Overview

Medtech companies in Latin America have significant opportunities driven by a growing demand for advanced medical technologies, accelerated by the COVID-19 pandemic and an increasing prevalence of chronic diseases. The article highlights that strategic partnerships, regulatory engagement, and a focus on digital health innovations are essential for companies to navigate challenges and capitalize on the region's robust growth potential in the medical technology sector.

Introduction

The Medtech industry in Latin America is experiencing a dynamic transformation, driven by a surge in demand for cutting-edge medical technologies and improved healthcare services. As countries like Brazil, Mexico, and Argentina emerge as key players, a wave of innovation is reshaping the landscape, particularly in response to the increasing prevalence of chronic diseases and an aging population. The COVID-19 pandemic has further accelerated this evolution, prompting the rapid adoption of telemedicine and remote monitoring solutions.

Amidst this backdrop, the region presents both opportunities and challenges for U.S. Medtech companies, necessitating strategic collaborations and a deep understanding of the complex regulatory frameworks that govern market entry.

With a robust growth trajectory projected through 2024, the potential for Medtech advancements in Latin America is immense, but it requires a solution-driven approach to bridge the gap between innovation and execution.

The Current Landscape of Medtech in Latin America

The medical technology sector in Latin America is witnessing remarkable growth, fueled by a heightened demand for advanced medical technologies and enhanced healthcare services. Countries such as Brazil, Mexico, and Argentina are key players in this transformation, with a surge of startups and established companies channeling investments into innovative healthcare solutions. The increasing prevalence of chronic diseases, coupled with an aging population, has intensified the necessity for medical devices and digital health solutions.

Notably, the COVID-19 pandemic, with around 46.5 million diagnosed cases in the region, has acted as a catalyst, expediting the adoption of telemedicine and remote monitoring technologies. This shift not only addresses immediate healthcare needs but also opens up opportunities for medtech companies in Latin America to capitalize on the evolving healthcare landscape. For instance, ReGelTec's successful Early Feasibility Study using HYDRAFIL™ in Barranquilla, Colombia, exemplifies how collaboration with local health groups is bridging gaps in clinical research.

