Overview

This article delves into the complexities and processes involved in obtaining Medtech approval in Latin America, underscoring the distinct regulatory frameworks of countries such as Brazil, Mexico, and Colombia. Successful navigation of these intricate processes demands a comprehensive understanding of local regulations, proactive engagement with regulatory bodies, and the integration of innovative technologies. These elements are crucial for ensuring timely access to medical devices within a rapidly evolving healthcare landscape. As the Medtech sector continues to grow, collaboration and informed strategies become increasingly vital for stakeholders aiming to thrive in this environment.

Introduction

In the rapidly evolving landscape of medical technology, navigating the approval process in Latin America presents both challenges and opportunities for companies aiming to introduce innovative medical devices. Each country in the region enforces its own specific regulatory requirements, making it essential to understand the intricacies of authorities like:

- ANVISA in Brazil

- COFEPRIS in Mexico

- INVIMA in Colombia

As the demand for medical devices surges—driven by a rising prevalence of chronic diseases—the regulatory environment is shifting towards more adaptive frameworks that promise faster approvals without compromising safety. This article delves into the complexities of Medtech approval in Latin America, exploring the critical steps involved, the role of early feasibility studies, and the unique advantages offered by conducting clinical trials in this diverse region. By staying informed and strategically engaging with regulatory bodies, companies can position themselves for success in a market ripe with potential.

Overview of Medtech Approval in Latin America

Navigating the Medtech approval landscape in Latin America necessitates a nuanced understanding of a diverse framework, as each country enforces its own specific rules and requirements. This complexity is underscored by the presence of key governing bodies, including ANVISA in Brazil, COFEPRIS in Mexico, and INVIMA in Colombia, which play a crucial role in medical device oversight as a Level 4 health authority by PAHO/WHO. Each authority employs distinct evaluation processes for medical devices, leading to significant variations in timelines and documentation requirements.

As of 2025, the oversight environment is evolving, with a notable increase in the demand for medical devices driven by the rising prevalence of chronic diseases in the region. This trend highlights the critical role that oversight bodies play in facilitating timely access to innovative medical technologies. Collaborations such as Welwaze Medical Inc. with bioaccess™ for the Celbrea® medical device launch illustrate how strategic partnerships can enhance market entry and compliance access in Colombia.

The potential for streamlined processes is demonstrated by successful Medtech approval in Latin America, particularly in Brazil, Mexico, and Colombia, when companies engage proactively with these authorities. Current trends indicate a shift towards more adaptive governance frameworks, allowing for faster approvals while maintaining safety and efficacy standards. The partnership with IDx Technologies to enhance AI-driven disease detection in ophthalmology exemplifies the integration of advanced technologies in clinical research. Stakeholders must remain vigilant and responsive to leverage the opportunities presented by this dynamic market.

As noted by the Head of Clinical Data Engineering, "Traditionally, data management was outsourced to our CRO vendor partners. Part of the initiative is to bring all our studies in-house so that our internal teams can start working on it." This perspective underscores the growing importance of internal data management practices in enhancing efficiency and oversight, which aligns with bioaccess™'s comprehensive service offerings, including feasibility studies, site selection, compliance reviews, and project management.

Furthermore, the statistic that 50% of insurers in Europe indicate the inclusion of telehealth benefits highlights a broader trend that emphasizes the growing importance of medical devices and the processes that oversee them. Understanding the commonalities and trends across ANVISA, COFEPRIS, and INVIMA is essential for Medtech companies aiming for Medtech approval in Latin America. By staying informed about the compliance environment and adapting to its changes, companies can better position themselves for success in this burgeoning market.

Additionally, the case study on adverse event reporting systems in pharmacovigilance illustrates the significance of oversight processes in ensuring safety and efficacy, further emphasizing the need for vigilance and adaptability among stakeholders.

