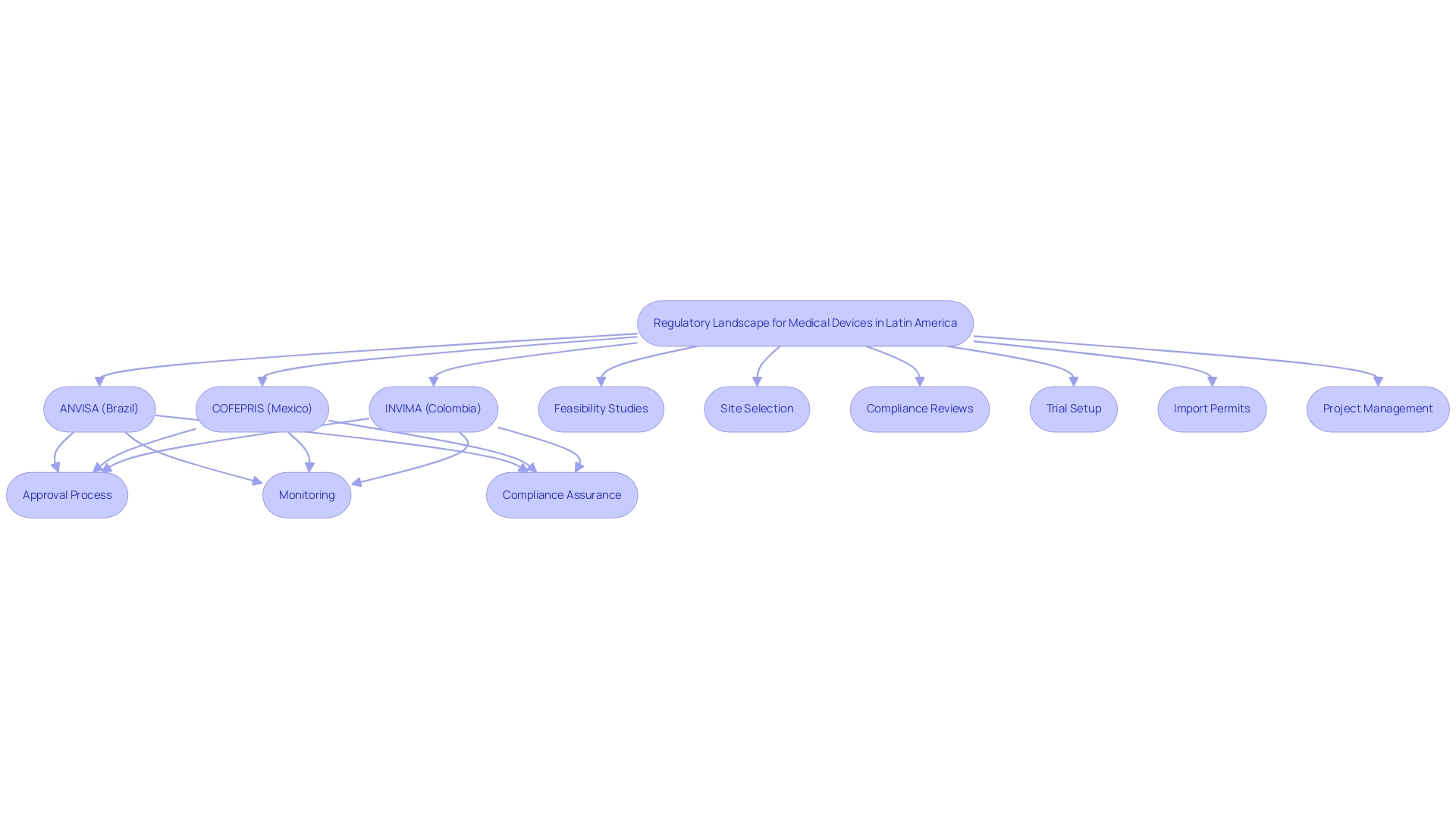

The Regulatory Landscape for Medical Devices in Latin America

The legislative landscape for medical devices in Latin America presents a complex and varied framework that differs markedly from one country to another. Each nation is governed by its own oversight authority, with ANVISA in Brazil and COFEPRIS in Mexico serving as prominent examples responsible for overseeing medical device approval and monitoring. In Colombia, INVIMA (Instituto Nacional de Vigilancia de Medicamentos y Alimentos) plays a critical role in regulating health products, ensuring compliance with health standards, and facilitating the importation of medical devices through its Directorate for Medical Devices and other Technologies.

