Overview

Building a successful Medtech market strategy for Latin America involves understanding the region's healthcare systems, regulatory environments, and consumer needs, particularly in light of the growth projections for the sector. The article emphasizes the importance of thorough research, strategic partnerships, and compliance with local regulations, such as those from INVIMA, to effectively navigate market complexities and capitalize on emerging opportunities in medical technology.

Introduction

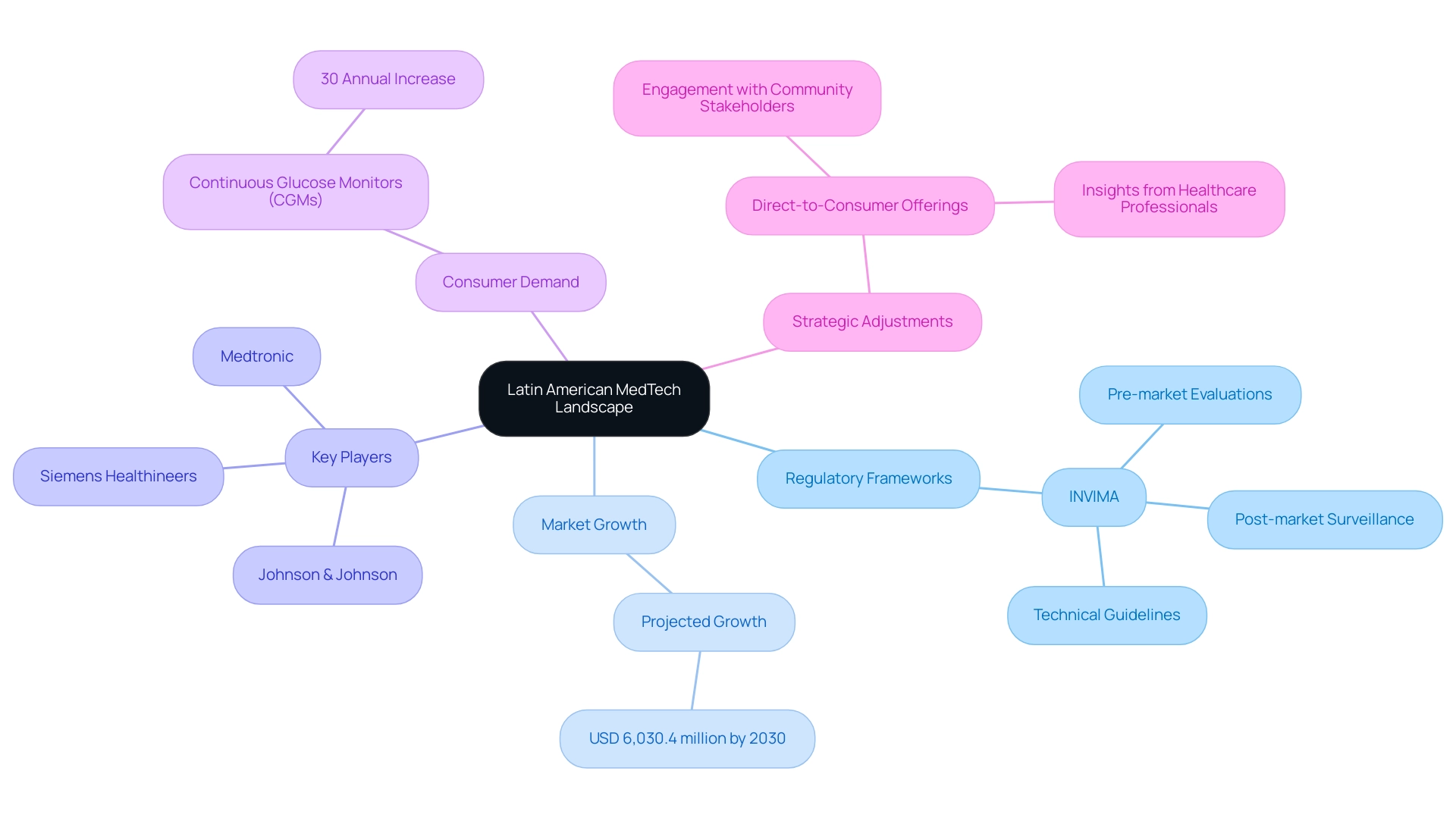

The Latin American MedTech landscape is a dynamic and rapidly evolving sector, characterized by unique regulatory frameworks, diverse healthcare systems, and a growing demand for innovative medical technologies. As companies seek to navigate this complex environment, understanding the intricacies of local regulations, such as those established by INVIMA in Colombia, becomes paramount.