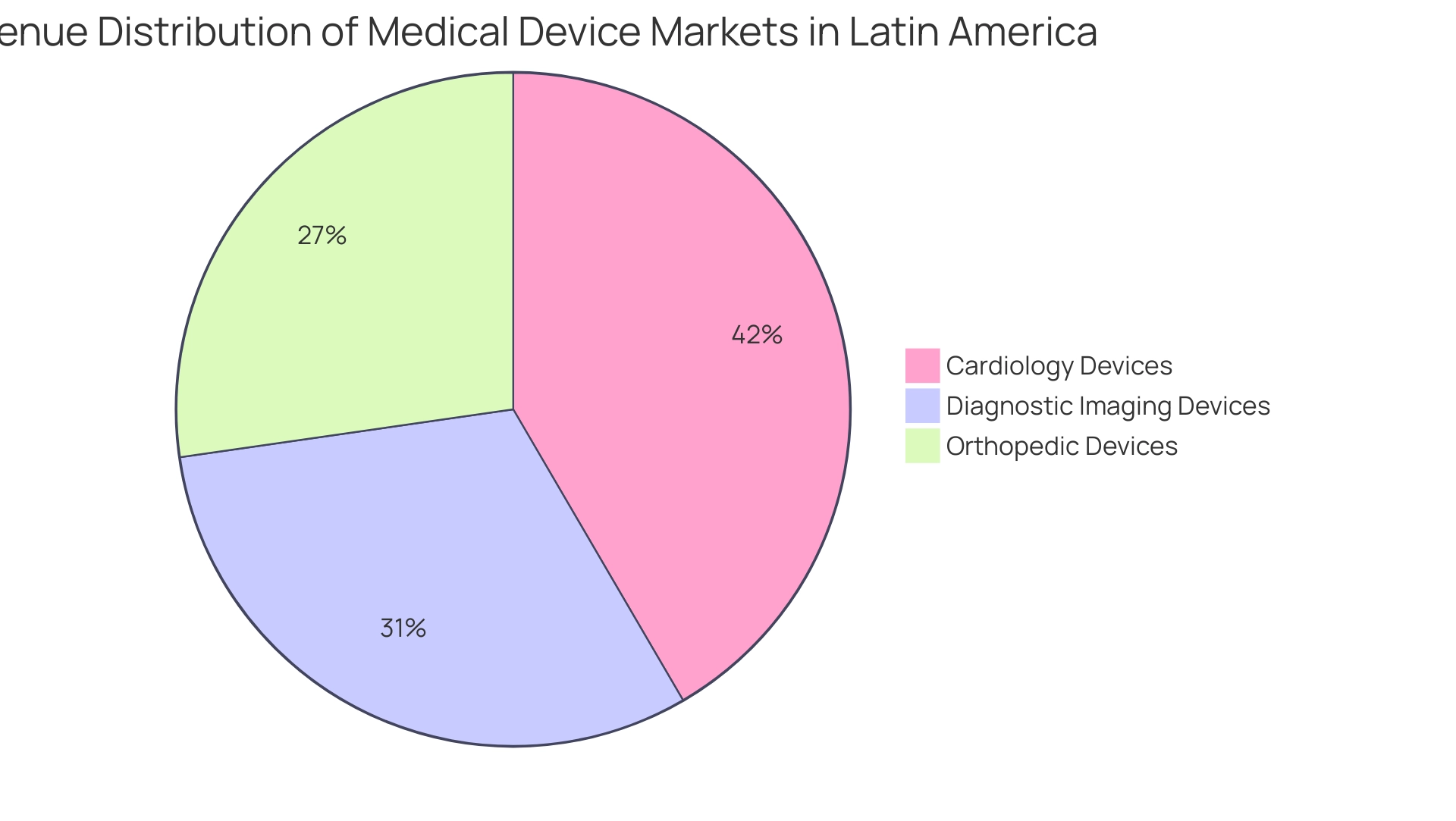

However, US medical technology firms still encounter significant challenges, including professionalism, language barriers, and fragmentation of resources, which hinder effective communication and collaboration with hospitals in South America. As Research Manager Anil Kumar P. emphasizes, "the industry must remain at the forefront of innovation to consistently exceed client expectations," reflecting the growing importance of advanced medical technologies in the region. Moreover, the revenue for different medical device markets in the southern continent highlights this growth, with:

- Cardiology devices at 5.49 billion USD

- Diagnostic imaging devices at 4.11 billion USD

- Orthopedic devices at 3.6 billion USD

With projections indicating a robust growth trajectory for the medical technology sector through 2024, there are ample opportunities for medtech companies in Latin America to implement a solution-driven approach that bridges the gap between innovation and execution, particularly through strategic partnerships that enhance clinical trial capabilities and streamline processes.

Navigating the Regulatory Framework for Medtech in Latin America

The regulatory landscape for medical technology in Latin America is intricate, characterized by the unique regulations and guidelines of individual countries. For instance, in Brazil, the ANVISA (Agência Nacional de Vigilancia Sanitaria) supervises the registration and approval of medical instruments, ensuring that products meet stringent safety and efficacy standards. Similarly, Mexico's COFEPRIS (Comision Federal para la Proteccion contra Riesgos Sanitarios) plays a crucial role in safeguarding public health through rigorous evaluation processes.

As the regulatory environment continues to evolve, particularly with anticipated updates in 2024, medical technology firms, including those partnering with bioaccess®, must proactively engage with these agencies from the outset of their product development. This early involvement is essential to navigate the complexities of regulatory compliance and mitigate the risk of costly delays. For example, a case study involving Genius Sports UK Limited highlights the importance of understanding local regulations and utilizing appropriate compliance strategies to achieve successful market entry.

Additionally, bioaccess® is committed to ensuring the security of client information throughout the clinical trial process, implementing reasonable measures to prevent loss or unauthorized alteration of data. It is important to note that while we strive to protect your information, inherent risks exist in information transmission, and clients should be aware of these risks when sharing sensitive data. The Enabled Pre-Assessment Support Unit (UHAP) offers valuable resources for applicants seeking guidance on their submissions, further facilitating the regulatory process.

Moreover, a notable statistic reflects that approximately 30% of new medical devices are now designed with sustainability in mind, indicating a growing trend in the industry that not only aligns with consumer expectations but also influences regulatory considerations. Regulatory experts emphasize that adherence to these frameworks not only facilitates market entry but also upholds the principle highlighted by COFEPRIS-GCP: A research participant’s right to safety and the protection of their health and welfare must take precedence over the interests of science and society. Therefore, grasping the subtleties of ANVISA and COFEPRIS regulations is essential for medical technology companies, particularly those utilizing bioaccess®, as it opens up opportunities for medtech companies in Latin America aiming for effective market integration in the southern continent.