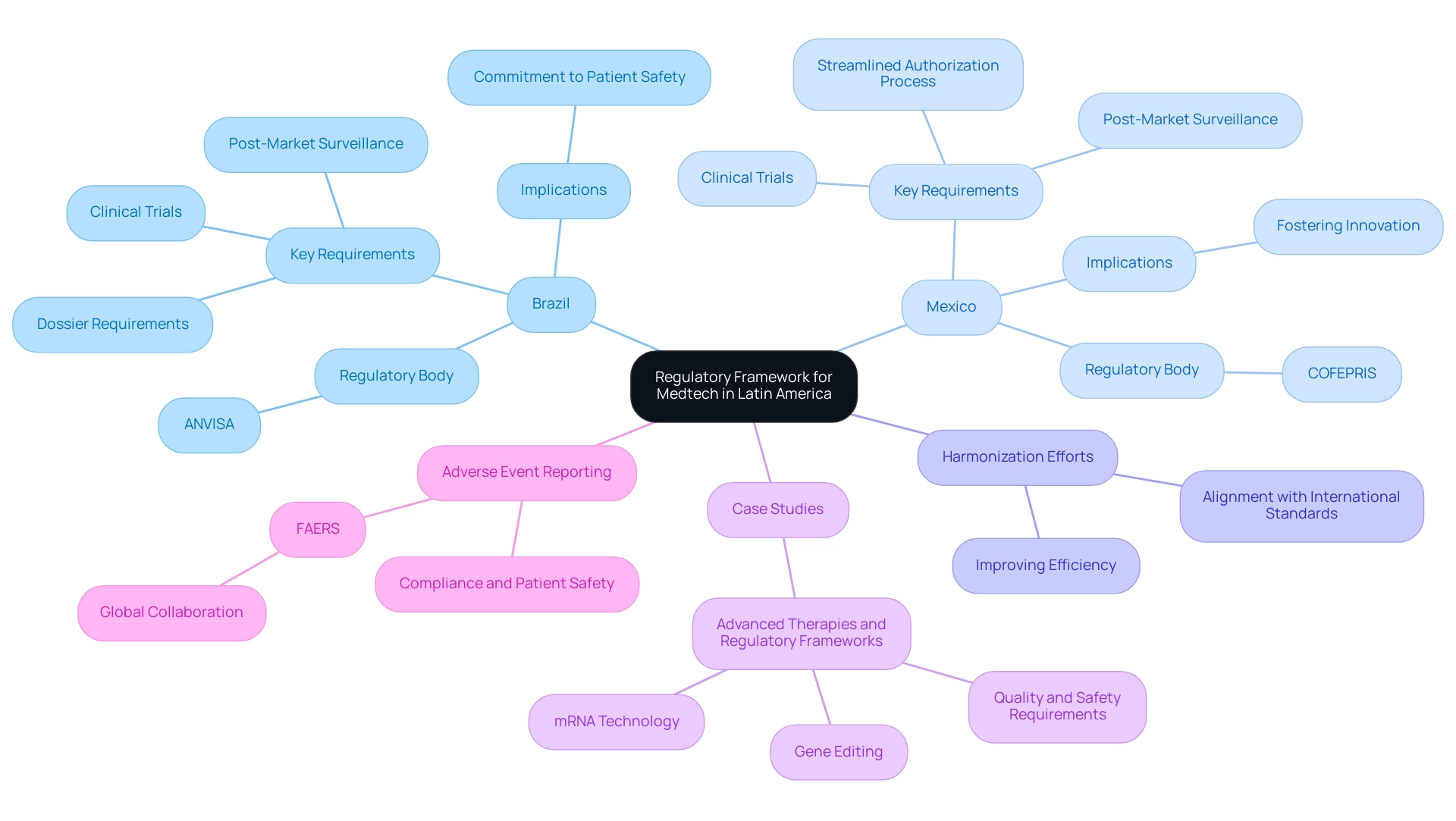

Understanding the Regulatory Framework for Medtech

The governance framework for Medtech approval in Latin America is shaped by a complex interplay of local laws and international standards. Each nation has its own regulatory body responsible for the approval of medical devices. In Brazil, the National Health Surveillance Agency (ANVISA) mandates a thorough dossier for Medtech approval that includes medical data, safety assessments, and efficacy evidence.

Conversely, Mexico's Federal Commission for the Protection against Sanitary Risk (COFEPRIS) offers a more streamlined authorization process for certain device classifications, which can lead to faster approval and expedite market entry for innovative products.

Navigating these regulations requires a deep understanding of the specific documentation, clinical trial protocols, and post-market surveillance obligations that each authority imposes. For instance, Brazil's stringent requirements reflect a commitment to patient safety, while Mexico's approach aims to foster innovation without undermining oversight. As of 2025, both ANVISA and COFEPRIS are adapting their frameworks to align more closely with international standards, which is significant for Medtech approval in Latin America.

This harmonization effort is vital, as it not only improves the efficiency of Medtech approval but also guarantees that medical devices meet international safety and efficacy standards.