This agency has been categorized as a Level 4 health authority by PAHO/WHO, indicating its competence and efficiency in safeguarding the safety, efficacy, and quality of medicines. For contract research entities and medtech companies operating within the Latin America Medical Device CRO, a thorough understanding of these regulations is paramount, as non-compliance can result in significant repercussions, including product recalls, legal challenges, and delays in market entry. Furthermore, contract research organizations must take into account how adherence to guidelines is incorporated into mergers and acquisitions (M&A) strategies, as this is essential for effectively navigating the compliance environment.

Latin America Medical Device CROs play a pivotal role in ensuring that clinical studies align with local regulations—offering services such as:

- Feasibility studies

- Site selection

- Compliance reviews

- Trial setup

- Import permits

- Project management

- Reporting on serious and non-serious adverse events

Thereby facilitating more efficient interactions with oversight bodies and expediting the approval process for innovative medical devices. Katherine Ruiz, a compliance affairs expert with extensive experience at INVIMA, exemplifies the expertise needed to navigate this landscape, having advised many foreign manufacturers on obtaining market clearance for their innovations in Colombia. Furthermore, with the changing nature of the compliance landscape, staying updated on the latest alterations is vital for chief risk officers to provide accurate advice to their clients, assisting them in sustaining a competitive advantage in the swiftly advancing medtech market.

For instance, the recent case study highlighting three key pharma regulatory updates in South Korea for 2024 underscores the importance of remaining compliant and competitive in various markets.