To assist clients in navigating these complex regulatory landscapes, bioaccess® provides structured guidance based on best practices outlined in user manuals, ensuring that all necessary steps are taken to achieve compliance.

Fostering US-Latin American Medtech Collaboration

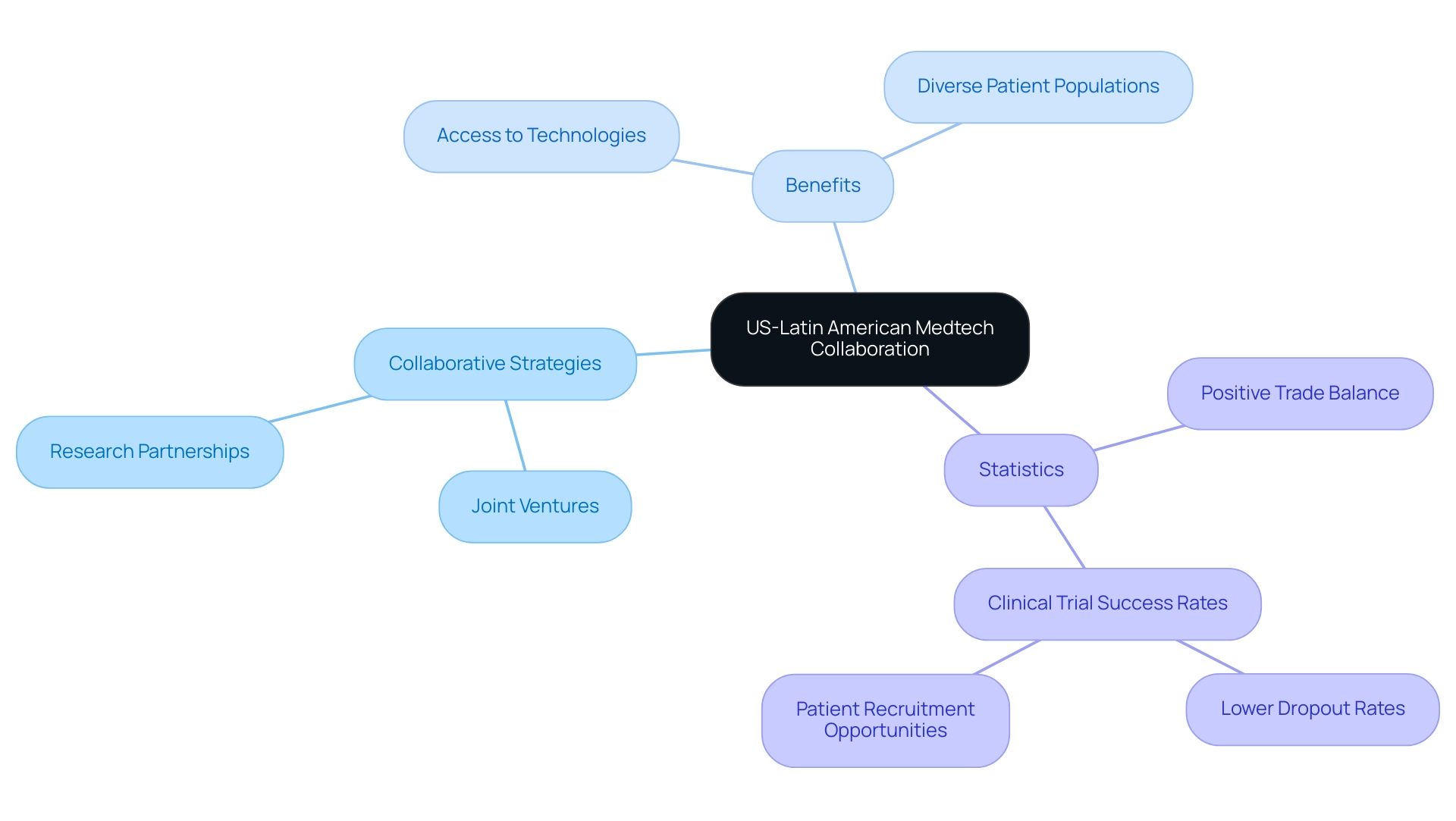

Collaborations between U.S. and South American Medtech companies are increasingly essential in harnessing mutual strengths and driving innovation, creating significant opportunities for medtech companies in Latin America. For instance, joint ventures and research partnerships are emerging as pivotal strategies to enhance product development. U.S. companies find significant advantages in utilizing America's diverse patient populations for clinical trials, which can lead to richer data and better insights.