With projections indicating significant market growth, reaching approximately USD 6,030.4 million by 2030, the opportunities for MedTech firms are substantial. However, this potential is accompanied by challenges that require:

- Strategic partnerships

- Thorough market research

- A keen awareness of consumer preferences

By delving into the various facets of this market, including:

- Regulatory compliance

- Consumer insights

- Emerging trends

Organizations can position themselves for success in a region ripe with possibilities for innovation and collaboration.

Understanding the Latin American MedTech Landscape

Building a successful medtech market strategy for Latin America requires navigating the complexities of the region's medical technology landscape through a comprehensive analysis of healthcare systems, economic conditions, and cultural nuances, particularly in light of regulatory frameworks like those established by INVIMA, the Colombia National Food and Drug Surveillance Institute. Created in 1992, INVIMA plays a critical role in overseeing the marketing and manufacturing of health products, ensuring compliance with safety and efficacy standards through processes such as pre-market evaluations, post-market surveillance, and the establishment of technical guidelines for manufacturers. Its classification as a Level 4 health authority by PAHO/WHO underscores its commitment to these standards.

Begin with meticulous research to identify key players, emerging trends, and potential challenges within the industry. Notably, building a successful Medtech market strategy for Latin America is essential as the sector is expected to grow significantly, with projections indicating that it will reach USD 6,030.4 million by 2030. This growth presents both challenges and opportunities for major companies like Medtronic, Johnson & Johnson, and Siemens Healthineers, which must adjust their strategies to meet regional demands.

Comprehending local regulations and reimbursement policies, shaped by INVIMA's guidelines, is essential for building a successful Medtech market strategy for Latin America. Furthermore, the rising demand for medical technologies, particularly among health-conscious consumers seeking devices like continuous glucose monitors (CGMs), emphasizes the need for building a successful Medtech market strategy for Latin America, which presents new revenue opportunities for MedTech companies. For instance, the demand for CGMs has increased by over 30% annually, highlighting the market potential.

As emphasized in recent collaborations, such as the partnership between Welwaze Medical Inc. and bioaccess™ for the launch of the Cerebral® medical device, building a successful Medtech market strategy for Latin America involves engaging with community stakeholders, including healthcare professionals and patients, to provide invaluable insights into their needs and preferences. The impact of clinical studies on regional economies is significant, contributing to job creation and economic growth while enhancing healthcare quality. The case study titled 'Opportunities in Consumer Health' emphasizes how medical technology firms are shifting towards direct-to-consumer offerings, driven by hyper-conscious health care consumers.

By thoroughly grasping these factors, including the knowledge of experts such as Juan Cuya, MD, and Oswaldo Amaya, MD, you can contribute to building a successful medtech market strategy for Latin America by customizing your products and strategies to effectively synchronize with regional dynamics.