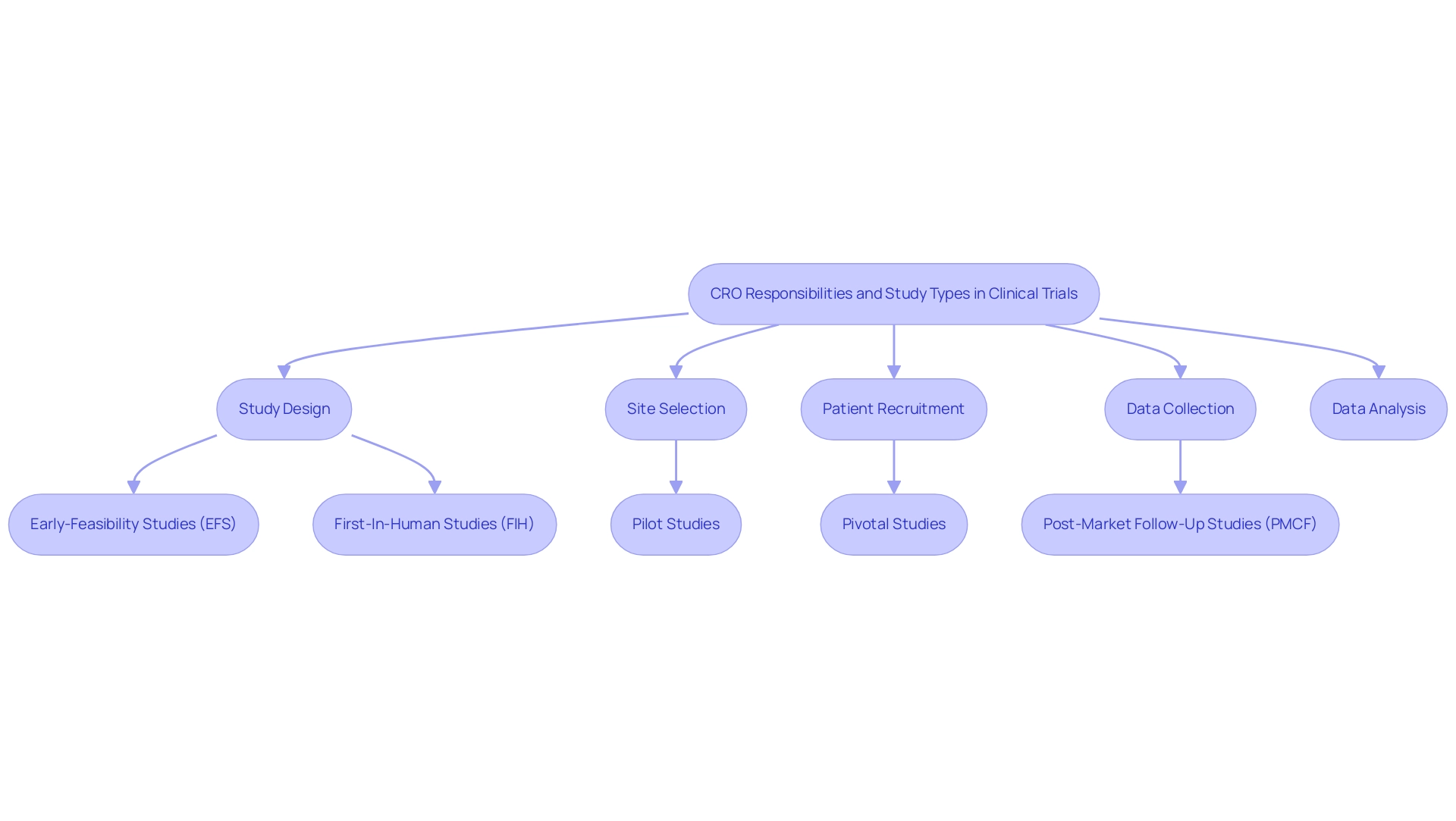

The Role of CROs in Clinical Trials for Medical Devices

Contract Research Organizations serve a crucial function in the implementation of studies for medical devices, managing all aspects of operation. Their responsibilities encompass:

- Study design

- Site selection

- Patient recruitment

- Data collection

- Analysis

Leading companies such as bioaccess™ utilize more than 20 years of experience to provide extensive management services for studies, including:

- Early-Feasibility Studies (EFS)

- First-In-Human Studies (FIH)

- Pilot Studies

- Pivotal Studies

- Post-Market Follow-Up Studies (PMCF)

By leveraging their specialized expertise and established connections with clinical locations in Latin America, the Latin America Medical Device CRO improves the efficiency of studies while ensuring compliance with standards, significantly accelerating patient recruitment and retention—a crucial factor for study success. For instance, GlobalCare Clinical Trials partnered with bioaccess™ to expand its ambulatory services in Colombia, achieving over a 50% reduction in recruitment time and a 95% retention rate. Recent statistics indicate that the composite success rate for drug development pipelines rose to 10.8% in 2023, recovering from a 10-year low in 2022.

This improvement was driven by enhanced Phase I success rates, which increased to 48%, and Phase III rates that rose to 66%, significantly above the pre-pandemic average of 56%. Such data emphasizes the significance of efficient study management, a strength of contract research organizations. Moreover, CROs are instrumental in monitoring study progress, safeguarding data integrity, and facilitating regulatory submissions.

Their capacity to customize approaches to meet the unique needs of each study, without compromising on quality or compliance, positions them as essential partners for organizations aiming to introduce innovative medical devices to the market. The influence of MedTech research extends beyond study results; they generate employment, encourage economic development, and enhance healthcare outcomes in local communities. As noted by expert Matej Mikulic, 'Get in touch with us now' to discover how the Latin America Medical Device CRO is transforming the clinical trial landscape, particularly in regions like Latin America, where recent developments have showcased their adaptability and effectiveness.

