Overview

The opportunities for MedTech in Latin America are significant, driven by collaborations with US companies, advancements in technology, and a supportive regulatory environment. The article details how initiatives in countries like Colombia, including tax incentives and a robust healthcare system, create a fertile landscape for innovation and clinical trials, ultimately enhancing healthcare delivery and economic development in the region.

Introduction

In the dynamic landscape of medical technology, the collaboration between the United States and Latin America emerges as a pivotal force, fostering innovation and enhancing healthcare delivery across both regions. This partnership is not merely a trend; it represents a strategic alignment of advanced technologies and diverse patient populations, paving the way for groundbreaking clinical trials and improved patient outcomes.

As companies like ReGelTec and Bioaccess™ forge ahead with initiatives that leverage local expertise and resources, the potential for growth in Latin America becomes increasingly evident. From navigating regulatory complexities to overcoming cultural barriers, the MedTech sector is poised for transformation, driven by a shared commitment to advancing healthcare solutions that cater to the unique needs of the region.

As the future unfolds, the insights gleaned from successful collaborations will be instrumental in shaping a robust MedTech ecosystem that benefits all stakeholders involved.

The Significance of US-Latin American MedTech Collaboration

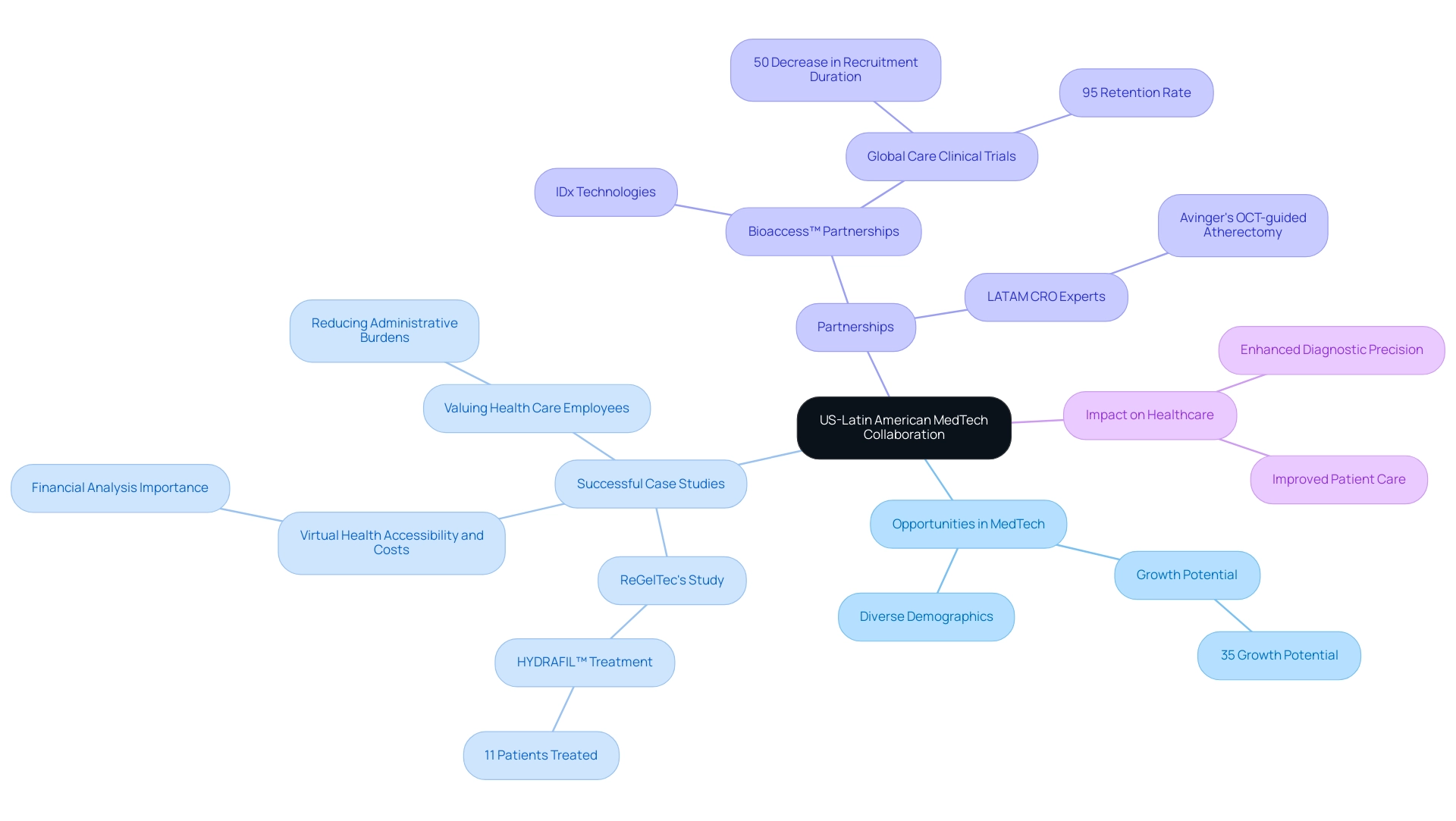

The collaboration between the US and Latin America in the MedTech sector represents opportunities for medtech in Latin America, driven by the advanced technologies and innovative solutions offered by leading US companies. A prime example is ReGelTec's Early Feasibility Study on HYDRAFIL™, which successfully treated eleven patients with chronic low back pain in Barranquilla, Colombia. This study not only demonstrates the effectiveness of novel treatments but also emphasizes the increasing reputation of Barranquilla as a center for trials, supported by the Caribbean Health Group and Colombia's Minister of Health.

Notably, the procedures were proctored remotely via Zoom, demonstrating the innovative approaches being employed in medical research. Bioaccess™ plays a pivotal role in this landscape, partnering with organizations like IDx Technologies to enhance AI-based disease detection capabilities in Latin American ophthalmology centers. This partnership aims to enhance diagnostic precision and patient results, further solidifying the region's status in medical research.

Furthermore, Global Care Clinical Trials' partnership with bioaccess™ has led to an impressive over 50% decrease in recruitment duration and a 95% retention rate for studies in Colombia. The insights from Dushyanth Surakanti, Founder & CEO of Sparta Biomedical, during bioaccess®'s first human study further illustrate the tangible benefits of these partnerships. Dr. John B. Simpson's research on Avinger's OCT-guided atherectomy in Cali, Colombia, exemplifies the fruitful collaborations with LATAM CRO Experts that drive innovation.