Building Strategic Partnerships for MedTech Success

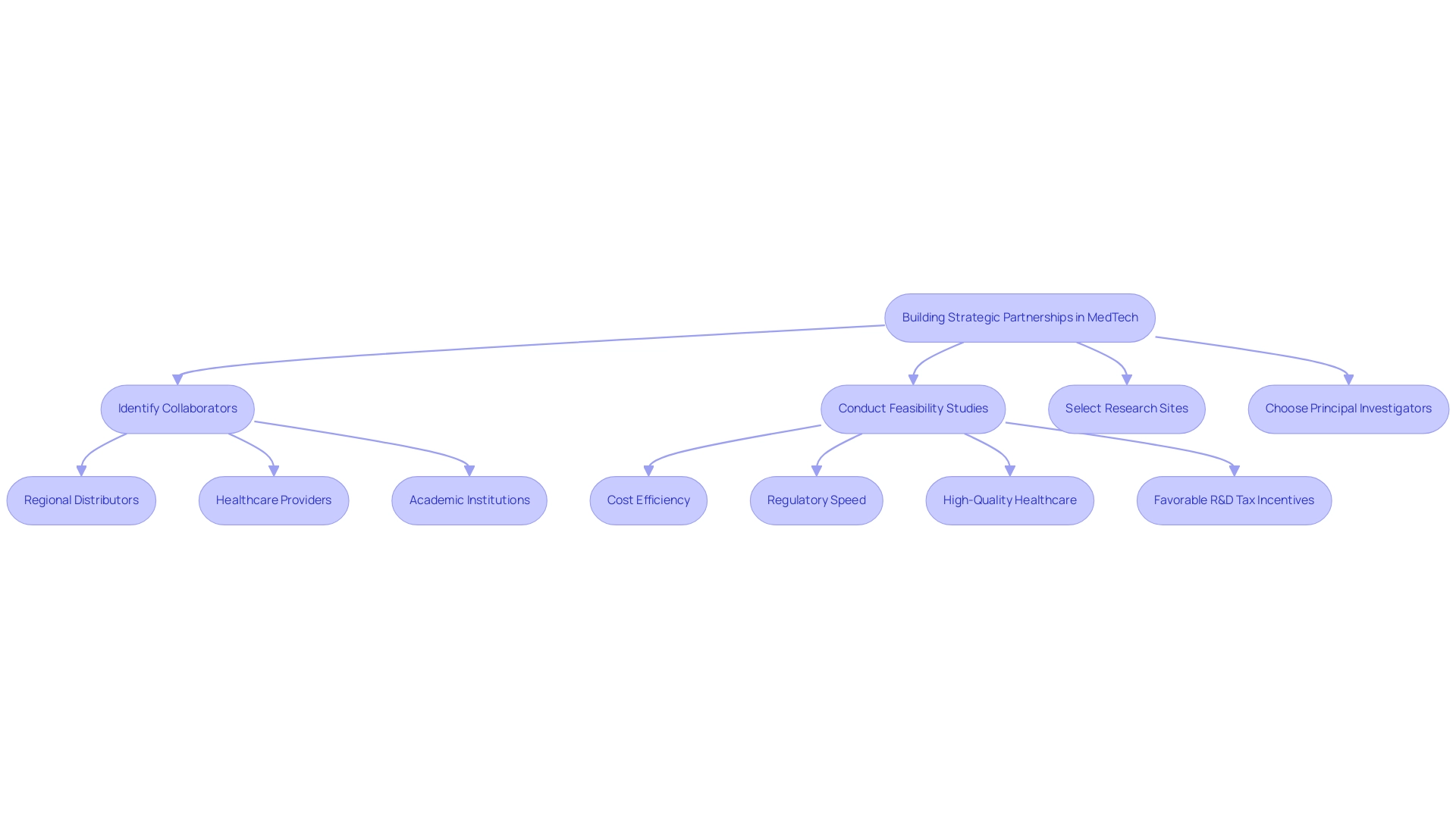

To create successful partnerships in the emerging Latin American MedTech sector, building a successful Medtech market strategy for Latin America requires identifying potential collaborators, including:

- Regional distributors

- Healthcare providers

- Academic institutions

Notably, universities in Brazil have significantly contributed to research and development for diagnostic kits, drugs, and vaccines, providing a strong foundation for collaboration. The region has witnessed significant growth in health tech startups, with a remarkable $1.09 billion raised from 2015 to 2021, showcasing a vibrant entrepreneurial landscape.

Furthermore, conducting feasibility studies, selecting appropriate research sites, and choosing principal investigators (PIs) are critical first steps in navigating the regulatory environment. Colombia's competitive advantages for first-in-human clinical trials include:

- Cost efficiency—medical procedures here can cost 40%–75% less than in the U.S.

- Regulatory speed

- High-quality healthcare

- Favorable R&D tax incentives

The marginal tax subsidy rate for profit-making small and midsize enterprises in Colombia was estimated at 0.67 in 2021, highlighting a supportive financial environment for potential partnerships.

Engaging in industry conferences and networking events in 2024 will provide valuable opportunities to establish connections and nurture relationships. When reaching out to prospective partners, it is crucial to articulate your value proposition clearly, emphasizing how a collaboration can yield mutual benefits. Joint ventures or co-development agreements are also effective strategies to harness shared resources and expertise.

This approach not only aids navigation through market complexities but also boosts competitive advantage. As research specialist Jennifer Mendoza highlights, nurturing collaborative relationships is essential for success in this dynamic sector; thus, companies should actively seek to engage with nearby entities. By prioritizing regional partnerships and leveraging comprehensive clinical trial management services, including trial set-up, start-up, and reporting, MedTech companies can aid in building a successful Medtech market strategy for Latin America while contributing to the ongoing growth of healthcare innovation in Colombia.