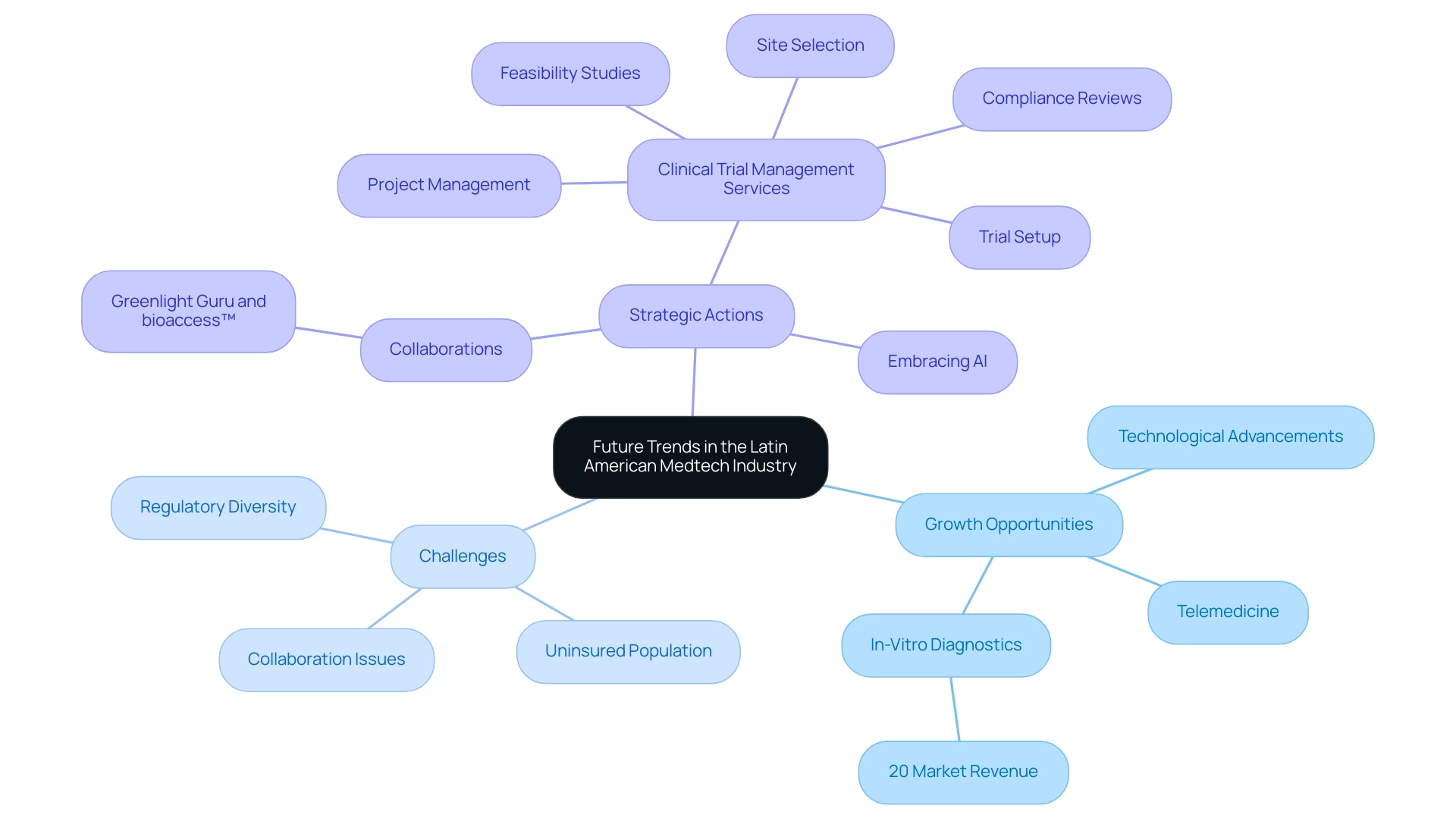

Future Trends in the Latin American Medtech Industry

The Latin America Medical Device CRO suggests that the Latin American medtech industry is poised for significant growth, driven by technological advancements, increasing healthcare demands, and a focus on patient-centered care. Trends such as telemedicine and digital health solutions are reshaping the sector, creating innovative opportunities. Research expert Jennifer Mendoza emphasizes this transformation, noting, "That year, in-vitro diagnostics (IVD) comprised 20 percent of the medical technology market revenue," highlighting the necessity for adaptation in this dynamic environment.

However, the industry is confronted with substantial challenges, as illustrated in the LATAM medical devices market case study, which points to a large uninsured population and diverse regulatory landscapes across countries. Moreover, US Medtech companies face additional hurdles such as professionalism issues, language barriers, and fragmentation of resources, which complicate their collaboration with Latin American hospitals. To overcome these hurdles, Latin America Medical Device CROs must embrace new technologies, including artificial intelligence, to enhance data analysis and improve patient recruitment.

The collaboration between Greenlight Guru and bioaccess™ exemplifies a strategic approach to accelerate Medtech innovations and clinical trials in Latin America, supporting companies like PAVmed in conducting pioneering studies such as their first-in-human trial in Colombia. Furthermore, with the regulatory landscape evolving, particularly under INVIMA's oversight as a Level 4 health authority by PAHO/WHO, Latin America Medical Device CROs are well-positioned to guide companies through these essential transitions. By actively engaging with industry trends and nurturing collaborative relationships with key stakeholders, CROs can establish themselves as leaders in the rapidly evolving Latin America Medical Device CRO sector.