By engaging with Latin American markets, US companies can uncover opportunities for medtech in Latin America, broadening their reach and gaining access to a diverse group of individuals essential for clinical trials and tailored medical solutions. The unique demographic landscape in Latin America creates opportunities for medtech in Latin America by allowing for the testing of new technologies that can significantly improve care, aligning with the 35% growth potential noted in recent surveys. Moreover, successful case studies, such as 'Virtual Health Accessibility and Costs,' demonstrate that while virtual health options can enhance accessibility for individuals, careful financial analysis is necessary to improve operational efficiency and retention.

Likewise, the case study on 'Valuing Health Care Employees' demonstrates how digital tools can ease administrative burdens, enabling medical staff to concentrate more on patient care. This synergy not only benefits healthcare providers but also drives innovation and growth for US companies, creating a mutually advantageous scenario that enhances healthcare delivery and fosters economic development across both regions.

Key Initiatives Fueling MedTech Growth in Latin America

A large number of crucial projects is presently driving the expansion of medical technology in Latin America, revealing significant opportunities for medtech in Latin America, especially in Colombia, which distinguishes itself as a top location for first-in-human (FIH) studies. Government programs focused on enhancing healthcare infrastructure are essential in increasing access to medical technologies, thus creating significant opportunities for medtech in Latin America and establishing a robust framework for innovation. Colombia's competitive advantages—cost efficiency with savings of over 30% compared to trials in North America or Western Europe, regulatory speed with IRB/EC and MoH reviews taking only 90-120 days, and a high-quality healthcare system recognized by the World Health Organization—provide substantial opportunities for medtech in Latin America and are critical for attracting MedTech investments.

Moreover, the nation has a population exceeding 50 million, with 95% encompassed by universal healthcare, highlighting the opportunities for medtech in Latin America by aiding efficient participant recruitment for research studies. The implications of universal healthcare coverage create opportunities for medtech in Latin America by enhancing recruitment strategies and ensuring a diverse patient pool with access to necessary medical services. R&D tax incentives create opportunities for medtech in Latin America by incentivizing investments in science and technology, which include:

- A 100% tax deduction on qualifying expenses

- A 25% tax discount

- A 50% future tax credit

- Approximately $10 million in government grants available for qualifying projects

Significantly, collaborations between US and Latin American universities and research entities, such as cooperative research initiatives and joint studies, are crucial for creating opportunities for medtech in Latin America by promoting knowledge exchange and improving the medical technology landscape. The regulatory oversight by INVIMA, classified as a Level 4 health authority by PAHO/WHO, ensures that clinical trials meet high standards of safety and efficacy. Such collaborative efforts are not merely beneficial; they are foundational for creating an environment that fosters opportunities for medtech in Latin America, ultimately leading to significant improvements in healthcare outcomes and contributing to economic growth within the region.