Companies must remain attentive to potential compliance changes, as these can significantly affect approval timelines and requirements. Statistics indicate that Brazil and Mexico are leading the way in clinical trial guidelines within Latin America, crucial for Medtech approval, with Brazil's framework recognized for its rigor and Mexico's for its agility. The FDA Adverse Event Reporting System (FAERS), supported by over 150 countries, serves as a model for international collaboration in pharmacovigilance, underscoring the importance of establishing effective channels for reporting adverse events and implementing corrective actions to maintain compliance and safeguard patient safety.

Mónica Mabel Guaita, CEO and Founding Partner of MMGC SRL, emphasizes, 'The tailored-service approach we offer enables us to provide solutions to large, medium, and small-sized companies, as well as to serve local and international businesses and local direct distributors.' This highlights the significance of tailored strategies for navigating the compliance landscape.

Recent case studies, such as those focusing on advanced therapies like gene editing and mRNA technology, highlight the necessity for oversight frameworks that balance innovation with patient safety. Regulatory bodies are actively updating guidelines to address the complexities associated with these advanced therapies, ensuring that clear requirements for quality, safety, and environmental risk assessment are established.

This proactive strategy is vital for achieving Medtech approval in Latin America, ensuring the effective incorporation of new medical technologies into healthcare practice, ultimately benefiting both companies and patients.

Alongside these regulatory insights, bioaccess® provides a variety of trial services crucial for navigating the Latin American medical technology landscape. Their expertise includes Early-Feasibility Studies, First-In-Human Studies, Pilot Studies, Pivotal Studies, and Post-Market Clinical Follow-Up Studies, providing a comprehensive suite of services tailored to meet the unique challenges of each market. By utilizing their extensive experience and tailored approach, bioaccess® ensures that clients can effectively manage the complexities of trials in Latin America, facilitating faster access to innovative medical technologies.