Concurrently, Latin American firms benefit from access to advanced technologies and funding, fostering growth in the sector. As Julio G. Martinez-Clark, CEO of bioaccess, observes, 'Colombia’s combination of a large and diverse population, experienced clinical research sites, and efficient regulatory processes make it an appealing option for U.S. medical firms.' This synergy not only accelerates innovation but also translates into improved healthcare outcomes across the region.

Dushyanth Surakanti, Founder and CEO of Sparta Biomedical, shares his positive experience with bioaccess® during its first human trial in Colombia, showcasing the efficient project management and regulatory compliance that enhance trial success. The ongoing trend of attracting medical device clinical trials, particularly in countries like the Dominican Republic, which boasts a population of over 11 million, reflects this dynamic shift. Moreover, specialists emphasize that robust patient-physician connections and urban densities lead to reduced dropout rates in clinical trials, with dropout rates in the region being significantly lower than those in the U.S. and EU.

This makes the region a fertile ground for patient recruitment and retention. For instance, a recent case study highlighted that despite low awareness of clinical trials among patients, effective communication and outreach strategies have improved recruitment efforts. As the medical technology sector continues to develop, there are significant opportunities for medtech companies in Latin America, particularly in how these partnerships influence innovation and healthcare provision.

Furthermore, statistics reveal that from 2018 to 2023, the trade balance of health equipment in the region of Central and South countries along with the Caribbean has exhibited a positive trend, further emphasizing the area's increasing significance in the global medical technology market. To explore how we can assist you in advancing your medical device trials, BOOK A MEETING with our team today. Our services include feasibility and selection of research sites, trial set-up, project management, and compliance reporting to ensure your success in this competitive landscape.

Overcoming Challenges in the Latin American Medtech Market

While the potential for expansion in the southern region is considerable, medical technology firms traversing this environment must face a variety of challenges. Cultural differences pose notable barriers to effective communication and collaboration, which can hinder project success. However, initiatives like the collaboration between bioaccess™ and Caribbean Health Group to position Barranquilla as a leading destination for clinical trials exemplify how focused partnerships can overcome these barriers.

Supported by Colombia's Minister of Health, this effort aims to enhance clinical research, driving job creation and economic growth in the region. Operational issues, including supply chain disruptions—evident in recent reports indicating substantial delays in healthcare logistics—complicate market entry. The region's inconsistent healthcare infrastructure adds another layer of complexity.

Furthermore, Medtech firms often face resistance from local stakeholders who are accustomed to established traditional practices. To thrive in this environment, companies must prioritize:

- Building local partnerships

- Engaging in comprehensive market research

- Adapting their strategies to align with the unique dynamics of each country

As Monica Mora, Chief Operating Officer focusing on operations, logistics, and compliance strategies for medical device firms in South America, emphasizes, 'Stakeholders must remain agile and proactive in exploring emerging trends to capitalize on opportunities in US-South American MedTech collaboration.'

Furthermore, with students from South America being 2.4 times more likely to invest in data science skills than the global average, there is a growing pool of talent ready to drive innovation in the sector. Another compelling case study involved a chain of laboratories in Mexico that implemented digital appointment confirmations, resulting in a remarkable 39% increase in patient attendance. This example underscores the importance of tailored approaches that resonate with local cultural contexts, ultimately facilitating smoother operational integration and acceptance.

Furthermore, bioaccess™ offers comprehensive clinical trial management services, including:

- Feasibility studies

- Compliance reviews

- Trial setup

- Project management

- Reporting processes

These services are essential for medical technology firms to navigate these challenges effectively.