As 2024 approaches, these initiatives are anticipated to gain further momentum, showcasing the opportunities for medtech in Latin America and solidifying the region's position as a key player in the global medical technology landscape.

Navigating the Regulatory Landscape for MedTech in Latin America

Navigating the regulatory landscape for MedTech in Latin America presents a multifaceted challenge, particularly when considering the opportunities for medtech in Latin America due to the diverse regulations implemented across different countries. Each nation operates under its own regulatory authority, with ANVISA in Brazil and COFEPRIS in Mexico playing pivotal roles in overseeing the approval and monitoring of medical devices and technologies. Businesses entering these markets must become acquainted with specific requirements, including:

- Research protocols

- Comprehensive documentation

- Effective post-market surveillance strategies

bioaccess®, your reliable CRO, is committed to supporting medical device studies in this area by applying global best practices adapted to local circumstances, which is essential for improving safety for individuals and ensuring adherence to regulatory standards.

Furthermore, the astonishing expense of cybercrime, expected to hit $10.5 trillion annually by 2025, highlights the need for strong regulatory frameworks to safeguard individual data and ensure adherence during trials. bioaccess® is committed to employing reasonable security measures to prevent the loss, misuse, or unauthorized alteration of information under our control, although absolute security cannot be guaranteed. We acknowledge the inherent risks involved in transmitting information and encourage clients to reach out with any queries or concerns regarding the processing of their information by contacting our Grievance Officer at IMH ASSETS CORP (doing business as "bioaccess®"), 1200 Brickell Avenue, Suite 1950 #1034, email: info@bioaccessla.com.

Collaborating with local regulatory consultants is vital, as they provide invaluable insights and guidance on compliance issues that can significantly impact a company's success. As Gavin McCartney, a partner at Stanton Chase London, aptly states,

We believe in your potential to achieve greatness and we'll do everything we can to help you get there.

This ethos resonates in the context of regulatory navigation, where understanding and adhering to complex regulations is critical for ensuring successful product entry and maintaining a robust market presence, particularly in light of the opportunities for medtech in Latin America.

Moreover, as shown by Paraguay's established regulatory framework for research studies, which has improved approval timelines despite ongoing concerns about corruption and oversight, the region's efforts to harmonize its regulatory frameworks—particularly in pharmacovigilance and technovigilance—are increasingly vital for enhancing patient safety and creating opportunities for medtech in Latin America.