Moreover, the impact of Medtech clinical studies on regional economies, such as job creation and economic growth, further underscores the importance of these collaborations.

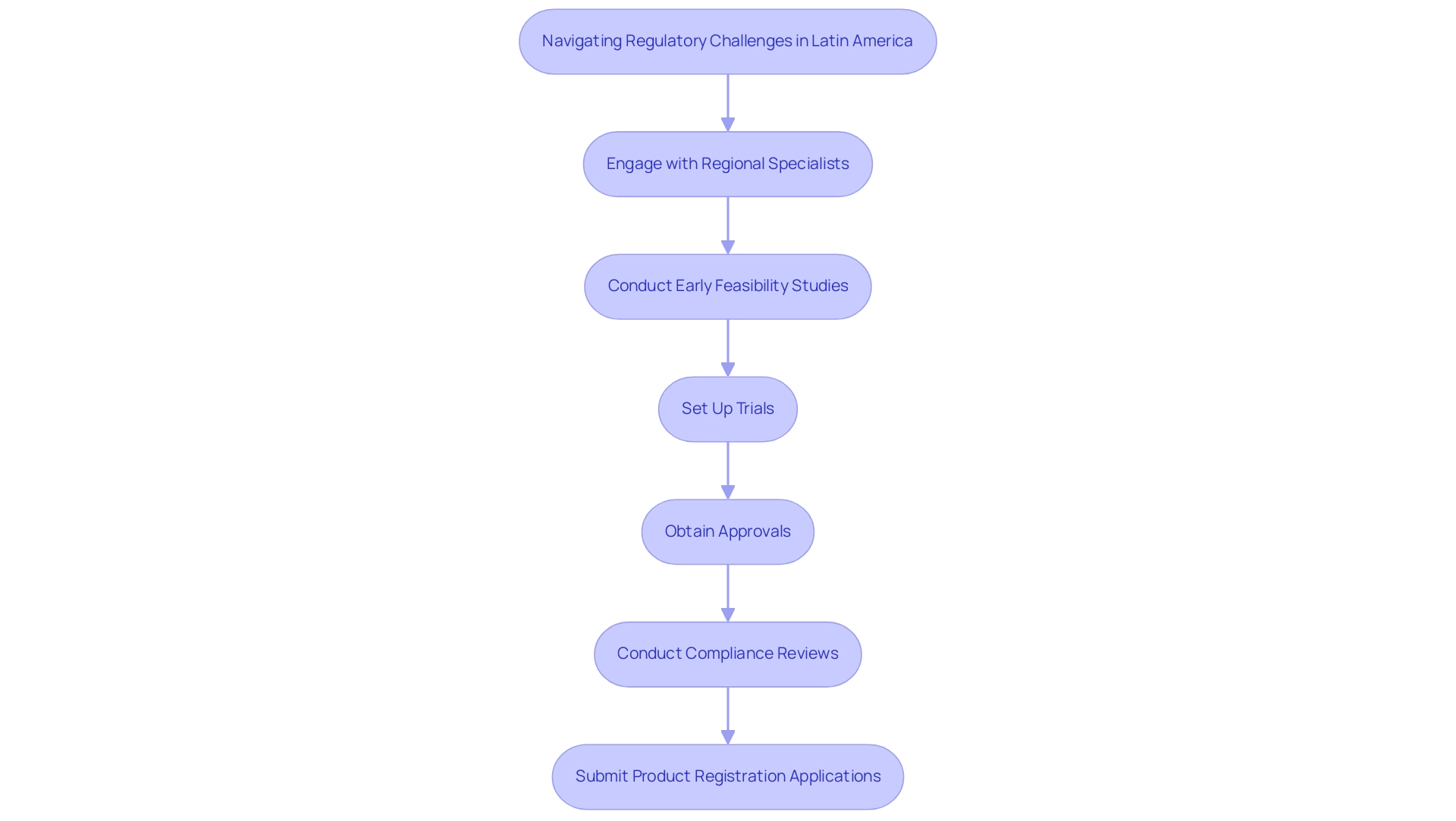

Navigating Regulatory Challenges in Latin America

Successfully navigating the compliance challenges in Latin America is essential for building a successful Medtech market strategy for Latin America, as it requires a comprehensive understanding of the unique regulations in each target country. Interacting with regional specialists, such as Katherine Ruiz, an expert in Compliance Affairs for Medical Devices and In Vitro Diagnostics in Colombia, can offer invaluable insights into the approval processes specific to medical devices. This expertise is crucial, especially when leveraging comprehensive clinical trial management services like those offered by bioaccess®, which include:

- Early-Feasibility Studies (EFS)

- First-In-Human Studies (FIH)

- Feasibility studies

- Site selection

- Compliance reviews

- Trial setup

- Project management

The trial setup process involves meticulous planning, including:

- The selection of research sites and principal investigators

- Obtaining necessary approvals from ethics committees and health ministries

- Ensuring compliance with local regulations

Thorough documentation is paramount; compiling clinical data and detailed technical specifications will bolster your product registration applications. Given the dynamic nature of regulations, staying updated on changes is essential.

Proactive engagement with regulatory bodies, including INVIMA—the Colombia National Food and Drug Surveillance Institute, recognized as a Level 4 health authority by PAHO/WHO—throughout the approval process not only helps address potential compliance issues but also fosters easier entry into the industry. By prioritizing these strategies, companies can mitigate risks and enhance their chances of building a successful Medtech market strategy for Latin America in the competitive landscape of medical technology.

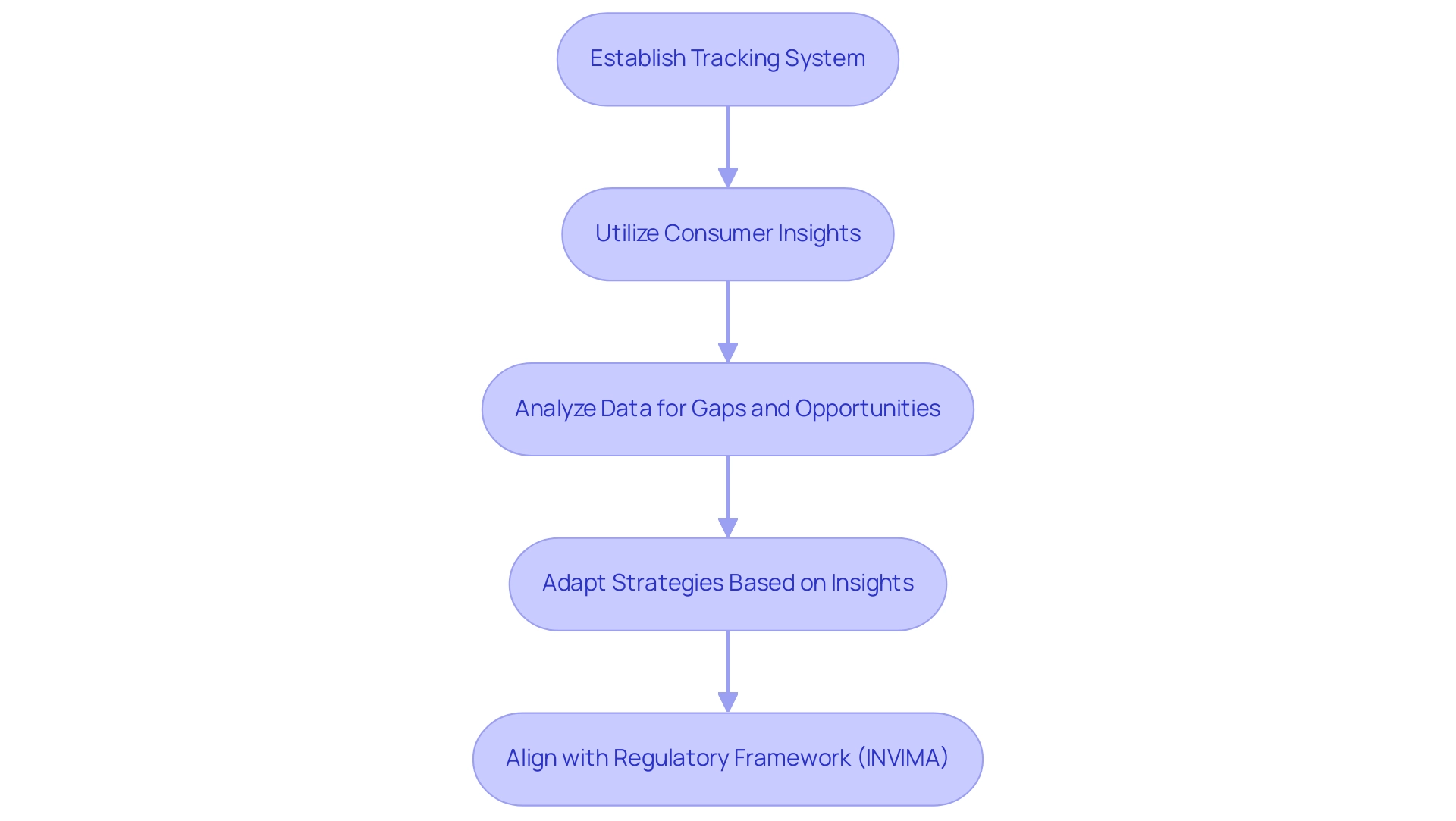

Market Tracking and Consumer Insights for Effective Strategy

Establishing a robust tracking system is essential for effectively navigating trends, competitor activities, and consumer preferences, which is crucial for building a successful Medtech market strategy for Latin America. The sector, which generated revenue of approximately 27.33 billion U.S. dollars in 2017, continues to evolve, with Mexico expected to register the highest compound annual growth rate (CAGR) in portable medical devices from 2024 to 2030. To gain valuable insights, it is crucial to utilize a variety of methods such as:

- Surveys

- Focus groups

- Social media analytics

Specifically targeting healthcare professionals and patients.