Step-by-Step Process for Medtech Approval

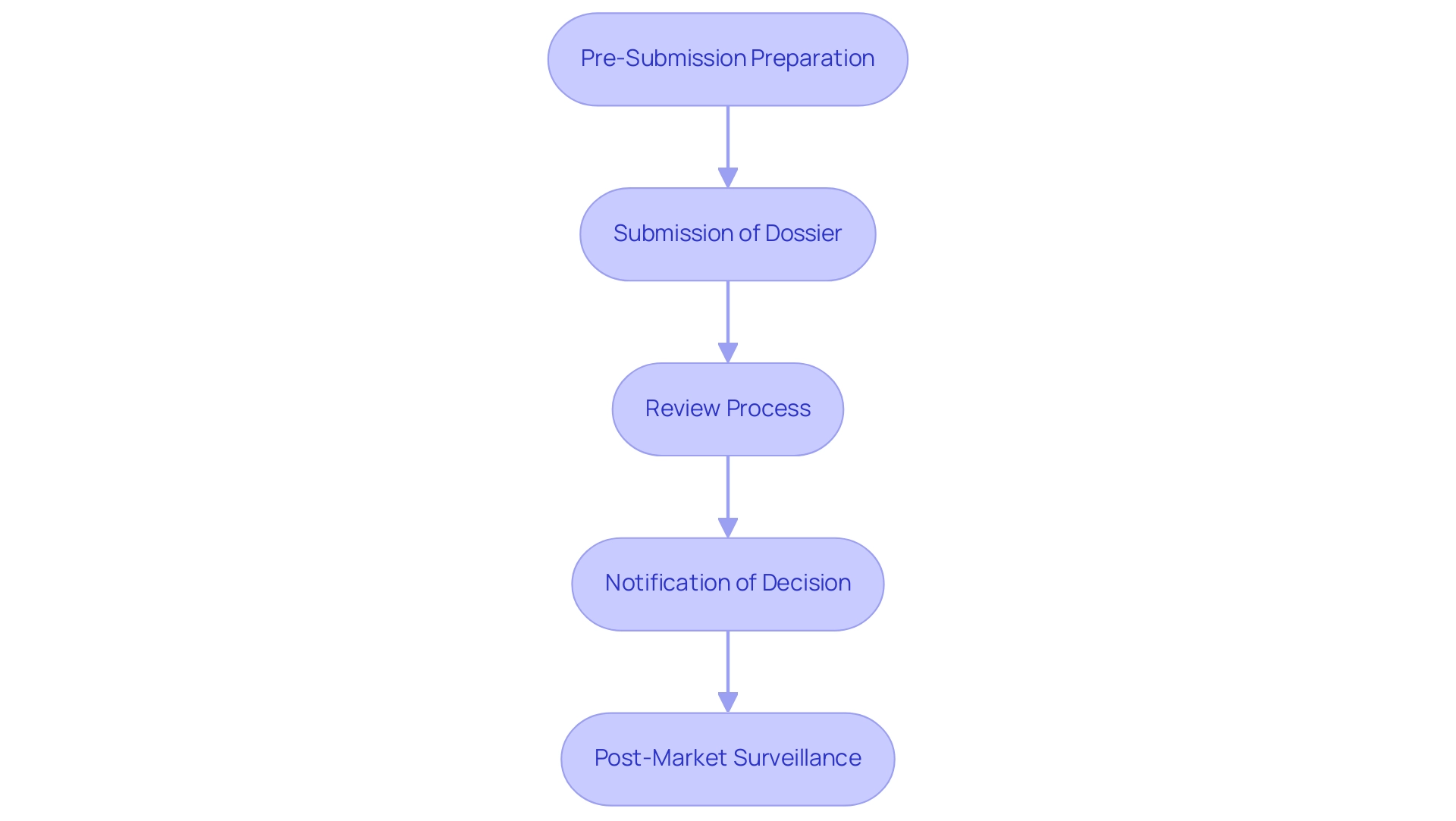

The structured pathway for Medtech approval in Latin America encompasses several critical steps designed to ensure compliance and safety. Here’s a detailed guide to navigating this process effectively in 2025:

- Pre-Submission Preparation: Companies must meticulously gather all necessary documentation, which includes product specifications, clinical data, and evidence of compliance with regulations. This foundational step is crucial as it sets the stage for a successful submission.

- Submission of Dossier: The next step involves submitting the complete dossier to the appropriate governing authority, such as INVIMA in Colombia, which oversees the marketing and manufacturing of health products. As noted by Steve Garchow in the LATAM Medtech Leaders Podcast, ensuring that all forms are completed accurately is essential to avoid delays. A well-prepared dossier can significantly enhance the chances of approval.

- Review Process: Following submission, the regulatory body, including INVIMA’s Directorate for Medical Devices and other Technologies, will conduct a thorough review of the dossier. This phase may involve requests for additional information or clarification, emphasizing the importance of clear and comprehensive documentation.

- Notification of Decision: Upon completion of the review, the company will receive a notification regarding the acceptance or rejection of their submission. Comprehending the typical duration for Medtech approval in Latin America, which may require several months, is essential for firms organizing their schedules efficiently.

- Post-Market Surveillance: After receiving approval, companies are required to adhere to post-market surveillance requirements mandated by INVIMA. This ongoing monitoring is essential to guarantee the device's performance and safety in the market, aligning with the latest regulations that many countries in the region are updating to attract innovation while maintaining high safety and quality standards.

In 2025, successful dossier submissions for medical technology products in Latin America will increasingly rely on a strategic approach that anticipates regulatory expectations. For instance, integrating cybersecurity measures during the design phase has become essential, as highlighted by case studies in the industry. By implementing robust cybersecurity protocols, manufacturers can protect patient data and comply with regulations like GDPR, thereby enhancing their submission's credibility.

Moreover, the renal denervation market has been identified as a potential multibillion-dollar opportunity, underscoring the relevance of medical technology innovations in Latin America. As pointed out by Singh from RBC Capital Markets, although a PFA-like year may not happen, the long-term potential in this sector is enormous, motivating companies to engage actively with the authorization process.

Overall, understanding the step-by-step process for obtaining Medtech approval in Latin America, including the specific dossier requirements and best practices for submission, is essential for companies aiming to prosper in the Latin American market. As Steve Garchow emphasized, fostering local expertise and adapting global strategies to meet local needs can significantly bridge the life science innovation gap in the region.