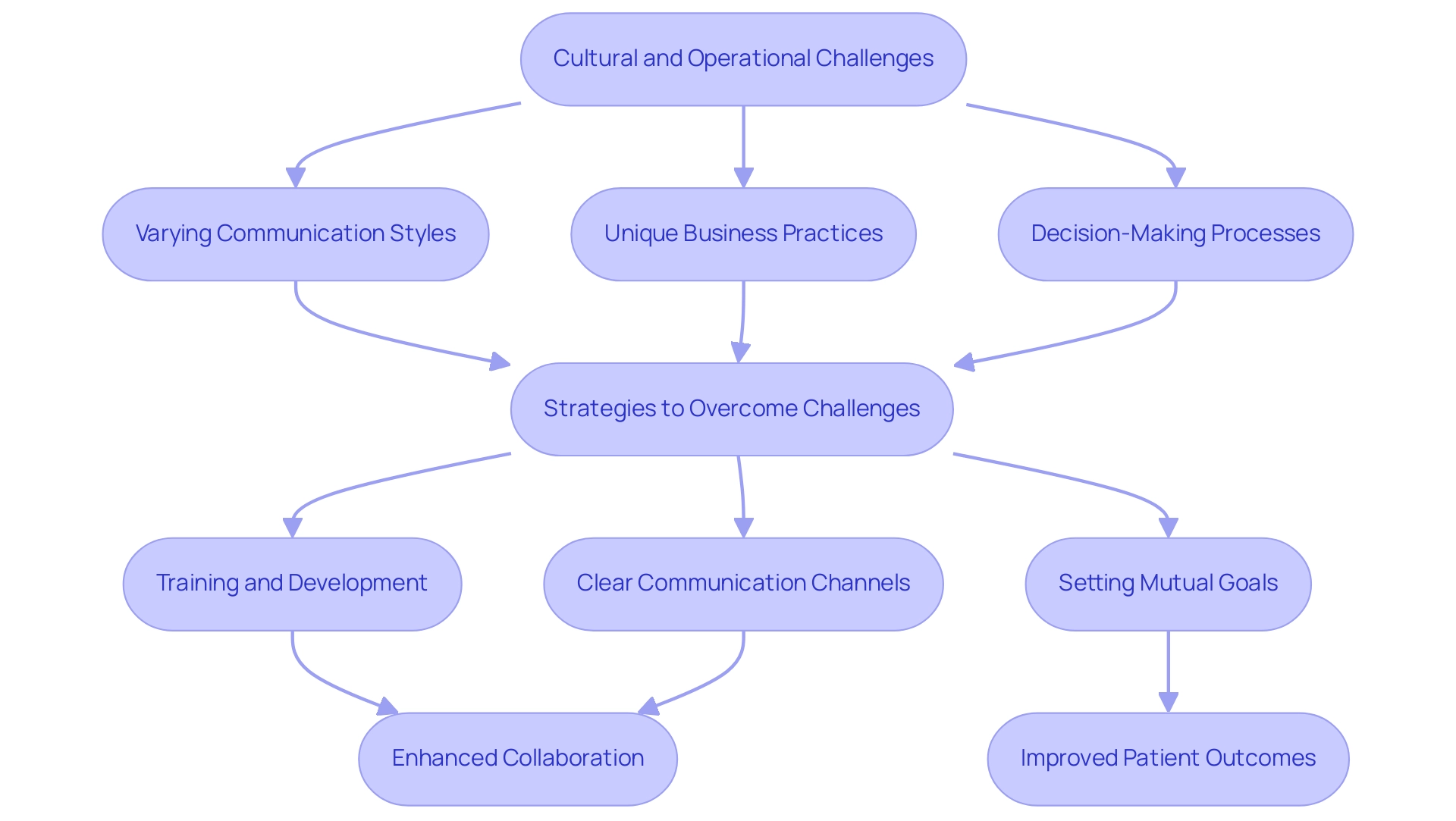

Overcoming Cultural and Operational Challenges in MedTech Partnerships

Cultural and operational challenges pose significant barriers to successful medical technology partnerships in Latin America. The region's unique business practices, varying communication styles, and different decision-making processes can lead to misunderstandings and impede effective collaboration. However, recent partnerships, such as between bioaccess™ and Caribbean Health Group, aim to position Barranquilla as a top destination for medical studies, with support from Colombia's Minister of Health.

Furthermore, partnerships like those with IDx Technologies are identifying Latin American ophthalmology centers for AI-based disease detection, enhancing regional capacities. Significantly, GlobalCare Clinical Studies has collaborated with bioaccess™ to improve ambulatory services in Colombia, achieving over a 50% decrease in recruitment duration and 95% retention rates, highlighting the essential healthcare challenges that MedTech collaborations seek to tackle. According to Dushyanth Surakanti, 'bioaccess® exemplifies regulatory excellence in Latin America, ensuring that we meet all necessary standards for our clinical trials.'

This highlights the critical need for cultural competence and adaptability in navigating these complex partnerships. Investment in training and development can enhance understanding among team members from diverse backgrounds, fostering a collaborative environment. Moreover, establishing clear communication channels and setting mutual goals can bridge cultural gaps and promote synergy.

A case study on telemedicine and digital wellness solutions illustrates this point; despite compliance challenges, these innovations present significant opportunities for medtech in Latin America, enhancing health outcomes in the region. Proactively addressing these challenges not only facilitates innovation but also enhances patient outcomes. Overall, by embracing these strategies, medical technology companies, including those led by advocates like Julio Martinez-Clark and operational experts like Monica Mora, can cultivate more effective partnerships that drive successful results and contribute to the region's healthcare advancements.

Future Trends and Opportunities in Latin America's MedTech Sector

The MedTech sector in Latin America is poised for substantial growth, supported by evolving trends that create numerous opportunities for medtech in Latin America. The demand for telemedicine and digital health solutions has surged, particularly in the wake of the COVID-19 pandemic, fundamentally transforming the healthcare landscape. This shift not only reflects a growing acceptance of remote healthcare but also highlights the need for innovative companies to penetrate this market efficiently.

Notably, the medical device markets in Chile and Colombia are projected to grow at CAGR of 9% and 8.4%, respectively, driven by high incidences of chronic diseases. Additionally, advancements in personalized medicine and sophisticated diagnostic tools are fueling the demand for tailored technologies that cater to individual patient needs. To improve research efforts, services such as:

- feasibility studies

- site selection

- compliance reviews

- study setup

- import permits

- nationalization of investigational devices

- project management

are essential.