Examining this data enables organizations to pinpoint gaps and recognize opportunities for innovation. Regularly reviewing strategies based on these insights ensures that product offerings remain relevant and competitive. As compliance expert Magdalena Ferrari del Sel will discuss during her session on 'Main Compliance Issues for LATAM — How to Surf LATAM's Compliance Challenges' on June 20, insights into consumer preferences are vital for success in the region, particularly as the Asia Pacific sector rapidly expands, projected to reach USD 252,551.0 million by 2030.

This growth presents both challenges and opportunities for Latin American companies, which are crucial for building a successful Medtech market strategy for Latin America to adapt their strategies accordingly. Grasping the oversight framework shaped by INVIMA, Colombia's National Food and Drug Surveillance Institute, is essential as this authority supervises the safety, efficacy, and quality of medical devices in the nation, classified as a Level 4 health authority by PAHO/WHO. This classification signifies that INVIMA meets high standards of regulatory performance, which can facilitate smoother entry for compliant products and enhance consumer confidence.

Moreover, utilizing resources such as the Horizon Databook, which offers access to over one million statistics and more than 20,000 reports, can provide stakeholders with essential information to make informed business decisions. By adapting to consumer feedback, companies not only enhance product development but also strengthen customer relationships, which is crucial for building a successful Medtech market strategy for Latin America. Specific tracking strategies, such as leveraging big data analytics and real-time feedback mechanisms, can further enhance understanding of consumer behavior and preferences in this dynamic environment.

Furthermore, building a successful Medtech market strategy for Latin America involves aligning product development and marketing strategies with INVIMA’s regulatory framework to enhance entry processes and ensure compliance, ultimately leading to successful outcomes in the competitive medical technology landscape.