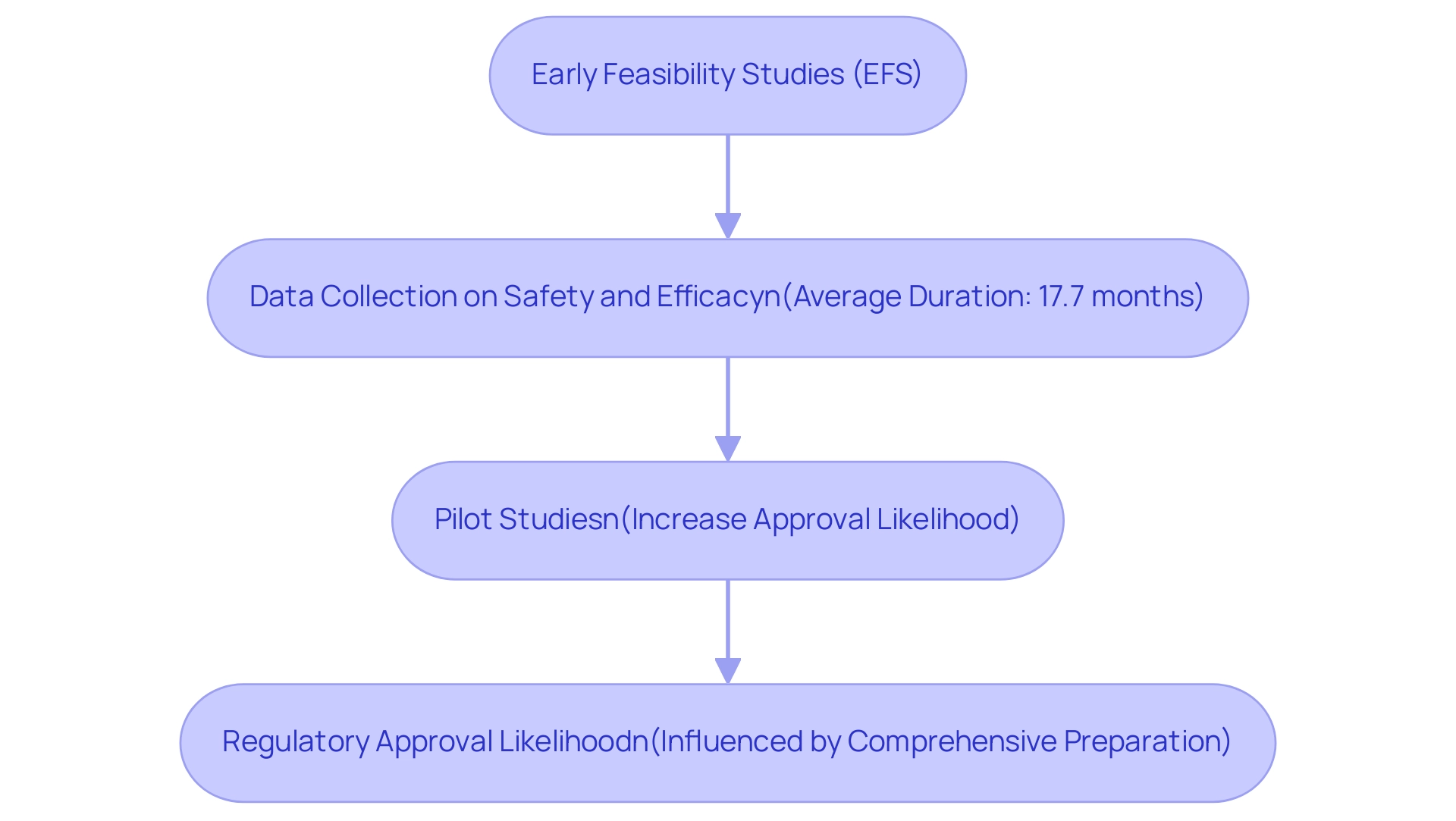

The Role of Early Feasibility and Pilot Studies in Approval

Early feasibility studies (EFS) and pilot studies are critical components of the Medtech approval process in Latin America, laying the groundwork for successful regulatory outcomes. These studies empower companies to evaluate their devices in a controlled setting, gathering essential data on safety and efficacy prior to embarking on large-scale trials. A prime example is Avantec Vascular Corporation's recent first-in-human clinical study of an innovative vascular device in Latin America, supported by bioaccess™, which illustrates how EFS can effectively facilitate the initial phases of device testing.

bioaccess™ provides Avantec Vascular with vital services, including the selection of a primary investigator and the submission of documentation for ministry of health endorsements. With an average duration of approximately 17.7 months for EFS, this timeframe permits a thorough assessment and refinement of device functionality. By identifying potential issues early in the development cycle, manufacturers can implement necessary adjustments, thereby enhancing the overall quality of the data submitted for official evaluation.

This proactive approach not only bolsters the integrity of clinical evidence but also underscores a commitment to patient safety, which can significantly influence compliance decisions. Indeed, pilot studies have been shown to increase the likelihood of approval, as they provide a clearer understanding of a device's performance and associated risks. Eileen Mihas, MDIC’s program director for early feasibility studies, remarked that "Future efforts will focus on adapting to post-pandemic staffing realities, optimizing coordination with international studies, and refining frameworks to reduce preclinical burdens."