In Colombia, the INVIMA plays a critical role as the national regulatory authority, ensuring the safety, efficacy, and quality of medical devices, classified as a Level 4 health authority by PAHO/WHO. This oversight not only supports compliance but also fosters international collaboration and economic growth through job creation and healthcare improvements. Furthermore, the reporting of study status and adverse events is vital for maintaining transparency and accountability in clinical trials.

As Jim Welch, EY Global Healthcare Leader, aptly notes,

Hear from Jim Welch as he shares important highlights on the state of the industry.

The trade balance of health equipment in Brazil, monitored from 2015 to 2023, further illustrates the economic landscape and its implications for the medical technology sector. To capitalize on these trends, stakeholders are urged to remain vigilant about technological advancements and invest in research and development.

Moreover, as regulatory frameworks evolve, companies adept at navigating these changes will be strategically positioned for success in the region. It is also crucial to consider the broader economic context, as interest payments on public debt in LAC have surpassed core government expenditures, which may affect investment in the medical technology sector. The anticipated growth trajectory of telemedicine, coupled with the increasing focus on personalized healthcare, highlights the opportunities for medtech in Latin America.

Conclusion

The collaboration between the United States and Latin America in the MedTech sector is reshaping healthcare delivery, showcasing the potential for innovative clinical trials and enhanced patient outcomes. Companies like ReGelTec and Bioaccess™ are leading initiatives that position Latin America as a hub for clinical research, leveraging unique advantages such as cost efficiency and diverse patient populations.

Despite these opportunities, navigating the complex regulatory landscape and cultural differences poses challenges. Successful partnerships depend on understanding local regulations and fostering effective communication. By investing in cultural competence and collaborative training, MedTech companies can overcome these barriers, driving innovation and improving healthcare experiences.

The future of MedTech in Latin America appears bright, with growing demand for telemedicine and personalized healthcare solutions. To thrive, stakeholders must remain adaptable and responsive to these trends. With a strategic focus on collaboration and innovation, the MedTech sector in Latin America is poised for significant growth, benefiting both companies and the diverse populations they serve.

Frequently Asked Questions

What opportunities exist for medtech in Latin America?

Opportunities for medtech in Latin America are driven by advanced technologies from US companies, a diverse population for clinical trials, and government initiatives aimed at enhancing healthcare infrastructure.

How does the collaboration between the US and Latin America benefit the MedTech sector?

Collaboration allows US companies to access diverse patient populations for clinical trials, leverage innovative technologies, and engage in partnerships that enhance research capabilities and improve healthcare outcomes.

Can you provide an example of a successful medtech trial in Latin America?

ReGelTec's Early Feasibility Study on HYDRAFIL™ in Barranquilla, Colombia, successfully treated eleven patients with chronic low back pain, demonstrating effective novel treatments and highlighting Barranquilla's growing reputation as a trial center.

What role does remote technology play in medical research in Latin America?

Remote technology, such as procedures proctored via Zoom, is utilized in medical research to facilitate innovative approaches and enhance the efficiency of clinical trials.

How has Bioaccess™ contributed to medtech advancements in Latin America?

Bioaccess™ has partnered with organizations like IDx Technologies to improve AI-based disease detection in ophthalmology, enhancing diagnostic precision and patient outcomes in the region.

What are the benefits of partnerships like that of Global Care Clinical Trials and Bioaccess™?

Their partnership has resulted in over a 50% decrease in recruitment duration and a 95% retention rate for studies in Colombia, showcasing the effectiveness of collaboration in clinical research.

What competitive advantages does Colombia offer for medtech trials?

Colombia offers cost efficiency, regulatory speed (with reviews taking only 90-120 days), a high-quality healthcare system, and a population with 95% universal healthcare, facilitating participant recruitment for research studies.

What tax incentives are available in Colombia to promote R&D in medtech?

Colombia offers a 100% tax deduction on qualifying expenses, a 25% tax discount, a 50% future tax credit, and approximately $10 million in government grants for qualifying projects.

How does regulatory oversight in Colombia support medtech initiatives?

Regulatory oversight by INVIMA, classified as a Level 4 health authority, ensures that clinical trials meet high standards of safety and efficacy, fostering a supportive environment for medtech innovation.

What future trends are anticipated for medtech in Latin America as 2024 approaches?

Initiatives in the medtech sector are expected to gain momentum, further solidifying Latin America's position as a key player in the global medical technology landscape.