Emerging Trends and Future Opportunities in Latin American Medtech

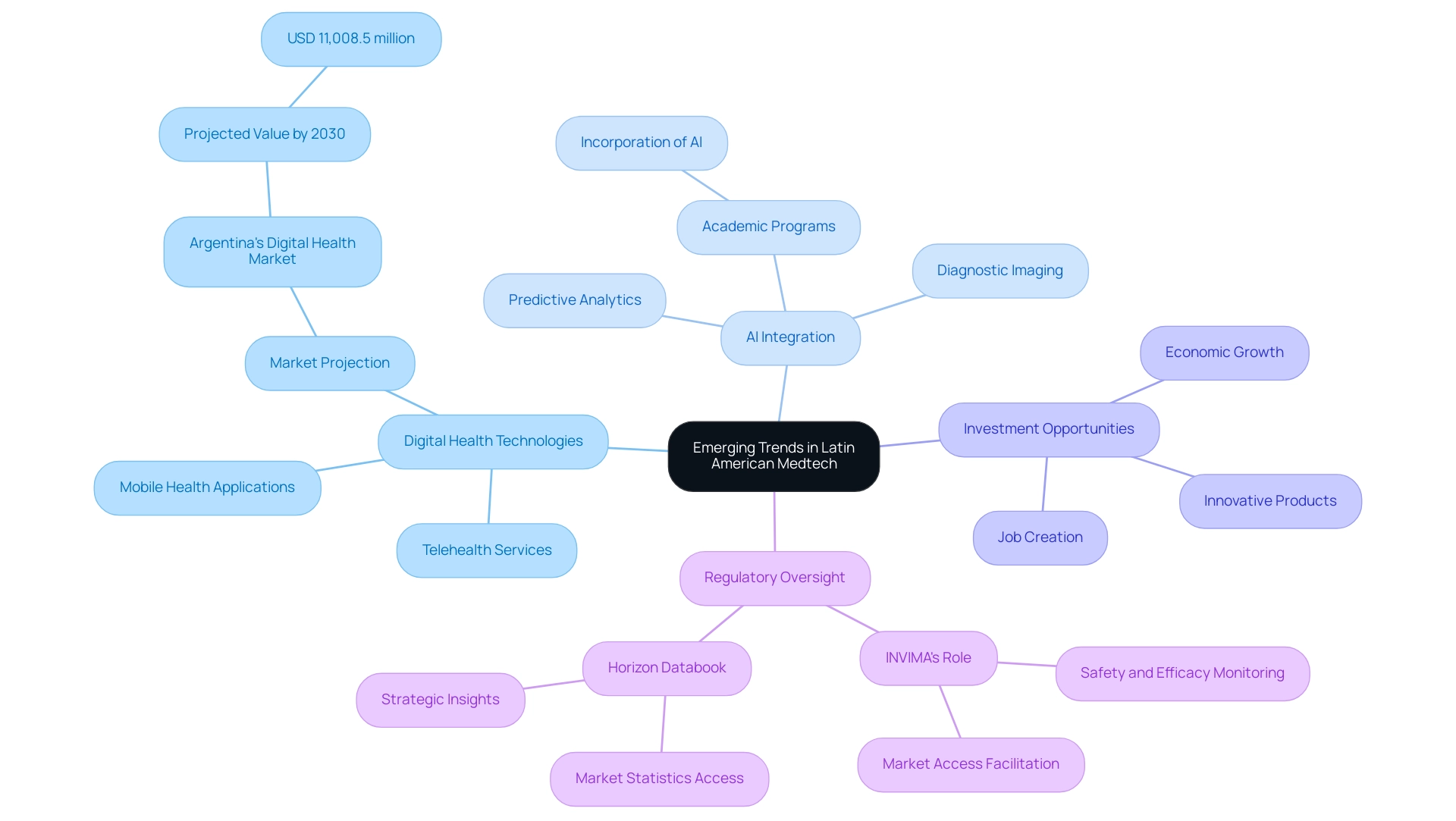

The medical technology sector in South America is on the verge of a major transformation, driven by various encouraging trends set to alter the market environment. Digital health technologies, such as telehealth services and mobile health applications, are gaining traction as patients increasingly demand more accessible and efficient healthcare solutions. For instance, Argentina's digital health market is projected to reach USD 11,008.5 million by 2030, reflecting the region's dedication to healthcare innovation.

Key players like Epic Systems Corporation, Telefonica SA, AT&T, and Alphabet Inc are actively driving this growth, establishing a robust competitive environment.

Moreover, the integration of artificial intelligence and machine learning into medical devices is expected to substantially enhance diagnostic accuracy and treatment outcomes. AI algorithms are being utilized in diagnostic imaging and predictive analytics, demonstrating how these technologies can improve patient care. This advancement is further supported by the increasing inclusion of AI in academic programs across many Latin American universities, indicating a strong future for AI development in the region.