This statement highlights the evolving Medtech landscape and the necessity of adapting to emerging challenges. Furthermore, case studies demonstrate the efficacy of EFS in fostering innovation and collaboration within the industry. For instance, the Harmonization by Doing initiative has successfully integrated Japan into global medical device development, enhancing collaboration and streamlining authorization processes. This program exemplifies how EFS can promote cross-border collaboration, ultimately benefiting the governance landscape.

Additionally, it is essential to recognize that resubmissions will be assessed based on responses to prior comments and modifications made to the project. This aspect of the oversight process emphasizes the need for comprehensive preparation and responsiveness to feedback, which can greatly affect the timeline for endorsement. As the Medtech sector continues to adapt to post-pandemic realities, the role of early feasibility studies in ensuring timely and effective Medtech approval in Latin America remains paramount.

bioaccess® offers extensive trial management services, encompassing feasibility studies, site selection, compliance evaluations, trial setup, import permits, project management, and reporting, ensuring that clients adeptly navigate the complexities of the compliance landscape.

Opportunities for Conducting Clinical Trials in Latin America

Latin America presents a wealth of opportunities for conducting clinical trials, particularly in Colombia, which stands out for its competitive advantages in first-in-human studies. With a diverse patient population, operational costs approximately 30% lower than those in North America and Western Europe, and accelerated regulatory timelines, Colombia is increasingly appealing to Medtech companies seeking approval in the region. The total IRB/EC and MoH (INVIMA) review process typically takes only 90-120 days, ensuring a swift pathway to trial initiation.

Moreover, Colombia's healthcare system is highly regarded, ranked #22 by the WHO and consistently recognized for its quality, making it an ideal environment for research. Hospitals in Colombia are permitted to conduct research with pharmaceutical drugs only after passing a rigorous ICH/GCP certification process, which ensures high standards of quality and compliance.

By partnering with local research organizations (CROs) like bioaccess®, companies can effectively navigate the intricate compliance landscape. Dushyanth Surakanti, Founder & CEO of Sparta Biomedical, noted, "My experience with bioaccess® during the initial human study in Colombia illustrated the effectiveness of local CROs in navigating the regulatory framework." These partnerships provide invaluable insights into local practices and patient demographics, which are crucial for successful trial execution.

Recent statistics indicate that patient recruitment in Latin America can be up to 30% faster compared to other regions, allowing for quicker study timelines and earlier market entry.

The potential for conducting medical trials in Colombia is further bolstered by R&D tax incentives, which play a crucial role in facilitating Medtech approval in Latin America. Investments in science and innovation yield significant financial benefits, including a 100% tax deduction, a 25% tax discount, and a 50% future tax credit, along with approximately $10 million in government grants. As demand for innovative medical devices continues to rise, obtaining Medtech approval in Latin America by leveraging the unique advantages of Colombia can provide a strategic edge in the competitive medical technology landscape. Organizations that identify and respond to these opportunities, particularly through insights provided by resources such as the Horizon Databook, will be well-prepared to advance their research initiatives and introduce their products to the market more effectively.

Bioaccess® plays a pivotal role in bridging the gap between innovative medical technology firms and potential clinical research studies in Colombia, enhancing the relevance of this opportunity.