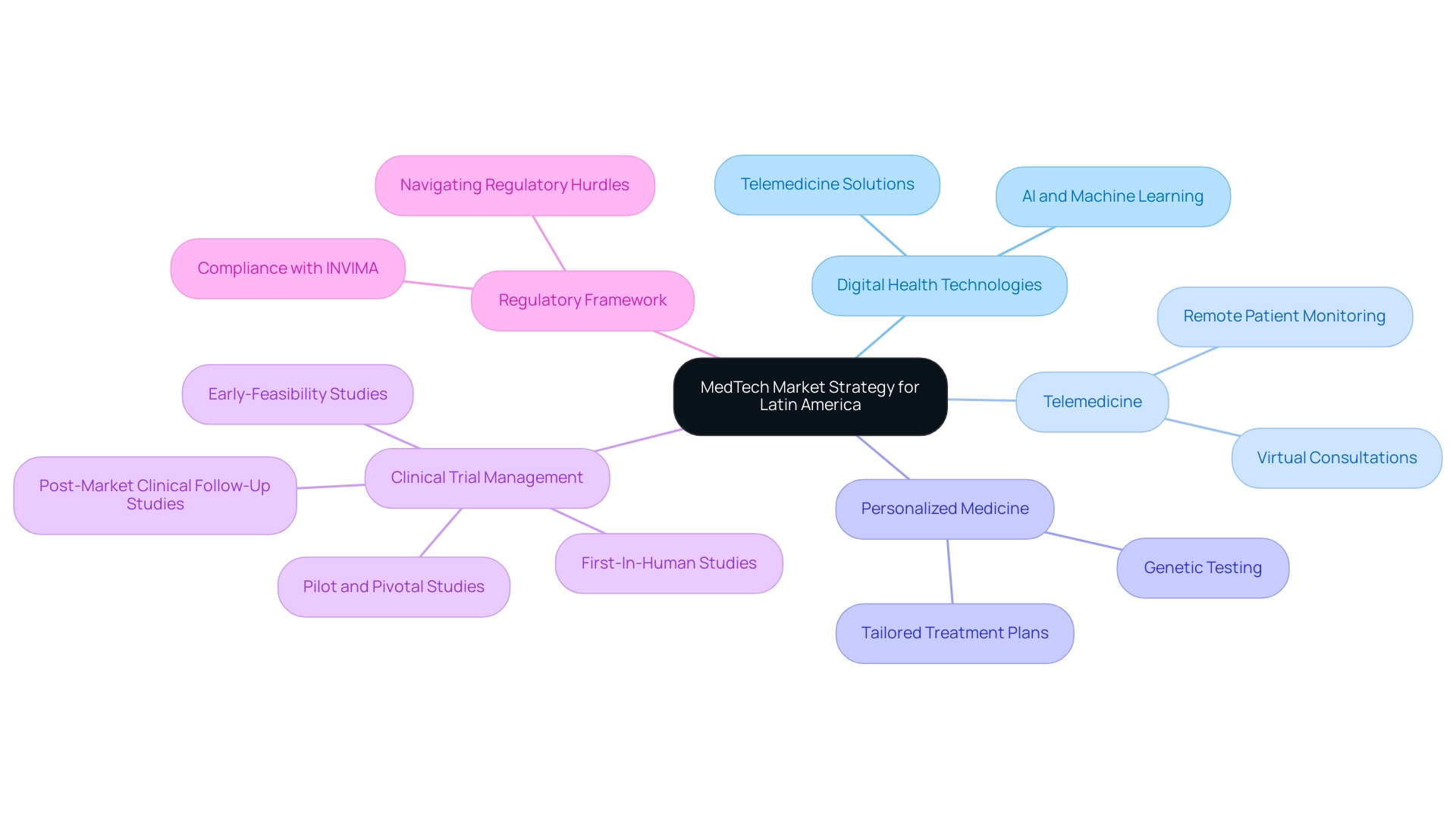

Future Trends and Opportunities in Latin American MedTech

To effectively harness future trends in the Latin American MedTech sector, building a successful Medtech market strategy for Latin America is essential, focusing on digital health technologies, telemedicine, and personalized medicine. The orthopedic devices sector in Latin America is generating revenues of approximately 3.6 billion USD, highlighting the importance of building a successful Medtech market strategy for Latin America to capitalize on significant growth opportunities. Notably, dropout rates in Central and South America are about one-third of those found in the U.S. and EU, highlighting the potential for successful technology adoption.

Furthermore, Brazil boasts the highest density of CT scanners in Latin America as of 2022, indicating a robust infrastructure for advanced medical technologies. Engaging with a specialized provider like bioaccess®, which has over 20 years of experience in building a successful Medtech market strategy for Latin America, can enhance your clinical trial management with their expertise in:

- Early-Feasibility Studies

- First-In-Human studies

- Pilot and Pivotal Studies

- Post-Market Clinical Follow-Up Studies

Their approach emphasizes flexibility and specialized knowledge, both of which are crucial for building a successful Medtech market strategy for Latin America while navigating the complexities of clinical trials.

Embracing advancements in artificial intelligence and machine learning is crucial as these technologies are increasingly integrated into healthcare solutions. Additionally, building a successful Medtech market strategy for Latin America involves understanding the regulatory framework through INVIMA, the Colombia National Food and Drug Surveillance Institute, which is vital for compliance and oversight in this Level 4 health authority. Engaging with industry leaders and attending relevant conferences is essential for building a successful Medtech market strategy for Latin America, as it will keep your organization informed about emerging technologies and market dynamics.