As investments in healthcare continue to escalate, there are significant opportunities for medtech companies in Latin America to introduce innovative products and solutions that will ultimately improve patient care and outcomes. Clinical studies conducted in collaboration with local Medtech associates not only foster healthcare improvement but also create jobs, stimulate economic growth, and promote research and development in the communities they serve. With regulatory oversight from INVIMA, classified as a Level 4 health authority by PAHO/WHO, these initiatives are well-positioned to drive international collaboration and recognition.

INVIMA plays a crucial role in ensuring the safety, efficacy, and quality of medical devices and health products by monitoring compliance with regulations, which is vital for maintaining public trust and facilitating market access for innovative solutions. The Horizon Databook further exemplifies this potential, offering subscribers access to over 1 million market statistics and 20,000+ reports, providing strategic insights into market trends and customer preferences, enabling informed decision-making in the competitive digital health landscape.

Conclusion

The Medtech industry in Latin America is experiencing rapid transformation, driven by the demand for innovative healthcare technologies and services. Countries like Brazil, Mexico, and Argentina are responding to challenges such as chronic diseases and an aging population, with the COVID-19 pandemic further accelerating the adoption of telemedicine and digital health solutions.

To succeed in this dynamic landscape, navigating complex regulatory frameworks like Brazil's ANVISA and Mexico's COFEPRIS is essential. Early engagement with these agencies ensures compliance and minimizes risks, while the growing trend towards sustainability in medical device design aligns with both regulatory standards and consumer expectations.

Collaboration between U.S. and Latin American Medtech companies is crucial, leveraging diverse patient populations for clinical trials and fostering innovation. Despite cultural and operational challenges, successful partnerships demonstrate that local engagement can lead to significant advancements in healthcare delivery.

Looking forward, the rise of digital health technologies and artificial intelligence presents substantial opportunities for the Medtech sector. As investments in healthcare continue to grow, the potential for innovative solutions that enhance patient care is immense. By embracing a solution-driven approach and prioritizing collaboration, U.S. Medtech companies can significantly contribute to the evolution of healthcare in Latin America, ultimately benefiting both the market and the communities it serves.

Frequently Asked Questions

What is driving the growth of the medical technology sector in Latin America?

The growth is fueled by a heightened demand for advanced medical technologies, enhanced healthcare services, an increasing prevalence of chronic diseases, and an aging population.

Which countries are key players in the transformation of the medical technology sector in Latin America?

Brazil, Mexico, and Argentina are key players in this transformation.

How has the COVID-19 pandemic impacted the adoption of medical technologies in Latin America?

The pandemic has expedited the adoption of telemedicine and remote monitoring technologies, addressing immediate healthcare needs and creating opportunities for medtech companies.

What are some examples of successful medical technology initiatives in Latin America?

ReGelTec's Early Feasibility Study using HYDRAFIL™ in Barranquilla, Colombia, showcases collaboration with local health groups to bridge gaps in clinical research.

What challenges do US medical technology firms face in South America?

They encounter challenges such as professionalism, language barriers, and fragmentation of resources, which hinder effective communication and collaboration with hospitals.

What are the revenue figures for different medical device markets in Latin America?

The revenue figures are as follows: 1. Cardiology devices: 5.49 billion USD, 2. Diagnostic imaging devices: 4.11 billion USD, 3. Orthopedic devices: 3.6 billion USD.

What is the projected growth trajectory for the medical technology sector in Latin America?

Projections indicate a robust growth trajectory for the sector through 2024, presenting opportunities for medtech companies.

What is the regulatory landscape for medical technology in Latin America?

The regulatory landscape is complex, with unique regulations in each country, such as ANVISA in Brazil and COFEPRIS in Mexico, which oversee the registration and approval of medical instruments.

Why is early engagement with regulatory agencies important for medical technology firms?

Early engagement is essential to navigate regulatory compliance complexities and mitigate the risk of costly delays in product development.

What percentage of new medical devices are designed with sustainability in mind?

Approximately 30% of new medical devices are now designed with sustainability considerations.

How does bioaccess® assist clients in navigating regulatory compliance?

Bioaccess® provides structured guidance based on best practices outlined in user manuals to help clients achieve compliance with regulatory requirements.