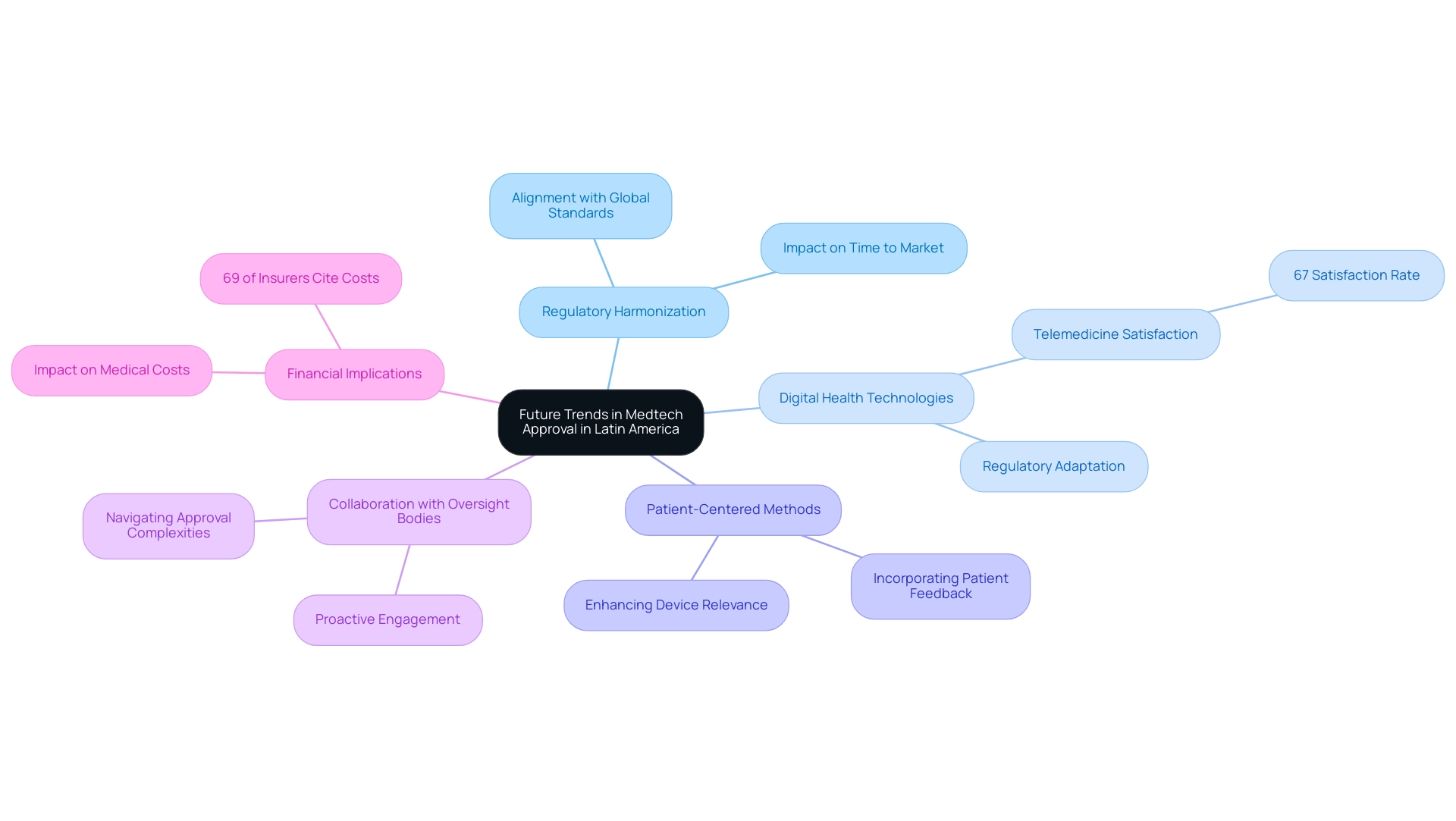

Future Trends in Medtech Approval in Latin America

The landscape of Medtech approval in Latin America is on the brink of significant transformation, driven by several pivotal trends. One of the most notable is the movement towards increased oversight harmonization across the region. As oversight bodies strive to align their standards with global benchmarks, companies can anticipate more effective and streamlined validation processes.

This shift not only reduces the time to market for innovative medical devices but also enhances the overall quality of research conducted in the region. With over 20 years of expertise in medical technology, bioaccess® leads this change, providing expedited clinical study services designed to meet these evolving standards.

In addition to compliance harmonization, the incorporation of digital health technologies is reshaping the medical technology validation framework. The growing prevalence of telemedicine and digital health solutions necessitates that regulators adapt their guidelines to accommodate these advancements. This evolution is crucial, as 67% of individuals in the U.S. express satisfaction with telemedicine appointments, indicating a strong consumer preference for digital health options.

Businesses that embrace these technologies and align their strategies with compliance expectations will discover a competitive edge. Moreover, the emphasis on patient-centered methods is becoming increasingly significant in the approval process. Regulatory bodies are recognizing the importance of incorporating patient feedback and outcomes into their evaluations, which can lead to more relevant and effective medical devices.

This trend is further supported by insights from industry specialists who stress the need for medical technology firms to engage proactively with oversight bodies. For instance, the 2025 WTW Global Medical Trends Survey indicates that 69% of insurers cite the expense of new medical technologies as the primary factor influencing medical costs, underscoring the financial implications of policy changes. By staying informed about these evolving trends and fostering collaborative relationships with regulators, companies like bioaccess® can navigate the complexities of the approval process more effectively.