As Monica Mora, Chief Operating Officer specializing in operations and compliance strategies for medical device firms in Latin America, notes,

Staying adaptable and innovative is key to seizing new opportunities in this evolving landscape.

The evolving character of US-Latin American medical technology collaboration, propelled by technological progress and an emphasis on telemedicine and personalized medicine, highlights the importance of building a successful Medtech market strategy for Latin America, as illustrated in the case study titled 'Future Trends and Opportunities in US-Latin American Medical Technology Collaboration.' This study highlights the challenges of compliance hurdles and communication barriers while showcasing innovative solutions that are paving the way for accelerated clinical trials and enhanced medical device studies.

By prioritizing these areas and leveraging comprehensive clinical trial management services, including addressing regulatory challenges, your company can focus on building a successful Medtech market strategy for Latin America, thereby maintaining a competitive edge in the vibrant MedTech sector.

Conclusion

The Latin American MedTech landscape presents a wealth of opportunities for innovation, driven by a growing market projected to reach USD 6,030.4 million by 2030. Navigating this complex environment requires a thorough understanding of local regulations, such as those enforced by INVIMA in Colombia, which plays a pivotal role in ensuring product safety and efficacy. By establishing strategic partnerships with local entities and conducting comprehensive market research, companies can effectively align their products with consumer needs and preferences, thus enhancing their chances of success.

Moreover, the importance of regulatory compliance cannot be overstated. Engaging with local regulatory experts and staying informed about evolving regulations is essential for smooth market entry. As highlighted, leveraging clinical trial management services and embracing technological advancements, such as digital health and AI-driven solutions, will further bolster a company’s competitive edge in this dynamic sector.

In summary, the combination of strategic partnerships, meticulous market tracking, and adherence to regulatory frameworks will empower MedTech firms to thrive in the Latin American market. By prioritizing these elements, organizations can not only capitalize on emerging trends but also contribute significantly to the advancement of healthcare innovation in the region. As the landscape continues to evolve, those who remain adaptable and focused on consumer insights will be best positioned to seize the abundant opportunities that lie ahead.

Frequently Asked Questions

What is necessary for building a successful medtech market strategy in Latin America?

A successful medtech market strategy in Latin America requires a comprehensive analysis of healthcare systems, economic conditions, and cultural nuances, especially considering regulatory frameworks like those established by INVIMA.

What role does INVIMA play in the Latin American medtech landscape?

INVIMA, the Colombia National Food and Drug Surveillance Institute, oversees the marketing and manufacturing of health products, ensuring compliance with safety and efficacy standards through pre-market evaluations, post-market surveillance, and technical guidelines for manufacturers.

What is the expected growth of the medtech sector in Latin America by 2030?

The medtech sector in Latin America is projected to reach USD 6,030.4 million by 2030, highlighting significant growth potential.

Why is understanding local regulations and reimbursement policies important for medtech companies?

Understanding local regulations and reimbursement policies, shaped by INVIMA's guidelines, is essential for navigating the market successfully and ensuring compliance with regional demands.

What emerging trends are affecting the demand for medical technologies in Latin America?

There is a rising demand for medical technologies, particularly devices like continuous glucose monitors (CGMs), which have seen an increase in demand of over 30% annually, presenting new revenue opportunities for MedTech companies.

How can MedTech companies engage with community stakeholders in Latin America?

Engaging with community stakeholders, including healthcare professionals and patients, provides invaluable insights into their needs and preferences, which is crucial for building a successful market strategy.

What are some critical steps in forming partnerships in the Latin American MedTech sector?

Key steps include identifying potential collaborators such as regional distributors, healthcare providers, and academic institutions, as well as conducting feasibility studies and selecting appropriate research sites.

What advantages does Colombia offer for clinical trials?

Colombia offers cost efficiency (medical procedures can be 40%–75% less than in the U.S.), regulatory speed, high-quality healthcare, and favorable R&D tax incentives, making it an attractive location for first-in-human clinical trials.

How can MedTech companies leverage industry conferences and networking events?

Engaging in industry conferences and networking events provides valuable opportunities to establish connections, nurture relationships, and articulate clear value propositions for potential partnerships.

What is the impact of MedTech clinical studies on regional economies?

MedTech clinical studies significantly contribute to job creation and economic growth, underscoring the importance of collaborations in enhancing healthcare innovation in the region.