The comprehensive clinical trial management services offered, including feasibility studies, site selection, compliance reviews, trial setup, and project management, are crucial for navigating this landscape. The orthopedic devices market alone is projected to reach an impressive 3.6 billion USD, underscoring the sector's robust growth potential as it adapts to these advancements. Notably, Brazil, with the highest density of CT scanners, is set to significantly influence the medtech landscape in the region.

Conclusion

The medtech sector in Latin America is undergoing a remarkable transformation, with Contract Research Organizations (CROs) playing a critical role in this evolution. As detailed in the article, CROs not only facilitate the clinical development process for medical devices but also navigate complex regulatory landscapes and expedite clinical trials. Their expertise is essential for both emerging startups and established firms, particularly in a market projected to grow at a compound annual growth rate of 9% from 2024 to 2030.

Despite the promising growth potential, challenges remain, particularly for medtech startups. Navigating diverse regulatory frameworks and securing funding are significant hurdles that can delay product approvals and market entry. However, CROs like bioaccess™ are positioned to alleviate these challenges by providing tailored solutions that enhance compliance and streamline trial management.

The collaborative efforts of CROs with local health authorities, such as INVIMA in Colombia, further underscore the importance of these organizations in ensuring successful clinical trials.

Looking ahead, the Latin American medtech industry is set to embrace innovative trends, including the rise of digital health solutions and telemedicine. As CROs adapt to these changes and leverage new technologies, they will continue to be indispensable partners in advancing the region's healthcare landscape. The synergy between technological advancements and CRO expertise will not only expedite the introduction of innovative medical devices but also foster economic growth and improve healthcare outcomes across Latin America.

The time is ripe for stakeholders in the medtech sector to harness these opportunities and navigate the evolving landscape effectively.

Frequently Asked Questions

What are Latin America Medical Device CROs?

Latin America Medical Device CROs are organizations that specialize in outsourced development services tailored for the medical device sector, facilitating activities from preclinical studies to post-market monitoring.

What role do CROs play in the medical device sector?

CROs play a vital role in the regulatory submission process and management of research studies, ensuring compliance and accelerating product development timelines.

What is the significance of the partnership between bioaccess™ and Caribbean Health Group?

This partnership aims to establish Barranquilla as a premier location for medical research in Latin America, supported by Colombia's Minister of Health.

How has GlobalCare Clinical Trials improved clinical trial processes in Colombia?

GlobalCare Clinical Trials, in partnership with bioaccess™, has reduced clinical trial subject recruitment time by over 50% and achieved a subject retention rate exceeding 95%.

What is the projected growth rate for the Latin America Medical Device CRO market?

The market is expected to grow at a compound annual growth rate (CAGR) of 9% from 2024 to 2030.

Who are some key players in the Latin America Medical Device CRO market?

Key players include IQVIA Holdings Inc, Charles River Laboratories International Inc, and Icon PLC.

What services do CROs like bioaccess™ provide?

Bioaccess™ offers extensive research study management services, including feasibility assessments, site selection, compliance evaluations, study setup, import permits, project management, and reporting.

What challenges do medtech startups face in Latin America?

Startups face challenges such as navigating complex regulatory frameworks, obtaining funding, and dealing with compliance obstacles that can delay product approvals.

What is the importance of INVIMA in Colombia?

INVIMA is the Colombian National Food and Drug Surveillance Institute that regulates health products and ensures compliance with health standards, facilitating the importation of medical devices.

How do CROs assist with compliance in clinical studies?

CROs ensure that clinical studies align with local regulations by providing services such as feasibility studies, site selection, compliance reviews, and project management.

What economic impact do medtech clinical studies have in local communities?

Medtech clinical studies contribute to job creation, promote economic growth, improve healthcare, and foster international collaboration.

What is the legislative landscape for medical devices in Latin America?

The legislative landscape is complex and varies by country, with each nation having its own oversight authority, such as ANVISA in Brazil and COFEPRIS in Mexico.

What are some key responsibilities of Contract Research Organizations (CROs)?

CROs are responsible for study design, site selection, patient recruitment, data collection, and analysis.

What trends are shaping the Latin American medtech industry?

Trends such as telemedicine and digital health solutions are creating innovative opportunities in the sector, driven by technological advancements and increasing healthcare demands.

How can CROs help medtech companies navigate the evolving regulatory landscape?

CROs can provide expertise and guidance on compliance with regulations, helping companies adapt to changes and successfully conduct clinical trials in the region.