As we look towards 2025, the medical technology sector in Latin America is poised for a dynamic shift, characterized by these trends. Companies that adapt to the shifting compliance landscape and leverage the opportunities presented by digital health technologies will be well-positioned to thrive in this burgeoning market. As April Chan-Tsui, Director of Product Operations at Clarivate, observes, 'The alignment of compliance standards with international benchmarks is essential for fostering innovation and ensuring patient safety in the medical technology sector.'

This perspective reinforces the importance of regulatory harmonization in shaping the future of Medtech approval in Latin America, where bioaccess® brings unmatched expertise, particularly in Early-Feasibility, First-In-Human, Pilot, Pivotal, and Post-Market Follow-Up Studies. Furthermore, understanding the role of INVIMA, the Colombian National Food and Drug Surveillance Institute, is crucial as it oversees medical device regulation and classification, ensuring compliance with standards that align with those of Level 4 health authorities as classified by PAHO/WHO.

Conclusion

Navigating the Medtech approval process in Latin America is undeniably complex, as each country presents its own regulatory challenges and opportunities. Key authorities such as ANVISA, COFEPRIS, and INVIMA play a pivotal role in shaping this landscape, with evolving frameworks designed to balance innovation and patient safety. For companies aiming to successfully bring their medical devices to market, understanding the distinct requirements and timelines of these regulatory bodies is essential.

Moreover, the significance of early feasibility studies and pilot studies emerges as a critical step in refining devices prior to full-scale clinical trials. These proactive measures not only enhance the quality of data submitted for approval but also demonstrate a commitment to safety that can positively influence regulatory outcomes. The potential for conducting clinical trials in countries like Colombia, characterized by competitive advantages and a supportive regulatory environment, further underscores the opportunities for Medtech companies to flourish in this region.

As the regulatory landscape progresses towards harmonization and the integration of digital health technologies, companies that remain informed and agile will be better positioned to leverage these changes. Emphasizing patient-centric approaches and fostering collaboration with regulatory authorities will be essential strategies for success. The future of Medtech in Latin America is promising, with significant potential for innovation and growth in a market that is evolving to meet the needs of both patients and healthcare providers. Companies that seize these opportunities will not only enhance their market presence but also contribute to the advancement of healthcare solutions in the region.

Frequently Asked Questions

What is the approval landscape for Medtech in Latin America?

The Medtech approval landscape in Latin America is complex, with each country having its own specific rules and requirements. Key governing bodies include ANVISA in Brazil, COFEPRIS in Mexico, and INVIMA in Colombia, each employing distinct evaluation processes that lead to variations in timelines and documentation.

How do the regulatory bodies in Latin America differ in their approval processes?

ANVISA in Brazil mandates a thorough dossier that includes medical data, safety assessments, and efficacy evidence. In contrast, COFEPRIS in Mexico offers a more streamlined authorization process for certain device classifications, which can expedite market entry for innovative products.

What trends are influencing Medtech approval in Latin America as of 2025?

There is an increasing demand for medical devices due to the rising prevalence of chronic diseases. Regulatory bodies are evolving towards more adaptive governance frameworks, allowing for faster approvals while maintaining safety and efficacy standards.

How can companies successfully navigate the Medtech approval process in Latin America?

Companies can successfully navigate the approval process by engaging proactively with regulatory authorities, understanding specific documentation requirements, and adapting to potential compliance changes. Collaborations and partnerships can also enhance market entry and compliance access.

What role does internal data management play in Medtech approvals?

Internal data management is becoming increasingly important for enhancing efficiency and oversight in clinical studies. Companies are moving towards managing studies in-house to improve data handling and compliance.

How are advanced therapies like gene editing and mRNA technology impacting regulatory frameworks?

Regulatory bodies are updating guidelines to address the complexities of advanced therapies, ensuring that clear requirements for quality, safety, and environmental risk assessment are established to balance innovation with patient safety.

What services does bioaccess® provide to assist in navigating the Medtech landscape?

Bioaccess® offers a variety of trial services, including Early-Feasibility Studies, First-In-Human Studies, Pilot Studies, Pivotal Studies, and Post-Market Clinical Follow-Up Studies, tailored to meet the unique challenges of each market in Latin America.

Why is understanding the compliance environment crucial for Medtech companies in Latin America?

Understanding the compliance environment is essential as it helps companies adapt to changes that can significantly affect approval timelines and requirements, ultimately positioning them for success in the growing Medtech market.